3 September, 2024

Welcome to this week’s JMP Report,

The big news in the local stock market last week was the announcement of Kina Securities Limited’s (PNGX:KSL) results for H1 2024. Overall a pretty strong result, blemished only by the K7.4 million negative net impact on the results from the fraud announced to the market during Q2.

Underlying earnings were up by 8.4% to K50.3 million for the half, with the Statutory Earnings figure coming in at K42.9 million – 8.9% lower than the same period in the prior year. Very pleasing to see strong growth in FX Income and strong growth in fees and commissions income. Headline Gross Revenue growth of 17.6% to K250.2 million was also a strong result.

KSL investors must keep an eye on the ongoing growth in the cost-to-income ratio which increased again to 58.9%. Driving down this ratio will take some time and is naturally dependent on the continuing growth in the scale and size of the bank which will allow costs to gradually be amortised against a larger revenue pool:

| 1H-2023 (PGK Millions) | 1H-2024 (PGK Millions) | Change | |

|---|---|---|---|

| Gross Revenue | 212.8 | 250.2 | +17.6% |

| – Net Interest Income | 98.1 | 111.6 | +13.8% |

| – FX Income | 21.6 | 37.0 | +71.8% |

| – Fee & Commission Income | 64.6 | 74.6 | +15.4% |

| – Other Income | 3.2 | 4.3 | +36.9% |

| Operating Expenses | (105.4) | (147.5) | +39.9% |

| Operating Profit | 82.1 | 80.8 | -2.4% |

| Bad & Doubtful Debt Expenses | (4.3) | (7.8) | +80.6% |

| Profit Before Tax | 77.8 | 73.0 | -7.0% |

| Income Tax | (31.4) | (30.1) | -4.1% |

| STATUTORY PROFIT | 46.4 | 42.9 | -8.9% |

| Add Back: Fraud Loss Provision (net of Tax) | – | 7.4 | – |

| UNDERLYING PROFIT | 46.4 | 50.3 | +8.4% |

The 8.4% growth in underlying profit is in line with the 8% delivered by BSP the previous week, however as the smaller of the two, investors are justified in expecting KSL to outpace its larger rival.

KSL declared a dividend of K0.106 per share which is payable on 4 October 2024. The stock will trade ex-dividends from this coming Friday, 6 September 2024.

Overall, market activity on PNGX was very subdued, with only modest trades in KSL and a single, small trade in KAM:

WEEKLY MARKET REPORT | 26 August, 2024 – 30 August, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | – | 17.54 | – | 17.62 | – | – | – |

| KSL | 64,958 | 3.09 | 200,720 | 3.05 | 3.09 | 0.01 | 0.32% |

| STO | – | 19.51 | – | 19.37 | – | – | – |

| NEM | – | 146.00 | – | 148.00 | – | – | – |

| KAM | 1,235 | 1.30 | 1,606 | 1.30 | – | 0.05 | 4.00% |

| NGP | – | 0.75 | – | – | 0.75 | – | – |

| CCP | – | 2.50 | – | 2.50 | – | – | % |

| CPL | – | 0.79 | – | – | 0.70 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

| TOTAL | 202,326 |

WEEKLY YIELD CHART | 26 August, 2024 – 30 August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIV | YIELDS 2024 FINAL DIV | YIELD % |

| BSP | 7,498,483,509 | K0.37 | K1.06 | K0.45 | 8.61% |

| KSL | 799,373,506 | K0.10 | K0.16 | K0.106 | 8.61% |

| STO | 62,426,009,196 | K0.31 | K0.66 | – | 4.97% |

| NEM | – | – | K3.99 | – | – |

| KAM | 50,661,584 | K0.12 | – | – | – |

| NGP | 31,664,583 | K0.03 | – | – | – |

| CCP | 693,895,850 | K0.11 | K0.13 | – | 9.60% |

| CPL | 195,964,015 | – | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | – | 1.98% |

| TOTAL | 72,782,328,729 | 5.36% |

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

NEM has been exluded from Market-wide yield calcs.

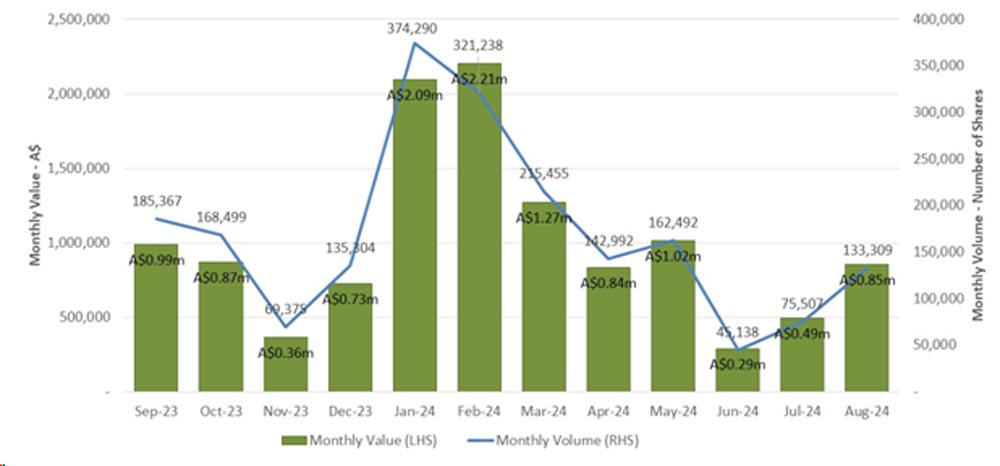

A number of investors are interested in the interplay between the price and volumes of dual listed shares across PNGX and ASX. This includes watching the volumes and prices for key PNGX listed securities on ASX.

BSP Financial Group (PNGX:BSP, ASX:BFL) has struggled to grow trading volumes on the ASX in recent months. August saw a modest improvement, with 133,309 shares traded during the month for a value of A$852,114. This is better than in recent months, however still a long way from the liquidity expected of a stock of this size and calibre:

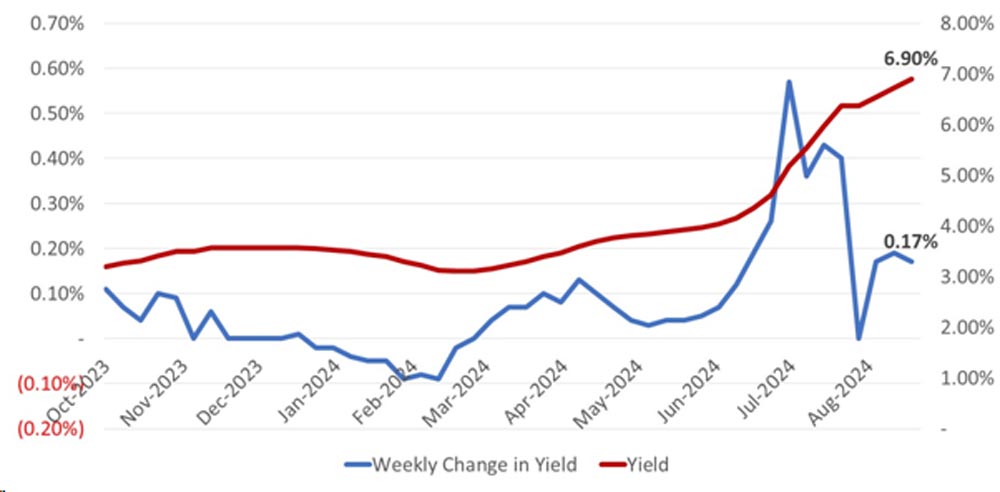

There were some interesting developments in the fixed interest markets, with yet another increase in the 364-day yields to 6.90% – 0.17% higher than the previous week.

Unlike in recent weeks, where bids received have been relatively modest, last week saw strong support for the auction (albeit at higher average yields), with a total of K444.09 million in bids received against an initial amount on offer of K256.0 million. K68.0 million in bids were accepted by BPNG at an average rate of 4.91% for 182-days which is a higher level of activity than usual in this maturity. This allowed BPNG to accept only K260.09 million in bids out of a total of K346.09 received in the 364-day category, thus presumably capping the weekly increase in the rate at 0.17%. Did BPNG intervene in the market to encourage local institutions to participate more actively?

Investors should continue to expect yields to rise as there remains considerable market imbalances.

In the fixed interest market, yields in the 364-day series saw another robust increase, with the weekly auction ending up at an average yield of 6.73% or 19bps above the previous auction.

We look forward to a continuation of the half-year reporting season in coming weeks, with CCP and CPL’s reports being eagerly anticipated.

What we have been reading

The Sausage Indicator: Everything You Need to Know

What does sausage tell us about the future prices of gold and silver, as well as what might happen with the stock market? Let’s take a closer look at what the Federal Reserve knows about sausage and what this means for the US economy. This important indicator should not be ignored.

A poll from the Dallas Federal Reserve released last week shows that one maker had ‘modest growth’ in their sausage product category. Increased demand for sausages may signal that U.S. households are trying to save more on food. Surprisingly, sausages are among other food products closely associated with economic downturns.

Americans swapping steak for sausage in their shopping carts could be a subtle hint that the economy is slowing down. The Dallas Fed’s Texas Manufacturing Outlook Survey, released Monday, reported one food manufacturer had ‘modest growth’ of its dinner sausage sales. The producer said that a rise in demand for sausages usually comes along when the economy starts to slow down, and consumers look for inexpensive proteins rather than expensive meats like beef or chicken.

‘Sausage tends to gain popularity when the economy slows, as it’s a cost-effective protein that can help stretch food budgets,’ the producer commented.

One thing that is happening post-COVID is that grocery prices increase due to high inflation. The new inflationary environment is eating into consumer finances—making value more of a priority for Americans. We saw that in recent earnings reports from big firms, such as McDonald’s and Amazon. On its July earnings call, McDonald’s executives noted that their lower-income customers are resisting eating out because of high prices, forcing the fast-food behemoth to promote its $5 value meal. Amazon joined in and said that bargain-hunting shoppers have affected its business.

Inflation fell dramatically in July to 2.9%, coming down from the early summer 2022 high, but it is still a worry. This was the first time inflation had been reported under 3% since March 2021. The Federal Reserve is still at 2% inflation and is tipped to have an interest rate cut this September, which may give a reprieve. Traders price in a 25-basis point reduction with a slightly smaller chance of a 50-basis point cut.

Robeco Launches New Climate Transition-Focused Equities Index Suite

International asset manager Robeco announced the launch of the Robeco Climate Equities Indices, and new index family aimed at providing investors with exposure to investments supporting global efforts to reduce carbon emissions and mitigate climate change, and catering to a broad range of climate investing stages.

According to Robeco, the new indices incorporate, to varying degress, the firm’s proprietary tools enabling forward-looking metrics into stocks contributing to a low-carbon economy and reducing carbon footprint, such as those with credible and ambitious emissions reduction targets, or companies providing transition-enabling solutions. Metrics incorporated into the indices include Robeco’s Climate Traffic Light, which assesses company alignment with the Paris Agreement, SGD Framework, which assesses company alignment with relevant SDGs, and Climate Beta, which measures company exposure to climate transition risk.

Lucian Peppelenbos, Climate Strategist at Robeco, said:

“We decided years ago to not only focus on carbon emissions data when looking at climate investing. We invested in resources to also evaluate other climate characteristics of companies such as their alignment with the Paris Agreement, whether companies provide solutions to lower the world’s future emissions and their level of climate transition risk. We have developed these metrics inhouse and integrate them into our investment solutions. It’s great that our climate IP is now being made available to an even larger group of investors.”

The index family is being launched with three new indices, targeting a diverse set of investor needs, including the Robeco Developed Low-Carbon Climate Leaders Tilt Equities Index, Robeco Developed Paris-Aligned Climate Leaders Tilt Equities Index, and Robeco Developed Climate Leaders Equities Index.

The Low Carbon Climate Leaders Tilt Index aims to reflect market returns, subject to carbon footprint 30% lower than the underlying universe, with a tilt towards stocks that contribute to the low-carbon economy transition, and away from stocks that are more susceptible to climate risk.

The Paris-Aligned Climate Leaders Tilt Index aims to reflect market returns, subject to meeting the requirements to EU Paris Aligned Benchmarks (PABs), with goals including a carbon footprint at least 50% below the underlying universe and at least 7% annual decarbonization. The index also avoids stocks that are misaligned with a path to net zero, tilts towards companies contributing to a low-carbon economy and away from stocks that are more susceptible to climate risk. According to Robeco, the index is targeted to investors looking to integrate more forward-looking climate metrics and more exposure to climate solutions providers.

The Climate Leaders Equities Index is aimed at investors seeking climate transition-related opportunities by investing in solutions providers for the low-carbon economy transition. The index aims to reflect market returns, subject to an overweight in stocks assessed as having a positive contribution to climate change mitigation and the transition to a low-carbon economy, and to stocks aligned with the goals of the Paris Agreement, and underweighting stocks considered more susceptible to climate risk.

Joop Huij, Head of Robeco Indices, said:

“We’re excited to launch this climate index family to offer investors a more nuanced approach to climate index investing, compared to carbon emissions’ focussed indices.”

Please feel free to reach out for your investment needs.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814