12 February, 2024

Welcome to this week’s JMP Report,

On the equity front last week saw 6 stocks trade on the local market. BSP traded 1,047,251 , closing 32t higher at K15.32, KSL traded 543,930, closing 10t higher at K2.70, STO traded 104, closing steady at K19.24, KAM traded 1,199, closing 10t higher to close at K1.00, NGP traded 1,604, closing steady at K0.69 and CCP traded 1,500, closing steady at K2.01 per share.

WEEKLY MARKET REPORT | 5 February, 2024 – 9 February, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2022 FINAL DIV | 2023 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 1,047,251 | 15.32 | 15.31 | – | 0.32 | 2.09 | K1.4000 | K0.370 | 13.33 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO |

| KSL | 543,930 | 2.70 | 2.70 | 3.00 | 0.10 | 3.70 | K0.1610 | K0.097 | 10.75 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO |

| STO | 104 | 19.24 | 19.24 | – | – | 0.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | K0.12 | 13.33 | TUE 19 SEP 2023 | WED 20 SEP 2023 | THU 19 SEP 2023 | YES |

| KAM | 1,199 | 1.00 | 1.00 | – | 0.10 | 10.00 | K0.5310 | K0.314 | 4.42 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | – |

| NGP | 1,604 | 0.69 | – | 0.69 | – | 0.00 | – | K0.0.3 | 5.80 | FRI 6 OCT 2023 | WED 11 OCT 2023 | WED 1 NOV 2023 | – |

| CCP | 1,500 | 2.01 | 2.00 | – | – | 0.00 | K0.123 | K0.110 | 11.51 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES |

| CPL | – | – | – | – | – | – | – | – |

– |

WED 22 MAR 2023 | THU 30 MAR 2023 | THU 30 JUL 2023 | – |

| SST | – | 35.46 | 36.46 | 40.00 | – | 0.00 | K0.70 | K0.35 | 2.96 | FRI 29 SEP 2023 | MON 2 OCT 2023 | TUE 31 OCT 2023 | NO |

Dual Listed Stocks PNGX/ASX

BFL – 6.31 +30c

KSL- 88c +3c

NEM 50.98 -3.15

STO -7.32 -.59c

On the interest rate front

In the very short end 7 day Central Bank Bills were offered at 2.50% with almost 2.4bn taken out of the weekly market. In the 364 day market we are seeing a downward trend with rate auction results coming in at 3.30%. We are yet to see any indication on when we are likely to see the first of the 2024 GIS auctions.

Other assets we like to watch

Silver – 22.62 flat

Platinum – 873.50 down 2.50

Bitcoin – 48,194 +13%

Ethereum – 2,506 +9.71%

PAXGold –+2003 +.20%

What we’ve been reading this week

Carbon Credit Insurance Market to Hit $1B in 2030, $30B by 2050

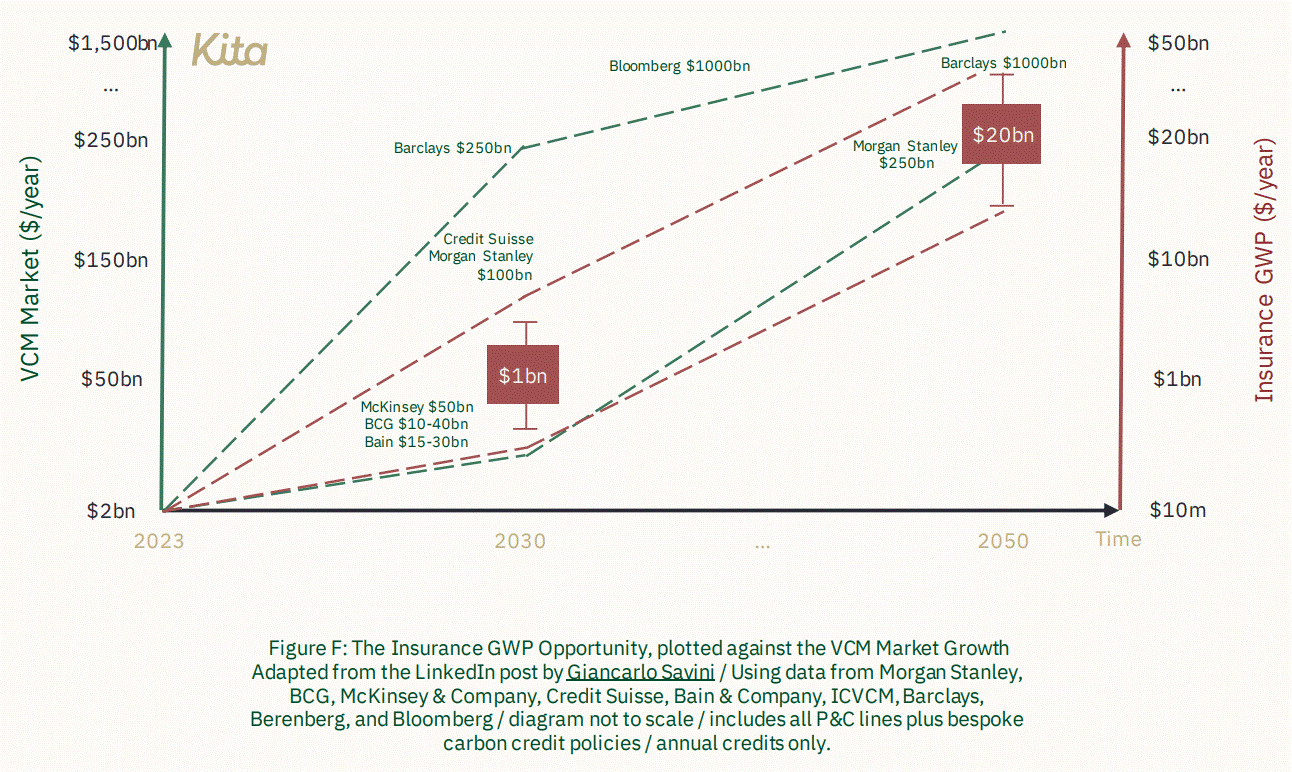

Insurance has a crucial role to play in supporting carbon markets as the world continues its journey to net zero. A report estimates that by 2030, insurance premiums could reach ~$1 billion and 2030 and $10-$30 billion by 2050.

The report is a collaboration between Oxbow Partners and Kita, titled “Are carbon credits the next billion-dollar insurance market?”

Premiums with a Purpose: The Role of Carbon Credit Insurance

The study emphasizes the crucial role of insurance in supporting the carbon market amid global efforts to combat climate change. It also provides a comprehensive overview of the carbon market’s potential, offering valuable insights for industry experts.

According to the report, insurance can provide 4 key benefits to the carbon credit market:

- A balance between traditional risk management practices and innovation – enabling improved access to finance to scale carbon projects.

- A stamp of confidence – risk management and regulatory expertise, honed over decades, can bring confidence to the market and its participants.

- Detailed assessment of carbon project risk – highlighting areas of concern across the market and project types, where wider risk management improvements are required.

- Encourage market participants to take risks – insurers take on responsibility when things go wrong, giving market actors the freedom to take risks which are necessary to release capital and scale carbon projects and their associated benefits.

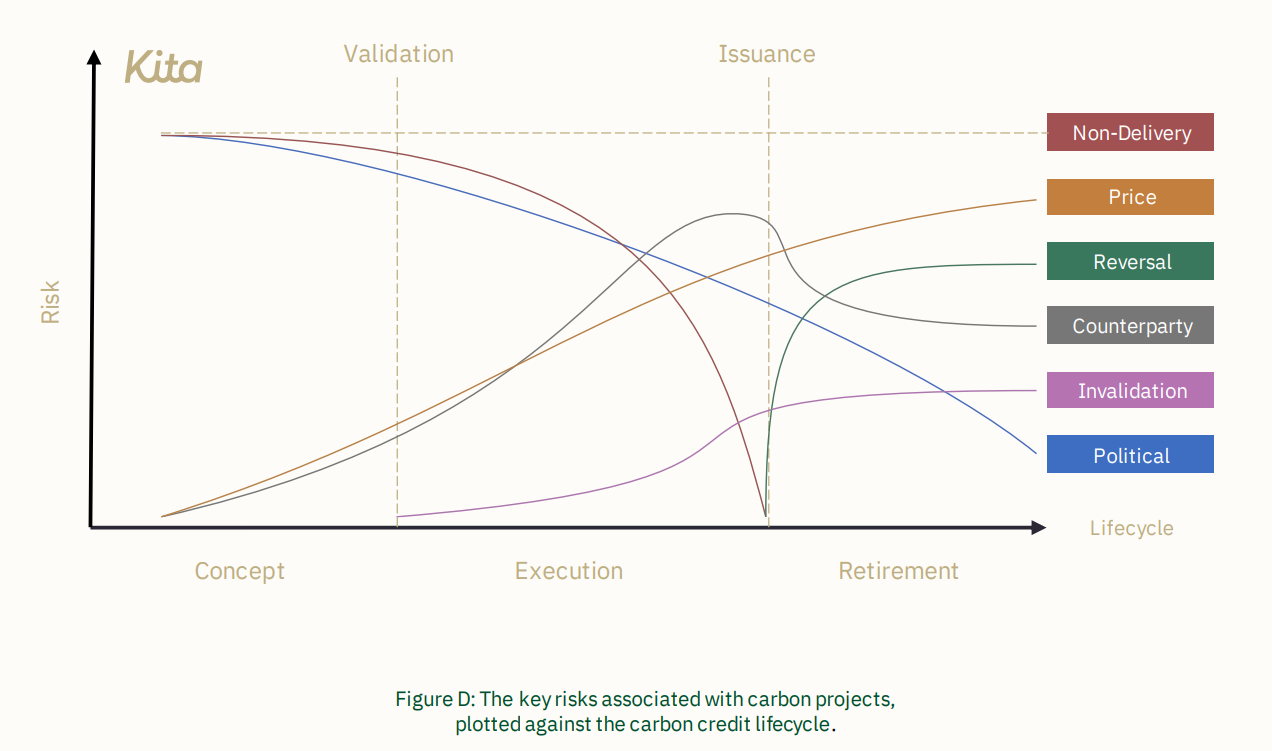

Below are the risks identified in the report, which the insurance market could mitigate.

Industry leaders, including prominent brokers and insurers such as Aon, Howden, Marsh, AXA XL, CFC, Chaucer, and Fidelis, are optimistic about the market’s prospects, viewing its expansion as inevitable. These industry giants think that the carbon credit insurance explosive growth isn’t a matter of “not if” but “when”.

Miqdaad Versi, Head of the Sustainability Practice at Oxbow Partners, expressed optimism about the market’s potential. He particularly highlighted its importance in facilitating green initiatives while generating profits. While James Kench, Head of Insurance at Kita, added that:

“The insurance market is on the front line for climate risk and is uniquely placed to help business and society navigate through increasingly uncertain times. This report is a call to action for the insurance industry to embrace a vast new carbon risk pool with purpose.”

The Billion-Dollar Horizon

The report forecasts the total addressable market for carbon credit insurance to reach about $1 billion in annual Gross Written Premium (GWP) by 2030, with a projected increase to $10-30 billion GWP by 2050.

However, this estimate may underestimate the market’s full-scale potential. The calculations focus solely on the voluntary carbon market (VCM), excluding the compliance market.

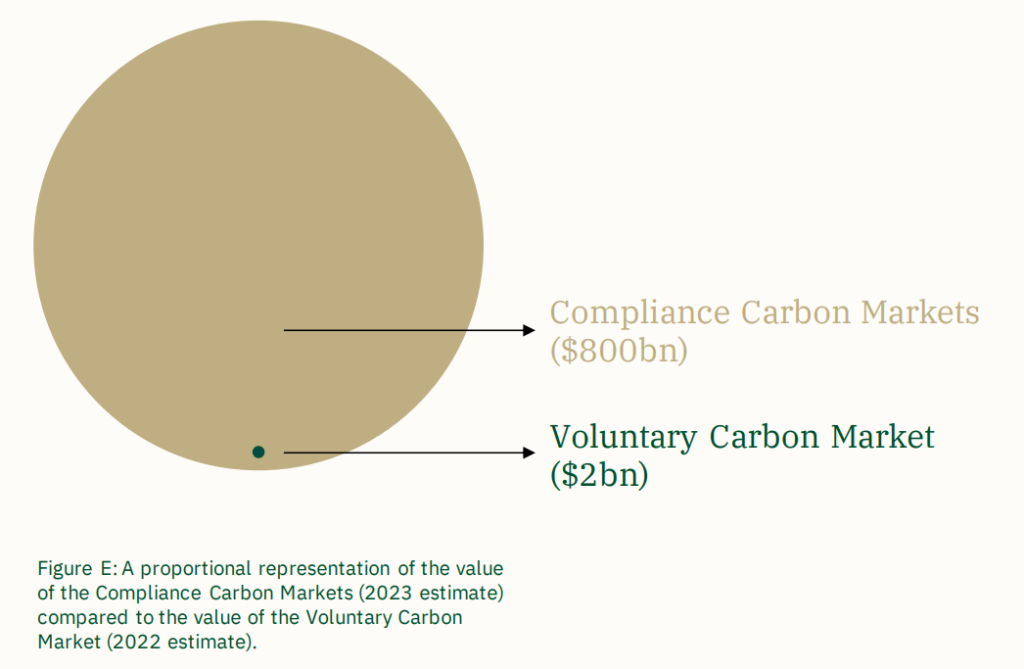

In 2023, the global Compliance Carbon Markets were valued at over $800 billion. These markets are closely linked to policy shifts and geopolitical tensions, leading to fluctuations in their size and growth trajectory depending on external factors and the prevailing environment.

In 2022, the VCM was valued at $2 billion. However, Abatable, a carbon intelligence and procurement platform, estimated that in the same year, deals worth $10 billion were executed. This implies that investment into the market was about 5x the value of the carbon credits issued.

According to a Barclays Special Report, the VCM could grow to $250 billion by 2030. Various organizations have made predictions of VCM growth in 2030, with estimates ranging from $10 billion to $250 billion. The complexity, rapid evolution, and convergence of the markets make size predictions challenging.

However, even the lowest forecasts anticipate the market to grow 5x. Long-term predictions are optimistic, with some expecting the market to exceed a trillion dollars by 2050.

Currently, the VCM predominantly covers credits sold by carbon dioxide removal (CDR) projects.

McKinsey estimates that based on expected delivery of announced projects, the CDR market could reach $40-$80 billion by 2030. As the CDR industry scales up, which overlaps with the VCM, it’s likely to further stimulate market growth.

So, if the VCM and compliance carbon markets converge as expected, it would lead to a substantial market expansion.

Addressing Risks in the Carbon Market

The GWP opportunity covers a broad spectrum of insurance needs within the carbon market sector. This includes specialized insurance for carbon credits as well as traditional insurance lines necessary for carbon projects and businesses operating in this sector. For instance, construction, property, casualty, financial lines, and marine insurance, among others.

While the report’s long-term prospects for the insurance industry are optimistic, their approach in estimating the potential market opportunity was conservative.

The authors also discounted the potential impact of regulatory mandates requiring insurance and the merging of both markets. Their estimation was also based on the projected annual carbon credit market, rather than the additional investment required to produce these credits themselves. Factoring in the latter could potentially result in a multiple of 3-5x if applied on top.

Indeed, the rapidly evolving carbon markets present a complex landscape, characterized by unique risks and significant challenges. However, the presence of insurance within these markets is paramount for their exponential growth.

The introduction of insurance mechanisms can effectively address risks, enhance confidence among investors, and consequently stimulate increased investment. This, in turn, will enable the markets to scale at the necessary rate to align with global emission reduction targets and effectively combat climate change.

Thank you Carbon Credits

HSBC, Google Partner to Finance and Grow Climate Tech Companies

ESG TOOLS, SERVICES/ SUSTAINABLE FINANCE

Mark Segal February 8, 2024

HSBC and Google Cloud announced today the launch of a new partnership aimed at financing and supporting companies providing climate mitigation and resilience solutions.

The new partnership will connect HSBC’s specialist climate tech finance team with companies in the Google Cloud Ready – Sustainability (GCR-Sustainability) validation programme to explore venture debt financing options. Launched in 2022, GCR-Sustainability showcases companies with solutions available on Google Cloud to help businesses and governments to accelerate their sustainability programs and initiatives, including carbon emission reduction, value chain sustainability improvement and ESG data processing to help identify climate risks.

Justin Keeble, Managing Director for Global Sustainability at Google Cloud, said:

“The scale of climate challenge requires a global ecosystem of technology providers bringing solutions that drive impact. This is why we launched our Google Cloud Ready – Sustainability ecosystem which – one year in – includes leading climate tech companies. Many of these partners need access to finance and we are excited to partner with HSBC to support firms key to climate action.”

According to the companies, the new partnership targets key goals including increasing the number of partners in the GCR – Sustainability programme over the next two years, and providing financing opportunities for HSBC, following its announcement last yearof a goal to make $1 billion available to support early-stage climate tech companies around the world.

Natalie Blyth, Global Head of Commercial Banking Sustainability at HSBC, said:

“A step change is needed to scale up the new technologies that will play a critical role in supporting global decarbonization. Partnerships and innovative financing solutions are key, especially during a period when investment in climate tech startups has fallen. By combining financing support, cloud technologies and connectivity to partners across our combined footprints, we will help climate tech vendors accelerate their growth, and develop the solutions we urgently need at scale.”

With the launch of the new collaboration, HSBC and Google announced the partnership’s first venture debt package, provided to LevelTen Energy, a provider of renewable transaction infrastructure connecting and supporting renewable energy buyers, advisors and sellers. In addition to its validation in GCR-Sustainability, LevelTen partnered with Google last year to develop a faster and easier RFP process for renewable Power Purchase Agreements (PPAs), speeding up the time to negotiate and execute deals by around 80% and enabling the acceleration of clean energy deployment.

Ross Trenary, Chief Financial Officer of LevelTen, said:

“We are proud to be a GCR-Sustainability-validated company and are looking forward to working closely with the team at HSBC. This venture debt package will enable us to scale our platform, which provides transaction infrastructure for carbon-free energy buyers, sellers and financiers. HSBC’s global reach aligns with our international presence, while giving us opportunities to connect with HSBC clients that are looking to achieve sustainability goals.”

Thank you to Mark Segal, ESG Today

Moody’s Rolls Out New Scoring System of Companies’ Net Zero Transition Plans

ESG TOOLS, SERVICES | Mark Segal February 9, 2024

Credit ratings, research, and risk analysis provider Moody’s Investors Service announced the release of its first Net Zero Assessment (NZA), its new scoring system aimed at enabling investors to evaluate and compare companies’ decarbonization plans and actions.

Officially launched last year, the new NZAs provide an assessment of the strength of a company’s carbon emissions reduction profile relative to a global net zero pathway consistent with the Paris Agreement’s most ambitious goals, considering the entity’s ambitions, as well as its plan and governance around emission reductions. The NZAs utilize a 5-point scale from NZ-1 (highest score) to NZ-5 (lowest score).

For its first NZA, Moody’s assigned Italian energy infrastructure provider Snam’s climate transition plan with a score of “NZ-3” or ‘significant,’ with the company’s ambition rated as “well below 2°C,” consistent with the Paris Agreement goals, and its implementation as “solid,” with its action plan on Scope 1 and 2 emissions based on proven and easy-to-scale-up technology, but partly offset by implementation hurdles for its Scope 3 emissions, including having a relatively high share of emissions arising from hard-to-control sources.

Brian Cahill, Global Head of ESG at Moody’s Investors Service, said:

“Market participants confront considerable challenges in comparing decarbonization plans across companies because of inconsistent disclosure requirements, differences in the magnitude, coverage and timing of targets, as well as differences in the capacity of firms to implement their business transformation plans and meet their stated targets. NZAs provide an independent and comparable assessment of an entity’s emissions reduction profile, enabling market participants to better understand the relative positioning of non-financial corporates as they transition to a low-carbon future.”

Thank you to Mark Segal, ESG Today

If you would like further information regarding our investment options, please feel free to email me.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814