11 September, 2023

Hello and welcome to this week’s JMP Report

On the equity front last week we saw 3 stocks trade. BSP traded 489 shares, closing 6t higher at K13.20, KSL traded 166,872 shares, closing 15t lower at K2.41 and CCP traded 1,080 shares, closing steady at K2.05.

WEEKLY MARKET REPORT | 4 September, 2023 – 8 September, 2023

| STOCK | QUANTITY | CLOSING PRICE | CHANGE | % CHANGE | 2021 FINAL DIV | 2021 INTERIM | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP | MARKET CAP |

| BSP | 489 | 13.20 | 0.06 | 0.45 | K1.4000 | – | 13.53 | FRI 22 SEPT 2023 | MON 25 SEPT 2023 | FRI 13 OCT 2023 | NO | 5,317,971,001 |

| KSL | 166,872 | 2.41 | -0.15 | -6.22 | K0.1610 | – | 9.93 | WED 6 SEPT 2023 | THU 7 SEPT 2023 | THU 5 OCT 2023 | NO | 64,817,259 |

| STO | 0 | 19.11 | – | 0.00 | K0.5310 | – | 2.96 | MON 28 AUG 2023 | TUE 29 AUG 2023 | THU 28 SEPT 2023 | NO | – |

| KAM | 0 | 0.90 | – | 0.00 | – | – | – | – | – | – | NO | 49,891,306 |

| NCM | 0 | 75.00 | – | 0.00 | USD$1.23 | – | – | FRI 18 AUG 2023 | MON 21 AUG 2023 | MON 18 SEPT 2023 | NO | 33,774,150 |

| NGP | 0 | 0.69 | – | 0.00 | – | – | – | – | – | – | NO | 32,123,490 |

| CCP | 1,080 | 2.05 | – | 0.00 | K0.225 | – | 6.19 | – | – | – | NO | 569,672,964 |

| CPL | 0 | 0.79 | – | 0.00 | K0.05 | – |

4.20 |

– | – | – | NO | 195,964,015 |

Dual listed stock, PNGX/ASX

BFL – 5.46 +20c

KSL – 76.5c -7c

NCM -26.30 +53c

STO – 7.78 -3c

Interest rates

In the very short end, BPNG met the market and issued 1.866b @ 2% for 7days. There were no other maturities issued. Indicating liquidity is being taken out of the market. In the TBill market, the 364 days saw 224mill offered with BPNG leaving the market oversubsribed by 75m. Average yield for this part of the curve remained relatively steady at 2.97%.

Other Assets we watch

Silver – 23.20 -1.35

Natural Gas – 2.59 – -10c

Bitcoin – 25,951 steady

Ethereum – 1,623 -0.21%

PAX Gold 1898 -1.16%

What we’ve been reading this week

Econosights – will inflation have a resurgence?

Key points

– A slowing in inflation data is leading to optimism that the fight against high inflation has been won.

– However, some leading indicators of inflation are turning up again. This includes some price indices in the PMI and ISM surveys, the likelihood of higher agricultural commodity prices, a broader lift in commodity prices, a rise in medium-term inflation expectations and a lift in real wages and higher consumer confidence which could see a rise in consumer spending.

– Upside inflation shocks could lead to renewed concern about further rate hikes, higher bond yields and the risk of a recession which would be negative for sharemarkets. While this is a risk, we still see inflation headed lower through 2023 and into 2024 due to the impacts of restrictive interest rates. But, it is worth watching the leading inflation indicators for signs of persistent upside inflation risks.

Introduction

Inflation data across most major economies has been slowing noticeability over recent months. While it may seem like the fight against inflation has been won by central banks, some recent leading indicators of inflation have ticked up again which could indicate that inflation may have a resurgence in late 2023/early 2024 which could take financial markets by surprise. We look at these issues in this edition of Econosights.

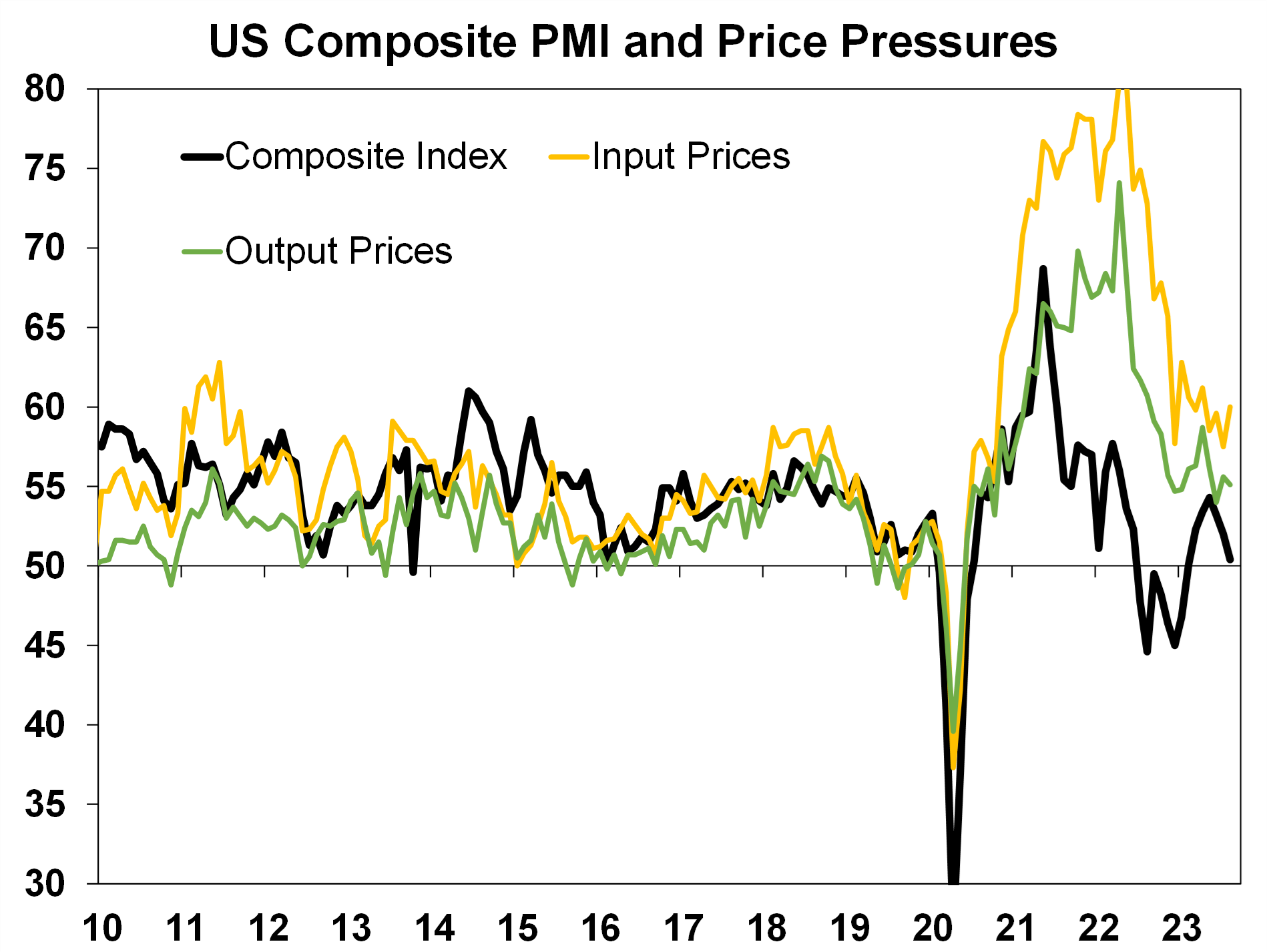

The PMI surveys

The Purchasing Managers Indices (PMIs) are a good leading indicator of global activity and contain sub-indices for input and output prices. After declining since mid-2022 input and output costs have stabilised in recent months and some look to be picking up again (see the chart below). This is also similar to the price indices in the US ISM index.

Source: Bloomberg, AMP

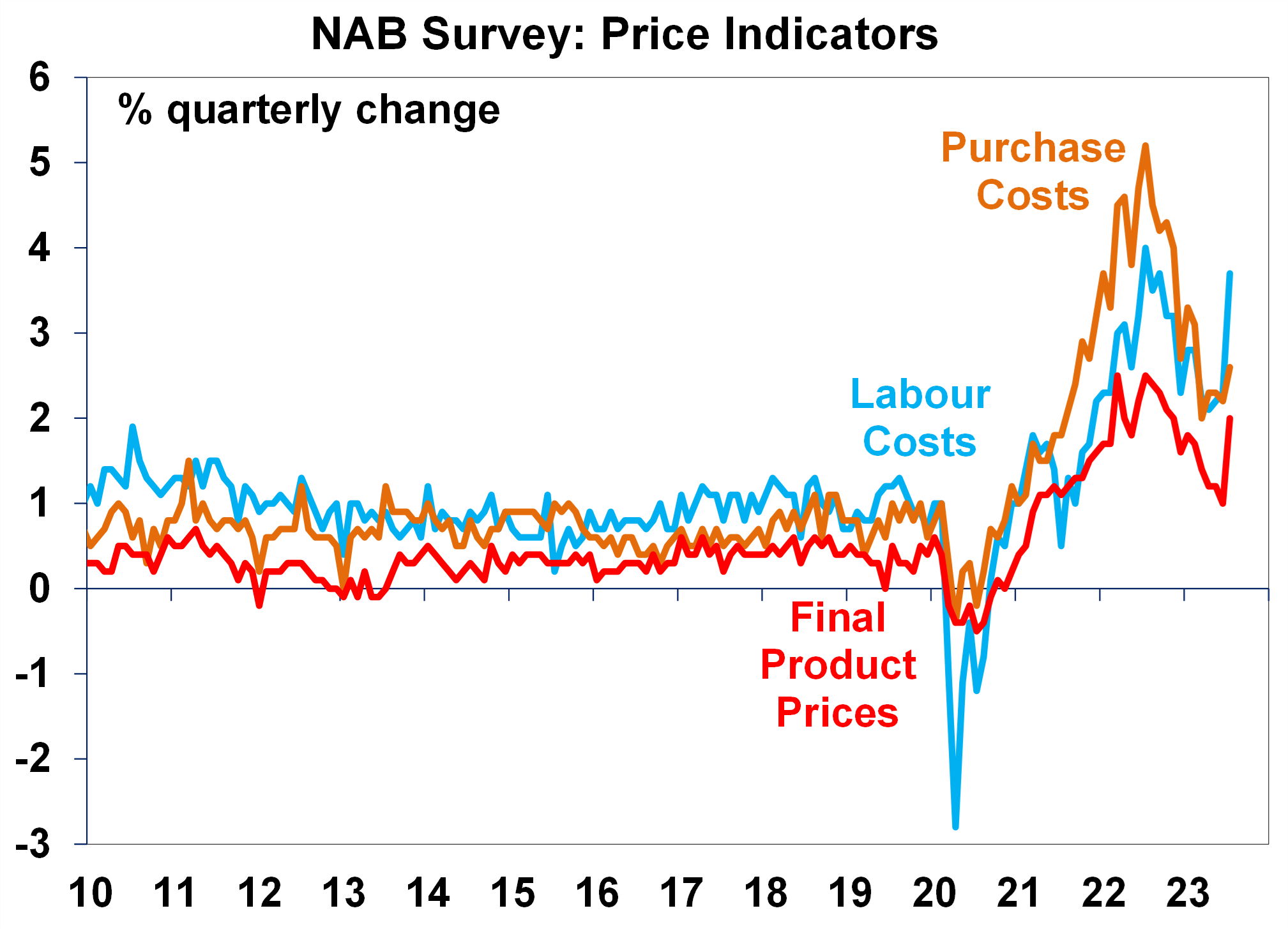

In Australia, the NAB business survey price indicators have also been trending up, especially in July (see the next chart) which could just be a one-off spike because of the decision to lift the minimum wage in June.

Source: Bloomberg, AMP

The trends in these price surveys are worth watching, as they tend to lead the hard inflation data.

Weather events and commodity prices

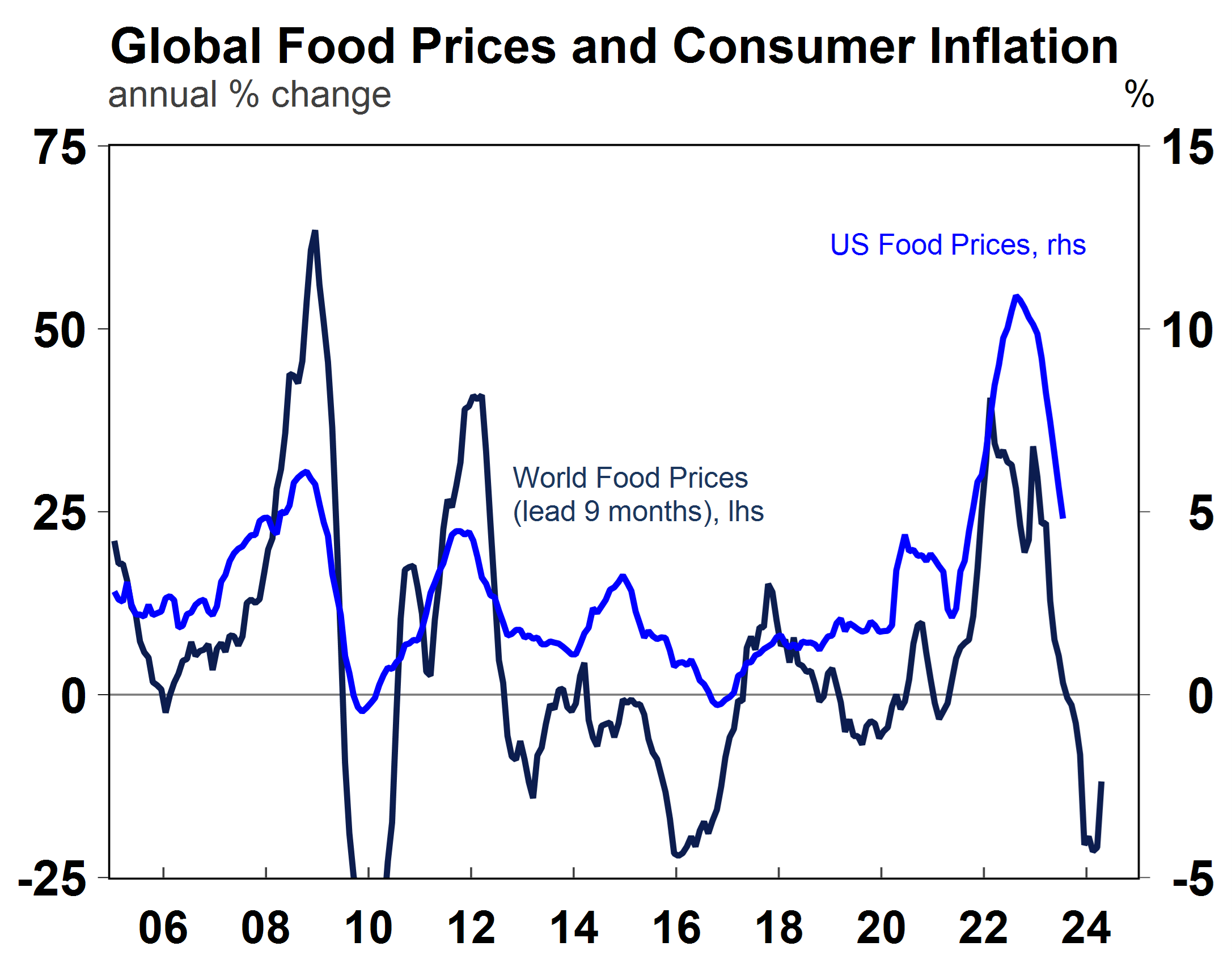

Extreme weather events can cause disruptions to food production and supply leading to volatility in food prices. While central banks usually look through spikes in prices, the events of the past few years have shown that temporary price changes can seep into numerous components of the supply chain. After large increases in food prices throughout 2021-22, food inflation is expected to slow further (see chart below).

Source: Macrobond, AMP

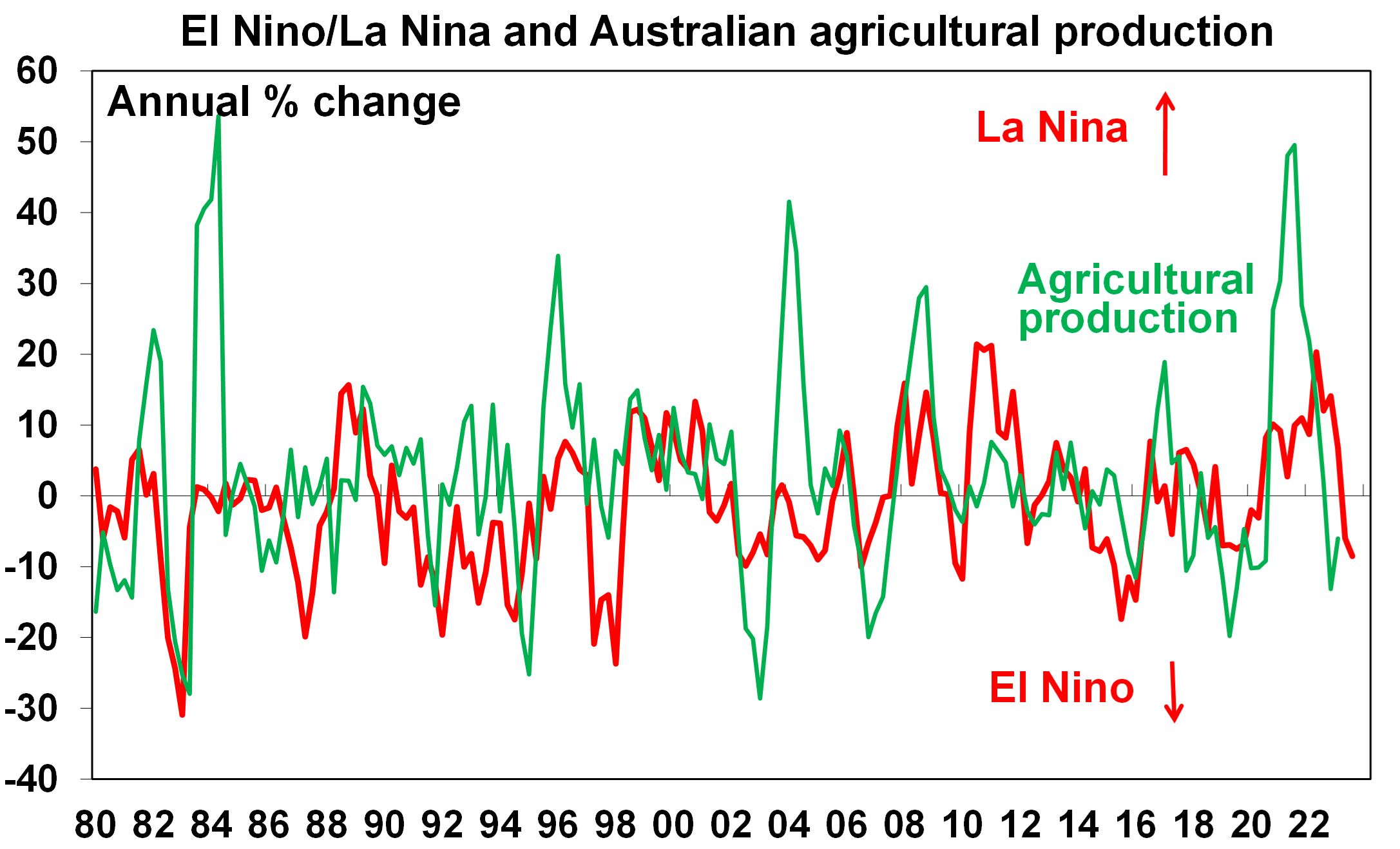

Australia’s Bureau of Meteorology has issued an “El Niño” alert for spring which occurs when sea surface temperatures rise in the tropical Pacific. The impact of El Niño is varied around countries as it typically brings drought to western Pacific countries like Australia, rains on the coast of South America and storm to the central Pacific. A way to measure the intensity of air pressure changes which detects weather events like El Niño or La Niña is through a “Southern Oscillation Index” or SOI which measures air pressure differentials in the South Pacific. A higher SOI is associated with La Niña weather and higher agricultural production (because of an increase in rainfall) in Australia and a lower SOI occurs with El Niño and lower Australian agricultural production (because of drier conditions) – see the chart below. However, the impact on inflation is mixed. Usually, El Niño is associated with higher agricultural prices because of lower production but last year’s La Niña high rainfall events also led to high inflation because of reduced supply, so the impact of weather changes is not clear-cut. However, there is a risk that El Niño leads to higher Australian agricultural prices over the next 3-6 months. For countries outside of Australia, the IMF found that El Niño also tends to be inflationary as non-fuel commodity prices rise, fuel prices increase (as coal and crude oil demand rises as there is lower output from hydroelectric power plants) and governments may decide to restrict supply of agricultural commodities.

Source: Bloomberg, AMP

Beside these weather disruptions, many commodity prices have been increasing lately including gas, coal and oil prices which will add to higher near-term inflation.

Inflation expectations

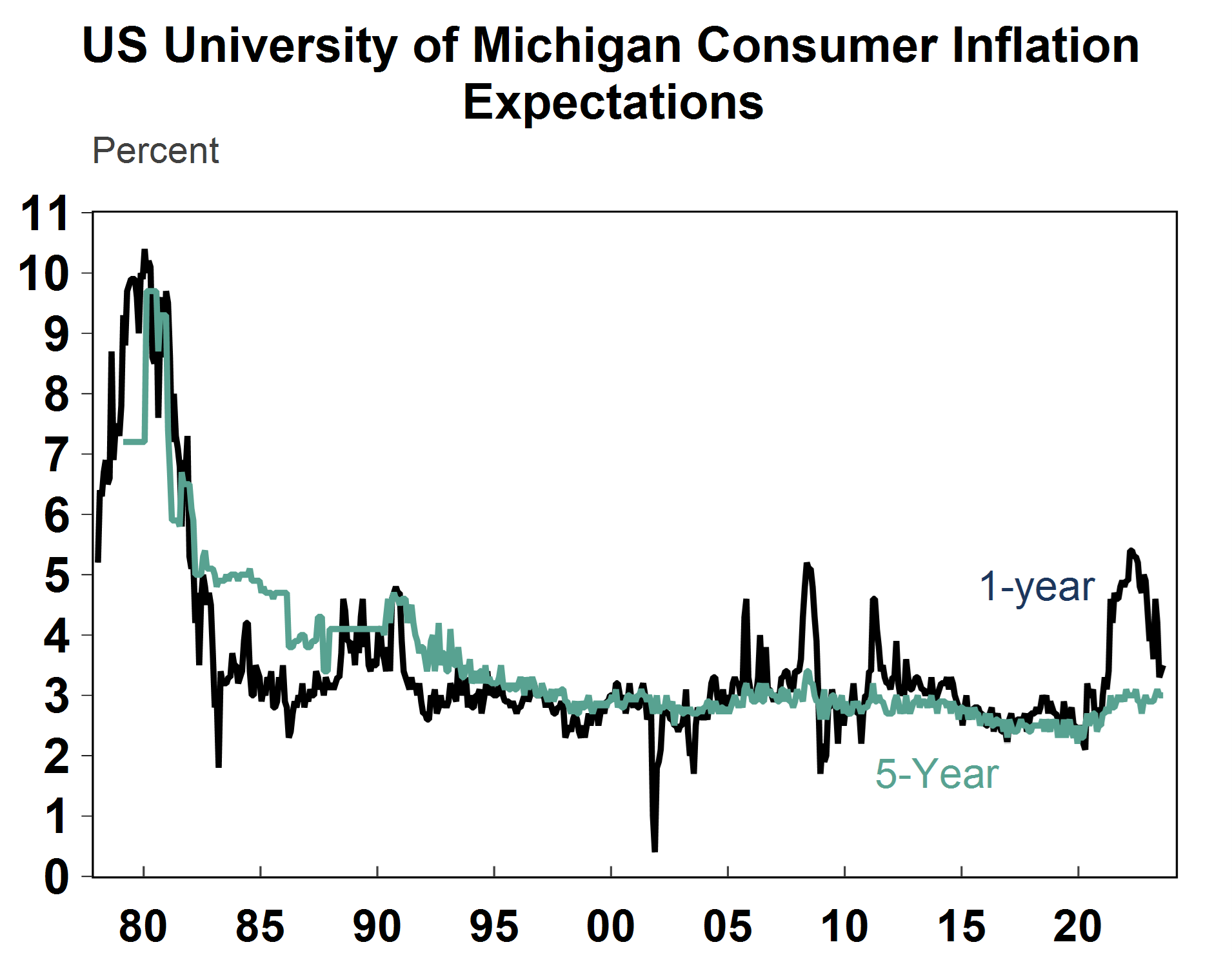

US short-term inflation expectations have come down from their 2022 highs and medium-term inflation expectations are still well contained but have drifted higher over the past months (see chart below) and are around 3% – the top end of central bank’s target range. Inflation expectations need to remain anchored to keep actual inflation contained.

Source: Macrobond, AMP

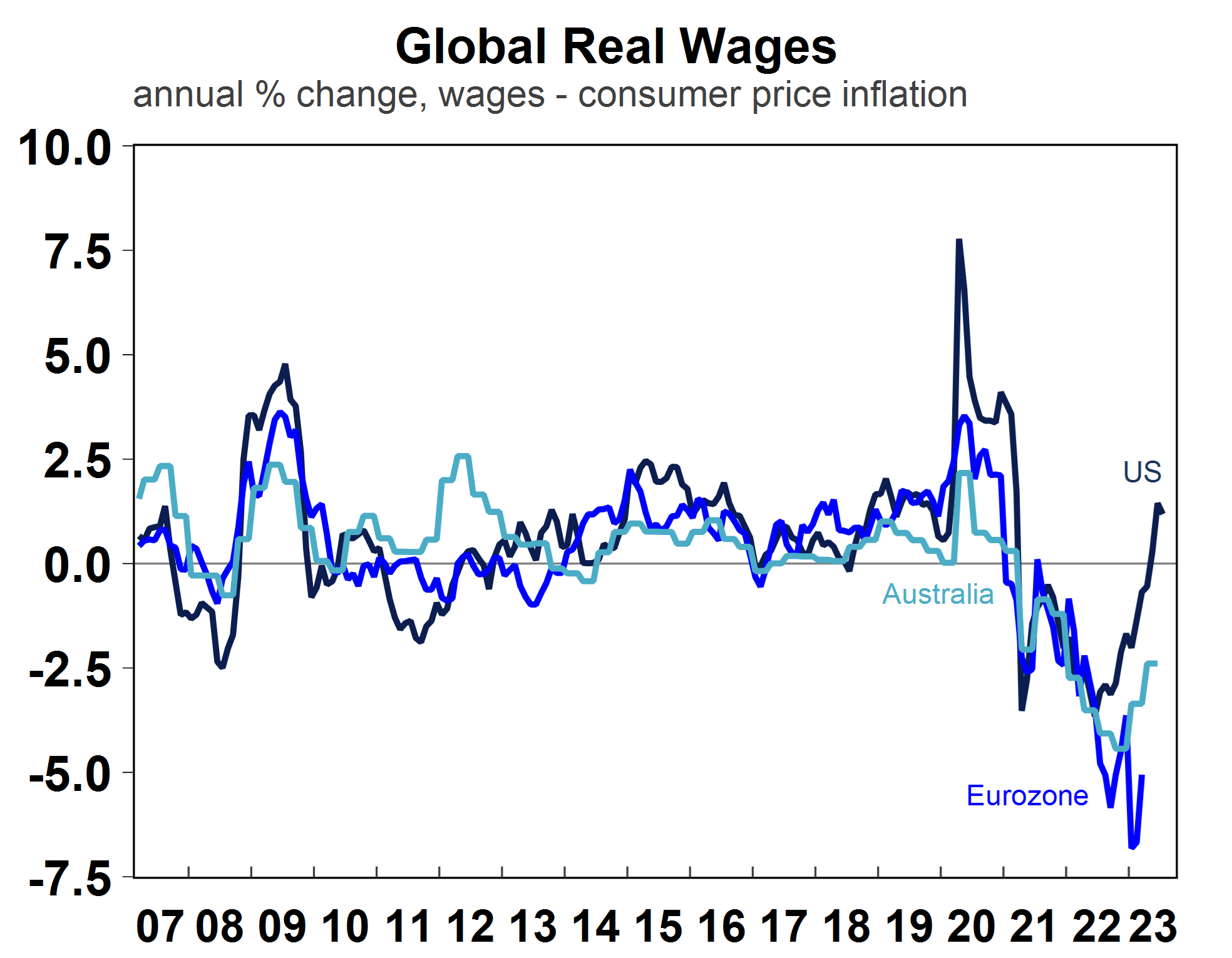

Real wages and consumer confidence

The slowing in headline inflation has led to a rise in real wages growth (real wages is the difference between nominal wages and inflation) around the world – see the chart below (although real wages growth is still negative in Australia and the Eurozone). A rise in real wages means a lift in consumer purchasing power and could see consumers increase spending as purchasing power increases, which could lead to a rise in inflation again as consumer spending increases.

Source: Macrobond, AMP

Source: Macrobond, AMP

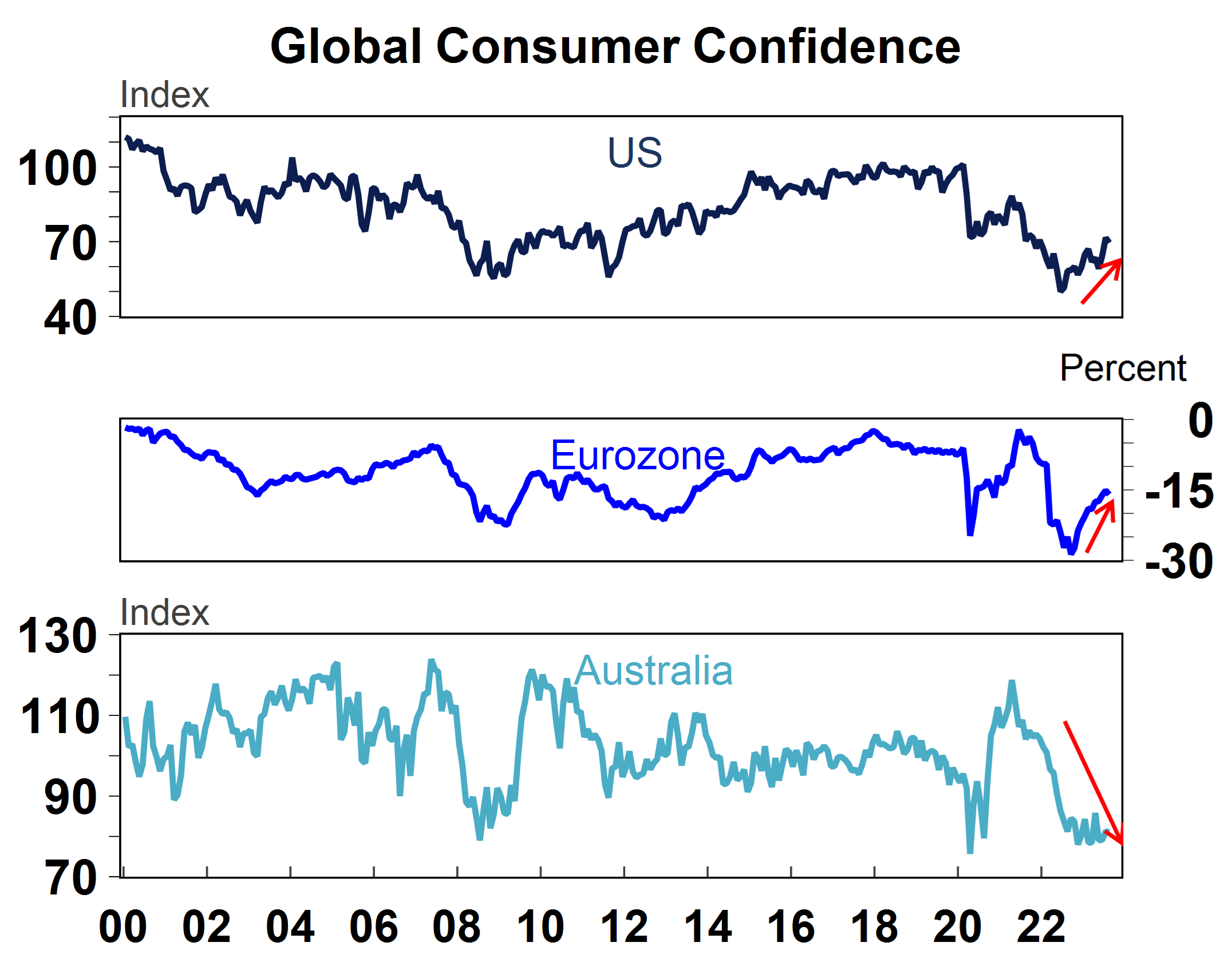

The increase in real wages growth appears to have led to a rise in consumer confidence (see the chart below) in the US and Eurozone. Australian consumer confidence is still around record lows.

Source: Macrobond, AMP

Source: Macrobond, AMP

Implications for investors

Inflation could start surprising to the upside again in the near-term leading to renewed concern about further rate hikes, higher bond yields and the risk of a recession which would be negative for sharemarkets. While this is a risk, we still see inflation headed lower through 2023 and into 2024 due to the impacts of restrictive interest rates. But, it is worth watching the leading inflation indicators for signs of persistent upside inflation risks.

In the medium-long term, inflation is likely to be higher compared to its low average in the decade prior to COVID because of: the reversal of globalisation towards onshoring/friend shoring, bigger governments and more intervention in sectors, an increase in government defence spending leading to bigger budgets, a decrease in the working age population and an increase in the dependency ratio and the impacts of climate change. There may be some offset from productivity improvements related to technology (and more specifically artificial intelligence) which could help to keep inflation down.

Over 90% of Executives Plan to Increase Spending on ESG Data this Year: Bloomberg

ESG TOOLS, SERVICES/ REPORTS, STUDIES | Mark Segal September 5, 2023

More than 90% of executives are expecting to meaningfully increase their spending this year on ESG data, with the vast majority believing that ESG data investment is required to keep pace with competitors or to develop a competitive advantage, according to a new survey by business and financial markets information service provider Bloomberg and capital markets consulting and research firm Adox Research.

For the study, Bloomberg and Adox surveyed over 100 portfolio managers, climate risk executives, and data management executives across North America, Europe, the UK and Asia Pacific.

The survey found that 92% of executives are projecting increasing their spending on ESG data by at least 10% year-over-year, including more than half that expect to increase spending by at least 20%, and 18% who expect ESG data spending to grow by 50% or more this year.

The plans to increase spending comes as most executives view ESG data as a key competitive factor, with 45% of respondents reporting that access to ESG data is “table stakes” to keeping up with competitors’ capabilities, and 44% saying that ESG data is critical to their firms’ competitive differentiation.

An additional 10% reported that their organizations use ESG data primarily for regulatory compliance, and only 1% said that ESG data was not very important for their product or marketing strategy.

Interestingly, nearly two thirds (64%) of respondents to the survey reported that they considered themselves to be ahead of their competitors in terms of ESG capabilities, while 28% saw themselves as behind.

Leila Sadiq, Global Head of Enterprise Data Content at Bloomberg, said:

“Once categorized as an alternative data source, ESG data has quickly become integral to the value financial firms deliver to their clients. Executives are making significant strategic investments in ESG data acquisition and management to differentiate themselves and meet client and regulatory demand.”

By category, top priority areas for ESG data spending identified by the survey respondents included ESG benchmarks and indices at 24%, followed by company-reported factors at 19%, and ESG scores at 17%. Data quality was cited as the top ranked criteria for selecting an ESG data provider, followed by breadth of coverage, cost, and ease of integration.

Less than a third (29%) of respondents reported that their organizations utilized a firmwide approach for evaluating and implementing their ESG data needs, while more than half said that they follow a decentralized framework managed by individual business lines, and 18% reported using an ad hoc approach to acquiring and managing ESG data, with no formal process in place.

The survey also examined the challenges the executives faced in managing ESG data, with constantly evolving and new ESG data content cited as the most challenging aspect of their firms’ ESG data management, followed by the management of multiple ESG vendor feeds, and linking ESG content to existing entity or instrument data.

Don Huff, Global Head of Client Services and Operations at Bloomberg Data Management Services, said:

“As this research confirms, our customers are grappling with the challenge of integrating large volumes of ESG data from multiple sources and the lack of consistency between vendors can lead to data quality issues and operational disruptions.”

Gert Raeves, Research Director and Founder of Adox Research, added:

“While firms are planning for ESG data to become a part of mainstream data and research workflows, they realize that the age of ESG data behaving the same as other financial data sets has not yet arrived. In the meantime, they are prioritizing technical scalability and data transparency to make sure analysts, investors, and regulators have the right tools to select, curate, and enrich existing datasets with key ESG attributes.”

H2FLY completes world’s first piloted flight of a liquid hydrogen powered electric aircraft

Scooter Doll | Sep 7 2023

Zero emission aircraft powertrain developer H2FLY is celebrating a major milestone in what it is hailing as a world’s first. The company has successfully piloted a flight of an electric aircraft powered by liquid hydrogen rather than gas, opening a new door of opportunity for zero-emissions long distance flights.

H2FLY is a Stuttgart, Germany-based company that specializes in the development of hydrogen electric aviation technology – more specifically, liquid hydrogen – with hopes of becoming one of the first to deliver a qualified propulsion system to market. It has the support of Joby Aviation, an eVTOL developer we often cover than acquired H2FLY in 2021.

Today’s news may be a world’s first, but H2FLY has already delivered several firsts compared to other zero-emission aviation companies. For instance, its HY4 hydrogen electric aircraft completed its maiden flight all the way back in 2016 and broke a world record in 2022 when it soared above 7,000 feet in the sky during a 77-mile journey across Germany.

Thanks to nearly a decade of experience, H2FLY has garnered the financial support of multiple German ministries as well as Project HEAVEN – a consortium of aviation specialists including the German Aerospace Center supported by the EU government to demonstrate the feasibility of liquid, cryogenic hydrogen use in aircraft.

H2FLY demonstrates viability of hydrogen electric aircraft

The hydrogen powertrain developer shared details of its latest aerial voyage test campaign which included four separate flights in the HY4 demonstrator electric aircraft, which was piloted by a human inside for the first time ever.

Rather than use pressurized gaseous hydrogen storage (GH2) like the past, the HY4 electric aicraft was powered by cryogenically stored liquid hydrogen (LH2), enabling significantly lighter tank weight and volume. H2FLY shared that as a result, its hydrogen-electric fuel cell propulsion system will be able to double the maximum range of the HY4 aircraft for instance, from 750 km (466 miles) to 1,500 km (932 miles). H2FLY cofounder Professor Josef Kallo spoke to the breakthrough:

This achievement marks a watershed moment in the use of hydrogen to power aircraft. Together with our partners, we have demonstrated the viability of liquid hydrogen to support medium and long-range emissions-free flight. We are now looking ahead to scaling up our technology for regional aircraft and other applications, beginning the critical mission of decarbonizing commercial aviation.

Looking ahead, H2FLY will continue its progress toward commercialization alongside the development of its new H2F-175 fuel cell systems which are expected to propel aircraft to full power range at altitudes up to 27,000 feet. The company’s future work will emerge from its new Hydrogen Aviation Center at Stuttgart Airport, set to open next year.

I hope you have enjoyed this weeks read. If you would like to discuss your investment journey with us, please do not hesitate to reach out.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814