19 August, 2024

Welcome to this week’s JMP Report,

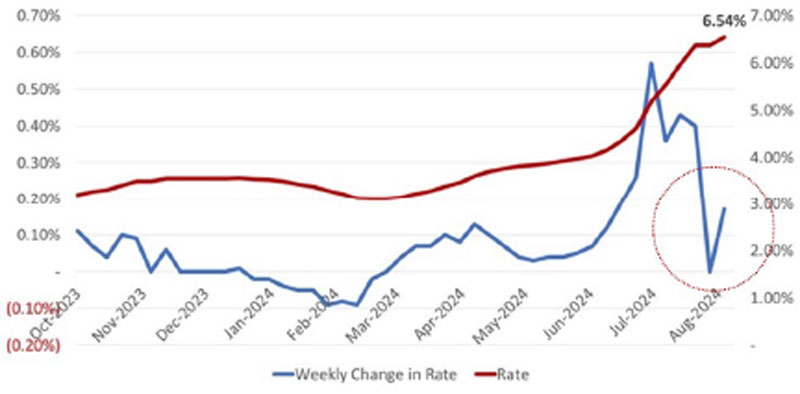

As predicted in last week’s report, all the action was in the fixed interest markets this week. 364-day Treasury Bills rose another 17 basis points to close at a yield of 6.54% in the weekly auction, resuming their upward trend. BPNG again decided to leave a fair bit of money on the table to stem the rise in rates, with K70 million in 364-day bids being rejected as too expensive.

- We still don’t have a good understanding of the current shape of the long-term yield curve in the domestic markets. Only a successful, well-supported GIS auction is likely to start to flesh out this picture; and

- There is some uncertainty as to the fiscal consequences of the short-falls in Treasury Bill and GIS sales in recent weeks. The market is looking for a clear indication of the GoPNG fiscal runway to the end of the year. In equity markets, it was another quiet week, with only limited trading:

- Only BSP, STO and KSL traded during the week, with total value of trading amounting to K498,200.

- KSL once again led the way with 146,494 shares traded and closing the week up 0.01 at K3.06. With some renewed weakness in the KSL ASX price, the PGK price spread between PNGX and ASX has been somewhat restored re-encouraging importers of the stock. § BSP traded 2,673 shares on-market, ending the week at K17.54.

- A small parcel of STO shares also changed hands, with 156 shares trading at K19.51, down 0.09 during the week.

WEEKLY MARKET REPORT | 12 August, 2024 – 16 August, 2024

| STOCK | QUANTITY | CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 2,673 | 17.54 | 46,884 | 17.54 | – | – | – |

| KSL | 146,494 | 3.06 | 448,272 | 3.06 | 3.09 | 0.01 | 0.33% |

| STO | 156 | 19.51 | 3,044 | 19.51 | – | (0.09) | (0.46%) |

| NEM | – | 146.00 | – | 147.00 | – | – | – |

| KAM | – | 1.25 | – | 1.25 | – | – | – |

| NGP | – | 0.75 | – | – | – | – | – |

| CCP | – | 2.23 | – | 230 | – | – | – |

| CPL | – | 0.79 | – | – | 0.75 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

| TOTAL |

372,607 |

BSP will be releasing its 6-monthly results this week which should provide useful guidance as to its continuing performance.

WEEKLY YIELD CHART | 12 August, 2024 – 16 August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIVE | YIELD % |

| BSP | 7,498,483,509 | K0.37 | K1.06 | 8.16% |

| KSL | 789,073,766 | K0.10 | K0.16 | 8.39% |

| STO | 62,426,009,196 | K0.31 | K0.66 | 4.97% |

| NEM | – | – | K3.99 | – |

| KAM | 50,661,584 | K0.12 | – | – |

| NGP | 31,664,583 | K0.03 | – | – |

| CCP | 618,941,977 | K0.11 | K0.13 | 10.81% |

| CPL | 195,964,015 | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | 1.98% |

| TOTAL | 72,702,228,951 | 5.32% |

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates. NEM has been exluded from Market-wide yield calcs.

What we have been reading

World Bank Issues $225 Million Bond with Interest Tied to Carbon Removals from Amazon Reforestation

The World Bank announced that it has priced a $225 million bond, with financial returns to investors linked to the generation of carbon removal units (CRUs) from reforestation projects in Brazil’s Amazon rainforest.

The transaction marks the first bond to link financial returns to the removal of carbon from the atmosphere – compared with prior bonds tied to carbon credits from avoided emissions – as well as the World Bank’s largest-ever outcome bond.

Jorge Familiar, Vice President and Treasurer, World Bank, said:

“As demonstrated by the historic level of participation in today’s transaction, private investors are eager to connect their financial return to positive development outcomes in the Amazon region. With this largest ever outcome bond we continue to be encouraged by the growing interest in the structure as well as the expanded list of sectors supported.”

Under the terms of the 9-year, 100% principal-protected bond, investors will receive a coupon consisting of a fixed guaranteed component, and a variable component tied to CRUs generated by reforestation projects by Brazil-based company Mombak.

Founded in 2021, Mombak is focused on large-scale carbon removal projects, starting with native, biodiverse reforestation of the Amazon rainforest. The company’s solution targets capturing carbon through large-scale reforestation of degraded, unproductive pastureland with native tree species and assisted natural regeneration, with co-benefits including reversing biodiversity loss, improving watershed assets and generating employment and social impact in local communities. Mombak recently signed one of the largest-ever nature-based carbon removal offtake agreements with Microsoft.

Proceeds from the bond will be used to support the World Bank’s sustainable development activities globally. Additionally, investors will forgo a portion of the ordinary coupon payments, which will be allocated through a hedge transaction to Mombak to support the financing of the reforestation projects. The transaction is anticipated to mobilize approximately $36 million to support Mombak’s projects.

HSBC acted as lead manager on the deal, and is facilitating the hedge transaction. The CRUs generated from the project will be purchased through an offtake agreement by a CRU off-taker, with a portion of the revenue generated to be paid to bondholders in the form of CRU-Linked interest. According to the World Bank, the bond may provide a financial benefit to investors relative to World Bank bonds of similar maturity if the CRU revenues are generated as expected.

Greg Guyett, CEO of Global Banking & Markets at HSBC, said:

“We are pleased to work alongside the World Bank on this innovative bond which aims to support the reforestation of thousands of hectares of the Brazilian Amazon rainforest. We are committed to helping our clients fund sustainable development projects that make a difference in the climate challenge.”

Investors in the new bond included Nuveen, T. Rowe Price, Mackenzie Investments, Rathbones Group, and Velliv.

Matt Lawton, CFA, Global Impact Credit Portfolio Manager, T Rowe Price, said:

“T Rowe Price is very proud to be a lead investor in the World Bank’s pioneering Amazon Reforestation-Linked Outcome Bond. This innovative, outcomes-based transaction offers a unique combination of attractive financial return potential alongside material and measurable positive impact. We believe this bond will help deliver additionality through removing carbon, improving biodiversity, and supporting job creation.”

6 investing mistakes to avoid when the share market falls

| Stockspot | 9 August, 2024

The ASX has been going through some turbulence of late with market corrections in America and Asia giving Australian shares a bit of a cold.

Our market dropped 6% in a single day in early August 2024. It’s important to remember that market dips aren’t actually uncommon. In fact, there’s a 10-20% fall in the market nearly every year.

Despite regular market dips and economic recessions, Australian shares have still earned investors on average 10.9% p.a. since 1926, so it pays to stay invested and be patient when markets have periods of negative returns.

Many investors make the mistake of selling when the market falls, concerned that the economy is heading towards a recession. Their fear is that the economy may get worse and any rebound will take years.

At this period in 2024, that is elevated by fears from the US that they are about to go into a recession, which could be passed on to Australia.

This thought process is completely understandable. Research shows people feel the pain of loss twice as much than the enjoyment of profits.

They will often react without thinking. It’s our fight-or-flight response. Our amygdala (the part of our brain that regulates emotions) is in overdrive trying to prevent loss.

However, a knee-jerk reaction is likely to negatively affect your returns, so it’s important to avoid panic.

With that in mind, here are six mistakes to avoid when markets fall so you can stay on the road to investing success.

Mistake #1: Selling your portfolio in fear of a recession

Market movements and losses have always been followed by longer periods of gains and recovery.

If you exit the market in a panic, however, you risk not being invested when the market rebounds – by which point, it might be too difficult to buy back in at a higher price.

There have been 12 recessions in the US since World War II – the share market has risen during half of them.

The share market is often ahead of the economy, so by the time any recession hits, the market might already be on the way back up.

Stay calm and remember that time in the market, instead of timing the market, is the secret sauce of long-term investing.

We recommend clients have at least a three-year investment timeframe, because the longer you invest, the better your chances of making a great return.

Mistake #2: Changing your portfolio strategy

Changing your portfolio risk in reaction to market performance is a form of market timing and similar to selling your portfolio. Unfortunately, the result is the sale of investments that have fallen the most in price.

There are certain circumstances where it’s appropriate to change your investment strategy, but selling investments at a low point is generally not the way to go.

If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan.

Mistake #3: Not topping up your investments (if you have the means)

Market dips can be a good time to top up your investments since you’re able to benefit from buying shares at a cheaper price. Think of it as a Black Friday at your favourite store. Hardly something to run from!

If you set up regular deposits to your investment account, you can manage the risk of market dips and balance out how much you pay for your investments through dollar-cost averaging.

Mistake #4: Not reinvesting your dividends

Even though the value of shares might decline over the short-term, many companies will still be paying dividends.

When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when share prices go up again.

Mistake #5: Not rebalancing your portfolio

Rebalancing is another way to take advantage of market dips.

Portfolio rebalancing is the process of realigning the assets in a portfolio to desired levels. It involves periodically buying or selling assets in a portfolio and can be difficult to do on your own.

Stockspot automatically rebalances our clients’ portfolios.

In March 2020, we sold gold and bonds which had performed well and invested the profits into share markets that had collapsed. The share market rebounded, and as a result, many of our clients were up 40% or more on the extra shares we bought for them when we rebalanced again in November 2020.

Mistake #6: Not diversifying your investments

While the broad share market index is down, there are sectors that have fared much worse during this market dip.

US stocks lost 8% in a week while Japanese stocks lost 20%, including 12% in a single day.

If you have a properly diversified portfolio (investments in several asset classes), you can ignore market dips and not worry about catastrophic losses that can occur when you have invested into a single asset or sector.

Index investing comes out stronger from each market crisis because loss-making active investors and day traders convert to a diversified indexed approach.

At Stockspot, we prepare for uncertainty and dips in the market by investing across a broad range of different investments.

Defensive assets like bonds and gold are a proven way to protect a portfolio and provide a cushion when markets dip.

If you diversify, you’ll avoid large losses from a single investment. This can make a big difference to your sanity when markets fall.

Research has shown that setting a diversified investment strategy and ignoring the movements of the market leads to much better outcomes than trying to outsmart the market.

In short, if you’ve focused on setting yourself up with a diversified portfolio that’s rebalanced appropriately, simply stick to your strategy, stay invested, and perhaps top up if you have the cash reserves.

Please feel free to reach out for your investment needs.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814