6 August, 2024

Welcome to this week’s JMP Report,

Our esteemed colleague and friend, Chris Hagan has decided to pursue other interests in the financial services industry and has handed the baton for the JMP Weekly Report on to our other team members.

We would like to express our gratitude to Chris for his tireless efforts and significant contributions to JMP Securities and the Papua New Guinea capital markets over the years. We are proud to have worked alongside him as a friend and colleague, and we are committed to building on his dedication to keeping the market well-informed. We look forward to the opportunity to invite Chris to share his insights with you again in the future.

Once Chris has settled into his new role, we will ask him to resume providing our clients with his valuable recommended reading materials, as we know they greatly appreciate them.

WEEKLY MARKET REPORT | 29 July, 2024 – 2 August, 2024

| STOCK | QUANTITY | CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 18,348 | 17.52 | 321,457 | 17.52 | – | 0.02 | 0.11% |

| KSL | 106,985 | 3.05 | 326,304 | 3.05 | 3.06 | (0.01) | 0.33% |

| STO | 879 | 19.60 | 17,228 | 19.60 | – | 0.09 | 0.46% |

| NEM | 54 | 146.00 | 7,884 | 147.00 | – | 1.00 | 0.68% |

| KAM | 1,000 | 1.25 | 1,250 | 1.25 | – | – | – |

| NGP | – | 0.75 | – | – | – | – | – |

| CCP | 2,539 | 2.23 | 5,66, | – | – | – | – |

| CPL | – | 0.79 | – | – | 0.79 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

# We have excluded NEM market cap as PNG assets form a comparatively small part of the total NEM operations and stock in PNG is limited.

^ As at 05 Aug 2024 CCP is suspended from trading pending an announcement to the market.

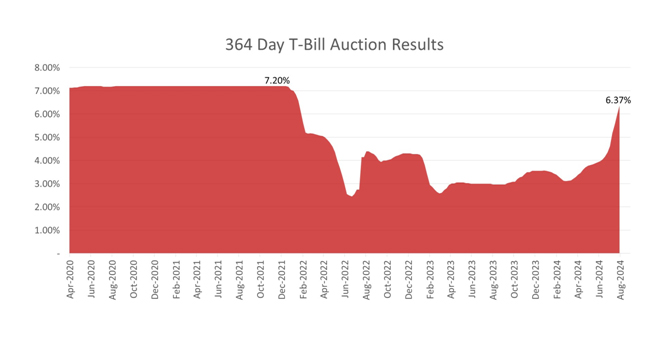

WEEKLY YIELD CHART | 29 July, 2024 – 2 August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIVE | YIELD % |

| BSP | 7,494,208,463 | K0.37 | K1.06 | 8.16% |

| KSL | 789,073,725 | K0.10 | K0.16 | 8.39% |

| STO | 62,714,495,877 | K0.31 | K0.66 | 4.97% |

| NEM | – | – | K3.99 | – |

| KAM | 50,661,584 | K0.12 | – | – |

| NGP | 31,664,583 | K0.03 | – | – |

| CCP | 618,941,977 | K0.11 | K0.13 | 10.81% |

| CPL | 195,964,015 | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | 1.98% |

| TOTAL | 72,983,836,545 | 5.32% |

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates. NEM has been exluded from Market-wide yield calcs.

In terms of the market action on PNGX last week, we note the following:

- Last week saw trades in 6 shares on PNGX. Total value of trading was a modest K679,786.

- KSL led the way with 106,985 shares traded and closing the week down 1t at K3.05.

- The market continues to rely heavily on volumes imported from the ASX as part of a spread-trade between the two markets. With the gap in the share price between PNGX and the ASX narrowing to around A$0.10, this source of supply may reduce. Will this result in upward pressure on the PNGX price or just a drop in trading?

- BSP traded 18,348 shares, ending the week at K17.52.

- It was good to see trading in NEM last week, with 54 Depository Receipts traded at K146.00. There is strong demand for NEM, however only limited supplies in the markets. Unfortunately, the NEM Depository Receipts on PNGX are not easily exchangeable with the ASX equivalent and so there is no obvious source of additional supply. At any rate, at current prices, NEM is trading at a discount on PNGX compared with the ASX equivalent.

- KAM continues to hold at recent higher prices, however the stock still trades at a significant discount to NTA.

- 6-monthly reporting season is just about upon. Look out for meaningful datapoints from KSL, BSP, CCP and CPL.

- CCP went into a brief trading halt on Friday, only to emerge after having announced on Monday that it has now received a full approval from BPNG for its banking operations and a license to that effect has been issued. Investors will need to get an understanding of the impact of this on the short and long-term performance of the company.

- It will be useful for the market to be put at ease by KSL in terms of the containment and resolution of the recent fraud within its operations. The 6-monthly report should provide some guidance.

- Where are the bidders for CPL? The market is having a hard time valuing CPL at the moment and there are not even opportunistic, low-ball bids in the system, probing for seller nervousness. We note that assistance from GoPNG may be starting to flow. How will this impact on the company’s financial position? Again, we anticipate the 6-monthly report eagerly.

- Fixed Interest Markets are in turmoil. GoPNG, through BPNG auctions have seen Treasury Bill yields rise rapidly in recent weeks, closing last week at 6.37% for the 364 day paper. Yields are up more than 300 basis points over the last couple of months.

- At 6.37% weighted average successful bids, BPNG chose to leave K60 million on the table and accepted K160.74 million out of K233.74 in bids received. This suggests market participants anticipate yields continuing to climb higher but BPNG wanting to manage the ascent. Where will the rates stabilize?

- It is interesting that BPNG has restarted issuing 91 day Treasury Bills since July 2024 and at the same time increasing the amounts on offer in 182 and 273 day categories. Clearly liquidity is a concern at the moment. The 91 day paper most recently traded at 3.42%.

What we have been reading

Japan Causing Massive Deleveraging Event, Buffet on Defence

U.S. stocks suffered a horrible end to the week as investors moved to bonds and pulled away from equities. The jobs report came out weak (114,000 vs 175,000 expected), but the Fed’s Barkin dismissed the numbers as reasonable. But what else is happening in the markets which could be causing such a dramatic drop?

To understand, let’s first discuss carry trades. This means borrowing a low interest rate currency and using the money to fund something with a higher return. In this case, the carry trades we will discuss are in Japanese Yen. It has been the standard for roughly 20 years for traders to borrow Yen, then use the money for something deemed high return, such as stocks.

What would happen if Japanese low interest rates and therefore cheap currency started to reverse? What would happen if the stocks which seemed high return started to look not so hot? This would be a total reversal of the status quo. If that does not sound damaging enough, let’s introduce leverage into the equation. These trades are typically done with very high leverage which can make reversals especially explosive. That’s what has been happening as banks around the world begin to cut, and Japan has recently hiked their interest rate.

Friday, we talked about using the currency pair USD/JPY to predict the future of gold prices. Here is the same chart one day later. Notice the Yen rocketed in value, meaning the USD went lower in comparison:

U.S. Dollar to Japanese Yen – 1 Week Chart August 2024

This may be part of what is causing a rug pull in equities. Here is the U.S. S&P 500:

US 500 1 Day Chart August 2024 with data on when Fed hinted at rate cut

Warren Buffett also seems to be growing cautious about stocks. At Berkshire Hathaway, the cash reserves have surged to nearly US$277 billion, and he’s sold about half of the company’s stake in Apple, despite their record quarterly operating profit. The results suggest that Buffett might be concerned about the U.S. economy or that stock market valuations have become too inflated.

These findings came after a stock market decline that pushed the Nasdaq into correction territory and a weak jobs report, which raised concerns about U.S. economic activity and whether the Federal Reserve delayed too long in cutting interest rates.

This marks the seventh consecutive quarter that Berkshire has sold more stocks than it bought. The company also repurchased only US$345 million of its own stock, down from US$2.57 billion in the first quarter, with no buybacks in the first three weeks of July.

Bursa Malaysia Debuts Malaysia’s First Nature-Based Carbon Credits

Saptakee S | Carbon Credits

Bursa Malaysia Drives Carbon Credits Market with Kuamut Project

Bursa Malaysia is proactive in engaging with stakeholders, carbon experts, and local developers to boost the carbon credit market in Malaysia.

Notably, in March 2024, the Kuamut project achieved its first Verified Carbon Units (VCUs) under Verra’s Verified Carbon Standard (VCS), cutting annual emissions nearly by 800,000 tCO2e.

It also provides significant climate, community, and biodiversity benefits, earning Gold Level status for Climate under the Climate, Community, and Biodiversity (CCB) Standards. Furthermore, it has accolades from BeZero Carbon for being one of the most advanced forest management projects.

Leading news agencies revealed that units and organizations committed to reducing their environmental impact had joined the auction. Essentially, they focused on offsetting tough GHG emissions through carbon credits. The auction for the forest protection and regeneration project was cleared at RM50 per contract.

Bursa Malaysia CEO Datuk Muhamad Umar Swift has emphasized,

“It has been a long wait for Malaysia to finally witness the auction of the country’s first domestically produced quality carbon credits. A critical step to accelerate the development of domestic carbon projects is to adopt some form of compliance carbon market.”

He has critically assessed the situation, pointing out that the voluntary renewable energy certificates (RECs) market took five years to expand. Given the complexities of implementing carbon projects, especially nature-based ones, he believes Malaysia’s voluntary carbon market will need ongoing improvements to reach its full potential.

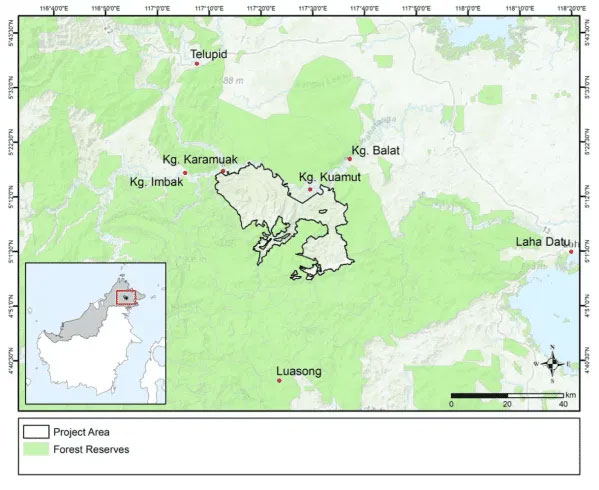

Kuamut Project: The Ultimate Carbon Sink

Earlier in May, Bursa Malaysia released a press statement glorifying the geography, ecology, and biodiversity of the Kuamut Project. Located in Sabah’s Tongod and Kinabatangan districts of Malaysian Borneo, it protects and preserves 83,381 hectares of tropical forest.

It is a public-private partnership between the Sabah Forestry Department, Rakyat Berjaya Sdn Bhd, Yayasan Sabah, and Permian Malaysia. Describing further, the project also receives operational support from PACOS Trust and the Southeast Asia Rainforest Research Partnership (SEARRP).

The Kuamut Project is hugely significant for the South Asian nation and is handled by Permian Malaysia, the leading environmental & ecological services for businesses headquartered in London. The project addresses the climate crisis by preventing emissions from deforestation and forest degradation. Safeguarding the forest ensures that carbon remains stored in the biomass. Moreover, as the forest regenerates, it will strengthen its function as a carbon sink.

Bursa Malaysia through this conservation project also aims to improve the livelihood of the locals by creating ample sustainable economic opportunities. They are equally responsible for preserving the rich biodiversity, flora and fauna of the forest.

Image: The Kuamut Forest Conservation Project

Malaysia source: Permian Global

Permian Global: In a Mission to Secure Tropical Forests

Permian Global operates across Brazil, Colombia, Indonesia, Malaysia, and Peru. It uses private-sector carbon finance to protect, and regenerate threatened tropical forests. The company halts deforestation, prevents species loss, and empowers local communities through large-scale projects in collaboration with locals.

By generating verified carbon units, these projects help corporations meet their climate goals. They believe that protecting forests keeps biomass carbon locked in vegetation, thereby mitigating climate change. Furthermore, local involvement ensures sustainable economic alternatives are carried out in those specific regions.

Most importantly, tropical forests, rich in biodiversity, benefit from these projects, which also include species research and monitoring.

Stephen Rumsey, founder and Chairman of Permian Global said,

“We are incredibly grateful to Bursa Malaysia for their vision and leadership in developing the Carbon Exchange and especially for their support of the Kuamut Project.”

He further added,

“Climate action requires system-wide transformation. This means the rapid development of high-integrity, high-impact actions on the ground, like the Kuamut Project, but it also means building the financial infrastructure that drives investment in these vital activities. BCX is an enormously important piece in the climate puzzle.”

Bursa Malaysia Ensures to Carbon Market Transparency

Last year, BCX auctioned credits from the Linshu Biogas Project in China and Cambodia’s Southern Cardamom Project. However, the Southern Cardamom Project faced backlash for lacking free, prior informed consent from the local community, prompting Verra to investigate in June 2023. So, this time Bursa Malaysia does not want any discrepancy in information. It is rather completely focused on sustained improvement in Malaysia’s voluntary carbon market.

All in all, as Malaysia’s carbon market grows, Bursa Malaysia aims to position the country as a prime spot for nature-based carbon projects, attracting local and international investment. Consequently, the successful launch of the Kuamut project is expected to boost funding for forest conservation and community development. We hope these efforts will solidify Malaysia’s role in global sustainability initiatives.

Please feel free to reach out for your investment needs.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814