3 October, 2022

Welcome to this week’s JMP Report.

Last week we saw BSP, KSL and STO do all the work. BSP traded 541,212 shares unchanged at K12.41, KSL saw 26,065 shares trade lower by 10t closing at K2.90 while STO traded 411 shares unchanged at K19.10.

Refer details below

WEEKLY MARKET REPORT | 26 September, 2022 – 30 September, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 541.212 | 12.41 | – | – | K1.3400 | K0.34 | 11.61 | FRI 23 SEPT | MON 26 SEPT | FRI 14 OCT | NO | 5,317,971,001 |

| KSL | 26.065 | 2.90 | -0.1 | -3.45 | K0.1850 | K0.0103 | 7.74 | MON 5 SEPT | TUE 6 SEPT | TUE 4 OCT | NO | 64,817,259 |

| STO | 411 | 19.10 | – | – | K0.2993 | K0.26760 | – | MON 22 AUG | TUE 23 AUG | THU 22 SEPT | – | – |

| KAM | 0 | 0.95 | -0.05 | -5.26 | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | K0.70422535 | – | FRI 26 AUG | MON 29 AUG FEB | MON 29 AUG | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 1.85 | – | – | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | K0.04 | – |

– |

THU 5 APR | THU 14 APR | FRI 29 APR | – | 195,964,015 |

Our Order Book this week has us as nett buyers of CCP, NCM and BSP

Dual listed PNGX/ASX

BFL – $5 +10c

KSL – $0.85 +.05

NCM – $16.92 +17C

STO – $7.09 -33C

And on the interest rate front,

The 364 day bills remained flat at 3.99% with 295mill bids accepted which was oversubscribed by 8 mill.

And for the alternatives

|

Gold -$1673 Silver – $19.08 Platinum – $881 Bitcoin -$ 19,059.70 Ethereum – $1201 Binance – $1251 |

Please see the following attachments for your interest.

Download | Article on Board Minutes

Download | Board Minutes Template

Download | MPMG - PNG Kundu

Download | 2022 Santos US and UK Roadshow

What we’ve been reading this week

WILL ALL ASSETS BECOME TOKENISED?

An ariticle from Ainslie bullion

“Everything will be tokenised” is a statement that is growing in popularity. We’re on track towards a world where everything that can be, will be tokenised. This trend comes particularly after central banks globally progress past the “exploratory” phases of Central Bank Digital Currencies (CBDCs) into building real infrastructure.

We have explored CBDCs here before, but to catch everyone up quickly, from the Reserve Bank of Australia:

“A CBDC would be a new digital form of money issued by the Reserve Bank. It could be designed for retail (or general purpose) use, which would be like a digital version of banknotes that is essentially universally accessible, or for wholesale use, where it is accessible only to a more limited range of wholesale market participants for use in wholesale payment and settlement systems.”

CBDCs may trigger a systemic shift towards shifting ALL asset ownership, all built on blockchain technology.

The next phase for blockchain technology is bridging real-world asset ownership to blockchain – unlocking new opportunities and reducing inefficiencies in the real world. The visionaries who build upon the foundations will transform the space, solving not only problems in crypto but in the real world too.

We can already see this next frontier being developed. One example of real-world assets being bridged into the highly interoperable tokenised world is our very own Gold & Silver Standard – where we tokenise gold and silver in various forms. Something previously impossible with physically-backed gold and silver is lending and earning interest – often gold’s biggest criticism is that “you can’t earn a yield.” Well, now you can use DeFi lending to extract a yield.

So what else can be tokenised?

- Assets:Cash and property, as well as business assets – assets that are present on the balance sheet.

- Equities:Equity (shares) can be tokenised. This is already being done on some crypto exchange platforms.

- Funds:An investment fund is a type of asset that investors can tokenise — these tokens represent an investor’s share of the fund. Each investor is provided tokens that represent their share of the fund.

- Services:A business can offer goods or services. Investors can use tokens to purchase goods or services provided by the supplier. E.g., Tokenising gift cards.

With accelerating digitisation, tokenisation innovations can have an even greater impact on how we store wealth for future generations to come – whether that means by transforming traditional drivers like network effects or trade linkages between countries’ economies.

Future innovations using tokenisation, such as DeFi lending/borrowing, fractional ownership, crowdfunding, and more, have the potential to transform many, if not all industries. There will be many other developments in this decentralised economy that have yet to be imagined. What we can say is that it will be a much more transparent and direct type of market than what we are used to.

Assets that can’t be liquidated often have an unestablished market price. In this case, asset owners typically provide buyers with incentives like illiquidity discounts, which reduce the asset’s price. Tokenization of assets would increase an asset’s liquidity, as it facilitates fractional ownership, which eliminates illiquidity discounts. Moreover, selling small fractions of ownership enables owners to charge a fair market price.

Another example of tokenising assets is real estate. Using blockchain technology, tokenisation promises to turn the notoriously illiquid asset of property into a highly tradeable digital share.

Exchanging real estate on a blockchain platform will reduce the costs associated with a particular real estate investment. Through tokenisation, investors can purchase and sell the digitised asset without incurring closing costs, which reduces transaction costs substantially.

Tokenisation in real estate has also yielded the positive outcome of fractional and divisible ownership. The value of real estate has traditionally been indivisible as it is treated as a single asset. Tokenisation makes it possible to fractionalise the asset, leading to greater access thereto and better liquidity of the investment.

Real and digital assets are becoming one. Tokenisation democratises access to markets while ensuring fairness and security. The only obstacle today is legal boundaries — to what extent this hurdle stands in the way depends on the type of assets being tokenised.

Global Shares Sliding again – what’s driving it and is there any light at the end of the tunnel – (non PNGX)

By Shane Olive, Head of Investment Strategy and Economics and Chief Economist at AMP

Key points

Share markets remain under pressure from high inflation, rising rates & bond yields and the rising risk of recession and the threat that poses to company profits.

With the rising risk of global recession, global and Australian shares are at high risk of further falls in the short term.

However, it’s not all negative. Pipeline inflation pressures are continuing to decline and inflation expectations remain relatively low which should enable central banks to become less hawkish from later this year. Share market seasonality also improves into December and the direction setting US share market normally sees strong gains after mid-term elections.

Introduction

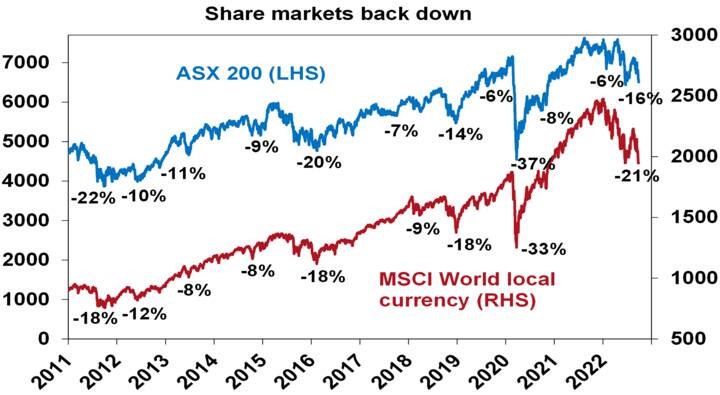

Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets. This year has been anything but. After falling sharply into mid-June (at which point US shares had fallen 24% from their highs, global shares 21% and Australian shares 16%), share markets rallied into mid-August reversing half of their declines on the back of hopes the Fed would pivot towards an easier monetary stance and hopefully avoid a recession. Since mid-August though shares have fallen again and are now back to around their June lows.

Source: Strategas, AMP

And, bond yields have pushed up again with US, UK, German 10-year yields rising to levels not seen in a decade.

What’s driving the renewed weakness

The plunge in shares back to their June lows mostly reflects the same concerns that drove the falls into June:

- Inflation remains high or is still rising depending on the country. For example, US headline inflation is still 8.3%yoy and core inflation at 6.3%yoy in August is still under pressure from rising services inflation. Headline inflation is 8.9% in the UK, 9.1% in Europe, 9.9% in the UK and an estimated 7.2% in Australia.

- Global central banks have become more hawkish noting that permanently high inflation will lead to lower living standards and the longer inflation stays high the greater the risk that inflation expectations move higher, making it harder to get down. As a result, they are committed to getting it back to target and have been flagging more rate hikes (eg with the dot plot of Fed interest rate forecasts around 1% higher than 3 months ago) and an implied tolerance for a recession in order to get it under control.

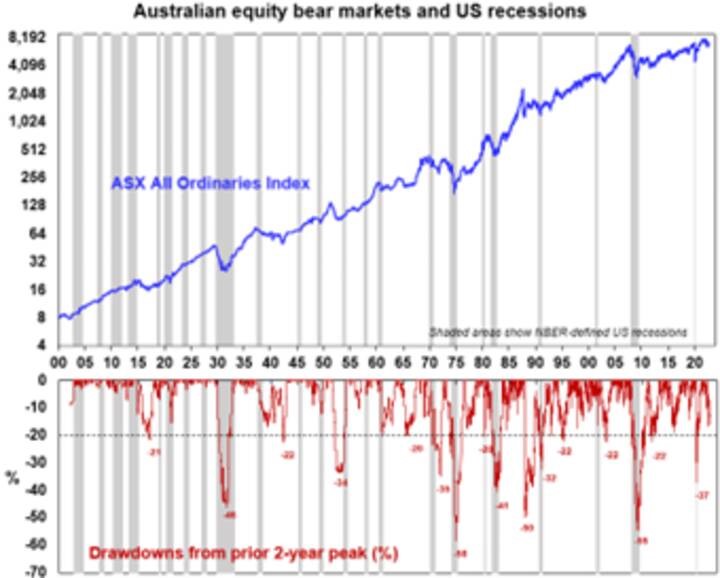

- Increasingly hawkish central banks are bad for shares in the short term for two reasons. First higher interest rates and make shares less attractive from a valuation perspective. Second, a recession would weigh on company profits. Recession is now almost certain in Europe and about a 50% probability in the US. In Australia the probability of recession is now around 40% (if as we expect the cash rate peaks around 3%, but if it rises to 4.3% as predicted by the money market then recession is probable here). Historically deep bear markets in US and Australian shares have tended to be associated with a US recession.

Source: ASX, Bloomberg, AMP

- Fears of an escalation of the Ukraine war – after Russia’s troop mobilisation, “referenda” to incorporate occupied areas into Russia and a threat to use nuclear weapons. Ongoing tensions with China and the approaching November US mid-term elections are not helping.

- A large fiscal stimulus in the UK has caused a surge in UK bond yields & plunge in the pound adding to fears of a crisis. While the new Government’s tax cuts and deregulation may have supply side merit the benefits of this tend to take years to become apparent and in the meantime the risk is that it adds to inflation and fears about runaway debt.

- We are in a weak period of the year seasonally for shares – with September being the weakest month of the year on average for shares and October known for volatility. This can be magnified when the trend in shares is down.

- As seen in the first half the year, tech stocks and particularly crypto currencies remain the biggest losers of monetary tightening, after being the biggest winners of easy money.

Shares are oversold and on technical support at their June lows so could bounce from here. But the risks are skewed to the downside in the short term. While investor confidence is very negative, we have yet to see the sort of spike in put/call option ratios or VIX that normally signals major market bottoms. The RBA is fortunately starting to sound a bit more balanced and aware of the way monetary policy impacts with a lag, but the danger is that the Fed and central banks have become locked into supersized hikes based on backward looking inflation and jobs data, and a loss of confidence in their ability to forecast inflation at a time when they should be giving more attention to monetary policy lags. This increases the risk of overtightening driving a deep recession with earnings downgrades driving another leg down in share prices (after the first leg down which was driven by rising bond yields). A decisive break below the June low for the US share market could open up another 10% leg down with a similar flow through to Australian shares.

It’s not all doom and gloom

However, there is some light at the end of the tunnel on a 12-month view:

- Central banks determination to stop high inflation becoming entrenched is good news from a longer-term perspective as the 1970s experience tells us that the alternative would be bad for economies, jobs and investment markets.

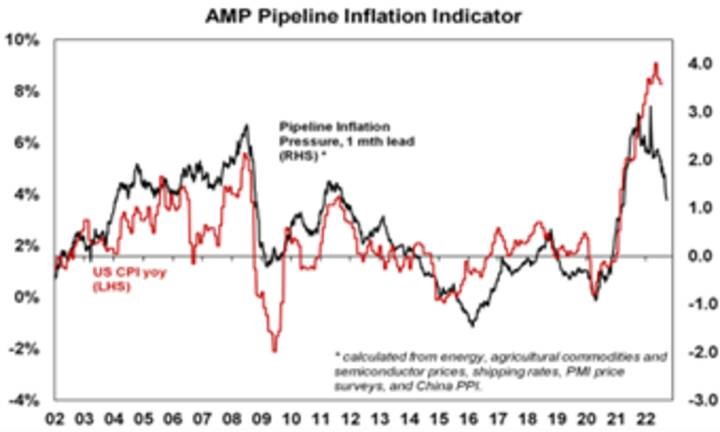

- Producer price inflation looks to have peaked in the US, UK, China and Japan.

- This is consistent with our Pipeline Inflation Indicator which is continuing to trend down given falling price and cost components in business surveys, falling freight rates and lower commodity prices (outside of gas and coal).

Source: Bloomberg, AMP

- Some of the key components that initially drove higher inflation in the US are starting to slow with weakening growth in new market rents (which with a lag drives about 33% of the US CPI) and softening used car prices.

- Consumer inflation expectations have fallen in the US and Australia, helped by aggressive central bank moves and falling petrol prices. US 5 year plus inflation expectations have fallen back to 2.8% which is well below the near 10% level seen in 1980. This should make it easier for central banks to get inflation back down without having to take interest rates to exorbitant levels.

- Money supply growth has slowed from its 2020 surge, and this is likely to contribute to lower inflation ahead.

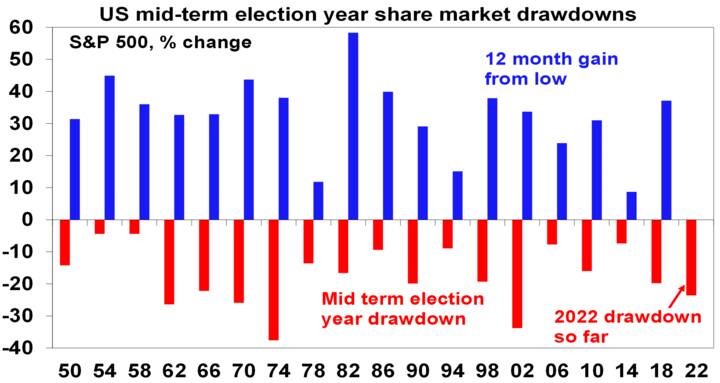

- Post US mid-term election returns tend to be strong, just as mid-term election year drawbacks tend to be more severe – with an average top to bottom fall of 17% in US shares in mid-term election years followed by an average 33% gain one year from the low.

Source: Strategas, Bloomberg, AMP

The bottom line is that while short-term inflation remains high, these considerations are consistent with the US having reached peak inflation and point to lower inflation ahead which should enable central banks to slow the pace of hiking by year end, in time to avoid a severe recession. If this applies in the US, then Australia should follow as its lagging the US by about six months with respect to inflation. (Although we expect the RBA to slow the pace of rate hikes well ahead of the US – given the greater sensitivity of the Australian household sector to higher rates than in the US and lower inflation pressures in Australia.) For this reason, while short term risks around shares remain high, we remain optimistic on shares on a 12-month horizon.

Key things for investors to bear in mind

Sharp share market falls are stressful for investors as no one likes to see their investments fall in value. And try as one may, it’s never easy to accurately predict economies and shares. So, at times like these it’s important to focus on basic investment principles. In particular, these things are worth keeping in mind:

- share market pullbacks are healthy and normal – their volatility is the price we pay for the higher returns they provide over the long term;

- it’s very hard to time market moves so the key is to stick to an appropriate long-term investment strategy;

- selling shares after a fall locks in a loss;

- share pullbacks provide opportunities for investors to buy them more cheaply;

- shares invariably bottom with maximum bearishness;

- Australian shares still offer an attractive income (or cash) flow relative to bank deposits; and

- to avoid getting thrown off a long-term strategy – it’s best to turn down the noise around all the negative news flow.

How private corporations stole the sea

Guy Standing

Super-trawler Frank Bonefaas was caught with 632 tonnes of illegally caught fish in 2015. Photo: Joost Bakker/Wikimedia Commons

For most of human history, the oceans have been seen as a global commons, the benefits and resources of which belong to us all in equal measure. But our seas — and the marine environment as a whole — are being ravaged by exploitation for corporate profit. The result is a social, economic and ecological crisis that threatens the very life support system of the Earth.

Oceans cover 70% of the planet’s surface, provide half the oxygen we breathe and help combat climate change by absorbing carbon dioxide. About 40% of the world’s population live in coastal communities and depend on ocean, coastal and marine resources for their livelihoods and well-being.

Many of the critical issues affecting the “blue commons” require international action. These include the depletion of fish populations by subsidised industrialised fisheries; destruction of the seabed and vital coral reefs by oil multinationals; a threatened biodiversity wipe-out from deep-sea mining for minerals; and the reckless spread of commercial aquaculture.

The 2022 United Nations Ocean Conference, held last month in Lisbon, came up with plenty of fine words and promises, but nothing that would put these trends into reverse. Just before the conference, after more than two decades of negotiations, the World Trade Organization finalised a feeble agreement on fishing subsidies, in which the initial commitment to abolish “harmful subsidies” was deleted from the final text.

My new book, The Blue Commons, argues that the only way to stop — and reverse — the destruction and depletion of marine resources and ecosystems is to revive the ethos of the sea as a commons, managed for the benefit of all by those whose lives and livelihoods depend on it.

Only commoners have a tangible and emotional vested interest in preserving the seascape and using the seas’ resources sustainably. They should be compensated for loss of the blue commons, with “common dividends” financed by levies on exploitation for private gain.

Privatising the sea

Since 1945, when the United States unilaterally asserted ownership of the continental shelf and parts of the high seas around its shores, much of the blue commons has been converted into private property.

The UN Convention on the Law of the Sea endorsed the biggest enclosure in history in 1982, granting countries exclusive economic zones that extended 200 nautical miles from their coastlines. This set in train procedures and institutional mechanisms that have expanded privatisation and financialisation to all parts of the marine economy.

It also cemented neocolonialism, granting imperialist countries such as the US, France and Britain millions of square miles around lands far from their shores — their so-called “overseas territories”.

It is hard to exaggerate the scale of the plunder of the blue commons in the period of neoliberal economic dominance since the 1980s. The seas have become the frontier of global rentier capitalism. The spreading claws of financial capital are evident almost everywhere, with private equity growing in prominence.

The financial industry, fronted by the World Bank, has steered the much-touted “blue growth” strategy, promising an unlikely combination of economic growth, poverty alleviation and environmental improvement. The pickings for profit look tempting. Were the seas a country, the income generated from all marine activities would make it the world’s seventh-biggest economy, which (at least pre-COVID-19) was expected to see rapid growth fuelled by tourism, ports and shipping.

Specifically British problems

Some issues affecting the marine environment are particularly pertinent in Britain. Taken together, they justify the creation of a national commission on the blue economy, to reset economic and social policy regarding our waters.

The British government operates a regressive, weakly administered fishing quota system that gives private property rights to commercial fishing companies. Most of the British fishing quota goes to a handful of big corporations. Well over a quarter has been given to just five families, all on the Sunday Times Rich List. Just one giant vessel — registered in Britain but Dutch-owned — has 23% of the quota.

The system by which fishing quota is divided up is opaque and susceptible to corruption. But the government’s 2020 Fisheries Act, which regulates fisheries post-Brexit, made no changes. It has led to chronic overfishing — often illegal — compounded by the fact that breaches are treated as mild civil offences, not criminal ones.

To take just one example: the Dutch-owned super-trawler mentioned above was caught with 632,000 kilograms of illegally caught mackerel in 2015. It was fined just £102,000 and then allowed to sell the fish for £437,000 and retain its quota share.

To compound this impunity, the Royal Navy and Scotland’s Marine Sea Fisheries Inspectorate have only 12 “marine protection vessels” to monitor fishing practices in a sea area three times the size of Britain’s land area. Meanwhile, the Marine Management Organisation (MMO), England’s regulatory body, had its budget slashed as part of austerity, leading to a sharp drop in inspections and investigations of fishery violations and a similar drop in warnings and prosecutions.

Marine protection in name only

The British government has made much of its claim to be extending its protection of sea and marine species through marine protected areas (MPAs), also called marine conservation zones. These cover nearly a quarter of the Britain’s territorial waters. But most MPAs are poorly protected, with highly destructive fishing methods such as bottom-trawling and dredging allowed in many of them.

Recently, the MMO brought a case against Greenpeace for dropping boulders into supposedly protected areas to disrupt trawling. The judge had the sense to toss out the case as “absurd”, urging the MMO to do its designated job, and not harass those induced to act in its stead. Meanwhile, BP was recently given the go-ahead by another government regulator to dump thousands of tonnes of steel pipes and cables from a decommissioned oil rig into an MPA in the North Sea.

Under common law in Britain, the monarchy and government are supposed to be trustees or stewards, responsible for preserving the commons for future generations. Instead, they have handed them over for multinationals to exploit for profit, with minimal environmental protections or compensation for the commoners — the British public.

For instance, in another sell-out of the blue commons, the Crown Estate (the Queen’s property company) has been allowed to auction off large expanses of the seabed around Britain to multinational corporations for offshore wind farms. The latest round of auctions last year will raise up to £9 billion over ten years for the royal family and the Treasury.

Deep-sea mining — and worse to come

Coming up are even bigger concerns: prospective deep-sea mining (“seabed harvesting”) for minerals, and the extension of intellectual property rights to marine genetic resources, which are of particular interest to medicine.

UK Seabed Resources, a subsidiary of the US arms company Lockheed Martin, in partnership with the British government, holds licences to search the Pacific for deep-sea mining sites. High demand for minerals such as cobalt and lithium important to the electronics and renewable energy industries means deep-sea mining promises to be highly profitable — but threatens to cause potentially catastrophic damage to marine ecosystems.

The International Seabed Authority (ISA), the regulator for deep-sea mining in more than half the world’s ocean area, has a mandate to promote “the orderly, safe and rational management” of seabed resources. It is charged with mitigating the damage from seabed mining, but not with stopping or even limiting it, despite calls from leading scientists for a moratorium. The ISA’s pitiful budget is nowhere near large enough to monitor what giant corporations are up to.

If the ISA fails to agree to a mining code, after years of delay, unregulated commercial seabed mining could start next year.

As for intellectual property rights, Britain has missed the proverbial boat. Companies in just three countries, Germany, the US and Japan, hold more than three-quarters of the thousands of patents already taken out on marine genetic resources. Astoundingly, German multinational chemical giant BASF owns nearly half the patents.

These patents will guarantee monopoly income flows from the blue economy for many years and give rich corporations in rich countries private control over a key research and development agenda that affects the whole world.

[Reprinted from Open Democracy under a Creative Commons licence. Guy Standing is a professorial research associate at SOAS University of London.]

Global banks representing $23 billion in steel loans sign onto Sustainable STEEL Principles

Six leading banks — Citi, Crédit Agricole CIB, ING, Societe Generale, Standard Chartered, and UniCredit — will measure and disclose their steel-related loan emissions via the Sustainable STEEL Principles (SSP), the first climate-aligned finance agreement for the steel industry.

New York – September 23, 2022

Under RMI’s leadership, six top lenders to the global steel sector — Citi, Crédit Agricole CIB, ING, Societe Generale, Standard Chartered and UniCredit — today announced the signing of the Sustainable STEEL Principles (SSP), the first Climate-Aligned Finance (CAF) agreement for lenders to the steel industry.

The SSP are the turn-key solution for measuring and disclosing the 1.5°C alignment of steel lending portfolios. Designed to support the practical achievement of net-zero emissions in the steel industry, they also provide the tools necessary for client engagement and advocacy.

The Principles were carefully designed over the course of a year by a working group facilitated by RMI, led by ING and co-led by Societe Generale, with participation from Citi, Standard Chartered and UniCredit. The resulting framework positions lenders to facilitate the net-zero transition of the steel industry — the largest source of industrial emissions globally. Signatories to the SSP represent a combined bank loan portfolio of approximately $23 billion in lending commitments to the steel sector, for a market share of over 11% of total private sector steel lending, according to RMI research.

The SSP provides a methodology for banks to measure and report the emissions associated with their loan portfolios compared to net-zero emissions pathways. In doing so, the framework informs banks of how emissions-intensive their steel loans are relative to the net-zero pathway needed to stay within our planet’s remaining carbon budget — a metric known as climate alignment.

Steel is used in everything from cars and fridges to buildings and planes. However, because of the sector’s reliance on coal, it contributes 7% of CO2 emissions globally. With demand for steel projected to grow 30% by 2050, emissions are set to rise significantly if we continue with business-as-usual.

This innovative, voluntary agreement is based on the model of the groundbreaking Poseidon Principles in shipping. Launched in 2019, The Poseidon Principles now include 28 banks representing over 50% of global shipping finance. Following a similar logic, the SSP enable lenders to signal their expectations for emissions reductions across hard-to-abate industries and to engage their clients to identify the financings available to support their decarbonization. Similar frameworks for aviation and aluminum are also in development.

Signatories to the Sustainable STEEL Principles commit to the following five principles:

- Standardized assessment – A methodology to measure portfolio emissions

- Transparent reporting – A framework to disclose progress annually

- Enactment – Instructions to obtain credible, high-quality data

- Engagement – Signatories are encouraged to engage clients on net-zero transition plans, and available financial products

- Leadership – Signatories are encouraged to utilize the framework for advocacy, in the interest of the decarbonization of the steel industry

For banks with net-zero commitments, the SSP provide ready-made implementation guidance to help achieve them. This includes a steel-specific measurement and disclosure framework for banks to help set targets and assess their own climate progress, in accordance with guidance from the Net-Zero Banking Alliance (NZBA).

RMI’s Center for Climate-Aligned Finance convened banks to create this first-of-its-kind framework to help solve the sector’s funding needs. Steel finance could soon emulate trends in shipping, where signatories to the Poseidon Principles are closing over a billion dollars of Poseidon-based sustainability-linked loans annually.

The SSP was established by leading lenders to the steel sector and is ready for adoption by banks around the world. The NZBA steel sector working group, comprising over 16 financial institutions, plans to consider the SSP methodology as one avenue for achieving a bank’s NZBA commitment for the steel sector.

Metals and mining teams from the working group banks, in consultation with industry, asset managers and RMI, developed this framework over more than a year of intensive collaboration. Over 80 stakeholders reviewed and informed the Principles, including representatives from the financial sector, industry leaders and climate NGOs.

The design was informed by a close collaboration with the Net-Zero Steel Initiative, a project of the Mission Possible Partnership, as well as the United Nations Environment Programme Finance Initiative. RMI participated on the SBTi Expert Advisory Group on steel and the Climate Bonds Initiative Technical Working Group for steel in an effort to align standards wherever possible. The SSP Association, the SSP’s governing body, plans to continue collaboration with several organizations, and will explore signing an MOU with Responsible Steel in the near future.

Law firm Allen & Overy provided legal counsel and CRU provided cutting-edge steel sector data. SSP’s Secretariat is staffed by RMI’s Center for Climate-Aligned Finance and led by Lucy Kessler and Sam Kooijmans. Additional RMI staff that contributed to the design of the Sustainable STEEL Principles include James Mitchell, Lachlan Wright, Estefania Marchan, Tamara George, and Shravan Bhat.

The SSP counts banking signatories from North America and Europe, with steel clients all over the world. Other banks committed to decarbonizing the steel sector are encouraged to join. To learn more, visit steelprinciples.org or email Lkessler@rmi.org.

I hope you have enjoyed this week’s read, have an awesome week and I look forward to receiving any queries you may have

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814