10 September, 2024

Welcome to this week’s JMP Report,

There were three main pieces of news during last week:

- BSP traded at an all-time high of K18.00. Although volumes were modest, there remains unrequited bidders at that price on the board. Furthermore, during the start of this week, confirmed bidders for larger volumes at K18.01 per share have entered the market;

- 364-day Treasury Bill yields climbed above 7.00% during last week’s auction, settling at a recent high of 7.02% weighted average; and

- Bidders have finally emerged for CPL with an open bid for 100,000 shares on the board.

Conditions on equity markets were very quiet, with only K110,844 worth of stocks trading. Active scrips included BSP, KSL, STO and CCP but none of these recorded trading values in excess of K50,000.

The new all-time high for BSP was noteworthy and market-watchers are keenly following to ascertain whether this represents a new level at which bidders must enter the market to have any hope of getting stock.

CCP defended its recent high of K2.50 per share which augurs well for its stock price as we get closer to its release of H1 2024 financial results. We expect an overall strong performance based on the significant increase in the value of CCP’s BSP shareholdings, however the trading conditions for its property and financial services businesses are less clear.

Following the January riots in Port Moresby, the financial position and performance of CPL has been shrouded in mystery and traders have struggled to price the stock. Offers have remained on the exchange at or near the last traded price of K0.79, with the lowest offers currently at K0.75. However, there have been no trades at all this year.

The good news is that PNGX has open bids for 100,000 CPL shares. The bad news is that the bidders are prepared to pay only K0.25 per share. Thus far, there has been no trade. However, it seem clear that the most (not so) recently traded price is unrealistic. CPL has informed the market that the total costs incurred during the January riots amounted to more than K21 million which is a very significant amount indeed.

We look forward to the market completing the price-discovery process for CPL and eagerly anticipate the company’s H1 2024 results presentation.

WEEKLY MARKET REPORT | 2 September August, 2024 – 6 September August, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 2,117 | 18.00 | 38,106 | 18.00 | – | 0.46 | 2.26% |

| KSL | 13,349 | 3.10 | 41,382 | 3.05 | 3.09 | 0.01 | 0.32% |

| STO | 758 | 19.95 | 14,743 | 18.00 | – | (006) | (0.31%) |

| NEM | – | 146.00 | – | 148.00 | – | – | – |

| KAM | – | 1.30 | – | 1.25 | – | – | – |

| NGP | – | 0.75 | – | – | 0.75 | – | – |

| CCP | 6,645 | 2.50 | 16,613 | 2.50 | – | – | – |

| CPL | – | 0.79 | – | 0.25 | 0.70 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

| TOTAL | 110,844 |

WEEKLY YIELD CHART | 2 September August, 2024 – 6 September August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIV | YIELDS 2024 FINAL DIV | YIELD % |

| BSP | 7,695,137,010 | K0.37 | K1.06 | K0.45 | 8.61% |

| KSL | 801,952,130 | K0.10 | K0.16 | K0.106 | 8.61% |

| STO | 62,617,990,772 | K0.31 | K0.66 | k0.506 | 6.00% |

| NEM | – | – | K3.99 | – | – |

| KAM | 50,661,584 | K0.12 | – | – | – |

| NGP | 31,664,583 | K0.03 | – | – | – |

| CCP | 693,895,850 | K0.11 | K0.13 | – | 9.60% |

| CPL | 162,959,549 | – | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | – | 1.98% |

| TOTAL | 73,143,087,799 |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

NEM has been exluded from Market-wide yield calcs.

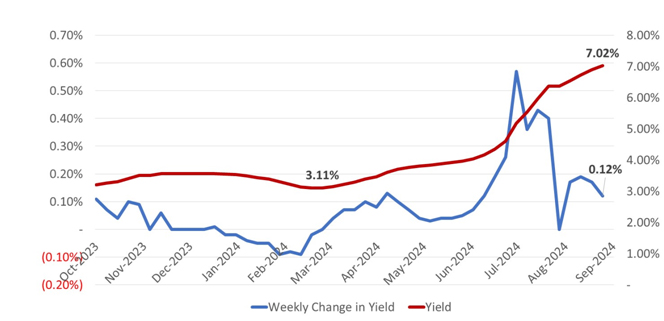

Fixed interest markets continued the trend of weekly increases in the yields. The 364-day series issued during the week was priced at an average yield of 7.02%, 0.12% higher than the week before. Rates have now increased by a whopping 3.91% from the YTD low of 3.11% on 6 March 2024.

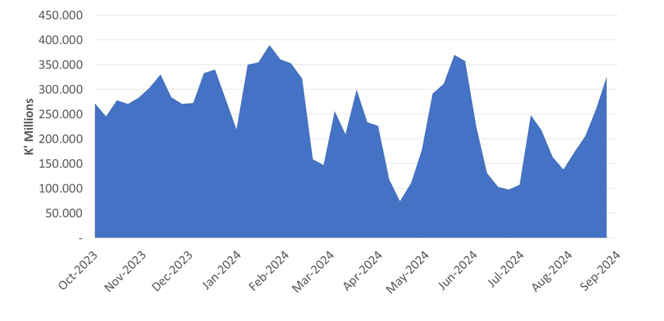

For a second week running, the auction was well supported by the market, with successful bids of K325.41 million in the 364-day category and total collections by BPNG of K358.7 million. This was K84 million more than BPNG had originally asked for.

The result is another spike in the 364-day volumes which falls into the pattern of peaks and troughs experienced in recent months.

There is still no sign of a successful GIS auction so the market is none-the-wiser in terms of the shape of the longer term yield curve.

All eyes will be on politics this week, with a much anticipated Vote of No Confidence (VONC) scheduled in Parliament for Thursday, 12 September 2024. How this will impact on capital markets will be dependent upon the final outcomes and the plans for recovery harboured by the differing political camps.

What we have been reading

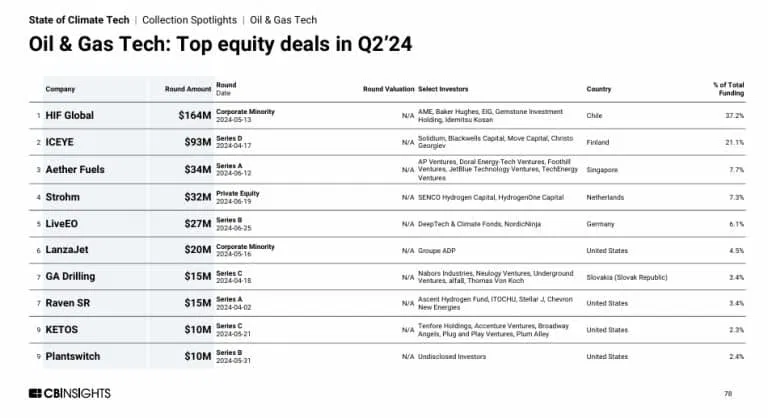

Oil and Gas Sector Sizzles: Top 5 Equity Deals of Q2 2024

By Saptakee S | Carbon Credits September 8, 2024

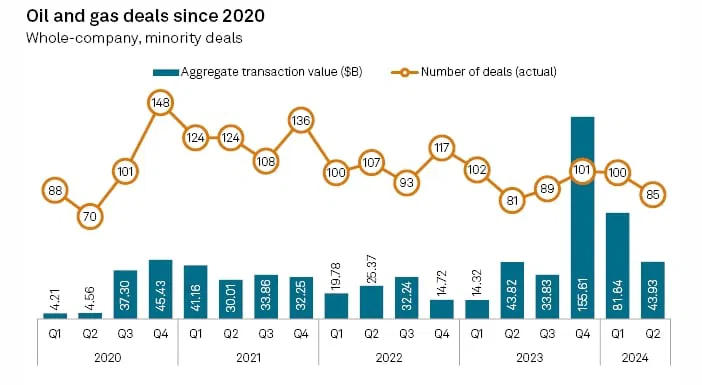

The oil and gas sector are buzzing with activity as equity deals gain momentum. This is because this year has witnessed a good volume of investments, underscoring a vibrant market keen to drive energy innovation and navigate the shifting trends. From major acquisitions to key partnerships, these deals are influencing the future direction of the energy industry.

Deal Activity Sees Slight Uptick with Focus on Sustainability

According to S&P Global, in the recent quarter, the oil and gas industry recorded 85 whole-company and minority-stake deals, totaling $43.93 billion. This represents a modest increase from the same period in 2023, which saw 81 deals valued at $43.82 billion.

Oil and Gas Deal S&P Globalsource: S&P Global

The growing deal activity highlights a trend toward integrating environmental sustainability into the industry’s investment strategies.

1. HIF Global Secures $164 Million Investment for eFuels Projects

Highly Innovative Fuels (HIF) Global, the electrofuel giant secured a $164 million investment this May to fund its eFuels projects from its existing shareholders and a new partner, Japanese energy company Idemitsu Kosan. Total funding goes to $424 million.

Cesar Norton, President & CEO of HIF Global, expressed enthusiasm about the partnership, stating,

“We are excited to welcome Idemitsu as a new partner in our mission to power the world with renewable energy. This collaboration goes beyond financial support; it symbolizes our shared commitment to a greener future. We’re grateful to our shareholders for their continued support as we develop eFuels facilities globally that could recycle 25 million metric tons of CO2, equivalent to the emissions of over 5 million cars.”

Susumu Nibuya, Executive Vice President, and COO of Idemitsu Kosan mentioned that Idemitsu is concentrating on e-methanol, blue ammonia, and sustainable aviation fuel (SAF) to achieve carbon neutrality by 2050.

This investment marks the first step in a broader four-part collaboration, which includes financial backing, eFuels purchase agreements, market development in Japan, and establishing CO2 supply chains.

2. ICEYE Secures $136M in Series D Funding Round

ICEYE Ltd. is a Finnish company and a spin-off from Aalto University’s Radio Technology Department makes microsatellites. Precisely it is a leader in synthetic aperture radar (SAR) satellite technology. This April, it secured $93M in growth funding to expand its SAR satellite constellation and product offerings.

This oversubscribed round builds on the company’s February 2022 Series D, bringing total funding to $438M. ICEYE experienced strong growth in 2023, ending the year with over $100M in revenue. The new funding will drive the next phase of expansion, focusing on:

Increasing demand for its Missions business, with growing interest from governments for defense and civil applications using next-gen SAR satellites.

Expanding SAR data services to offer innovative products for tracking Earth’s changes, day, or night, in any weather.

Accelerating growth in its Solutions offerings, with significant investment in Flood Insights, Wildfire Insights, and future peril-based analysis for government and commercial use.

CEO Rafal Modrzewski emphasized the support from new investor Solidium, highlighting trust in ICEYE’s mission to lead the global SAR market. The company’s achievements and clear targets intensified investors’ faith. Notably, the deal was facilitated by Citigroup.

3. Aether Fuels Raises $34M to Revolutionize Sustainable Aviation and Shipping

Aether Fuels, a leader in climate technology, secured $34 million in Series A funding from a global group of investors. AP Ventures led the round, joined by Chevron Technology Ventures, CDP Venture Capital, and Zeon Ventures. Previous investors, including Xora Innovation, TechEnergy Ventures, Doral Energy-Tech Ventures, Foothill Ventures, and JetBlue Ventures, also participated.

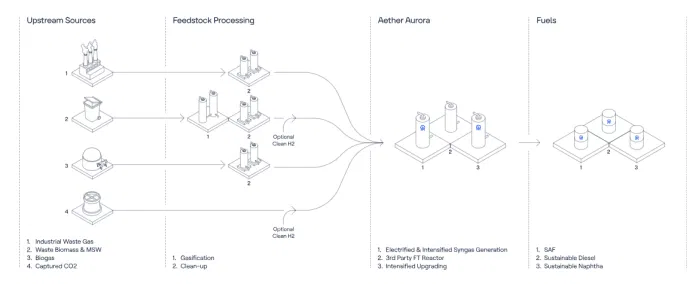

With this funding, Aether aims to speed up the development of Aether Aurora, its advanced technology for producing sustainable aviation and shipping fuels.

The press release further highlighted that Aether Aurora with its partner GTI Energy will use Fischer-Tropsch’s advanced process to boost fuel production and make it cost effective. This flexible technology can turn different types of waste carbon into jet fuel and other liquid fuels, solving supply issues that other sustainable aviation fuel methods face.

Aether Aurora’s unique ability to create sustainable fuels from any feedstock:

Aether oil and gas

source: Aether

Significantly, Aether will also use the new funding to expand its R&D and plant capacity in the U.S. and Southeast Asia for SAF and other liquid fuels in partnership with strategic allies.

4. SENCO Invests in Strohm with $32M Equity Surge in Thermoplastic Pipeline Innovation

This year, on June 19, SENCO Hydrogen Capital, a private equity firm known for its focus on hydrogen and energy transition investments, announced a significant $32 million (€20 million) equity investment in Strohm, a Dutch company renowned for its innovative pipeline technology, which they call it Thermoplastic Composite Pipelines (TCPS).

The funding aims to boost Strohm’s growth, particularly in hydrogen and carbon capture utilization and storage (CCUS). This partnership is also focused on reducing the carbon footprint of pipeline infrastructure, aiming for a more sustainable energy future.

Martin van Onna, CEO of Strohm says,

“Strohm is a pioneer in the development of TCP and has set itself the goal of significantly reducing CO2 emissions in the pipeline infrastructure sector. “The partnership with SENCO enables us to further scale our technologies and continue our successful expansion, especially in the field of energy transformation around hydrogen and CCUS”

This deal is part of a broader €30 million capital increase in Strohm, with existing shareholders like Chevron Technology Ventures, Shell Ventures, and Evonik Venture Capital also participating. Together, these companies are advancing innovative technologies that support low-carbon energy solutions.

5. LiveEO Raises $27 Million to Revolutionize Climate Risk Management

This June, LiveEO, a leader in transforming satellite data into actionable insights, has raised $27 million (€25 million) in a Series B funding round led by NordicNinja and DeepTech & Climate Fonds (DTCF). This investment will accelerate the development of LiveEO’s AI-driven solutions and expand its team.

NordicNinja is the largest Japanese-backed VC in Europe, and it is focused on deep tech, climate tech, and digital society solutions. DTCF is financed by the German Future Fund.

LiveEO turns raw satellite data into insights that help businesses manage climate risks and improve resilience. The platform is trusted by major companies like Deutsche Bahn and Network Rail to monitor and protect assets. The new funding will further enhance LiveEO’s mission to make industries more sustainable while addressing climate challenges.

Daniel Seidel, co-founder, and co-CEO of LiveEO, elaborated on the company’s mission to leverage satellite data for planetary protection and industrial sustainability. He noted that the new funding will accelerate this mission, helping businesses worldwide navigate climate, environmental, technological, and regulatory challenges.

MUST READ: The Top 4 Venture Capital Climate Companies: How Are They Shaping the Green Future?

However, CB Insights had a complete list of companies that secured good investments and contributed to a fruitful quarter this year.

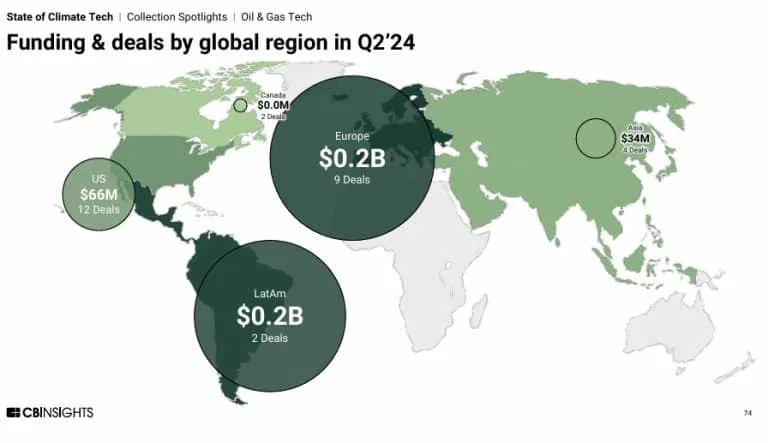

Global Funding & Deals: Regional Insights

As we can see from the image Europe dominating the space in Q2 2024, with 9 massive deals totaling to $0.2 billion followed by Latin America.

Oil and Gas Deal

The strategic investments made this year clearly outlines a bright future for the oil and gas industry. As sustainability gains traction across various industries, the significant advancements in natural energy resources and technology will undoubtedly reduce carbon emissions and create a greener world.

Bad Jobs Report, Stocks Hammered, Gold & Silver Down

At the end of last week, gold sank while the price of silver plummeted by a whopping 3% against USD. This was after the latest in a series of reports that showed a cooling in the U.S. labour markets amidst a slow economy. All three major U.S. stock indices declined by at least 1% on Friday, the Nasdaq slumped more than 2% on the day and posted its largest weekly percentage decline since January 2022. This followed a mixed U.S. monthly jobs report that kept the U.S. interest rate outlook unclear.

Nasdaq price drop after jobs report release

The U.S. Bureau of Labor Statistics reported Friday that 142,000 new jobs were added last month. Although this may be a positive compared to 114,000 in July, it was a letdown from the expected 161,000.

While the U.S. unemployment rate fell from 4.3% to 4.2% a month earlier, the report is the latest to show the labour market is cooling more than expected under the weight of interest rates currently at 23-year highs. The Federal Reserve’s policy committee will meet later this month, with at least a 25-basis rate cut certain, though pressure may build to cut by 50 basis points. The CME Fedwatch tool currently shows a 55% probability of a 25-basis point cut and a 45% chance for a 50-basis point drop. This makes it a coin toss at this point.

Since March 2020, this month is the first time that the Fed will be cutting short-term interest rates. The speculation around cuts has continued for years and plagued the trading and investment environment. Now we are on the cusp of cuts, which have basically been locked in for this month. Historically, this has been the single most powerful catalyst for gold and silver

Bank of America analysts have just announced that they see a barrage of 25-basis point cuts at the next five consecutive FOMC meetings. This would be potentially more interesting than debating 50 versus 25, as this would be a rapid pathway down to highly inflationary levels.

Please feel free to reach out for your investment needs.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814