17 July, 2023

Hello and welcome to this week’s JMP Report

Last week saw 5 stocks trade on the local market. BSP traded 162,191 closing steady at K12.80, KSL traded 336,854, closing steady at K2.40, STO traded 181 also closing steady at K19.11 , KAM traded 500, also closing steady at K0.85 and NGP traded 9,707 to also close the week out steady at K0.69.

WEEKLY MARKET REPORT | 10 July, 2023 – 14 July, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 162,191 | 12.80 | – | 0.39 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 336,854 | 2.40 | – | 0.00 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 181 | 19.11 | – | 0.00 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 500 | 0.85 | – | 0.00 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 9,707 | 0.69 | – | 0.00 | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 2.00 | – | 0.00 | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.80 | – | 0.00 | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

Order Book

This weeks Order Book starts the week out as nett buyers of BSP, and STO

Dual Listed PNGX/ASX

BFL – 4.99 +19c

KSL – 77c +3c

NCM – 27.96 +1.77

STO – 7.70 +24c

Other Asset Prices

Gold – 1958 -0.29%

WTI Crude – 74.21 -0.64%

Gas 2.55 +.51%

Bitcoin 30359 +0.58%

Ethereum 1934 +10.10%

PAX Gold 1927 +1.19%

Interest Rates

This week we saw good volume again in the 7day auction with 300mill offered to the banks. The banks responded with 525mill in bids with the market was left significantly short by 225mill with this week’s auction averaging 2.23%

Stock was offered across the remainder of the board with the 14days @ 2.25%, 28days @ 2.38%, while issuing 140mill. The 63days came in at 2.66% with the bank issuing 48mill, 93 days averaged 2.81% and the bank issuing 36mill. Overall, the market was left 433mill short for the week.

In the TBill market, we have not received the results for last week, but I don’t see any real change from the average of 2.99% from the last few weeks. There has been no announcement regarding the next GIS auction.

What we’ve been reading this week

How to manage risks of AI – Bill Gates

Co-chair, Bill & Melinda Gates Foundation

July 14, 2023

The world has learned a lot about handling problems caused by breakthrough innovations.

The risks created by artificial intelligence can seem overwhelming. What happens to people who lose their jobs to an intelligent machine? Could AI affect the results of an election? What if a future AI decides it doesn’t need humans anymore and wants to get rid of us?

These are all fair questions, and the concerns they raise need to be taken seriously. But there’s a good reason to think that we can deal with them: This is not the first time a major innovation has introduced new threats that had to be controlled. We’ve done it before.

Whether it was the introduction of cars or the rise of personal computers and the Internet, people have managed through other transformative moments and, despite a lot of turbulence, come out better off in the end. Soon after the first automobiles were on the road, there was the first car crash. But we didn’t ban cars—we adopted speed limits, safety standards, licensing requirements, drunk-driving laws, and other rules of the road.

We’re now in the earliest stage of another profound change, the Age of AI. It’s analogous to those uncertain times before speed limits and seat belts. AI is changing so quickly that it isn’t clear exactly what will happen next. We’re facing big questions raised by the way the current technology works, the ways people will use it for ill intent, and the ways AI will change us as a society and as individuals.

In a moment like this, it’s natural to feel unsettled. But history shows that it’s possible to solve the challenges created by new technologies.

I have written before about how AI is going to revolutionize our lives. It will help solve problems—in health, education, climate change, and more—that used to seem intractable. The Gates Foundation is making it a priority, and our CEO, Mark Suzman, recently shared how he’s thinking about its role in reducing inequity.

I’ll have more to say in the future about the benefits of AI, but in this post, I want to acknowledge the concerns I hear and read most often, many of which I share, and explain how I think about them.

One thing that’s clear from everything that has been written so far about the risks of AI—and a lot has been written—is that no one has all the answers. Another thing that’s clear to me is that the future of AI is not as grim as some people think or as rosy as others think. The risks are real, but I am optimistic that they can be managed. As I go through each concern, I’ll return to a few themes:

- Many of the problems caused by AI have a historical precedent. For example, it will have a big impact on education, but so did handheld calculators a few decades ago and, more recently, allowing computers in the classroom. We can learn from what’s worked in the past.

- Many of the problems caused by AI can also be managed with the help of AI.

- We’ll need to adapt old laws and adopt new ones—just as existing laws against fraud had to be tailored to the online world.

In this post, I’m going to focus on the risks that are already present, or soon will be. I’m not dealing with what happens when we develop an AI that can learn any subject or task, as opposed to today’s purpose-built AIs. Whether we reach that point in a decade or a century, society will need to reckon with profound questions. What if a super AI establishes its own goals? What if they conflict with humanity’s? Should we even make a super AI at all?

But thinking about these longer-term risks should not come at the expense of the more immediate ones. I’ll turn to them now.

Deepfakes and misinformation generated by AI could undermine elections and democracy.

The idea that technology can be used to spread lies and untruths is not new. People have been doing it with books and leaflets for centuries. It became much easier with the advent of word processors, laser printers, email, and social networks.

AI takes this problem of fake text and extends it, allowing virtually anyone to create fake audio and video, known as deepfakes. If you get a voice message that sounds like your child saying “I’ve been kidnapped, please send $1,000 to this bank account within the next 10 minutes, and don’t call the police,” it’s going to have a horrific emotional impact far beyond the effect of an email that says the same thing.

On a bigger scale, AI-generated deepfakes could be used to try to tilt an election. Of course, it doesn’t take sophisticated technology to sow doubt about the legitimate winner of an election, but AI will make it easier.

There are already phony videos that feature fabricated footage of well-known politicians. Imagine that on the morning of a major election, a video showing one of the candidates robbing a bank goes viral. It’s fake, but it takes news outlets and the campaign several hours to prove it. How many people will see it and change their votes at the last minute? It could tip the scales, especially in a close election.

When OpenAI co-founder Sam Altman testified before a U.S. Senate committee recently, Senators from both parties zeroed in on AI’s impact on elections and democracy. I hope this subject continues to move up everyone’s agenda.

We certainly have not solved the problem of misinformation and deepfakes. But two things make me guardedly optimistic. One is that people are capable of learning not to take everything at face value. For years, email users fell for scams where someone posing as a Nigeran prince promised a big payoff in return for sharing your credit card number. But eventually, most people learned to look twice at those emails. As the scams got more sophisticated, so did many of their targets. We’ll need to build the same muscle for deepfakes.

The other thing that makes me hopeful is that AI can help identify deepfakes as well as create them. Intel, for example, has developed a deepfake detector, and the government agency DARPA is working on technology to identify whether video or audio has been manipulated.

This will be a cyclical process: Someone finds a way to detect fakery, someone else figures out how to counter it, someone else develops counter-countermeasures, and so on. It won’t be a perfect success, but we won’t be helpless either.

AI makes it easier to launch attacks on people and governments.

Today, when hackers want to find exploitable flaws in software, they do it by brute force—writing code that bangs away at potential weaknesses until they discover a way in. It involves going down a lot of blind alleys, which means it takes time and patience.

Security experts who want to counter hackers have to do the same thing. Every software patch you install on your phone or laptop represents many hours of searching, by people with good and bad intentions alike.

AI models will accelerate this process by helping hackers write more effective code. They’ll also be able to use public information about individuals, like where they work and who their friends are, to develop phishing attacks that are more advanced than the ones we see today.

The good news is that AI can be used for good purposes as well as bad ones. Government and private-sector security teams need to have the latest tools for finding and fixing security flaws before criminals can take advantage of them. I hope the software security industry will expand the work they’re already doing on this front—it ought to be a top concern for them.

This is also why we should not try to temporarily keep people from implementing new developments in AI, as some have proposed. Cyber-criminals won’t stop making new tools. Nor will people who want to use AI to design nuclear weapons and bioterror attacks. The effort to stop them needs to continue at the same pace.

There’s a related risk at the global level: an arms race for AI that can be used to design and launch cyberattacks against other countries. Every government wants to have the most powerful technology so it can deter attacks from its adversaries. This incentive to not let anyone get ahead could spark a race to create increasingly dangerous cyber weapons. Everyone would be worse off.

That’s a scary thought, but we have history to guide us. Although the world’s nuclear nonproliferation regime has its faults, it has prevented the all-out nuclear war that my generation was so afraid of when we were growing up. Governments should consider creating a global body for AI similar to the International Atomic Energy Agency.

AI will take away people’s jobs.

In the next few years, the main impact of AI on work will be to help people do their jobs more efficiently. That will be true whether they work in a factory or in an office handling sales calls and accounts payable. Eventually, AI will be good enough at expressing ideas that it will be able to write your emails and manage your inbox for you. You’ll be able to write a request in plain English, or any other language, and generate a rich presentation on your work.

As I argued in my February post, it’s good for society when productivity goes up. It gives people more time to do other things, at work and at home. And the demand for people who help others—teaching, caring for patients, and supporting the elderly, for example—will never go away. But it is true that some workers will need support and retraining as we make this transition into an AI-powered workplace. That’s a role for governments and businesses, and they’ll need to manage it well so that workers aren’t left behind—to avoid the kind of disruption in people’s lives that has happened during the decline of manufacturing jobs in the United States.

Also, keep in mind that this is not the first time a new technology has caused a big shift in the labor market. I don’t think AI’s impact will be as dramatic as the Industrial Revolution, but it certainly will be as big as the introduction of the PC. Word processing applications didn’t do away with office work, but they changed it forever. Employers and employees had to adapt, and they did. The shift caused by AI will be a bumpy transition, but there is every reason to think we can reduce the disruption to people’s lives and livelihoods.

AI inherits our biases and makes things up.

Hallucinations—the term for when an AI confidently makes some claim that simply is not true—usually happen because the machine doesn’t understand the context for your request. Ask an AI to write a short story about taking a vacation to the moon and it might give you a very imaginative answer. But ask it to help you plan a trip to Tanzania, and it might try to send you to a hotel that doesn’t exist.

Another risk with artificial intelligence is that it reflects or even worsens existing biases against people of certain gender identities, races, ethnicities, and so on.

To understand why hallucinations and biases happen, it’s important to know how the most common AI models work today. They are essentially very sophisticated versions of the code that allows your email app to predict the next word you’re going to type: They scan enormous amounts of text—just about everything available online, in some cases—and analyze it to find patterns in human language.

When you pose a question to an AI, it looks at the words you used and then searches for chunks of text that are often associated with those words. If you write “list the ingredients for pancakes,” it might notice that the words “flour, sugar, salt, baking powder, milk, and eggs” often appear with that phrase. Then, based on what it knows about the order in which those words usually appear, it generates an answer. (AI models that work this way are using what’s called a transformer. GPT-4 is one such model.)

This process explains why an AI might experience hallucinations or appear to be biased. It has no context for the questions you ask or the things you tell it. If you tell one that it made a mistake, it might say, “Sorry, I mistyped that.” But that’s a hallucination—it didn’t type anything. It only says that because it has scanned enough text to know that “Sorry, I mistyped that” is a sentence people often write after someone corrects them.

Similarly, AI models inherit whatever prejudices are baked into the text they’re trained on. If one reads a lot about, say, physicians, and the text mostly mentions male doctors, then its answers will assume that most doctors are men.

Although some researchers think hallucinations are an inherent problem, I don’t agree. I’m optimistic that, over time, AI models can be taught to distinguish fact from fiction. OpenAI, for example, is doing promising work on this front.

Other organizations, including the Alan Turing Institute and the National Institute of Standards and Technology, are working on the bias problem. One approach is to build human values and higher-level reasoning into AI. It’s analogous to the way a self-aware human works: Maybe you assume that most doctors are men, but you’re conscious enough of this assumption to know that you have to intentionally fight it. AI can operate in a similar way, especially if the models are designed by people from diverse backgrounds.

Finally, everyone who uses AI needs to be aware of the bias problem and become an informed user. The essay you ask an AI to draft could be as riddled with prejudices as it is with factual errors. You’ll need to check your AI’s biases as well as your own.

Students won’t learn to write because AI will do the work for them.

Many teachers are worried about the ways in which AI will undermine their work with students. In a time when anyone with Internet access can use AI to write a respectable first draft of an essay, what’s to keep students from turning it in as their own work?

There are already AI tools that are learning to tell whether something was written by a person or by a computer, so teachers can tell when their students aren’t doing their own work. But some teachers aren’t trying to stop their students from using AI in their writing—they’re actually encouraging it.

In January, a veteran English teacher named Cherie Shields wrote an article in Education Week about how she uses ChatGPT in her classroom. It has helped her students with everything from getting started on an essay to writing outlines and even giving them feedback on their work.

“Teachers will have to embrace AI technology as another tool students have access to,” she wrote. “Just like we once taught students how to do a proper Google search, teachers should design clear lessons around how the ChatGPT bot can assist with essay writing. Acknowledging AI’s existence and helping students work with it could revolutionize how we teach.” Not every teacher has the time to learn and use a new tool, but educators like Cherie Shields make a good argument that those who do will benefit a lot.

It reminds me of the time when electronic calculators became widespread in the 1970s and 1980s. Some math teachers worried that students would stop learning how to do basic arithmetic, but others embraced the new technology and focused on the thinking skills behind the arithmetic.

There’s another way that AI can help with writing and critical thinking. Especially in these early days, when hallucinations and biases are still a problem, educators can have AI generate articles and then work with their students to check the facts. Education nonprofits like Khan Academy and OER Project, which I fund, offer teachers and students free online tools that put a big emphasis on testing assertions. Few skills are more important than knowing how to distinguish what’s true from what’s false.

We do need to make sure that education software helps close the achievement gap, rather than making it worse. Today’s software is mostly geared toward empowering students who are already motivated. It can develop a study plan for you, point you toward good resources, and test your knowledge. But it doesn’t yet know how to draw you into a subject you’re not already interested in. That’s a problem that developers will need to solve so that students of all types can benefit from AI.

What’s next?

I believe there are more reasons than not to be optimistic that we can manage the risks of AI while maximizing their benefits. But we need to move fast.

Governments need to build up expertise in artificial intelligence so they can make informed laws and regulations that respond to this new technology. They’ll need to grapple with misinformation and deepfakes, security threats, changes to the job market, and the impact on education. To cite just one example: The law needs to be clear about which uses of deepfakes are legal and about how deepfakes should be labeled so everyone understands when something they’re seeing or hearing is not genuine

Political leaders will need to be equipped to have informed, thoughtful dialogue with their constituents. They’ll also need to decide how much to collaborate with other countries on these issues versus going it alone.

In the private sector, AI companies need to pursue their work safely and responsibly. That includes protecting people’s privacy, making sure their AI models reflect basic human values, minimizing bias, spreading the benefits to as many people as possible, and preventing the technology from being used by criminals or terrorists. Companies in many sectors of the economy will need to help their employees make the transition to an AI-centric workplace so that no one gets left behind. And customers should always know when they’re interacting with an AI and not a human.

Finally, I encourage everyone to follow developments in AI as much as possible. It’s the most transformative innovation any of us will see in our lifetimes, and a healthy public debate will depend on everyone being knowledgeable about the technology, its benefits, and its risks. The benefits will be massive, and the best reason to believe that we can manage the risks is that we have done it before.

You can join the conversation in the comments and become a Gates Notes Insider to get regular updates from Bill on key topics like artificial intelligence, global health and climate change, to access exclusive content, participate in giveaways, and more.

Half of Board Members Report Lacking Skills to Address Climate Issues: WTW/Nasdaq Survey

GOVERNANCE/ REPORTS, STUDIES

Mark Segal July 12, 2023

Nearly half of board members report lacking skills and expertise in their organizations for addressing climate issues, even as most acknowledge that a strong ESG strategy can lead to better financial outcomes, according to a new survey by advisory, broking and solutions company WTW and the Nasdaq Center for Board Excellence.

For the study, the Fostering Corporate Governance and Enhancing Board Effectiveness Survey, WTW and Nasdaq surveyed 349 board members across 44 countries.

The survey found that most board members recognized value in sustainability-focused initiatives, with 75% of respondents agreeing that “a coherent environmental, social and governance (ESG) strategy helps to create sustainable organizational value and stronger financial outcomes,” and “alignment with the organization’s business strategy” scoring as the most common factor influencing board members to prioritize ESG themes, cited by 85%.

Additional factors influencing the prioritizing of ESG factors included ethical reasons, by 78% of respondents, followed by long-term value creation, reputation and risk mitigation, while regulatory compliance placed only 6th, cited by 71%.

By ESG focus area, top priorities cited by respondents included human capital at 82% followed by governance at 70%, while only half ranked environmental and climate in their top-three priorities.

Despite acknowledging the value of a strong ESG strategy, many board members said that their organization’s don’t focus enough on sustainability issues, with fewer than two-thirds of (62%) of respondents agreeing that their boards have dedicated sufficient time and resources to governance of their ESG priorities.

Similarly, board oversight of ESG issues appears to be evolving, with an expectation for more specialist responsibilities in the future. While more than half of respondents reported that oversight of ESG governance is performed by a combination of the full board and other committees, 61% of these respondents also said that they expect to see a dedicated ESG or sustainability committee in the next three years, although 71% also acknowledged that some ESG oversight will continue to be a full board matter.

In addition to evolving oversight, boards also appear to expect to invest in ESG-related skills and education. While 48% of respondents reported lacking skills and expertise for addressing climate issues, only 18% expected this skills gap to remain in three years.

Kenneth Kuk, Senior Director, Work & Rewards at WTW said:

“Board members are evolving their ESG agenda from reacting to stakeholder pressure to proactively linking ESG to business strategy. As a result, we are seeing greater interest in addressing skills and resource gaps and more emphasis on oversight of emerging risks.”

Click here to access the study.

Oliver’s insights – 15 common sense tips to help manage your finances

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments

11 Jul 2023

Key points

Getting your personal finances right can be a challenge at times. Here are some common-sense tips that may be of use:

– Shop around when it comes to financial services.

– Don’t take on too much debt.

– Allow for interest rate to go up and down.

– Contact your bank if struggling with mortgage payments.

– Seek advice regarding fixed versus variable mortgage rates.

– Allow for rainy days.

– Credit cards are great, but they deserve respect.

– Use your mortgage for longer term debt.

– Start saving and investing early.

– Plan for asset prices to go through rough patches.

– See financial events in their longer-term context.

– Know your risk tolerance.

– Make the most of the bank of Mum and Dad.

– Be wary of the crowd.

– And…there is no free lunch.

Introduction

A few years ago, I put together a list of key common-sense points that may be useful in terms of borrowing to finance a home along with broader personal finance and investment decisions we make. Given the surge in interest rates lately, I thought it was worth an update so here they are. Many Australians may know these, but unfortunately financial literacy is still not taught in schools and so many don’t. Otherwise, Australians would have far less trouble with their finances. I have deliberately kept it simple and in many cases this draws on personal experience. I won’t tell you to have a budget though because that’s like telling you to suck eggs!

1. Shop around

We often shop around to get the best deal when it comes to consumer items but the same should always apply to services we get. It’s a highly competitive world out there and service companies want to get and keep your business. So when getting a new service – whether it be for a power contract, phone plan, insurance or mortgage, or who to manage your super etc it makes sense to look around to find the best deal. And when it comes time to renew a service – say your home and contents insurance – and you find that the annual charge has risen sharply, it makes sense to call your provider to ask what gives. I have often done this to then be offered a better deal on the grounds that I am a long-term loyal customer.

2. Don’t take on too much debt

Debt is great, up to a point. It helps you have today what you would otherwise have to wait until tomorrow for. It enables you to spread the costs associated with long term assets like a home over the years you get the benefit of it, and it enables you to enhance your underlying investment returns. But as with everything you can have too much of a good thing – and that includes debt. Someone wise once said “it’s not what you own that will send you bust but what you owe.” So always make sure that you don’t take on so much debt that it may force you to sell all your investments just at the time you should be adding to them or worse still potentially send you bust. Or to sell your house when it has fallen in value. A rough guide may be that when debt servicing costs exceed 30% of your income then maybe you have too much debt – but it depends on the level of your income and expenses. A higher income person could manage a higher debt servicing to income ratio simply because living expenses take up less of their income.

3. Allow that interest rates go up and down

Of course, we have been given a rather rude reminder that interest rates can go up over the last year. But when things are going one way for a long time as interest rates did when they fell from 2011 to 2020, it’s easy to forget that the cycle could turn. So, when you take on debt the key is to make sure you can afford higher interest payments at some point. Fortunately, under guidance from the bank regulator, APRA, lenders these days have to allow that you can service your debt when interest rates are an extra 3% above the proposed borrowing rate. Of course, after 12 rate hikes in quick succession which has taken interest rates back to levels last seen in 2012 the odds are we are now getting close to the peak in interest rates so some relief may be on the way next year.

4. Contact your bank if struggling with a mortgage

After the biggest surge in interest rates since the late 1980s, it’s understandable many may be worried about servicing their mortgage. A survey by AMP Bank found that nearly 70% of those with a mortgage are worried about meeting repayments if rates continue to rise with 31% worried right now, but that most of those with small safety buffers had not sought help from their lender. However, homeowners struggling with a mortgage should not be shy in seeking assistance either to get a lower interest rate or maybe to switch to a different mortgage repayment arrangement. The home mortgage market is highly competitive and it’s not in banks’ interest to see people default on their loans.

5. Seek advice regarding fixed versus variable rates

Australians have long struggled regarding how best to use fixed rates – often locking in at the top of the rate cycle & then staying variable at the bottom. Thankfully this recent cycle was different with a record 40% of mortgages locking in record low fixed rates around 2% in 2020-21. But still many didn’t. Sure, the fixers were only protected for two or three years but still they would have done better than those who stayed variable. As a general principle locking in low fixed rates makes sense when the rate cycle has gone down but staying variable when rates have gone up. Of course, it’s still hard to time it – eg, locking in fixed rates around 4% in 2016 after five years of rate falls would have been premature and there is always a case to maintain some flexibility by keeping a portion of the loan variable to allow for windfalls (like say an inheritance or a big bonus) that enable you to pay down your loan faster. The key is to seek advice.

6. Allow for rainy days

Because the future is uncertain it always makes sense to have a financial buffer to cover us if things unexpectedly go badly. The rainy day could come as a result of higher interest rates, job loss or an unexpected expense. This basically means not taking all the debt offered to you, trying to stay ahead of your payments and making sure that when you draw down your loan you can withstand at least a 3% rise in interest rates.

7. Credit cards are great, but they deserve respect

I love my credit cards. They provide free credit for up to around 6 weeks and they attract points that really mount up. So, it makes sense to put as much of my expenses as I can on them. But they charge usurious interest rates of around 20% if I get a cash advance or don’t pay the full balance by the due date. So never get a cash advance unless it’s an emergency and always pay by the due date. Sure the 20% rate sounds like a rip-off but don’t forget that credit card debt is not secured by your house and at least the high rate provides that extra incentive to pay by the due date.

8. Use your mortgage for longer term debt

Credit cards are not for long term debt, but your mortgage is. And partly because it’s secured by your house, mortgage rates are low compared to other borrowing rates. So, if you have any debt that may take longer than the due date on your credit card to pay off then it should be included as part of your mortgage if you have one.

9. Start saving and investing early

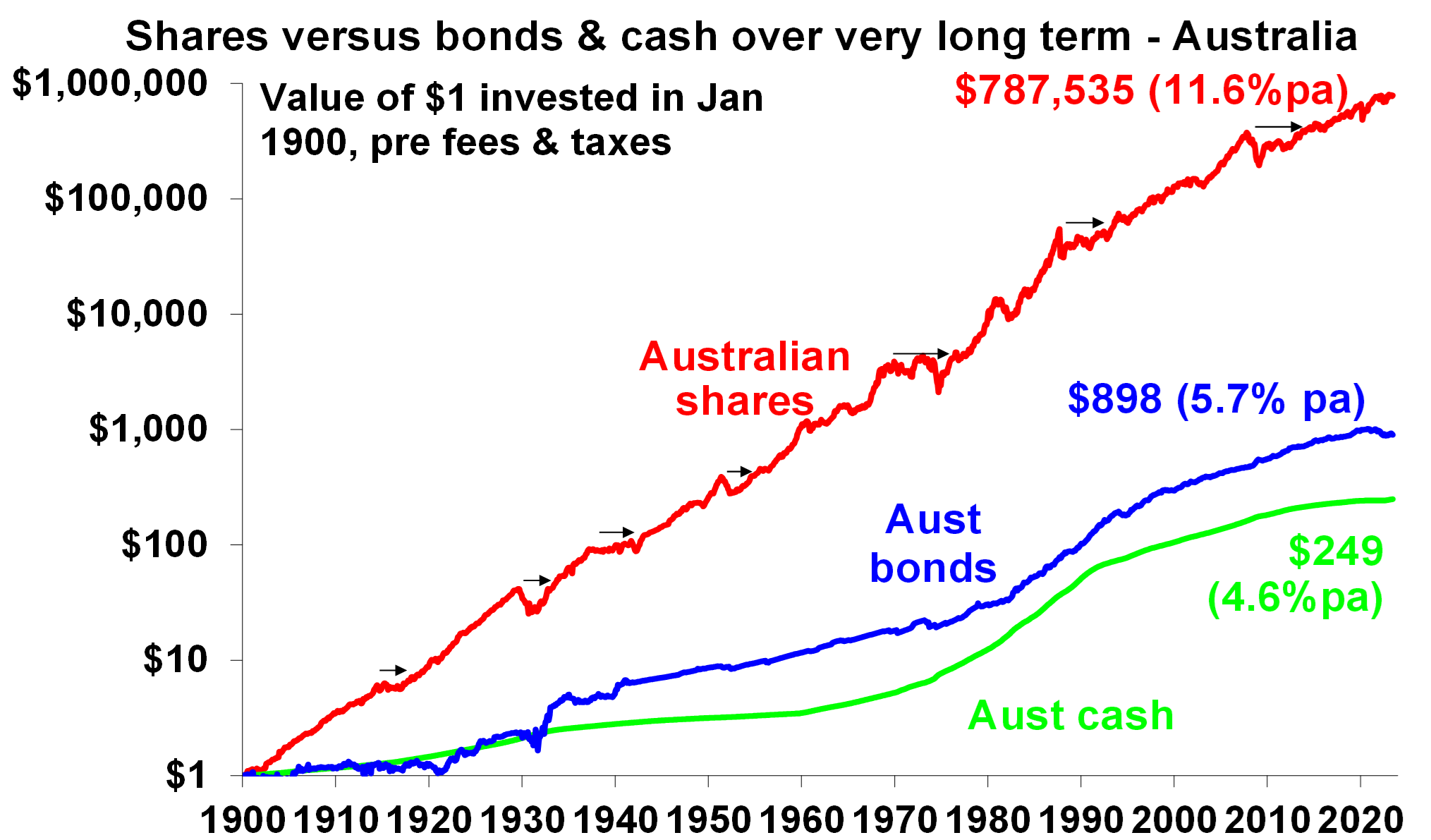

If you want to build your wealth to get a deposit for a house or save for retirement the best way to do that is to take advantage of compound interest – where returns build on returns. Obviously, this works best with assets that provide high returns on average over long periods. But to make the most of it you have to start as early as possible. Which is why those piggy banks that banks periodically hand out to children have such merit in getting us into the habit of saving early. This gives me another opportunity to show my favourite chart on investing which tracks the value of $1 invested in Australian shares, bonds and cash since 1900 with dividends and interest reinvested along the way. Cash is safe but has low returns and that $1 will have only grown to $249. Shares are volatile (and so have rough periods highlighted by arrows) but if you can look through that they will grow your wealth and that $1 will have grown to $787,535.

Source: ASX, Bloomberg, RBA, AMP

10. Plan for asset prices to go through rough patches

It’s well known that the share market goes through rough patches. The volatility seen in the share market is the price we pay for higher returns than most other asset classes over the long term. And while property prices will always be smoother than share prices because it’s not traded daily and so not as subject to very short-term sentiment swings, history tells us that home prices do go down as well as up. Japanese property prices fell for almost two decades after the 1980s bubble years, US and some European countries’ property values fell sharply in the GFC and the Australian residential property market has seen several episodes of falls over recent years. So, the key is to allow that asset prices don’t always go up – even when the population and the economy are growing.

11. See big financial events in their long-term context

Hearing that $70bn was wiped off the share market in a day or two sounds scary – but it tells you little about how much the market actually fell and you have only lost something if you sell out after the fall. Scarier was the roughly 35% fall in share markets in February-March 2020 due to the pandemic and scarier still the GFC that saw 50% falls. But such events happen every so often – the 1987 crash saw a 50% fall in a few months and Australian shares fell 59% over 1973-74. And after each the market has gone back up and resumed its long-term rising trend. The trick is to allow for periodic sharp falls in your investments and when they happen remind yourself that we have seen it all before and the market will most likely find a base and resume its long-term rising trend.

12. Know your risk tolerance

When embarking on your investing journey, it’s worth thinking about how you might respond if you found out that market movements had just wiped 20% off your investments. If your response is likely to be: “I don’t like it, but this sometimes happens in markets and history tells me that if I stick to my strategy, I will see a recovery in time” then no problem. But if your response might be: “I can’t sleep at night because of this, get me out of here” then maybe you should rethink your strategy as you will just end up selling at market bottoms and buying at tops. So, try and match your investment strategy to your risk tolerance.

13. Make the most of the Mum and Dad bank

The Australian housing boom that started in the mid-1990s has left housing very unaffordable for many. This has contributed to a big wealth transfer from Millennials to Baby Boomers and Gen Xers. For Millennials and Gen Z, if you can it makes sense to make the most of the “Mum and Dad bank”. There are two ways to do this. First stay at home with Mum and Dad as long as you can and use the cheap rent to get a foothold in the property market via a property investment and then use the benefits of being able to deduct interest costs from your income to reduce your tax bill to pay down your debt as quickly as you can so that you may be able to ultimately buy something you really want. Second consider leaning on your parents for help with a deposit. Just don’t tell my kids this!

14. Be wary of what you hear at parties

Back in 2021, Bitcoin was all the rage. But jumping in when it was near $US68,000 a coin at the point when everyone was talking about it back then would not have been wise – it’s now around $US30,000 but had a fall to below $US16,000 on the way and its yet to prove its use value, beyond something to speculate in. Often when the crowd is dead set on some investment it’s best to stay away, particularly if you don’t understand it.

15. There is no free lunch

When it comes to borrowing and investing there is no free lunch – if something looks too good to be true (whether it’s ultra-low fees or interest rates or investment products claiming ultra-high returns and low risk) then it probably is and it’s best to stay away.

Concluding comment

I have focussed here mainly on personal finance and investing at a very high level, as opposed to drilling into things like diversification and taking a long-term view to your investments. An earlier note entitled “Nine keys to successful investing” focussed in more detail on investing.

I hope you have enjoyed the read this week, please feel free to contact me if you would like to discuss your investment objectives. Have a great week.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814