July 19, 2021

Welcome to this week’s JMP Report.

Last week on the local bourse, three stocks saw trading activities. KSL had the highest number of shares trading 65,329 and closing down 0.010 toea or -0.31% to close out the week at K3.25 while BSP traded 1,602 shares closing up 0.10 toea or 0.82% to K12.30 (limited trading to the Trading Halt). OSH was quiet with only 120 shares trading and closed down 0.01 toea or -0.09% and NCM also trading small volume with 110 shares closing unchanged at K75.00 per share.

Cutting through the news surrounding BFL (BSP shares)

As you are aware, BFL announced a Share Trading Halt to their listed shares (BSP).

What does this actually mean? Under the PNGX and ASX rules, a listed company must withdraw their shares from trading if there has been significant events that may affect their share price. This was due to comments in the press around BFL’s compliance on Anti Money Laundering Rules (AML) rules which was reported in the press and therefore may have a price impact for shareholders.

BFL advised the Market of the facts surrounding the press comments which seemed to be an issue within BPNG and according to BFL, they have complied with all directions set by the Compliance Unit. After BFL released their statement to the Market, BFL advised both POMX and ASX and lifted the trading halt.

So how the week looked on the equities front, please refer to the details below;

|

WEEKLY MARKET REPORT 12.07.21 – 16.07.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

1,602 |

12.30 |

-0.10 |

0.82 |

|

KSL |

65,329 |

3.25 |

-0.01 | -0.31 |

|

OSH |

120 |

10.60 |

0.01 | -0.09 |

|

KAM |

– |

1.00 |

– | 0.00 |

|

NCM |

110 |

75.00 |

– |

0.00 |

|

CCP |

– |

1.70 |

– | 0.00 |

|

CPL |

– |

0.80 |

– |

0.00 |

On the interest rate front, there has been little change to the yield curve and yes, TBill closed at 7.20% from last weeks auction.

Our order book shows buys on most stocks and the bond market, with an offer of some short stock.

What we have been reading this week

An interesting article from Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist, AMP Capital. Thank you Shane and AMP Capital.

A surge in financial information and opinion along with our natural inclination to focus on bad news is arguably making us worse investors: more fearful & short term.

Five ways to help manage the noise and stay focussed as investors are: put the latest worry list in context; recognise that shares return more than cash in the long term because they can lose money in the short term; find a process to help filter noise; make a conscious effort not to check your investments so much; and look for opportunities that investor worries throw up.

Introduction

It sometimes seems that the worry list for investors has become more threatening and more confusing than ever. This was an issue prior to coronavirus – with trade wars, President Trump, social polarisation, tensions with China, concerns the Eurozone would break apart, slow growth in Australia, and ever-present predictions of a new global financial collapse. Coronavirus has only added to the worries with hourly updates about new cases, lockdowns, vaccines, etc. It sometimes seems that if coronavirus won’t get us, inflation and the mountain of debt will. To be sure these risks are real and can’t be ignored, but the risks around investing seem to receive ever higher prominence these days as the digital age enables the rapid dissemination of news and opinion. The danger is that all this noise is making us worse investors as we lurch from one worry to the next. The key to investor success is to manage the noise and stay focussed. This is an update of a note I wrote a few years ago but the need to turn down the noise is more important than ever.

Ever more worrying worries

While there’s no denying there are things to worry about, there is a psychological aspect to this that is combining with the increasing availability of information, and intensifying competition amongst different forms of media for clicks, which is magnifying perceptions around various worries.

Firstly, our brains are wired in a way that makes us natural receptors of bad news. People suffer from a behavioural trait that has become known as “loss aversion” in that a loss in financial wealth is felt much more distastefully than the beneficial impact of the same sized gain. This probably reflects the evolution of the human brain in the Pleistocene age when the key was to avoid being eaten by a sabre-toothed tiger or squashed by a wholly mammoth. This leaves us biased to be more risk averse and it also leaves us more predisposed to bad news stories as opposed to good.

Consequently, bad news and doom and gloom find a more ready market than good news or balanced commentary as it appeals to our instinct to look for risks. So “bad news and pessimism sells”. Flowing from this, prognosticators of gloom are more likely to be revered as deep thinkers than optimists. As Joseph Schumpeter observed “pessimistic visions about anything usually strike the public as more erudite than optimistic ones.”

Secondly, we are now exposed to more information than ever on how our investments are going and everything else. We can now check facts, analyse things, sound informed easier than ever. But for the most part we have no way of weighing such information and no time to do so. So, it becomes noise. As Frank Zappa (and maybe some others) noted “Information is not knowledge, knowledge is not wisdom.” This comes with a cost for investors. If we don’t have a process to filter it and focus on what matters, we can suffer from information overload.

This can be bad for investors as when faced with more (and often bad) news we can freeze up and make the wrong decisions with our investment. In particular our natural “loss aversion” can combine with what is called the “recency bias” – that sees people give more weight to recent events in assessing the future – to see investors project recent bad news into the future and so sell after a fall. A 1997 study by US behavioural economist Richard Thaler and others showed that providing investors in an experiment “with frequent feedback about their [investment] outcome is likely to encourage their worst tendencies…

More is not always better.

The subjects with the most data did the worst in terms of money earned.” As famed investor Peter Lynch observed “Stock market news has gone from hard to find (in the 1970s and early 1980s), then easy to find (in the late 1980s), then hard to get away from.”

Thirdly, there is an explosion in media outlets all competing for our eyes and ears. We are now bombarded with economic and financial news and opinions with 24/7 coverage by multiple web sites, subscription services, finance updates, dedicated TV and online channels, chat rooms, individuals’ comments via social media, etc. And, following from loss aversion, in competing for your attention, bad news and gloom naturally trumps good news and balanced commentary. So naturally it seems that the bad news is “badder” and the worries more worrying than ever.

I Googled the words “the coming financial crisis” recently and found 352 million search results with titles such as:

- “brace for the next crisis”;

- “stimulus spending could cause the next economic crash”;

- “cryptocurrencies will lead the next financial crisis”;\

- “a new crisis is ahead – can you survive it?”.

In the pre-social media/pre-internet days it was much harder for ordinary investors to be exposed to such disaster stories on a regular basis. The danger is that the combination of a massive ramp up in information and opinion, combined with our natural inclination to zoom in on negative news, is making us worse investors: more distracted, fearful, jittery and short-term focused, and less reflective and long-term focused.

Five ways to manage information & opinion overload

To be a successful investor you need to make the most of the power of compound interest and to do that you need to invest for the long-term in assets that grow with the economy and not get blown around by each new worry and fad. The only way to do this is to turn down the noise on the worry list and the explosion in investment information and opinion. This is getting harder given the distractions on social media. At an obvious level, it makes sense to turn off all notifications on your phone or iPad, but more fundamentally, here are five suggestions as to how to turn down the noise and stay focussed as an investor:

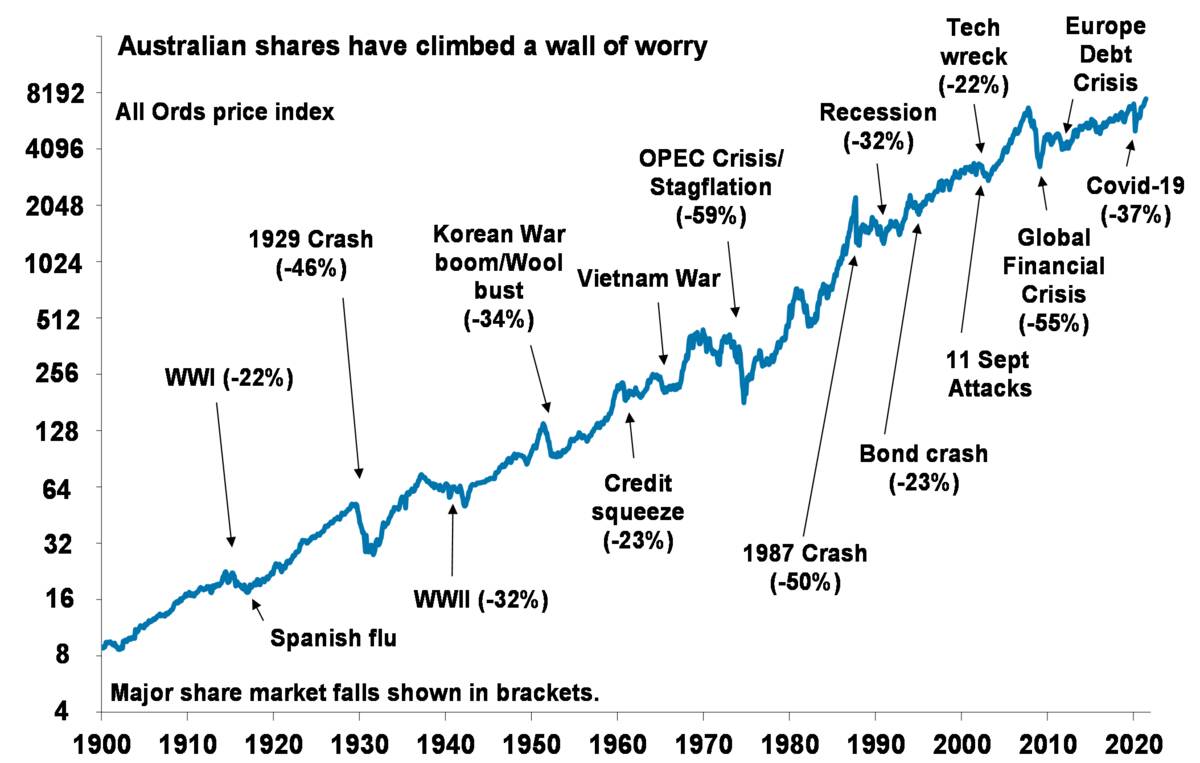

Firstly, put the latest worry in context. There’s always been an endless stream of worries. Here’s a partial list since 1900: 1906 San Francisco earthquake; 1907 US financial panic; WWI; 1918 Spanish flu pandemic (up to 50 million killed); The Great Depression; WW2; Korean War; 1957 flu pandemic; 1960 credit crunch; Cuban missile crisis; Vietnam War; 1968 flu pandemic; 1973 OPEC oil embargo; Watergate; the cancellation of The Brady Bunch; stagflation in the 1970s; the 1979 oil crisis; Latin American debt crisis; Chernobyl disaster; 1987 crash; First Gulf War; Japanese bubble economy collapse; US Savings & Loan crisis; Asian crisis; Tech wreck; 9/11 terrorist attacks; Second Gulf War; the GFC; the Eurozone public debt crisis; US trade wars; President Trump; & the coronavirus pandemic. But despite this investment returns have actually been good as shares climb a long-term wall of worry with the result being that since 1900 Australian shares have returned 11.8% pa and US shares 10% pa (including capital growth and dividends).

Source: ASX, AMP Capital

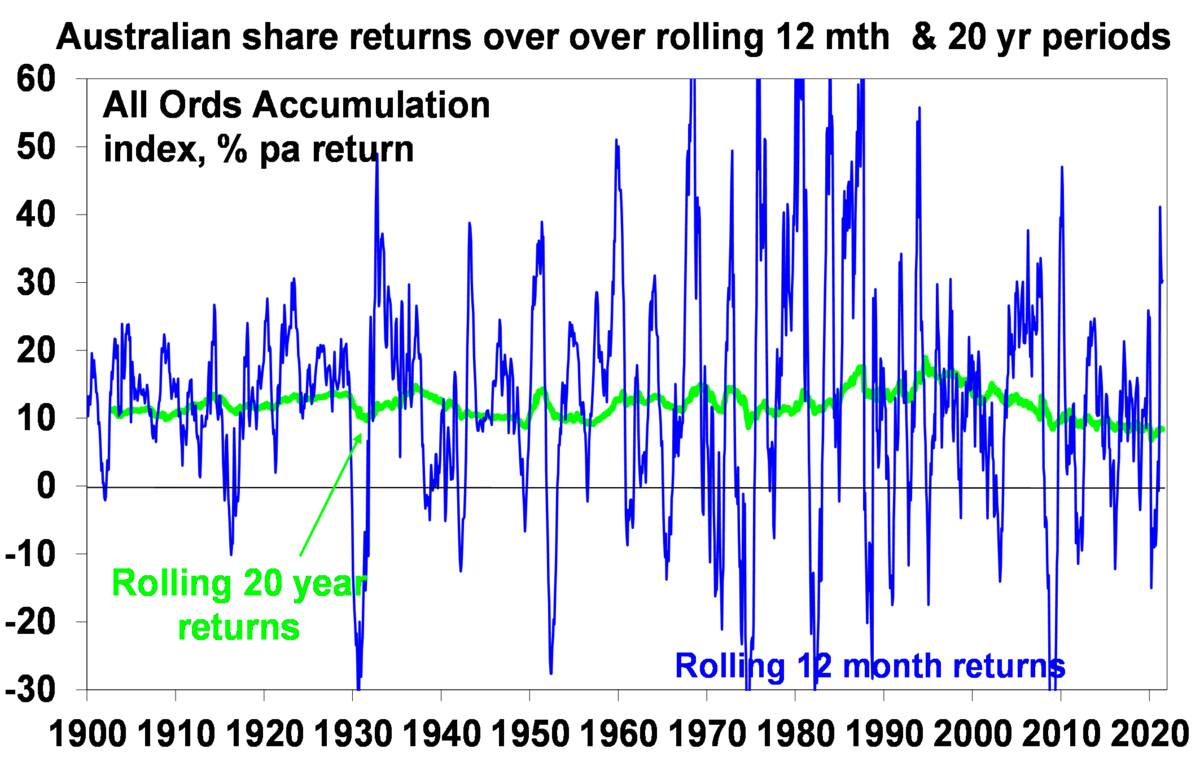

Secondly, recognise how markets work. A diverse portfolio of shares returns more than bonds and cash long term because it can lose money short term. As seen in the chart below, while the share market can be highly volatile in the short-term it has strong returns over all rolling 20-year periods.

Source: ASX, AMP Capital

And invariably the short-term volatility is driven by investors projecting recent events around profits, dividends, rents and interest rates into the future, and so, causing shares to periodically diverge from long-term fundamental value. So, share market volatility driven by worries, bad news, and bouts of recovery and investor euphoria is normal. It’s the price investors pay for higher longer-term returns.

Thirdly, find a way to filter news so that it doesn’t distort your investment decisions. There are lots of ways to do this depending on how much you want to be involved in managing your investments. If you want to be heavily involved it could mean building your own investment process or choosing 1-3 good investment subscription services and relying on them. Or simpler still, agreeing to a long-term strategy with a financial planner and sticking to it.

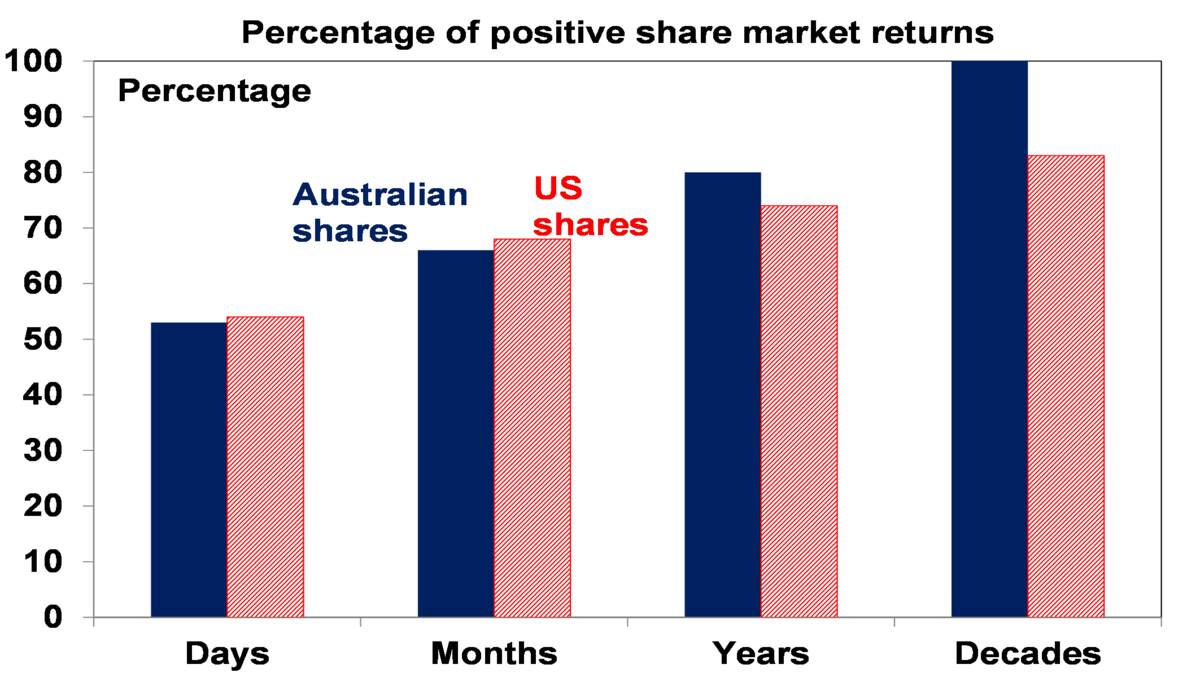

Fourthly, don’t check your investments so much. If you track the daily movements in the Australian All Ords price index, measured over the last twenty-five years or so it has been down almost as much as it has been up (see the next chart). It’s little different for the US S&P 500. So, each day is pretty much a coin toss as to whether you will get good news or bad as markets are thrown around by the daily noise. By contrast, if you only look at how the share market has gone each month and allow for dividends, historical experience tells us you will get bad news less than 35% of the time. Looking only on a calendar year basis, data back to 1900 indicates that the probability of bad news in the form of a loss slides further to just 20% of the time for Australian shares and less than 30% for US shares. And if you can stretch it out to once a decade, again since 1900, positive returns have been seen 100% of the time for Australian shares and 82% of the time for US shares.

Daily and monthly data from 1995. Data for years and decades from 1900. Source: ASX, AMP Capital

The less frequently you look the less you will be disappointed, and so, the lower the chance that a bout of “loss aversion” will be triggered which leads you to sell at the wrong time. So, try to avoid looking at market updates so regularly and even consider removing related apps from your smartphones & tablets.

Finally, look for opportunities that bad news and investor worries throw up. Always remember that periods of share market turbulence after bad news throw up opportunities for investors as such periods push shares into cheap territory from which strong gains have historically been seen. This is exactly what we saw last year at the height of coronavirus uncertainty.

Concluding comment

There is no denying that things occasionally go wrong weighing on investment returns. But predictions of imminent disaster are a dime a dozen. My long-term experience around investing tells me it’s far more productive to push against prognostications of financial gloom because most of the time they are wrong and end up just distracting investors from their goals.

China will become world’s largest carbon market after national trading starts this month

Derivatives related to emissions allowances may be added

By GT staff reporters

Photo taken on Nov. 26, 2013 shows the exterior of the Shanghai Environment and Energy Exchange(SEEE) where the inaugural ceremony of the carbon emission trading program is held in Shanghai, east China. Shanghai launched carbon emission trading on Tuesday, China’s second market for compulsory carbon trading. (Xinhua/Shen Chunchen)

China is set to become the world’s largest carbon emissions trading market in terms of the volume of greenhouse gases it handles, once the national-level exchange opens later this month, a Chinese official said on Wednesday.

Analysts and industry insiders are optimistic about the development of the carbon market and related industries, but there are gaps, mainly in finance, between China and mature carbon markets in Europe and the US.

“The electricity industry alone will make China the largest carbon market in the world. If other sectors are included later, China’s carbon market may exceed all other carbon markets, which will attract a huge amount of capital and technological investment,” Wang Jun, director of carbon asset management of Sichuan Yongxiang Co, told the Global Times on Wednesday.

China can even establish a global carbon trading and financing centre with the help of its massive carbon market, Wang added.

The first participants in the national carbon trading market will include 2,200 power enterprises, with total carbon emissions of about 4 billion tons annually, Zhao Yingmin, vice minister of the Ministry of Ecology and Environment, said on Wednesday at a press conference.

Emissions from installations covered by the EU Emissions Trading System (ETS) decreased 9.1 percent in 2019 compared with 2018, equivalent to152 million tons of carbon dioxide (CO2), according to an annual report from the European Commission.

As a carbon trading market will soon open in China, carbon allowances have become more important to enterprises and carbon has become a new kind of currency. Carbon’s financial function needs to be improved in China, with more financial derivatives related to emissions allowances expected on the market, analysts said.

“At present, only spot trading will be supported [on China’s carbon market]. Derivatives such as futures, options and swaps have not yet been launched, although these have been available in the EU for many years,” said Wang.

He added that there are big differences in views in China on whether to add such derivatives. “This also has something to do with the fact that China’s financial regulators are not deeply involved in the carbon market.”

Ye Yanfei, director of the Policy Research Bureau of the China Banking and Insurance Regulatory Commission, said on Wednesday that carbon emissions rights, which serve as collateral for the future, is “something that can be explored.”

“Carbon emissions rights can provide the basis for banks to expand financing,” Ye said.

Ye said that China’s carbon emissions total about 10-11 billion tons a year, while green credits support 700 million tons of CO2 reductions annually.

China also has to make progress in carbon pricing, which is at present one-tenth of that of the ETS.

As of the end of 2020, the carbon price in China’s pilot areas varied from 14-90 yuan ($2.16-13.9) per ton, while the price in Europe stood at about 50 euros ($58.9) per metric ton. Analysts predict that the price on the national carbon market is expected to start at 30-50 yuan.

“Carbon assets have been recognized by the majority of financial institutions and become one of the main targets of their asset allocation. However, at present, the national carbon market has not been opened to other institutions and individuals, except for emissions control enterprises,” said Wang.

The liquidity of China’s carbon market needs to be improved. Involving 2,000 enterprises, all from the power sector, is far from enough, an analyst of green finance and the low-carbon economy surnamed Xu told the Global Times on Wednesday.

No matter how carbon emission quotas are allocated, the optimal allocation can be achieved through marketization, according to the Coase Theorem, according to Xu.

“However, due to the low liquidity of China’s carbon trading market, carbon emissions quotas cannot be effectively circulated. Therefore, the government should issue carbon emissions allowances at an early stage to boost circulation,” said Xu.

BlackRock Real Assets to back Korean offshore wind farm project

By Son Ji-hyoung

BlackRock Real Assets said Thursday it has closed its first investment in South Korea’s offshore wind sector, in line with the country’s renewable energy transition initiative.

The New York-based asset managing arm dedicated to real estate and infrastructure investment acquired a 100 percent equity stake in renewables developer Korea Renewable Energy Development & Operation Holdings, formerly known as Igis Private Equity. The transaction price was not disclosed.

BlackRock Real Assets said it plans to inject $1 billion of equity over time to build out Kredo Holdings’ pipeline of offshore wind and other renewables assets amounting to over 2 gigawatts in power generation capacity in waters off Imjado in Sinan County, South Jeolla Province and Yeonpyeongdo, Incheon.

“We believe that offshore wind will play a vital role in the nation’s road to decarbonization and that (Kredo Holdings) is ideally placed to partner with us,” Charlie Reid, managing director of BlackRock Renewable Power, said in a statement.

“This transaction demonstrates how South Korea’s commitment to a net zero future is creating compelling investment opportunities for BlackRock’s clients.”

The projects are expected to be fully contracted under 20-year agreements with subsidiaries of the state-owned Korea Electric Power Corp.

BlackRock Real Assets in April raised $4.8 billion, more than one-third of which is marked for investments in climate infrastructure assets in the Asia-Pacific region.

Stonepeak Raises $2.75 Billion for Debut Renewable-Energy Fund

The infrastructure-focused firm so far has committed $800 million from the fund to four deals in the U.S. and Asia

A view of a solar project in Minster, Ohio, developed by Stonepeak portfolio company Madison Energy.

PHOTO: EITRI FOUNDRY LLC

By Luis Garcia

Stonepeak Partners has raised $2.75 billion for its first fund solely dedicated to investments in renewable energy.

The infrastructure-focused firm wrapped up Stonepeak Global Renewables Fund LP at an increased hard cap and far above its original $1.25 billion target, the firm said. More than 40 investors from 15 countries backed the fund.

One such investor, the New York State Common Retirement Fund, last year pledged $250 million to the fund, according to the WSJ Pro Private Equity LP Commitments database. The pension invested an additional $100 million in a parallel co-investment pool. Also last year, Border to Coast Pensions Partnership, a pension fund in the U.K., committed $100 million to the fund, the data show.

The fundraising benefited from increased investor appetite for renewable-energy strategies, said Hajir Naghdy, a Stonepeak senior managing director. The sector’s fast growth, combined with a desire by investors to participate in the world’s shift to clean energy, is driving capital to renewable energy-focused funds, industry consultants said.

European Union to send petrol cars to scrap heap in mammoth climate change plan

The European Commission wants to end the sale of new petrol and diesel cars by 2035. Source: Getty Images Europe

The European Commission wants to end the sale of new petrol and diesel cars by 2035, under a massive plan to fight climate change unveiled Wednesday.The EU went into battle on Wednesday to secure a path to its pledge of carbon neutrality by 2050, triggering an epic political clash over electric cars and fuel prices that could last for years.

The mammoth plan was unveiled by the European Commission and is intended to transform the bloc’s economy from fossil fuel dependency to a world of net-zero emissions.

Brussels also hopes to establish Europe as the unquestioned leader on meeting the goals of the Paris climate accord.

“Europe is now the very first continent that presents a comprehensive architecture to meet our climate ambitions,” EU Commission chief Ursula von der Leyen told reporters in Brussels.

“We have the goal, but now we present the roadmap to how we are going to get there,” she added.

The myriad proposals include an effective ban on the sale of new petrol-driven cars from 2035, one of the boldest moves against gas-guzzlers to date that the car lobby was quick to slam as “not rational”.

This would in practice mean that all cars and light vans sold from that date will be battery-powered electric cars.

Motorised road transport is Europeans’ most common way of getting about, but it represents 15 per cent of the bloc’s greenhouse gas emissions.

The dozen draft laws were announced by the European Commission’s environment supremo Vice President Frans Timmermans, who said the political challenge was immense.

“Nothing we have presented today is going to be easy. It’s going to be bloody hard. I know that,” he said.

At the heart of the legislative package is the ambition to breathe new life into the EU’s flawed Emissions Trading System (ETS), the world’s biggest carbon market, where industry pays for the right to pollute.

The laws will now snake their way through the EU’s legislative system amid high-stakes horse-trading in the European Parliament and among the bloc’s 27 member states, egged on by industry lobbyists and green activists.

“Each state will have to defend its interests because their situations are very different in terms of industry, geography, energy supply and investment capacity,” said a senior EU diplomat.

The jockeying has already begun, with powerful interests fighting hard to win special treatment – or extra time – before the constraints of a greener Europe come into force.

Environmentalists swiftly denounced the laws as not going far enough – with the European Environmental Bureau decrying a plan that was “unfit and unfair” to fight climate change effectively.

Climate campaigner Greta Thunberg said that unless the EU “tear up” their proposals, “the world will not stand a chance of staying below 1.5 degrees Celsius of global heating”.

“That’s not an opinion, once you include the full picture, it’s a scientific fact,” she tweeted.

‘Massive resistance’

One major fear is resistance from the motoring public in what could resemble a continent-wide replay of the French “yellow vests” protests that erupted when the government tried to impose a new fuel tax in the name of defending the environment.

The EU’s plan imposes sustainable and probably more expensive fuels in public-facing sectors such as transport, heating and construction, in a move some MEPs called “political suicide”.

Timmermans said that what Europeans are most worried about was: “Is this going to be fair?”

“If we fail to prove that, I think the resistance will be massive,” he said.

The legislative push is being promoted as the “Fit for 55” package, as its central aim is to align existing EU laws and targets with a deepened 55 per cent net emissions reduction by 2030.

The previous objective was a cut of at least 40 per cent from 1990 levels.

Electric is Big, but Hydrogen will be Bigger

by Rolf Lockwood

Cummins displayed a hydrogen-fuel-cell concept vehicle at the North American Commercial Vehicle Show in 2019.

Photo: Deborah Lockridge

You don’t have to look very hard at all to be inundated by news about electric cars and buses and trucks these days. In the four-wheel world, some manufacturers plan to offer predominantly electric powertrains within the decade or nearly so. By 2025, Volvo aims for 50% of its cars to be “pure electric,” the rest plug-in hybrids. In Norway — a rich oil-producing nation — the majority of cars sold today are already electric.

The electric storm won’t slow down, and it’s just as strong in the trucking universe. But Daimler and Volvo recently put the hydrogen fuel cell option more firmly on the truck map than it’s ever been. (More on that in a minute.)

You won’t catch me owning an electric personal vehicle any time soon, I promise. It’s about the range, or dramatic lack of it. I just read one car-maker’s attempt to assuage range fears, which suggested that its car’s 250-mile maximum one-charge driving distance would be fine for long trips. When you hit that max, you just stop for a meal and wait 40 minutes for a fast charger to give you 80% of a full charge, they say.

First off, getting 250 miles out of a charge assumes warm weather, with limited use of air conditioning and electric bits like headlights, and certainly no trailer being towed. Try getting that far in winter when battery life shrinks like mad. No, thanks. I routinely drive from my Toronto-area base to Michigan and Indiana and such places, and an electric car just wouldn’t cut it.

Just take a Detroit jaunt. For me, it’s an easy-peasy 290-mile run with no stops. Do I want to gamble that I can stretch my range by 40 miles? Or shut it down and wait 40 minutes when I’m less than an hour away from the end? Assuming I could find a vacant fast charger.

Columbus, Indiana, is something like 625 miles for me, usually a straight-through run. In ideal conditions, an electric vehicle with that 250-mile range would demand three stops, again assuming fast chargers. As things stand now, my Explorer needs one fuel stop for five minutes or so and maybe another 10 minutes to grab a hamburger to eat on the fly. The extreme hassle of stopping three times to recharge, not to mention wasting a couple of hours while plugged in, would drive me nuts. That nine-hour trip would become 11-12 hours at least.

In other words, again, an utterly firm no thanks.

But hey, this is about trucking. In our game we have an advantage in many applications where the required range is predictable. Urban and close-regional freight work, towing, utilities, and such where the truck is likely shut down overnight are all fine for battery-electric vehicles.

But when we get thousands of cars and buses and trucks demanding power from the grid at the same time, where are we then? Billions of dollars will have to be invested over the next 20 or 30 years to make it all work. I’m not even sure that’s possible. And if the power isn’t produced by sustainable, environmentally responsible means, what do we gain?

Hydrogen Fuel Cells Hydrogen fuel cells, on the other hand, don’t come with such baggage, though an expensive infrastructure does have to be developed. Crucially for trucks, a fill-up takes no longer than diesel does.

“Hydrogen-powered fuel-cell electric trucks will be key for enabling CO2-neutral transportation in the future,” said Martin Daum, chief of Daimler Truck. “In combination with pure battery-electric drives, it enables us to offer our customers the best genuinely CO2-neutral vehicle options, depending on the application.”

He was speaking in late spring during the formal launch of a new fuel-cell joint venture between Daimler Truck and the Volvo Group. The two companies outlined their “industry-first commitment to accelerate the use of hydrogen-based fuel cells for long-haul trucks and beyond” with the new venture, called cellcentric.

They say fuel-cell electric and battery-electric options are complementary, which they obviously are, if you accept that the grid and infrastructure challenges can be met.

Daimler Truck is testing its second-generation fuel-cell electric truck.

Photo: Daimler Truck

According to a press release, the other major European truck manufacturers, backed by Daimler and Volvo, are calling for the setup of around 300 “high-performance” hydrogen refuelling stations suitable for heavy-duty vehicles by 2025 and of around 1,000 hydrogen refuelling stations no later than 2030 in Europe. Daimler and Volvo aim to start with customer tests of fuel-cell trucks in about three years and to be in series production of such trucks during the second half of this decade.

This joint effort does not mean that the two manufacturers are joining forces to produce trucks together. All vehicle-related activities will be carried out independently from each other, and the companies will remain competitors in all vehicle and product ranges, particularly in the integration of fuel cells in their trucks.

Cellcentric is a huge step forward in the advancement of fuel cells in Europe, where environmental goals are far more rigidly respected than they are on this side of the Atlantic, but of course the technologies it develops will be applied elsewhere.

Fuel-Cell Trucks in North America

Here in North America, Daimler and Volvo’s involvement in fuel-cell-electric trucks remains to be seen, but there are many others in the picture.

Cummins, for example, is a leader. Among other projects, which include a demo fuel-cell truck running in California and a joint development with Navistar, it bought the Canadian company Hydrogenics two years ago and has since built a 20-megawatt PEM electrolyser system to generate green hydrogen. It’s the largest such operation in the world. Installed at the Air Liquide hydrogen production facility in Bécancour, Quebec, it can produce over 3,000 tons of hydrogen annually using clean hydropower. The technical details don’t matter here. Just know that this solves the challenge of how to store hydrogen.

Kenworth, Toyota, and Shell have teamed up with public agencies in California to test hydrogen-fuel cell trucks at the Port of Los Angeles with four fleets (including Toyota’s own private fleet.) The Class 8 fuel cell electric trucks will have the ability to travel 300 miles on one charge of hydrogen.

Hyzon is a new entrant into the hydrogen-fuel-cell truck market.

Photo: Hyzon

An interesting new entrant is Hyzon Motors, which aims to build up to 100 hydrogen production hubs across the United States and globally. Each hub will convert organic waste in nearly every form into locally produced, renewable hydrogen for Hyzon’s zero-emission commercial vehicles, including garbage trucks. The first hub is planned at a landfill in the San Francisco Bay Area and is expected to be commissioned in 2022.

“In our considered opinion, the slam-dunk use case for hydrogen is heavy, high-utilization vehicles,” said company CEO Craig Knight in an interview with my colleague Jim Park. “A big vehicle that gets driven many hours a day is a bloody hard thing to get off fossil fuels without hydrogen. So we focus on those heavy kind of payload-imperative type vehicles, where they’re paid to carry weight.”

It’s ready to put trucks on the road this year.

Please feel free to give us a call if you would like more information on managing your investments or setting up a JMP Nominee account which will assist with the tracking of your dividends, access to market information and management of your investment portfolio.

Thank you to the contributors whose articles we have shared and a big thanks to Ashurst for the attached their monthly publication, Low Carbon Pulse which is always a very informative read.

Have a great week, stay safe and get vaccinated.

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814