May 10, 2021

Good morning and welcome to this week’s JMP Report.

Attached you will find an update from BSP and two Governance documents you may find interesting.

BSP Secondary Listing Status Update (attached)

Governance Institute of Australia Member donated documents (attached)

BUSINESS CONTINUITY MANAGEMENT POLICY

On the Equity side of the market we saw BSP, KSL and OSH share the week’s activity. BSP traded 44,593 shares unchanged at K12.00, KSL traded 23,003 shares at K3.21 while OSH traded 591 shares at K10.50. Refer details below.

|

WEEKLY MARKET REPORT 03.05.21 – 07.05.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

44,593 |

12.00 |

– |

|

|

KSL |

23,003 |

3.21 |

0.01 | |

|

OSH |

591 |

10.5 |

||

|

KAM |

– |

0.90 |

– |

|

|

NCM |

– |

75.00 |

– |

|

|

CCP |

– |

1.70 |

– |

|

|

CPL |

– |

0.60 |

– |

|

In the interest rate market, the TBills continue their flatline yield with the 364 day auction averaging 7.20%. Finance Company money just as flat with Fincorp offering 3.5% for 6mths and 5.50% for 12mths.

The secondary bond market has been a little quiet with expectation of another Treasury Bond issue later in May, who said the 18th? rumour only.

This doesn’t stop us from trading the yield curve with opportunities between the 3yr and 10yr.

What we have been reading this week

How an Oil Company Becomes a Renewables Company

By Nathaniel Bullard (Bloomberg)

By Nathaniel Bullard (Bloomberg)

Last week a raft of oil majors released their first-quarter results, with companies like Royal Dutch Shell Plc showing a return to pre-pandemic profit levels. At the same time, some of the majors increased their energy transition commitments: as my Bloomberg Intelligence colleagues Salih Yilmaz and Will Hares noted on Twitter, Spanish firm Repsol SA devoted 40% of its capital expenditure to low-carbon projects, and France’s Total SE stated plans to increase its renewable energy capacity five-fold over the next four years.

There are energy-transition commitments, though, and then there are energy-transition results. And on the latter side, one company shines: Norway’s state-owned oil producer, Equinor ASA. It posted more than $2.6 billion of earnings in the first quarter of 2021, 49% of which was from renewable energy. Last quarter, Equinor earned more from renewables than it did from oil and gas exploration and production.

But Equinor’s results are more than evidence of a successful renewable-energy strategy. They’re also a sign of the challenge ahead for other oil majors with similar ambitions.

Equinor’s capital gains in renewables came from “farm downs,” i.e. the selling of assets at various stages of development to new owners. (Another term for farm down is “asset rotation,” which I discussed last week.) Equinor divested a 50% interest in two U.S. offshore wind projects and a 10% interest in two U.K. offshore wind farms. While asset rotation is slowing down in the power utility sector, it seems to be working fine for Equinor.

More interesting than the farming down itself is who Equinor is farming down to: two other European oil majors! BP Plc is buying into the U.S. projects, and Italy’s Eni SpA is buying into the U.K. projects—or in other words, BP and Eni are paying Equinor for the privilege of taking on the earlier stages of developing offshore wind.

Therein lies the challenge for Big Oil’s energy transition plans. Equinor’s way to benefit from renewable-energy assets is, essentially, to put in the early work of developing them—and then reap the cash benefits of selling them to others.

Importantly, early wind development is more time-dependent and expertise-dependent than it is capital-dependent. Equinor’s U.S. wind assets are the result of its success in the country’s 2018 offshore-lease auction, when it won stakes with a bid of $135 million. In its latest earnings statement, the company says BP paid $1.2 billion for those same assets, netting the Norwegian company $1 billion on the deal.

Equinor is a special creature in a few ways. First, one of the reasons it could be an early developer of U.S. offshore wind is that it has decades of experience developing and operating offshore oil and gas assets. Other oil majors (in particular BP) can claim the same expertise, but Equinor seems particularly adept at it.

Second, the company is two-thirds owned by the Kingdom of Norway, with Norway’s Government Pension Fund Global, also known as Norges Bank, owning another 3.59% of the company via Folketrygdfondet, which is authorized to invest 85% of its funds in Norwegian companies. Not only is the government a particularly patient and committed shareholder, it also has a hand in its portfolio companies’ strategies. The Folketrygdfondet “has an interest in an orderly transition in line with the Paris Agreement” and expects that its portfolio companies “integrate climate change considerations into policies and strategy.”

So to recap: Norway reinvests its state-oil company’s revenues back into said oil company, while also helping drive said oil company’s energy transition strategy. As Equinor’s first-quarter results show, all of this effort and coordination has made it possible for an oil company to get half its revenues from renewable energy, at least for now. Other oil majors reaching for that same brass ring will have their work cut out for them, certainly—and may continue to resort to buying assets from each other in their quest to get there.

EU steel orders not yet back to pre-pandemic levels: Eurofer

S&P Plattts

EU apparent steel consumption ‘falling since 2019’

Supply chain seen disrupted by pandemic

Import market share continues high

EU steel output ‘hasn’t recovered’ from 2009 crisis

London — Steel orders in the EU are not yet back to pre-pandemic levels, except in the automotive sector, where the rebound has been strong, European Steel Association market analysis director Alessandro Sciamarelli said May 6.

This is despite an industry-driven rebound in orders in Q3 and Q4 2020 and again in Q1 2021, the Eurofer official said.

“Steel consumption [in the EU] is still at low levels in historic terms,” Sciamarelli said in a webinar presentation. “Apparent steel consumption has been falling since early 2019, well before the pandemic, reflecting a negative trend in steel demand, a manufacturing downturn and destocking.”

An expected increase in 11.7% in apparent consumption in EU this year won’t offset the declines of -5.3% in 2019 and -11% in 2020, he said.

Real steel consumption – the use of steel in sectors’ production processes – in the EU dropped by -10.4% in 2020 from 2019 levels due to the impact of the pandemic and is set to rebound by 7.7% in 2021 and gain a further 4% in 2022, Eurofer said in a 2020-21 market outlook report. Q4 2020 consumption volumes were 36.3 million mt.

Construction output is expected to rebound in 2021 (+5%) and in 2022 (+4%), after falls of -4.6% in 2020 and 3.3% in 2019, Eurofer reported.

Automotive output is expected to rebound in 2021 (+15.9%), followed by more moderate growth in 2022 (+4.2%), according to data from Eurofer members. Automotive output fell (-19.8%) over full-year 2020, having fallen in 2019 (-5%), the report said.

Activity in the mechanical engineering sector is expected to rebound in 2021 (+8%) and continue in 2022 (+3.6%). In 2020, the mechanical engineering sector fell (-11.7%), having been stable in 2019 (-0.9%), Eurofer reported.

Imports: Still high market share

Steel imports into the EU from third countries fell last year in tonnage terms in tandem with lower demand, slumping 18% to around 23 million mt after sliding 12% in 2019. However, despite falling demand in Europe, and the use of trade policies, the market share of imports in the EU has not decreased in historical terms, Sciamarelli said. This is particularly so for flat products, which took a 22.3% market share in Q3 2020, while long products took a 9.1% market share.

In part this is because steel production in the EU has never recovered from its 30% drop in 2009, at the time of the global economic crisis, which was followed by a 12.1% drop in 2020, he said.

Conditions for safeguards seen persisting

Eurofer’s director international trade and external relations director, Karl Tachelet, claimed in a presentation that “multiple EU steel antidumping duties didn’t revert the trend of surging steel imports into the EU [in the period] before the EU system of safeguards and US Section 232 was introduced.”

Between 2012 and 2018, EU steel imports more than doubled (+112%) while exports fell 26%, according to Eurofer’s data. Therefore, “the basic conditions for continuation of the safeguards are still there,” Tachelet argued.

The current system of import safeguards and quotas is due to expire June 30. The merits or otherwise of their extension are being investigated by the European Commission, with EU producers generally in favor of their continuation, and consumers generally against.

Current tightness of certain products in the European market — recently propelling prices of products including hot-rolled coil to their highest-ever level — are not the result of the current quota system but rather of “temporary shortages in a supply chain disrupted by pandemic,” Sciamarelli claimed.

Persistent and worsening global steel overcapacity helps make the steel safeguard “a critical factor of stability in a volatile market,” Tachelet said. While according to the OECD, global steel overcapacity was estimated at around 650 million mt in 2020, with about half located in China, there are also “upcoming excess capacity regions” including Iran — where there is “massive” new capacity coming on stream — Indonesia, Vietnam, India, Korea, Brazil, Russia and in Turkey, where there is currently investment in two new blast furnaces, he said.

In comparison, the EU permanently closed 22 million mt -25 million mt of capacity between 2009 and 2019, including 3 million mt in 2019, according to Eurofer.

“We will see more dramatic situations in future,” Tachelet warned.

Most US coal generators can’t compete with wind and solar, US study finds

Ketan Joshi 6 May 2021

Ketan Joshi 6 May 2021

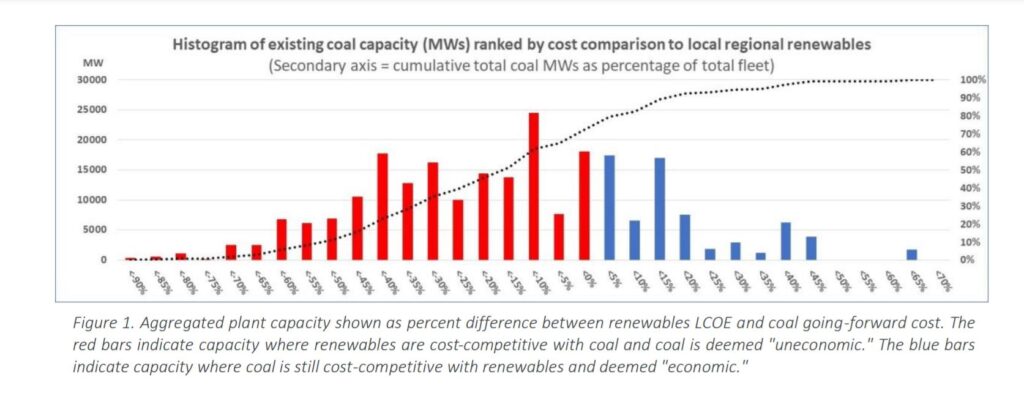

A new report from US think tank Energy Innovation shows that 72% of the country’s coal power fleet is now uneconomic compared to local wind and solar alternatives, or slated to retire within five years’ time. Of the 235 coal plants in the US, 182 are now generally uneconomic or have begun the process of retirement.

The authors describe this as a ‘cost crossover’ point. This marks when the costs of operating a coal plant are higher than the costs of building new wind and solar and operating those assets instead. They do not include other factors such as carbon pricing and subsidy schemes.

“In the last two years, the cost of renewables has fallen even faster than the National Renewable Energy Laboratory’s forecast in its 2018 Annual Technology Baseline, and faster than predicted in the original “Coal Cost Crossover” report, which was prepared in partnership with Vibrant Clean Energy in 2019”, write the authors.

“In other words, the coal cost crossover trend continues to accelerate”. The 2018 report’s projections for the proportion of coal to uneconomic relative to wind and solar for the year 2025 have been almost reached in the year 2020.

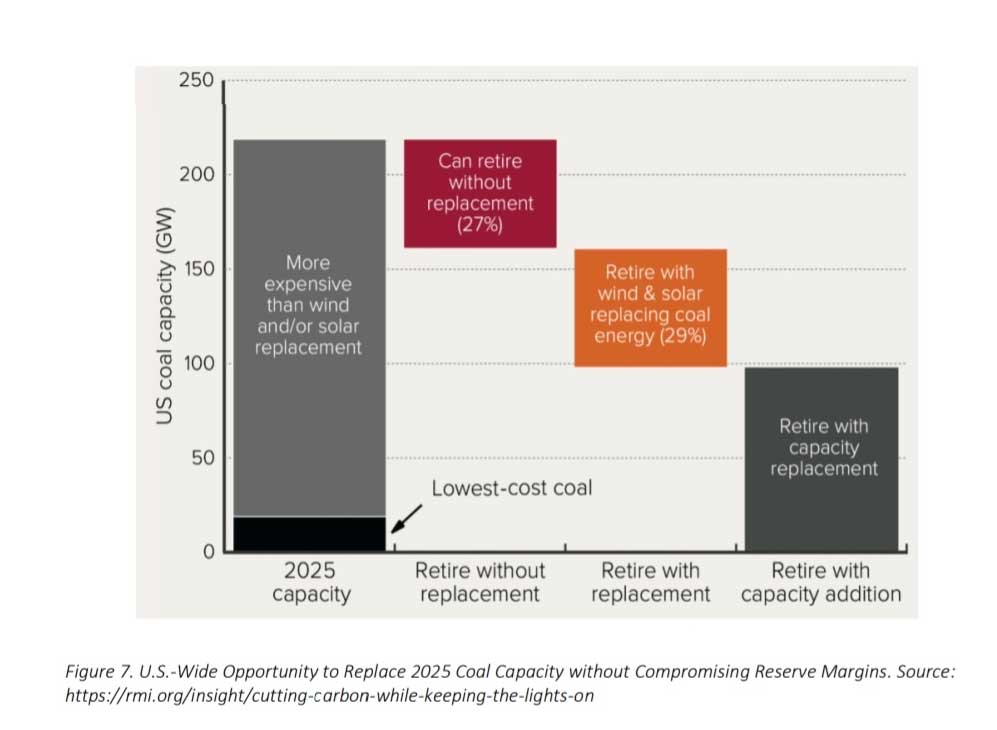

The report highlights that around one third of US coal capacity can retire without requiring any replacement, one third should be replaced with wind and solar, and the final third would require additional dispatchable capacity.

The United States has set an ambitious climate goal of 50-52% below 2005 levels in recent weeks, and aims to reach 80% clean energy by 2030 and 100% by 2035. This will have a significant impact on air pollution as well as greenhouse gas emissions.

“Because of significant coal plant retirements and reductions in coal power generation, coal power plants are causing fewer premature deaths in the U.S,” write the authors of the study. “However, coal power plants still cause about 3,000 premature deaths every year in the U.S. and are responsible for a host of negative health impacts including asthma and pre-term births. By switching from coal to clean, renewable power resources like wind and solar, we could continue to bring pollution-related deaths from the power sector down significantly”.

We hope you have enjoyed this week’s read. If you would like to discuss purchasing shares on the Port Moresby Exchange of ASX, please do reach out.

Have a great week and regards,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814