24 October, 2022

Last week we saw 5 stocks trade on the local bourse, BSP, KSL, CCP, CPL, and STO. BSP traded 60,161 shares unchanged at K12.41, CCP saw 26,870 shares trading higher by 0.05 toea at K1.90 per share, KSL traded 193,276 shares unchanged at K1.90, STO traded 523 shares at K19.10 while CPL saw 2,106 shares trade at K0.95 per share.

Refer details below

WEEKLY MARKET REPORT | 17 October, 2022 – 21 October, 2022

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 60,161 | 12.41 | – | – | K1.3400 | K0.34 | 11.61 | FRI 23 SEPT | MON 26 SEPT | FRI 14 OCT | NO | 5,317,971,001 |

| KSL | 193,276 | 2.90 | – | – | K0.1850 | K0.0103 | 7.74 | MON 5 SEPT | TUE 6 SEPT | TUE 4 OCT | NO | 64,817,259 |

| STO | 523 | 19.10 | – | – | K0.2993 | K0.26760 | – | MON 22 AUG | TUE 23 AUG | THU 22 SEPT | – | – |

| KAM | 0 | 0.95 | – | – | – | – | 10.00 | – | – | – | YES | 49,891,306 |

| NCM | 0 | 75.00 | – | – | USD$0.075 | K0.70422535 | – | FRI 26 AUG | MON 29 AUG FEB | MON 29 AUG | – | 33,774,150 |

| NGP | 0 | 0.70 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 26.870 | 1.90 | 0.05 | 2.63 | K0.134 | – | 6.19 | THU 16 JUN | FRI 24 JUN | THU 28 JUL | YES | 569,672,964 |

| CPL | 2,106 | 0.95 | – | – | K0.04 | – |

– |

THU 5 APR | THU 14 APR | FRI 29 APR | – | 195,964,015 |

Our Order Book this week has us as a nett buyer of BSP, KSL and STO

Dual listed stock PNGX/ASX

BFL – $4.90 steady

KSL – 85c down .05c

NCM – $16.83 -44c

STO – $7.60 steady

On the interest rate front, the 364day rates where softer with the auction average coming in at 4.13% +7bpts, undersubscribed by almost 49million. The Bank issued 160mill.

During the week we also had a GIS auction and the results in the 2yr at 4.2% through to the 10yr at 6.28%. The market was undersubscribed by 19mill. Full results are attached for your information.

GIS Auction Results

And a note from me;

Over time you may have bought your first share purchase or added to your existing portfolio. But what happens to your investment if you die? Let me tell you how we see the scenario playing out far too many times in PNG. The breadwinner buys the investment, passes away and no Last Will and Testament (Will) is in place. The Registry will have no option, if there is no Will in place, to transfer the funds to the Public Curators Office.

At least with your superannuation fund, hopefully you nominated a Beneficiary who would receive the proceeds if you were to pass away. This protection allows the surviving partner to continue to pay school fees, rent/mortgage payments etc.

But if there is no Beneficiary or you have not bought the shares in joint names or there is no Will, then your families chance of living the lifestyle you created is at significant risk of disappearing. So, please consider

- Contact me as to how we can assist you to protect your assets from moving over to the Public Curators Office if you were to pass away unexpectedly

- Buying some Life Cover

What we’ve been reading this week

35 years since Black Monday. What have investors learned?

October 19, 1987. A brief but violent stock market crash. Can it happen again?

Probably not. The Dow plummeted 22.6% on that day, a date that has since been immortalized as Black Monday. To put that into context, a drop of that magnitude would be a nearly 7,000 point slide based on the Dow’s current levels. In 1987, that was about a 508-point drop.

What’s happening: Rules have been put into place since 1987, so-called circuit breakers and trading halts, that would prevent a plunge of that magnitude from ever occurring again.

There have been some mini so-called flash crashes in stocks since then but nothing even remotely close to the type of panic seen on that Black Monday, when the inflation rate was 3.6%, George Bush (the first one) was the Republican nominee for president and a gallon of gas cost 89 cents.

It was clearly a panic-induced sell-off. CNN Business spoke to Jon Hirtle, a broker at Goldman Sachs in 1987, to get his recollections about Black Monday.

Hirtle, now executive chairman and founder of Hirtle Callaghan, a wealth management firm that has about $20 billion in assets, said that Black Monday was a “jaw dropping, what the heck” moment for Wall Street. The normal mechanics of trading simply stopped working.

“You couldn’t get a bid. People tried to sell and couldn’t. Normally, you just put an order in, and it was done,” he said.

Hirtle said it’s also important to remember that in 1987, most trades were physically handled on the floor of the exchange. Now, it’s mostly done electronically. That’s led some Wall Street veterans to derisively refer to the NYSE as nothing more than a glorified TV studio.

“The circumstances that led to 1987 have changed dramatically,” Hirtle said.

Return of speculation a worrisome sign? Still, there are some similarities between now and 35 years ago.

For one, stocks (prior to their 2022 pullback) were trading at historically high valuations. And there is a lot of speculation in the market right now, with traders betting on meme stocks like GameStop and AMC, bitcoin and other cryptocurrencies as well as other speculative investments.

In 1987, many investors were banking on a continued surge in corporate mergers. It was the era of the “Barbarians at the Gate”, when big private equity firms were taking over blue chip firms.

There seems to be even more risk-taking these days, Hirtle said. “There is no question that there is more gambling in the markets now.”

Hirtle also noted that while interest rates now are moving higher thanks to a recent series of Fed hikes, they are nowhere near the levels from 1987. The 10-year Treasury bond yield is currently about 4%, compared to nearly 10% just before the Black Monday crash. So rates have a lot more room to run before they truly become problematic.

But there’s another big difference between now and 1987 that could be more ominous. Black Monday turned out, in hindsight, to be a blip in an otherwise strong bull market and strong economy during the Reagan years.

The bottom line: The current bout of market volatility, however, is a worrisome sign and potential harbinger of a recession. That could mean more downside ahead for stocks.

“The big issue that we are confronted with is whether earnings forecasts for next year are correct,” said Marco Pirondini, head of equities at Amundi US. “Earnings expectations for 2023 are factoring in a lot of growth expected for an economy that will, at the very least slow down significantly and very likely enter a recession.”

Pirondini, who has been with Amundi since 1991, said that even though interest rates are still historically low, the speed and magnitude of the current rate hikes are unprecedented. The Fed could wind up breaking something in the markets or economy.

“It’s tough to predict the consequences of the Fed tightening,” he said.

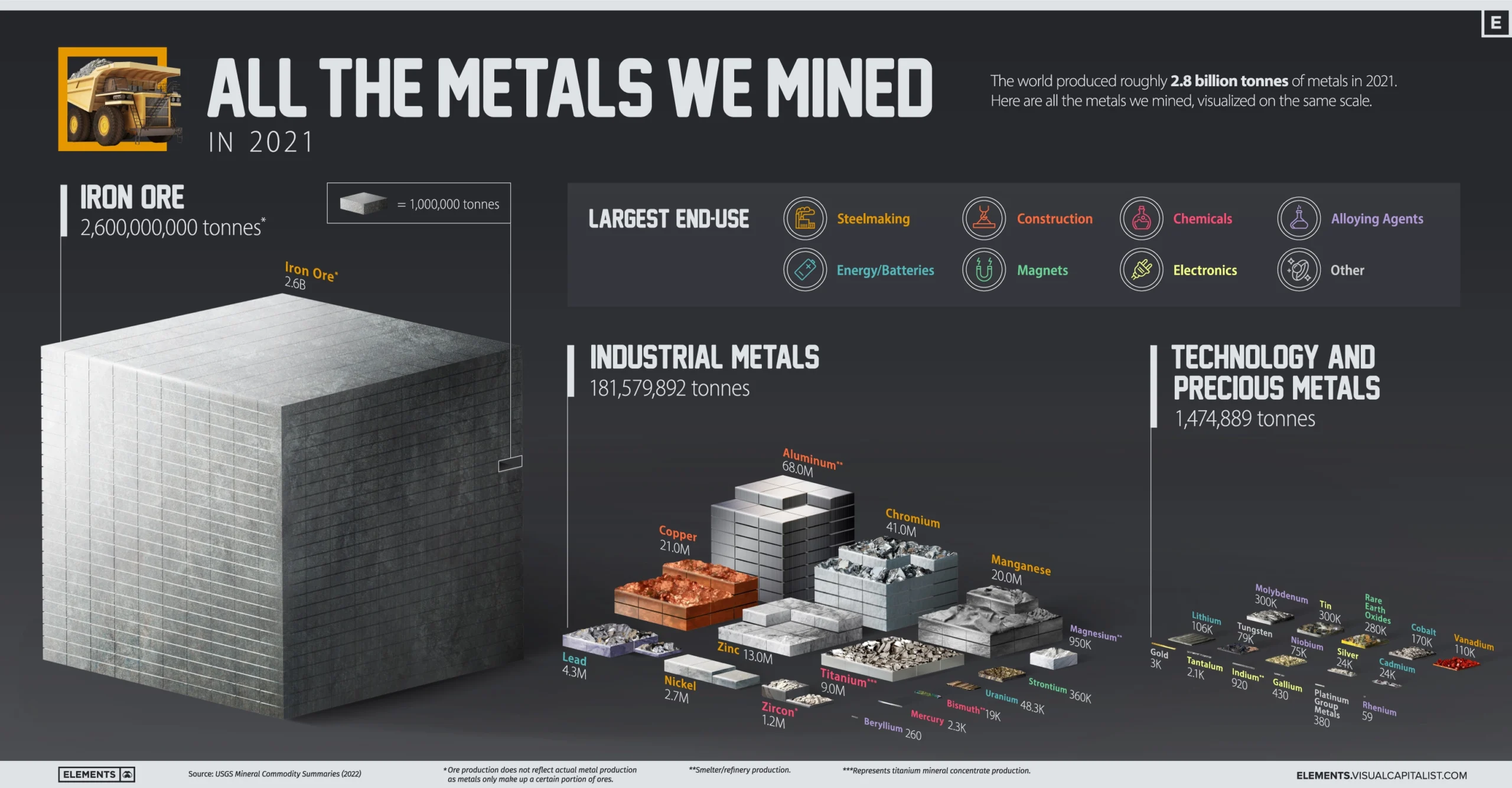

All the Metals We Mined in 2021

PS Lee, PhD 2nd degree connection 2nd Executive Director (ESI), Founder (CoolestDC), FASME, FEI, FIES

From every building we enter to every device we use, virtually everything around us contains some amount of metal.

Why Do We Mine So Much Iron Ore?

Iron ore accounted for 93% of the metals mined in 2021, with 2.6 billion tonnes extracted from the ground. It’s important to note that this is ore production, which is typically higher than metal production since metals are extracted and refined from ores. For example, the iron metal content of this ore is estimated at 1.6 billion tonnes.

With 98% of it converted into pig iron to make steel, iron ore is ubiquitous in our lives. Steel made from iron ore is used in construction, transportation, and household appliances, and it’s likely that you encounter something made out of it every day, especially if you live in a city.

Due to its key role in building infrastructure, iron ore is one of the most important materials supporting urbanization and economic growth.

Industrial Metals

Industrial metals are largely used in steelmaking, construction, chemical manufacturing, and as alloying agents. In 2021, the world mined over 181 million tonnes of these metals.

Aluminum accounted for nearly 40% of industrial metal production in 2021. China was by far the largest aluminum producer, making up more than half of global production. The construction industry uses roughly 25% of annually produced aluminum, with 23% going into transportation.

Technology and Precious Metals

Technology metals include those that are commonly used in technology and devices. Compared to industrial metals, these are usually mined on a smaller scale and could see faster consumption growth as the world adopts new technologies.

The major use of rhenium, one of the rarest metals in terms of production, is in superalloys that are critical for engine turbine blades in aircraft and gas turbine engines. The petroleum industry uses it in rhenium-platinum catalysts to produce high-octane gasoline for vehicles.

In terms of growth, clean energy technology metals stand out. For example, lithium production has more than doubled since 2016 and is set to ride the boom in EV battery manufacturing. Over the same period, global rare earth production more than doubled, driven by the rising demand for magnets.

The Metal Mining Megatrend

The world’s material consumption has grown significantly over the last few decades, with growing economies and cities demanding more resources.

Global production of both iron ore and aluminum has more than tripled relative to the mid-1990s. Other metals, including copper and steel, have also seen significant consumption growth.

Today, economies are not only growing and urbanizing but also adopting mineral-intensive clean energy technologies, pointing towards further increases in metal production and consumption.”

All the Metals We Mined in 2021: Visualized – Visual Capitalist

Brookfield Invests Billions in Carbon Capture and Decarbonization

By Jennifer L

Brookfield Asset Management is betting its money into the carbon capture sector with plans to invest over $2 billion, while charging the energy transition with nuclear power.

Brookfield expects a lot of new investment opportunities to come from 3 main global trends that they dubbed the “Three D’s” – Digitalization, Decarbonization, and Deglobalization.

The asset manager’s investment in 3 project developers in 2022 alone reached a total of $1.3 billion, believing that many firms will commit to slashing their emissions.

Here are the key highlights of the Toronto-based infrastructure investor’s series of investments under its “decarbonization” trend.

Betting Big on Carbon Capture

This summer saw Brookfield and its $15 billion Global Transition Fund invest billions into carbon capture ventures.

Brookfield’s renewable power and transition group manages $67 billion and runs over 6,000 power plants.

Carbon Transformation by LanzaTech:

The investor recently committed $500 million to LanzaTech, a Chicago-based carbon capture and transformation company. Its plants convert CO2 from industrial emissions into products people use everyday such as perfume, clothes, and fuels.

Brookfield’s investment will be for scaling up LanzaTech’s carbon capture and transformation technology. If milestones are met, the investor said that it’s even ready to pour in another $500 million, making it a billion-dollar investment.

Entropy’s Carbon Capture System:

Earlier this year, the asset manager also invested $300 million in Entropy Inc. It’s a developer of systems that capture CO2 emissions and store it underground.

Alberta-based Entropy is a subsidiary of Canadian oil-and-gas producer Advantage Energy Ltd.

Entropy’s system uses a proprietary solvent to “scrub” the gas from emissions before release into the air. Heat separates the gas from the solvent so that CO2 can be stored underground.

California Resources Corporation and CCS:

After Entropy, Brookfield also pledged $500 million in a joint venture with California Resources Corporation (CRC). The investment will build carbon capture and storage projects in Elk Hills Field.

Brookfield’s initial commitment will de-risk CRC’s projects and promote the decarbonization of California.

The initial investments of Brookfield in carbon capture ventures can rise to more than $2 billion as planned projects materialize.

As per Natalie Adomait, a managing partner in Brookfield Renewable,

“We see an immense opportunity both from a financial perspective but also to buy us time in the carbon budget…[for] the cost of other decarbonization technologies to come down… Carbon-capture technology has become proven and well understood so that it can be deployed in a very material way today.”

Adomait further added that the declining costs of carbon capture projects make them economically viable to reduce emissions.

She cited direct air capture (DAC) as one example of carbon-reducing technologies still in development.

More Investments from Private Firms

Private investment firms are also betting on carbon capture infrastructure operators as well as startup companies.

For instance, TPG Inc. invested $300 million in Summit Carbon Solutions LLC. The fund will help build a project serving ethanol producers and other industrial firms in the Midwest.

Likewise, Partners Group Holding AG co-led a $603 million funding in Climeworks, a DAC company that filters CO2 from the air.

Meanwhile, research estimates that carbon tech startups received a total of $5.6 billion in investments in the first half of 2022.

Add to this the Inflation Reduction Act that raises carbon capture incentives to $85 per metric ton from $50. With this law, many carbon capture projects are now economically viable at $85.

Yet, few companies have outperformed Brookfield’s bet on the sector so far.

There are plenty of energy transition funds like Brookfield’s Global Transition Fund seeking to invest in well-defined infrastructure investments. But the industry is not there yet.

This calls for partner investors who understand the risks in developing projects. This is where the most recent venture of Brookfield with Cameco comes in.

Charging Energy Transition Through Nuclear Power

With Cameco’s expertise in the nuclear industry and Brookfield Renewable’s expertise in clean energy, their partnership brings nuclear power at the heart of the energy transition.

It also creates a powerful platform for strategic growth across the nuclear sector.

Mark Carney, Brookfield Vice Chair and Head of Transition Investing, said:

“Every credible net-zero pathway relies on significant growth in nuclear power. It is an essential, reliable zero-carbon technology that directly displaces fossil fuels and supports the growth of renewables by providing critical baseload to our grids.”

He also noted that the partnership of Brookfield and Cameco will help drive forward the growth of nuclear power needed for clean energy transition.

Cameco and Brookfield, together with its institutional partners, form a strategic collaboration to acquire Westinghouse, one of the world’s largest nuclear services firms.

Acquiring Westinghouse brings several benefits to the investors and consortium partners. These include the following market trends:

Critical transition technology. Nuclear power is the one of the only zero-emission, baseload sources of electricity currently available at scale.

An estimated 400 GW of additional nuclear capacity will be needed by 2050.

Accelerating growth plans. Nuclear power is experiencing a resurgence around the world. 20+ countries are pursuing new projects or plant extensions.

More than 60 GW of new-build reactors are expected between 2020-2040.

Energy security. Energy supply chains are under stress due to geopolitical uncertainties. As countries look to boost energy security, demand for a stable supply of nuclear power will grow.

So, besides record financial performance, 2022 has been an active year for Brookfield’s quest to help decarbonize the economy.

I hope you have enjoyed this week’s read. Please do consider your wealth protection and contact me in regard to discussing how we can protect your family.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814