27 August, 2024

Welcome to this week’s JMP Report,

A big week for news has come and gone, with the release of BSP Financial Group’s 6-monthly results on Friday. Overall, a pretty strong result which shows BSP remains on track in terms of delivering profit growth and increasing dividends:

BSP Financial Group – Half-Year Financial Summary (PGK Millions)

| 1H-2023 (PGK Millions) | 1H-2024 (PGK Millions) | Change | |

|---|---|---|---|

| Revenue | 1,307 | 1,459 | +12% |

| – Net Interest Income | 901 | 982 | +9% |

| – FX Income | 202 | 259 | +28% |

| – Fee & Commission Income | 171 | 185 | +8% |

| – Insurance and Other Income | 34 | 33 | -0.4% |

| Operating Expenses | (477) | (579) | +21% |

| Operating Profit | 830 | 890 | +6% |

| Bad & Doubtful Debt Expenses | (79) | (84) | +7% |

| Profit Before Tax | 752 | 796 | +6% |

| Income Tax | (324) | (334) | +3% |

| Underlying NPAT | 427 | 461 | +8% |

| JV Impairment – Cambodia & Laos | – | (36) | – |

| ACT Settlement | – | 95 | – |

| Statutory NPAT | 427 | 520 | +22% |

Whilst the headline number of K520 million in NPAT is very positive, the 8% growth in underlying profits to K461 million for the first half is reflective of the continuing investment in the business. This is also reflected in the fact that the growth rate in operating expenses continues to exceed the revenue growth rate.

BSP management has in the past foreshadowed that this trend will continue for a while, with the Cost/Income ratio currently at 39.7%. Guidance has been to expect the ratio to settle in “the low forty percentage range” indicating some further cost pressures and additional investments in the operations in coming quarters.

Return on equity of 22.9% remains robust and K0.45 per share dividends will be welcomed by shareholders.

In terms of trading, only a smattering of BSP shares traded on the exchange last week, with 913 shares changing hands at an unchanged K17.54. The stock trades ex-dividend on 27 August 2024.

In addition to BSP, STO reported its half-year results during the week.

First half-year profit slid 17 per cent to $US659 million ($977 million) after its revenue from selling oil and gas fell, but a record interim dividend did not prevent its share price from slumping by more than five per cent.

Production in the first six months of 2024 was the equivalent of 44 million barrels of oil, down two per cent, while sales revenue of $US2.7 billion slid further, dropping nine per cent.

Santos is powered by its PNG business, which accounted for 47 per cent of revenue and 55 per cent of its total earnings before interest, tax, and depreciation for the half-year of $US1.85 billion.

Overall, market activity on PNGX was subdued:

WEEKLY MARKET REPORT | 19 August, 2024 – 23 August, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 913 | 17.54 | 16,014 | 17.54 | – | – | – |

| KSL | 335,291 | 3.08 | 1,032,696 | 3.05 | 3.08 | 0.02 | 0.65% |

| STO | 437 | 19.51 | 8,525 | 19.51 | – | – | – |

| NEM | – | 146.00 | – | 147.00 | – | – | – |

| KAM | – | 1.25 | – | 1.30 | – | – | – |

| NGP | – | 0.75 | – | – | – | – | – |

| CCP | 5,000 | 2.50 | 12,500 | 2.50 | – | 0.27 | 12.11% |

| CPL | – | 0.79 | – | – | 0.70 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

| TOTAL |

372,607 |

WEEKLY YIELD CHART | 19 August, 2024 – 23 August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIV | YIELDS 2024 FINAL DIV | YIELD % |

| BSP | 7,498,483,509 | K0.37 | K1.06 | K0.45 | 8.16% |

| KSL | 797,823,671 | K0.10 | K0.16 | – | 8.39% |

| STO | 62,426,009,196 | K0.31 | K0.66 | – | 4.97% |

| NEM | – | – | K3.99 | – | – |

| KAM | 50,661,584 | K0.12 | – | – | – |

| NGP | 31,664,583 | K0.03 | – | – | – |

| CCP | 693,895,850 | K0.11 | K0.13 | – | 9.60% |

| CPL | 195,964,015 | – | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | – | 1.98% |

| TOTAL | 72,782,328,729 | 5.36% |

a BSP declared K0.45 2024 Interim Dividends during the week. This has been used for purposes of yield calculations

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

NEM has been exluded from Market-wide yield calcs.

Credit Corp shares changed hands at K2.50 per share which was an increase of K0.27 or 12.11%, however this was on the basis of only 5,000 shares traded so it is early to say whether this price increase can be maintained.

There are bidders for KAM at K1.30 which is indicative of further strength in that security, however supplies remain constrained.

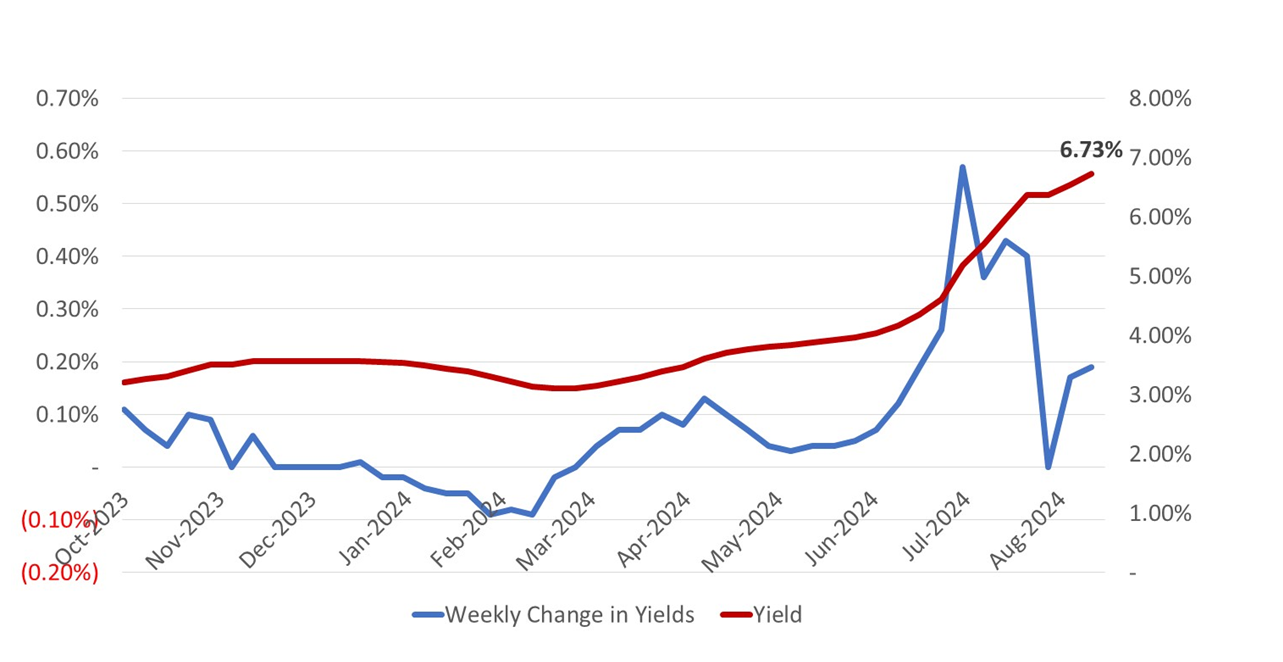

In the fixed interest market, yields in the 364-day series saw another robust increase, with the weekly auction ending up at an average yield of 6.73% or 19bps above the previous auction.

Volumes accepted across all maturities were K74 million below the offered amount and the total of K299.9 million in accepted bids across all maturities was only slightly higher than the weekly maturity of K298 million so not a lot of new capital was raised.

We look forward to a continuation of the half-year reporting season in coming weeks, with KSL, CCP and CPL being eagerly anticipated.

What we have been reading

Australia Senate Passes New Mandatory Climate Disclosure Law

A bill introducing mandatory climate reporting for large and medium-sized companies passed the Australian Senate today, marking a major step towards the establishment of a new climate risk disclosure framework in the country.

In a statement following the vote in the Senate, Australia Treasurer Jim Chalmers said:

“These critical reforms provide investors and companies the clarity and certainty they need to support the net zero transformation and further strengthen Australia’s reputation as an attractive destination for international capital.”

Launched earlier this year, the new proposed legislation would introduce climate-related reporting requirements broadly in line with the recently-released standards by the IFRS Foundation’s International Sustainability Standards Board (ISSB), including disclosures on climate-related risks and opportunities, and on greenhouse gas emissions across the value chain.

The establishment of mandatory climate disclosure requirements for companies forms the first step in the Albanese government’s sustainable finance strategy, outlined in June with the release of the government’s Sustainable Finance Roadmap, aimed at developing and reforming financial markets to support the mobilization of private capital needed to finance the transition to a net zero economy. Additional priorities under the Roadmap included establishing a sustainable finance taxonomy, and instituting a labeling regime for sustainable investments.

Under the initial draft, the new proposed legislation would apply to all public companies and large proprietary companies required to provide audited annual financial reports to the Australian Securities and Investments Commission (ASIC) that meet specific size thresholds, starting with companies with over 500 employees, revenues over $500 million or assets over $1 billion, as well as asset owners with more than $5 billion in assets, followed two years later by medium-sized companies (250+ employees, $200 million+ revenue, $500 million assets), while smaller companies (100+ employees, $50 million+ revenue, $25 million+ assets) would begin a year later. Reporting requirements for the first wave of companies would begin from the start of 2025.

The Australian Accounting Standards Board (AASB) is currently in the process of developing the internationally-aligned climate disclosure standards for Australian companies, which are expected to be issued shortly, and the Australian Auditing and Assurance Board (AUASB) is developing assurance standards for climate disclosures in late 2024.

Will the Australian house prices crash? And what’s needed to fix housing affordability

| Dr Shane Oliver 27 August, 2024

Key points

– Predictions of an Australian house price crash create lots of interest but have been a dime a dozen over the last 20 yrs.

– However, there is more to the surge in property prices than easy money with a supply shortfall being the main factor. Absent much higher interest rates and or unemployment, a house price crash in Australia looks unlikely.

– The key to sustainably improving housing affordability is to boost supply, better align immigration to housing supply, reduce or delay public infrastructure spending, encourage decentralisation and tax reform.

– A failure to boost affordability risks a further slide in home ownership and rising inequality.

Introduction

Apart from “what will home prices do?” and “where are the best places to buy a property?” the main debate around the Australian housing market has been about poor housing affordability, occasionally interspersed with a scare that home prices will crash. The most recent example of the latter was on 60 Minutes last week with a call by US demographer & economist Harry S Dent that Australian house prices could fall “as much as 50% in the coming years”. But how serious should we take forecasts for a crash? And more fundamentally how do we fix affordability?

Basic facts on the Australian property market

The basic facts regarding the Australian housing market are well known:

First, after strong gains in home prices over many years, it’s expensive relative to income, rents & its long-term trend and by global standards.

Second, flowing from this, housing affordability is poor:

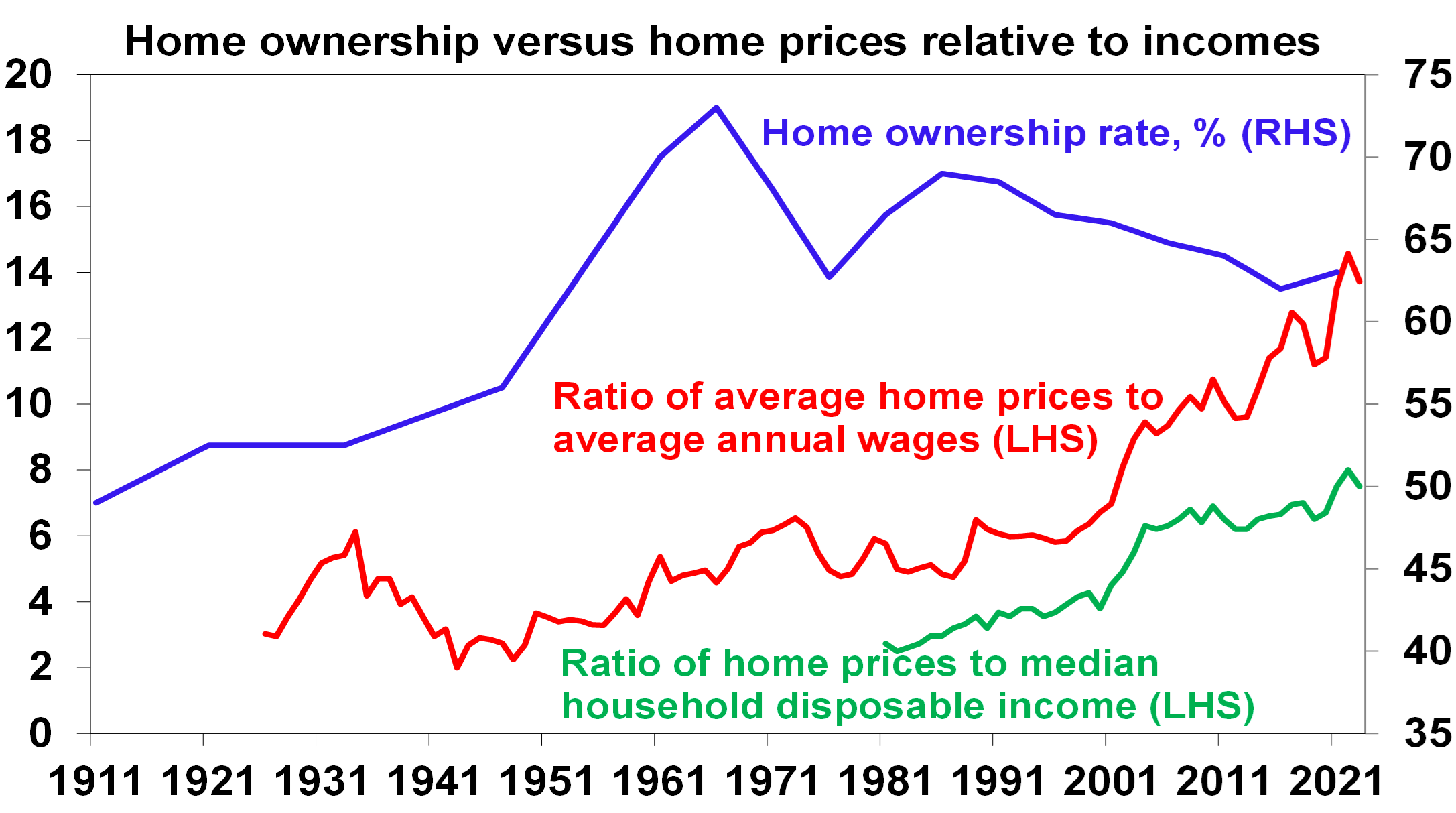

The ratio of average dwelling prices to average wages (red line in the next chart) & household income (green line) has doubled since 2000.

Source ABS, CoreLogic, AMP

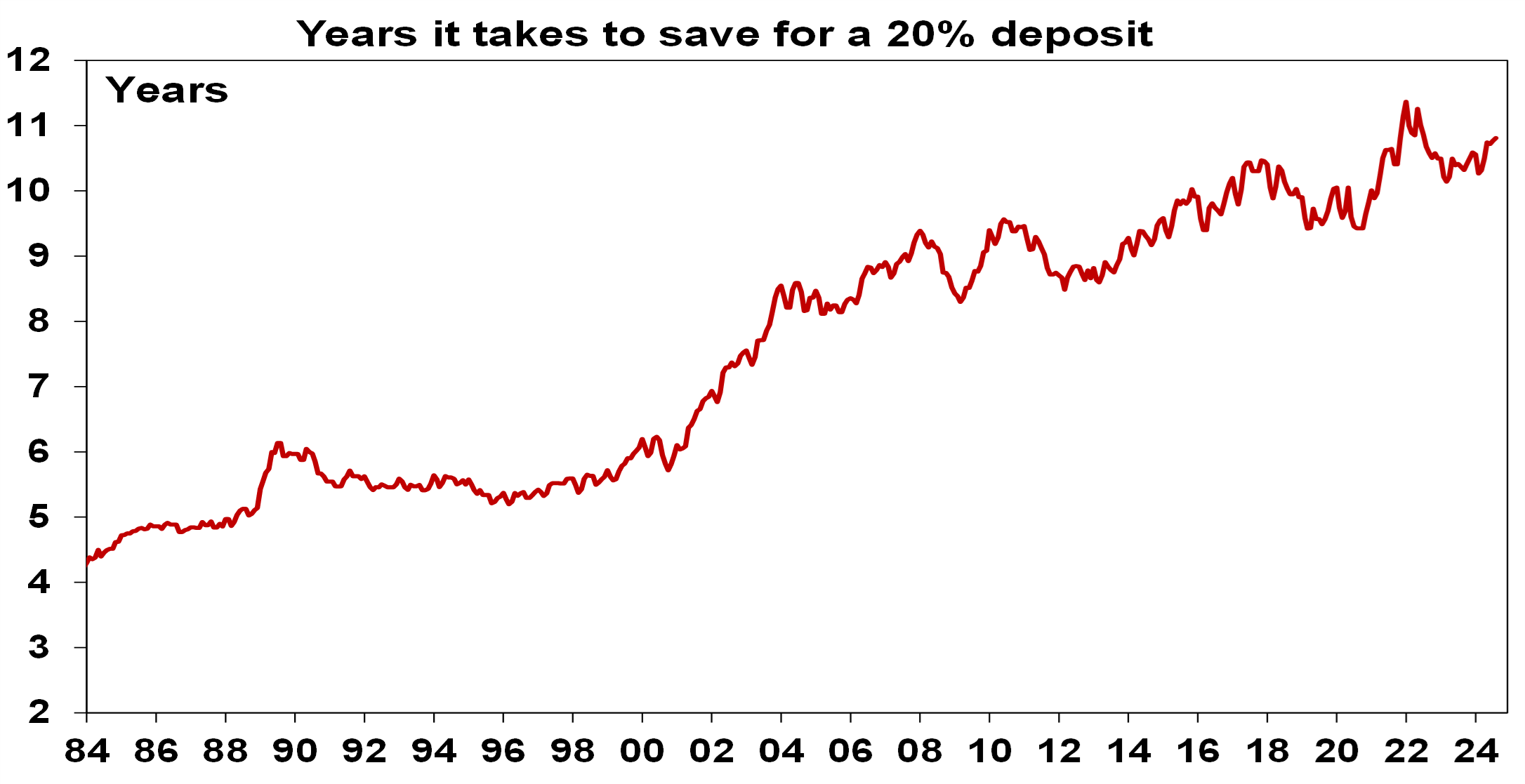

The time taken to save for a deposit has roughly doubled over the last 30 years from five years to more than 10 years.

Source: ABS, AMP

The portion of income needed to service a mortgage has hit an all-time high, thanks to the combination of the high price to income ratio and the sharp rise in mortgage rates starting in 2022.

Third, the surge in prices has seen our household debt to income ratio rise to the high end of OECD countries, which exposes Australia to financial instability on the back of high rates and or unemployment.

These things arguably make calls for some sort of crash seem plausible.

Crash calls for Australian property are nothing new

US commentator Harry S Dent’s forecast for an up to 50% fall in property prices is nothing new. Calls for an Australian property crash – say a 30% or more fall – have been trotted out regularly over the last two decades.

In 2004, The Economist magazine described Australia as “America’s ugly sister” thanks in part to a “borrowing binge” and soaring property prices. At the time, the OECD estimated Australian housing was 51.8% overvalued.

Property crash calls were wheeled out repeatedly after the GFC with one commentator losing a high-profile bet that prices could fall up to 40% & having to walk to the summit of Mount Kosciuszko as a result.

In 2010, a US newspaper, The Philadelphia Trumpet, warned: “Pay close attention Australia. Los Angelification (referring to a 40% slump in LA home prices) is coming to a city near you.” At the same time, a US fund manager was labelling Australian housing as a “time bomb”.

Similar calls were made in 2016 by a hedge fund: “The Australian property market is on the verge of blowing up on a spectacular scale…The feed-through effects will be immense… the economy will go into recession”.

Over the years, these crash calls have periodically made it on to Four Corners and 60 Minutes. The latter aired a program called “Bricks and slaughter” in 2018 with some predicting falls of as much as 40%.

And Harry S Dent was regularly predicting Australian property price crashes last decade that didn’t occur.

Why a crash is unlikely?

Of course, a crash can’t be ruled out, but as I have learned over the last two decades the Australia property market is a lot more complicated than many “perma property bears” allow for.

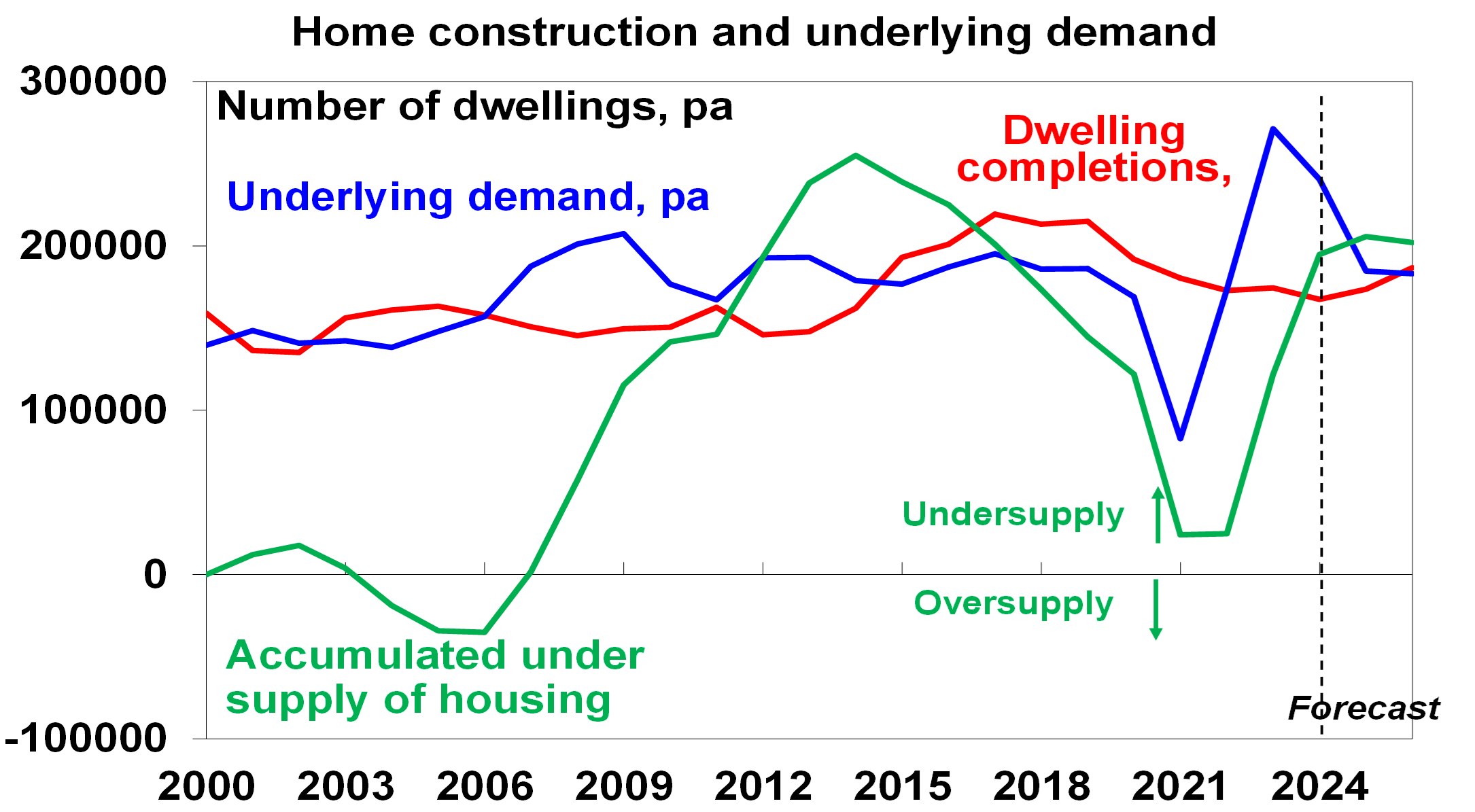

First, the property market is not just a speculative bubble fuelled by easy money and low interest rates. Sure low rates allowed us to pay each other more for homes but the key factor keeping them elevated relative to incomes has been that the supply of new dwellings has not kept up with demand due to strong population growth since the mid-2000s and more recently with record population growth resulting in an accumulated shortfall of around 200,000 dwellings at least but possibly as high as 300,000 if the reduction in average household size that occurred through the pandemic is allowed for. This partly explains why property prices have not collapsed despite the threefold rise in mortgage rates since May 2022.

Source: ABS, AMP

Second, the property market is highly diverse as evident now with strength in previously underperforming cities like Perth, Adelaide and Brisbane but weak conditions in Melbourne, Hobart and Darwin.

Thirdly, Australian households with a mortgage have proven far more resilient than many including myself would have expected in the face of the rate hikes in 2022 and 2023. This is evident in still relatively low mortgage arrears (of around 1% of total loans). This may reflect a combination of savings buffers built up through the pandemic including in mortgage pre-payments and offset accounts, access to support from the “bank of mum and dad”, the still strong jobs market allowing people to work extra hours & an ability to cut discretionary spending (suggesting definitions of what constitutes mortgage stress may be overstating things). Of course, arrears are starting to rise as these supports recede, so the continuation of this resilience should not be taken for granted.

Finally, the conditions for a crash are not in place. This would probably require a sharp further rise in interest rates and/or much higher unemployment. Sharply higher interest rates from the RBA are unlikely as global inflationary pressure is easing and global central banks are now cutting. Our inflation & rates went up with a lag versus other countries & are likely to follow on the way down. Higher unemployment – with jobs leading indicators pointing to less jobs growth – is the biggest risk though.

So, a property price crash is a risk, but would likely require a deep recession. Our base case for average home prices remains for modest growth ahead of a pick-up after rates start to fall.

What can be done to boost housing affordability?

Of course, a house price crash would improve housing affordability – but it’s also a case of “be careful of what you wish for” because a crash would likely also come with a deep recession and sharply higher unemployment which could see many lose their homes along with a hit to incomes. However, improving housing affordability is critical as its long-term deterioration is driving excessive debt levels and increased mortgage stress and contributing to a fall in home ownership (the blue line in the first chart). Of course, other factors have also driven falling home ownership since the 1960s including people starting work and family later in life, a decline in perceptions that owning a home is necessary for security & growth in other forms of saving beyond housing. But worsening affordability is likely a big contributor and falling home ownership due to this is something we should be concerned about as its contributing to increasing inequality and if it persists it could threaten social cohesion.

So, beyond crashing home prices, what can be done to boost housing affordability? My shopping list includes the following:

Build more homes – relaxing land use rules, releasing land faster and speeding up approval processes, encourage build to rent affordable housing and greater public involvement in provision of social housing. The commitment by Australian governments to build 1.2 million homes – backed up by incentives and strong moves by at last NSW and Victoria over five years starting from this financial year is a welcome and big move down the path to boost supply. So far though approvals and commencements running at around 160,000 to 170,000 homes annually are well below the implied 240,000 target.

Refocus on building more units – we will need more units (which are lower cost) than houses in the mix. The only time we consistently built more than 200,000 homes per annum was in the unit building boom of the 2015-19 period. Back then unit approvals were around 50% of total approvals whereas they are now about one third.

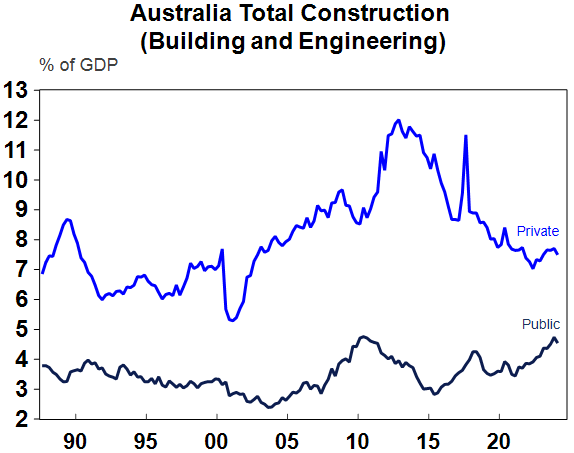

Slow down infrastructure spending – home builders are now regularly complaining about the difficulty in building apartments. Apart from issues around approvals, much of this relates to cost blow outs and labour shortages and beyond the disruption caused by the pandemic an ongoing driver is the competition for resources from booming public sector infrastructure projects.

Source: Macrobond, AMP

Match the level of immigration to the ability of the property market to supply housing – we have clearly failed to do this since the mid-2000s and particularly following the reopening from the pandemic, and this is evident in the ongoing supply shortfalls. Of course, we need to be careful to not over-react with the crackdown on student visas and numbers risking a lasting negative impact on our education sector which is our biggest export earner after iron ore and energy.

Encouraging greater decentralisation to regional Australia – this should be helped along with appropriate infrastructure and of course measures to boost regional housing supply.

Tax reform – including replacing stamp duty with land tax (to make it easier for empty nesters to downsize) and reducing the capital gains tax discount (to remove a distortion in favour of speculation).

Policies that won’t work, but are regularly put forward by populist politicians as solutions to poor affordability, include: grants & concessions for first home buyers (as they just add to higher prices); abolishing negative gearing (which would just inject another distortion into the tax system and would adversely affect supply), although there is a case to cap excessive use of negative gearing tax benefits; banning foreign purchases altogether (as they are a small part of total demand and may make it even harder to get new unit construction off the ground); and a large scale return to public housing (as a major constraint to more units is excessive costs and delays, and just switching to public housing won’t fix this).

Please feel free to reach out for your investment needs.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814