20 February, 2023

Welcome to this week’s JMP Report

Last week was a relatively quiet week on the local bourse with only BSP and NCM doing all the work. BSP traded 1,746,273 shares unchanged at K12.41 while NCM had 26 shares also traded unchanged at K75.00 per share.

Refer details below

WEEKLY MARKET REPORT | 13 February, 2023 – 17 February, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 1,746,273 | 12.41 | – | – | K1.3400 | K0.34 | 13.53 | FRI 23 SEPT 22 | MON 26 SEPT 22 | FRI 14 OCT 22 | NO | 5,317,971,001 |

| KSL | 0 | 2.79 | – | – | K0.1850 | K0.0130 | 9.93 | MON 5 SEPT 22 | TUE 6 SEPT 22 | TUE 4 OCT 22 | NO | 64,817,259 |

| STO | 0 | 19.10 | – | – | K0.2993 | K0.26760 | 2.96 | MON 22 AUG 22 | TUE 23 AUG 22 | THU 22 SEPT 22 | – | – |

| KAM | 0 | 0.95 | – | – | – | – | – | – | – | – | YES | 49,891,306 |

| NCM | 26 | 75.00 | – | – | USD$0.075 | K0.70422535 | – | FRI 26 AUG 22 | MON 29 AUG 22 | THU 29 AUG 22 | – | 33,774,150 |

| NGP | 0 | 0.69 | – | – | – | – | – | – | – | – | – | 32,123,490 |

| CCP | 0 | 1.90 | – | – | K0.134 | – | 6.19 | MON 19 SEP 22 | TUE 27 SEP 22 | FRI 18 NOV 22 | YES | 569,672,964 |

| CPL | 0 | 0.95 | – | – | K0.04 | – |

4.20 |

TUE 5 APR 22 | THU 14 APR 22 | FRI 29 APR 22 | – | 195,964,015 |

Dual Listed Stock

BFL – $4.80 +15c

KSL – 77c +.05

NCM – $23.57 – $1.18 (NCM rejects bid)

STO – $6.85 -10c

Alternatives

WTI – 76.34

Gold – 1850

Platinum – 921.40

Bitcoin 24,536 up

Ethereum – 1,685 up

PAX Gold 1821

Interest Rates

Last week we saw the TBill market drop slightly with average coming in at 2.75%. The Central bank did issue a further 20mill but still left the market 151mill oversubscribed.

Finance Company Money is stable with 1yr money at 2%.

No word on the commencement of the GIS program for 2023.

Please note the Tap Bond and Tap Bill markets are closed to the retail market temporarily.

What we’ve been reading this week

PNGX – BSP and CCP Trading Strategy – some thoughts

Lars Mortensen – Managing Director at JMP Securities Limited

PNGX Trading Strategies: Everyone involved in Papua New Guinea equity markets knows that a lot of the value and dividends from Credit Corporation (PNGX:CCP) derives from its significant investment in BSP (PNGX:BSP). However, is there a way to enhance portfolio returns by trading on a better understanding of this relationship?

Our analysts asked themselves this question and they have finally answered it. Well… at least in a historical context. Based on dividends and share prices between 30 June 2017 and 31 December 2022, it seems that Double-dipping BSP distributions could have been a thing!

Have a read and tell us what you think!

As always, our research is open-book and for the development of our collective understanding of the market. We do not provide recommendations or predictions. Past performance is no guarantee of future performance.

Always speak to your advisor before trading securities.

AXA IM Ties Exec Compensation to Climate Goals

Mark Segal February 16, 2023

Global asset management firm AXA Investment Managers (AXA IM) announced today that it will begin including ESG targets in the incentive compensation packages for senior executives, including goals focused on reducing the carbon footprint of investment portfolios.

The compensation policy will apply to approximately 400 senior executives at the firm, and focus primarily on portfolio decarbonization, with 75% of the ESG portion of deferred compensation tied to targets to reduce carbon intensity in the corporate portfolio by 25% by 2025 for AXA IM Core employees, or to have 50% of the real estate portfolio to be aligned to the Carbon Risk Real Estate Monitor (CRREM) trajectories by 2025 for AXA IM Alts employees. The remaining 25% of the ESG portion will be linked to AXA IM’s interim target to reduce its corporate operational CO2 footprint by 26% by 2025.

The new remuneration policy was announced alongside the launch of the firm’s new “AXA IM for Progress Monitor,” a new initiative to transparently communicate AXA IM’s progress towards its goal to become a net zero as a business and investor by 2050, including publication of key metrics on its website. The chosen metrics were selected based on their material contributions to AXA IM’s goals, and include the firm’s portfolio’s coal exposure, carbon intensity, real estate decarbonization, operational carbon footprint, climate-focused engagement and natural capital solutions investments.

Marco Morelli, Executive Chairman of AXA IM, said:

“As we further put sustainability at the heart of everything we do, we believe transparency and regular reporting on our progress and the challenges we may face is crucial. This is not something new at AXA IM but with the launch of the AXA IM for Progress Monitor, we are choosing to visibly position our non-financial targets alongside our financial ones and to increasingly onboard our organisation to make our employees a part of our sustainability journey. Our adjusted deferred remuneration policy which falls within this objective is key to achieve our objectives and effect change, on the road to net zero and beyond.”

Carbon Offset Market Could Reach $1 Trillion With Right Rules

Doubts over credit quality and climate impact gave investors pause in 2022, but long-term demand could still drive massive growth: BNEF

New York and London, January 23, 2023 – The total value of carbon credits produced and sold to help companies and individuals meet their de-carbonization goals could approach $1 trillion as soon as 2037, BloombergNEF finds in a new research report. However, the so-called voluntary carbon market – which allows for the trading of verified emission reduction credits equivalent to 1ton of carbon each – is not built for success as currently structured. More rigorous definitions of quality and greater emphasis on carbon removal could solidify market confidence, lift prices and drive demand.

Plagued by media and investor criticism, the offset market failed to grow in 2022, BNEF finds in its Long-Term Carbon Offsets Outlook. Companies bought just 155 million offsets, down 4% from 2021, due to fears of reputational risk from purchasing low-quality credits. Supply of such credits grew just 2%, with 255 million offsets created by projects around the world. The supply of “avoided deforestation” credits shrank by a third from 2021 to 2022. Some companies were accused of greenwashing after buying such offsets from projects that had questionable environmental impact.

Kyle Harrison, Head of Sustainability Research at BNEF and the lead author of the report, was highly critical of current standards. “Today’s offset market, built mostly on bilateral transactions for cheap credits, is potentially digging its own grave,” he said. “Buyers need transparency, clear definitions around quality and easy access to premium supply, or future years will resemble what we saw in 2022. These changes will send demand signals to the projects making the greatest decarbonization impact and in need of the most investment.”

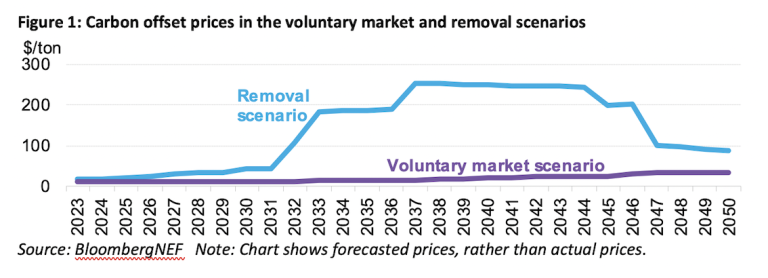

Looking to 2050, BNEF modeled supply, demand and prices for carbon offsets under three potential scenarios. Under each, demand would grow, but at substantially different rates. Prices would be dramatically different as well.

In the first, voluntary market scenario, companies could purchase any type of carbon offset to achieve their net-zero goals and would need 5.4 billion offsets annually in 2050. The market would remain consistently oversupplied and 8 billion offsets would be created annually in 2050, primarily from avoided deforestation. Prices would rise to just $12/ton in 2030 and $35/ton in 2050, allowing companies to lean on cheap offsets with dubious environmental value to meet their decarbonization goals. The market would be valued at just $15 billion annually in 2030 in this scenario – up from estimates of $2 billion today.

Under the removal scenario, the supply-demand balance would be much tighter as only offsets from projects that actually removed carbon from the atmosphere would be allowed to count. Credits from avoided deforestation or clean energy projects would be eliminated. In this scenario, the market would be briefly undersupplied starting in 2037 because the technology to remove carbon, direct air capture (DAC), remains costly to be built at major scale. Carbon offset prices would soar above $250/ton with the annual market reaching nearly $1 trillion.

A removal-only offset market would direct investment into technologies like DAC, helping to reduce costs. Such high prices could also force some companies to invest in other more impactful decarbonization strategies over offsets. There is a concern that such expensive offsets in later years would price most companies out of the market, however. It could even cause them to abandon their net-zero goals entirely, as they will be too expensive to achieve.

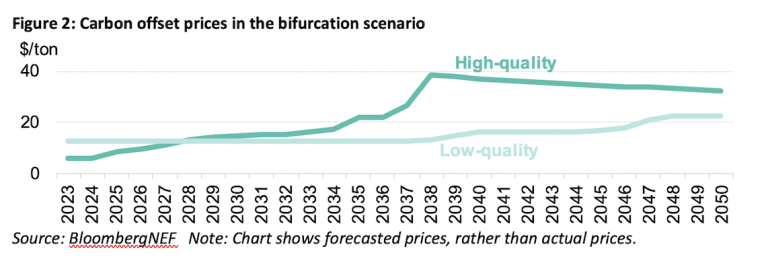

The definition of what constitutes a high-quality carbon offset is a hot-button issue today. Investors, companies and non-profits increasingly acknowledge that defining quality encompasses hard-to-quantify factors like permanence, additionally and benefits outside of decarbonization. A third scenario in BNEF’s outlook, the bifurcation scenario, assumes that this debate effectively splits the market into two pieces. One is a smaller, less liquid market for high-quality offsets, including technology-based removal and nature-based solutions in Africa, North America and Oceania. Demand for high-quality offsets reaches just 433 million in 2030 and 1.3 billion in 2050, but buyers are faced with a smaller pool of supply relative to other scenarios in the report at 1.4 and 3.2 billion in the same years. Prices peak at $38/ton in 2039 before dropping to $32/ton in 2050.

Existing separately in this bifurcation scenario is a larger market for all remaining low-quality offsets, including energy generation and nature-based solutions in Asia and Latin America. Prices are higher earlier due to greater demand at $12/ton in 2025, but reach just $22/ton in 2050. Companies leveraging this low-quality market could rely more on offsets to achieve their net-zero goals, but would have to contend with reputational risk at a far greater scale than what they face today.

The outcome of the bifurcation scenario could change depending on what encompasses high- and low-quality. Exchanges, futures products, technology providers and private-led initiatives like the Integrity Council on Voluntary Carbon Markets are working hard trying to standardize and simplify offset buying, creating clear quality tiers. If these efforts prove fruitful, standardization and quality definitions could drive much more liquidity in the market and help companies and investors differentiate their offsetting strategies. But with so many groups independently tackling this issue, buyers may leave more confused than they started.

“Creating standardization is the carbon offset market’s space race. Solving these issues could grow the market by several orders of magnitude, but we run the risk of too many of these competing efforts happening at once, similar to what we’ve seen in adjacent areas like ESG reporting and sustainable finance,” said Harrison. “If we continue with this siloed approach, we’re back at square one.”

BNEF updates its historical offset supply and demand data monthly and its long-term outlook annually.

Have a great week, if you would like to discuss your investment journey, please feel free to contact me.

Regards,

Chris Hagan.

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814