17 April, 2023

Welcome to this week’s JMP Report

Last week we saw 5 stocks trade on the local bourse, BSP, KSL, STO, KAM, and NCM. BSP traded 9,200 shares, closing 18t lower at K12.62. KSL traded 18,857 shares closing 2t lower at K2.48. STO traded 582 shares closing 2t lower at K19.08. KAM traded 1860 shares trading 15t higher to close at K0.95 and NCM traded 34 shares, trading K1.00 lower at K74.00.

Refer details below

WEEKLY MARKET REPORT | 10 April, 2023 – 14 April, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 9,200 | 12.62 | -0.18 | -1.43 | K1.4000 | – | 13.53 | THUR 9 MAR 2023 | FRI 10 MAR 2023 | FRI 21 APR 2023 | NO | 5,317,971,001 |

| KSL | 18,857 | 2.48 | -0.02 | -0.81 | K0.1610 | – | 9.93 | FRI 3 MAR 2023 | MON 6 MAR 2023 | TUE 11 APR 2023 | NO | 64,817,259 |

| STO | 582 | 19.08 | -0.02 | -0.10 | K0.5310 | – | 2.96 | MON 27 FEB 2023 | TUE 28 FEB 2023 | WED 29 MAR 2023 | YES | – |

| KAM | 1,860 | 0.95 | 0.15 | 15.79 | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 34 | 74.00 | -1.00 | -1.35 | USD$1.23 | – | – | FRI 24 FEB 2023 | MON 27 FEB 23 | THU 30 MAR 23 | YES | 33,774,150 |

| NGP | 0 | 0.69 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 2.00 | – | – | K0.225 | – | 6.19 | FRI 24 MAR 2023 | WED 29 MAR 2023 | FRI 5 MAY 2023 | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | K0.05 | – |

4.20 |

WED 22 MAR 2023 | THUR 30 MAR 2023 | THU 30 JUL 2023 | – | 195,964,015 |

There was no trading on the PNGX for leading into Easter due to some technical issues with the trading system. PNGX has since resolved the issues and trading is back to normal.

Our Order Book has us as nett buyers of BSP, CCP, STO and KSL.

Dual listed stock PNGX/ASX

BFL – 4.84 +9c

KSL – 74c + 2.5c

NCM – 29.96 +1.68(Newmont and Newcrest enter into exclusivity deed)

STO – 7.31 + 16c

Alternatives

Gold – 2000

Palladium – 1504

Platinum – 1045

Silver 25

Bitcoin – 30,353

Ethereum – 2,126

PAX Gold – 2,016

Interest Rates

In the TBill market we saw the 364 day rates remain relatively flat with the Bank issuing a further 70 mill leaving the market 257million oversubscribed.

The long awaited news arrived on the commencement of the 2023 GIS Issuance Program. We have been notified there are 8 maturities from 2yr out to 10yr with 50mill in each series.

What we’ve been reading this week

IMF WARN OF “HEAVY DOWNSIDE RISKS” AS FORECAST DROPPED AGAIN

Article care of Aisnlie Bullion Posted | 12/04/2023

It’s hard to turn on the radio or read a news site today without hearing of last night’s IMF World Economic Outlook report screaming of more pain ahead for the global economy. Whilst downgrading 2023 growth projections yet again, down 17.6% from 2022, it was clear that there are “heavy downside risks” and a “risk of harder landing” should the fallout from the bank failures continue or more occur. Pierre-Olivier Gourinchas, the IMF’s chief economist said:

“The risks are weighted heavily to the downside, in large part because of the financial turmoil of the last month and a half. That is under control as of now, but we are concerned that this could result in a sharper and a more elevated downturn if financial conditions were to worsen significantly.”

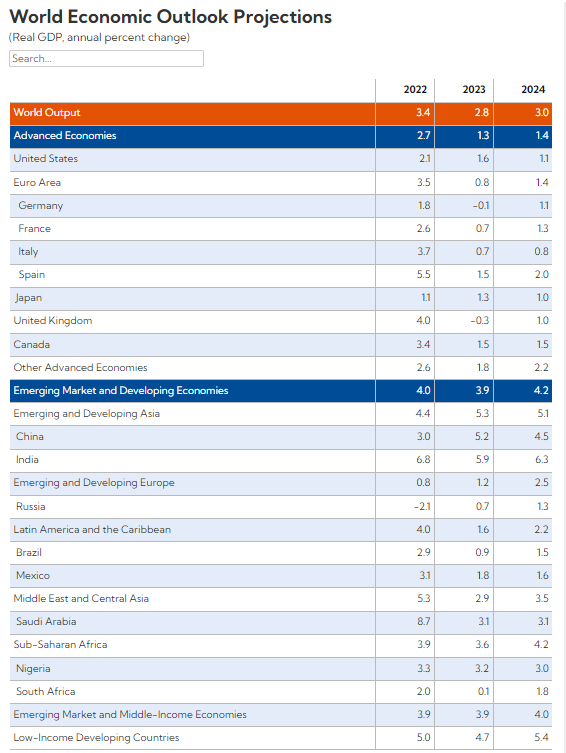

In their likely scenario, advanced economies grow at just 1.3% in 2023 and 1.4% in 2024 whilst emerging markets are forecast at 3.9% and 4.2% respectively, with the global number sitting at 2.8% and 3.0%, The IMF talk about the ‘plausible alternative’ which cuts that to 2.5% in 2023, the lowest since 2001 outside of the pandemic and GFC. The ‘severe downside’ scenario, assigned a 25% probability, is less than 2% global growth (which has only happened 5 times since we left the gold standard) and even worse of just 1% growth assigned a 15% probability.

Whilst not in the table above, they have Australia at just 1.6% in 2023.

The recent banking crisis is clearly front of mind for them and not accepted as a given that it is over. Contagion is clearly in the odds. From Gourinchas again:

“We can all remember the long time between the failure of an individual institution, whether it was Bear Stearns or Countrywide….Every time, this was treated like an isolated incident, until it wasn’t.”

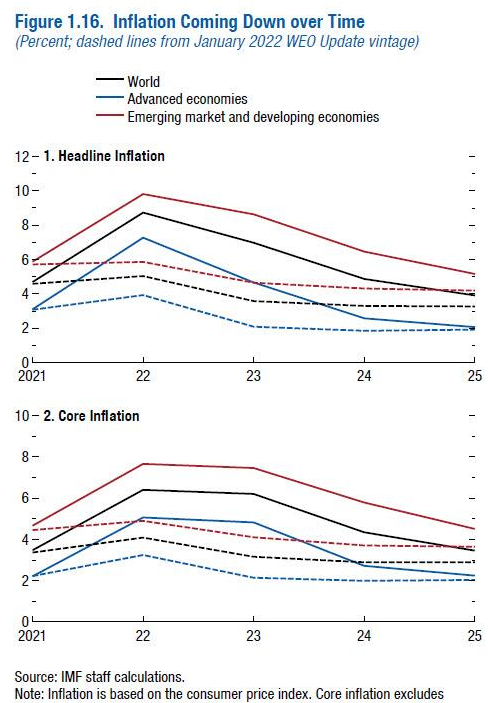

The recent bond market and banking crisis of course were borne of too hard too fast interest rate hikes to tame inflation. As they noted “Inflation is much stickier than anticipated even a few months ago” and “more worrisome is that the sharp [monetary] policy tightening of the past 12 months is starting to have serious side effects for the financial sector.”

They don’t see inflation as ‘fixed’ in any way and indeed are forecasting 7% for 2023, a still ‘sticky’ 4.9% average in 2024, and not returning to target until 2025. Per above, the impacts of responding to that inflation have been felt in both sovereign bond markets and banking sector alike with the IMF noting that “significant vulnerabilities exist both among banks and non-bank financial institutions”.

Tomorrow we see the latest CPI data out of the Mother Ship US economy. From ABC News:

“The US Consumer Price Index is expected to cool to 0.2 per cent in March, and economists are tipping annual inflation to slow from 6 per cent to 5.2 per cent because of the Federal Reserve’s string of interest rate rises.

However core inflation, which strips out volatile food and energy prices, is predicted to rise from 5.5 per cent to 5.6 per cent.”

We also will see the minutes from the last Fed meeting tonight. Combined with Fed member William’s last night calling for another hike (when ‘hope’ is for a pause) markets were unstable again.

All eyes will be on those minutes for more clues and that CPI print, so expect more volatility. Regardless, the IMF forecasts which, if history repeats, will be downgraded again, are sending a very very clear stagflationary warning. Higher inflation, lower growth, recession signals everywhere = wind in gold’s sails. Yesterday gold went through both USD2000 and AUD3000 and held overnight, and the Gold Silver Ratio dropped below 80. This could just be the beginning of the next bull run.

ChatGPT no substitute for research, advice

Rachel Waterhouse

Australian Shareholders’ Association

Artificial intelligence (AI) has pros and cons in the investment process.

Key points

- AI has many implications for the future of investment.

- But at the moment, investment information provided by ChatGPT is limited.

- Always question results from AI on investment topics and do further research.

There’s a bit of a buzz surrounding the use of artificial intelligence (AI) language software, mostly focused on ChatGPT.

Are we seeing the rise of a benevolent “living” machine, which can interact with humans and serve their needs, or are these the first steps towards creating HAL 9000 from 2001: A Space Odyssey?

For those not acquainted with this platform, ChatGPT is a “chatbot auto-generative system”, a program that uses “natural language processing” to communicate.

The system is informed by various sources and it models its language to respond to questions with real humans, using predictive text.

It interacts in a conversational way, with a dialogue format that allows it to answer follow up questions, admit its mistakes, challenge incorrect premises, and reject inappropriate requests.

What this means is that it can do a pretty good job mimicking human interaction.

ChatGPT’s meteoric rise commenced at its launch by OpenAI on 30 November 2022, drawing over 100 million registered users by the following January.

It’s been asked to write essays, compose poetry, comment on politics and answer life questions, leading to concerns about plagiarism, cheating, bias, misinformation, and worse.

Unlike Google, which provides search results based on existing web pages, ChatGPT reacts to information given to it and adapts its responses accordingly.

Like Google, ChatGPT is affected by the algorithms set by its programmers and the available information. So, it can provide an answer, but can it provide an accurate evaluation of the issue to which it is responding?

And – more importantly – what does this mean for the future of investment?

Does ChatGPT need an Australian Financial Services Licence?

In preparing to write this article, I thought I would ask ChatGPT to write an article for me about how it supports retail investors (this is NOT that article). Interestingly, it produced a 472-word piece, starting with:

“Investing in today’s complex financial markets can be a challenging task. The sheer amount of information available can be overwhelming, and it’s not always easy to know where to turn for reliable advice. Fortunately, ChatGPT is here to help. As a large language model trained by OpenAI, ChatGPT is uniquely suited to provide investors with the insights they need to make informed investment decisions. Here are some reasons why ChatGPT is helpful for investors:”

It’s an interesting marketing pitch, but do the claims stack up?

Can you use ChatGPT for investment advice?

Arguably, in the future, ChatGPT will be able provide information, insights, and analysis, that might help investors to make informed choices.

The problem at the moment is that the information is date limited.

For example, I asked about the names of the Chair and CEO of an organisation and not only was I advised that the platform only had information accurate as at September, 2021, but then gave me the wrong names for both positions as of that date.

This raises questions about its current functionality for investment purposes – it may have useful historical information, but you’re not going to be able to receive accurate sharemarket results. Investment advisors need not be worried yet.

What other limitations might there be?

Many people say not to follow the herd when investing. Yet, there is a real likelihood that ChatGPT – informed by programmers and the internet – will be the source of information for the herd in the future.

There is also the potential for gaming of the system. If we reach the point where people make decisions on whether to buy, hold, or sell shares, based on ChatGPT’s recommendations, the temptation may be for a company or individual to flood it with one type of information that skews its answers.

Without human intuition, judgement, and creativity, it is arguable that the platform will not be able to differentiate between information and misinformation, even if it is happy to tell you otherwise.

By all means, use ChatGPT as an information source, but not as your ONLY information source. Question what it tells you, do your own research, and don’t sack your financial advisor just yet.

The future of investment?

As the technology evolves and the database informing the answers grows larger and more contemporary, it is possible that AI will become more informed, accurate, and useful.

Real-time analysis would certainly be useful, and AI’s ability to give an answer quickly may give some people an edge, but there will always be questions around the biases of the programmers who created it and the algorithms they develop.

For example, Silicon Valley Bank in the US collapsed in March, with allegations that not enough attention was paid to social issues. How would a platform such as ChatGPT have seen that as an investment option? Would it have endorsed it because of perceived strong potential, or would it have raised a red flag about the bank going eight months without a chief risk officer?

Will AI platforms be able to be personalised to a future user’s financial goals, risk tolerance, investment horizon, and other preferences, or will it always be more generic? It’s not clear where the technology is going.

If we continue to head towards AI investment advisors, however, regulators will need to work hard to keep some control over the system to protect the consumer.

If you’re thinking of using ChatGPT for share information, maybe take it with a grain of salt, and ask, what could go wrong?

If you are curious about this new technology, you may want to sign up for a free account and ask ChatGPT a few questions for yourself. Or ask it to write you a poem or limerick.

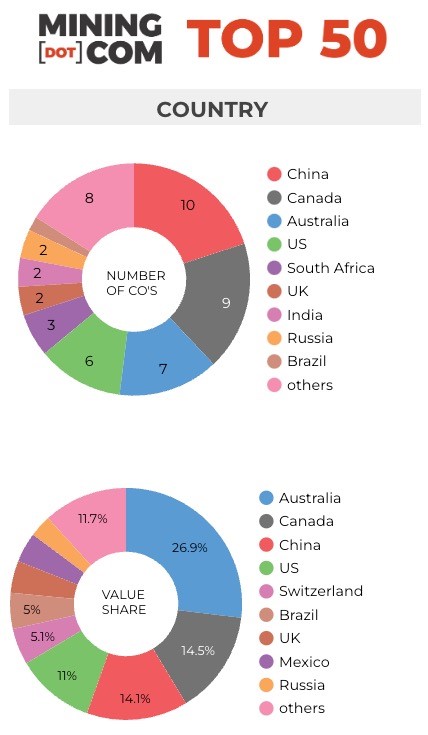

CHARTS: Mining’s top 50 companies top $1.4 trillion value amid M&A fever

Frik Els | April 11, 2023 | 11:28 am Markets Top Companies Australia Canada China Latin America USA Coal Cobalt Copper Gold Iron

Ore Lithium Nickel Palladium Platinum Potash Silver Uranium Zinc

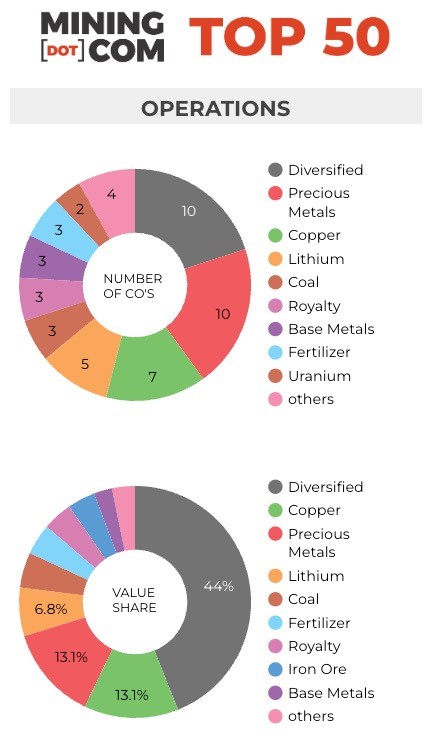

The world’s top 50 mining companies build on gains in the first quarter of 2023, but remain well below valuations this time last year as M&A fever grips the sector.

This time last year metals and mining were bubbling with high hopes for a post-pandemic Chinese economic resurgence, that inflation in the developed world would prove transitory and so would the Ukraine war, then barely a month in.

At the end of Q1 2022, the MINING.COM TOP 50* ranking of the world’s biggest miners hit an all time record of a collective $1.75 trillion in value as everything from copper and gold to uranium and tin rallied hard.

But the rout was swift and by the end of June the TOP 50 had lost an astonishing $600 billion in combined value as China’s zero-covid lockdowns remained in place, interest rates were hiked to curb stubborn inflation and the Ukraine war roiled energy markets.

Mining companies’ ratings have improved steadily since then, but at the end of Q1 this year the TOP 50 have only made up little over half the losses since the March 2022 peaks for a combined value of $1.43 trillion. That’s not far above levels seen end-March 2021 and up a relatively modest $49 billion since the end of last year.

Copper charge

Primary copper producers have fared well over the last quarter, outperforming the broader market and adding more than 16% in value as the bellwether metal continues to benefit from bullish predictions.

Following a string of acquisitions at home and abroad fast-growing Zijin Mining led the copper charge with a 21% gain for the quarter for a $46 billion valuation in Shanghai.

Zijin overtook First Quantum as the world’s fifth largest copper producer based on 2022 attributable production after the latter’s squabbles in Panama (since resolved) saw output decline. The Chinese copper and gold company also has growing ambitions in lithium.

Poland’s KGHM, the world’s number 7 producer with output of some 540kt in 2022 fell out of the ranking more than two years ago and is now languishing at number 61 with a market cap of $5.7 billion in Warsaw.

Coal stays in the black

Glencore’s rally, which saw the company maintain its March-2022 valuation throughout the year while other shares sank, went into reverse this year with the Swiss miner and trader only just holding the number three spot worldwide.

Glencore’s unsolicited bid for Teck Resources, in the process of spinning off its own coal operations, could, on paper at least, lead to that rarest of beasts – a mining company worth more than $100 billion.

Only Rio de Janeiro-based Vale apart from the perennial top 2 has achieved that feat, albeit for short stretches at a time.

Teck enters the Top 20 for the first time after holding its value since the March 2022 peak with investors betting that a stand-alone copper entity, fed by coal profits from a sister company, will attract a new set of investors.

While coal prices have begun to moderate, coal miners in the ranking have held onto most of the gains as large parts of the world turn to traditional sources of energy amid Russian oil and gas sanctions.

Uranium stocks enriched

Uranium counters also continue to find favour among investors amid volatile global energy markets with Kazatomprom re-entering the ranking in the final slot after a brief absence.

Canada’s Cameco makes the best performer list over the three months after spending much of the post-Fukushima period in the wilderness.

The Kazakh uranium producer, the world’s largest, pushed out Fresnillo as the Mexico City-based company suffers from silver’s relative underperformance to gold.

Golden years

Newcrest Mining tops the percentage gain table thanks in part due to its absorption of Canada’s Pretium Resources.

With a sweetened bid for the Australian miner from Newmont announced this week, a combined company could be worth around $55 billion and mark the return of a gold-focused company to the Top 10.

Bullion’s recent strength sees half the best performer list made up of gold companies, and representation in the ranking is destined to increase given merger fever among the lower rungs in the sector.

Platinum undercard

Weakness in platinum prices and operational woes for South African producers amid a power crisis sees Impala Platinum fall to just outside the top 50 for the first time.

Impala follows Sibanye Stillwater, which despite a diversification strategy away from South Africa and PGMs over many years and ranked at number 30 less than two years ago, dropped out a year ago.

Anglo American Platinum is the worst performer for the quarter, losing more than a third of its value this year.

Lithium lingers

Despite the sharp pullback in lithium prices so far in 2023, the five lithium stocks in the the Top 50 have held up well with a combined value of $97 billion.

Positioned at number 52 and 53, both Pilbara Minerals and IGO could swell the presence of Australian lithium miners in the rankings although gold counters Endeavour Mining and Kinross (post its Russia exit) – both of which are partial to acquisitions – could get in the Top 50.

*NOTES:

Source: MINING.COM, Mining Intelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at April 3, 2023 where applicable, currency cross-rates April 7, 2023.

Percentage change based on US$ market cap difference, not share price change in local currency.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Lithium and battery metals also pose a problem due to the booming market for electric vehicles and a trend towards vertical integration by battery manufacturers and mid-stream chemical companies. Battery producer and refiner Ganfeng Lithium, for example, is included because it has moved aggressively downstream through acquisitions and joint ventures.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem, as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

I hope you have enjoyed this weeks report, if you would like to discuss how we may be able to assist you with your investment journey, please do not hesitate to contact me

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814