17 September, 2024

Welcome to this week’s JMP Report,

We trust you have all returned safe and well from a long weekend of celebrating the independence of our glorious nation!

A couple of noteworthy items from the week gone by:

- New intra-day all-time high for BSP during the week of K18.02. The stock closed the week at K18.01 and there is fairly deep bid support at this price. We expect the BSP share price to continue to strengthen in coming weeks;

- NGP (NGIP Agmark Limited) produced a cracker of a set of financials for the six months to 30 June 2024. Revenue was up 142% to K188.6 million compared to the previous corresponding period, driven mainly by the significant increase in global cocoa prices. Profit After Tax was up 367% to K8.8 million for the half year period. The dividend was increased from K0.03 to K0.04 per share;

- CCP also recorded very strong headline numbers, with half-year statutory NPAT up 147% to K183.6 million. Core Profitability was up a more muted 5.1% to K67.8 million. The dividend was increased to K0.12 per share from K0.11 in the previous corresponding period;

- CPL unexpectedly had a tougher time of it, with the Net Loss Before Tax for the six months ending 30 June 2024 coming in at K13.8 million. In an announcement released to the market on 17 September 2024, the shock of the January riots hit the company hard but there is hope that the business is gradually rebuilding. CPL declared no dividends; and

- The Marape-Rosso government survived the long-awaited VONC during last week. Let’s see if this results in politics receding from the centre of public and business discourse for a couple of months?

The last week or so has been a busy one for news flow with both NGP and CCP reporting last week and CPL early this week.

From a trading volume perspective, activity was actually dominated by KSL which reported the previous week. Investors must have approved of the KSL results for the period ending 30 June 2024 as bidders lined up strongly.

903,802 KSL shares changed hands during the week, representing more than 95% of the total value of trading for the week. The stock closed at K3.15, up 1.61%.

In addition to KSL, BSP, KAM and NGP also so some modest trades during the week.

Following CPL’s reporting of its 30 June 2024 half-year results earlier on 17 September 2024, all of the companies on the PNGX have now reported for this period. Overall, the results for the first half of the year must be described as satisfactory, with NGP the standout performer and CPL the unsurprising battler.

WEEKLY MARKET REPORT | 9 September August, 2024 – 13 September August, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 1,344 | 18.01 | 24,205 |

18.01 | – | 0.01 | 0.05% |

| KSL | 903,802 | 3.15 | 2,846,976 | 3.15 | – | 0.05 | 1.61% |

| STO | – | 19.45 | – | 19.45 | – | – | – |

| NEM | – | 146.00 | – | 148.00 | – | – | – |

| KAM | 1,522 | 1.31 | 1,994 | 1.30 | – | 0.01 | 0.77% |

| NGP | 23,,600 | 0.75 | 17,700 | – | 0.75 | – | – |

| CCP | – | 2.50 | – | 2.60 | – | – | – |

| CPL | – | 0.79 | – | 0.25 | 0.70 | – | – |

| SST | – | 48.00 | – | 48.00 | 50.00 | – | – |

| TOTAL | 2,890,875 |

WEEKLY YIELD CHART | 9 September August, 2024 – 13 September August, 2024

| STOCK | MARKET CAPITALISATION | 2023 INTERIM DIV | YIELDS 2023 FINAL DIV | YIELDS 2024 FINAL DIV | YIELD % |

| BSP | 7,773,612,695 | K0.37 | K1.06 | K0.45 | 8.38% |

| KSL | 814,863,559 | K0.10 | K0.16 | K0.106 | 8.44% |

| STO | 62,617,990,772 | K0.31 | K0.66 | k0.506 | 6.00% |

| NEM | – | – | K3.99 | – | – |

| KAM | 51,051,678 | K0.12 | – | – | – |

| NGP | 31,664,583 | K0.03 | – | K0.04 | 5.33% |

| CCP | 693,895,850 | K0.11 | K0.13 | K0.12 | 10.00% |

| CPL | 162,959,549 | K0.05 | – | – | – |

| SST | 1,088,826,321 | K0.35 | K0.60 | K0.40 | 2.08% |

| TOTAL | 73,194,865,007 |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

NEM has been exluded from Market-wide yield calcs.

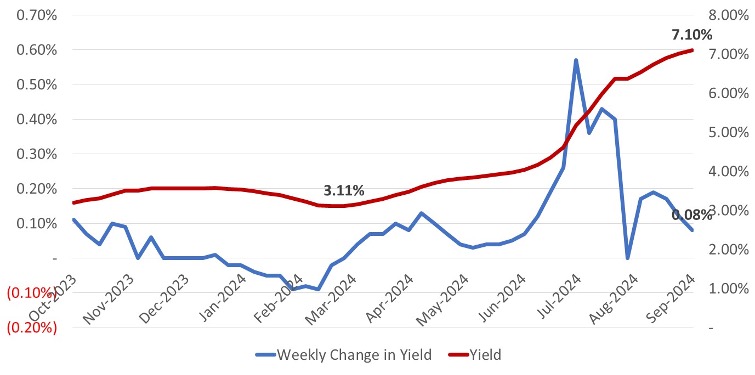

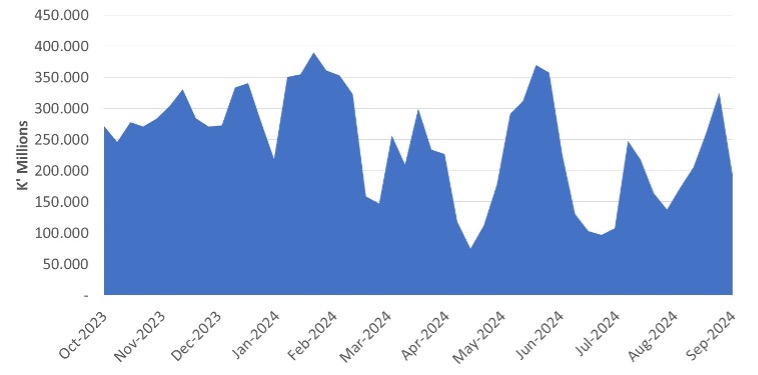

In fixed interest markets, GoPNG through BNG raised K205.4 million, a full K70 million less than the amounts on offer. Yield for the 364-day paper was up another 0.08% for the week and ended at a weighted average of 7.10%. It will be interesting to watch whether the return to a significant shortfall in bids this week is a sign of a return to faster increases in the yields or whether institutional support for the BPNG auctions can be renewed in the coming weeks. The financing needs of GoPNG until the end of this fiscal year are believed to be significant so it will be important to watch the next couple of weeks’ acutions.

We expect there to be a psychological hurdle at around 7.20% which, if breached, may result in a leap in rates.

The auction results for the week are indicative that the recent increases in volumes may have peaked again:

There is still no sign of a successful GIS auction so the market is none-the-wiser in terms of the shape of the longer term yield curve.

What we have been reading

$65 Billion Green Fund from Carbon Credits Sale? Says Indonesia’s President-elect Prabowo Subianto

By Saptakee S | Carbon Credits September 16, 2024

Indonesia is preparing for a green revolution as President-elect Prabowo Subianto plans to launch a groundbreaking green economy fund. The fund aims to raise $65 billion by 2028 through carbon emission credits sales from large-scale environmental projects.

Prabowo intends to manage the fund via a “special mission vehicle,” which will oversee all sustainable activities in the country, including forest preservation, reforestation, and other green initiatives. This ambitious plan marks a significant step in Indonesia’s efforts to combat climate change and promote sustainability.

Unlocking the Special Mission Vehicle to Manage the Green Fund

Prabowo has pledged to raise Indonesia’s economic growth from 5% to 8% during his five-year term, focusing strongly on investments in green projects. According to Ferry Latuhihin, one of Prabowo’s climate policy advisers, this fund will play a key role in helping Indonesia meet its emissions targets under the Paris Agreement.

Latuhihin explains that a newly established regulator will oversee Indonesia’s carbon emission rules and form a “special mission vehicle” to manage the green fund. This entity will handle various carbon offsetting projects, including forest preservation, reforestation, and the replanting of peatlands and mangroves. These initiatives are designed to generate carbon credits that can be sold both locally and internationally.

Latuhihin remarked in an interview with Reuters,

“By pooling funds through this vehicle, Indonesia hopes to finance large-scale green projects without tapping into the government’s budget.”

The government has set an ambitious goal to expand the special mission vehicle to $65 billion (1,000 trillion rupiah) by 2028. While it will start with seed capital, the fund is expected to grow primarily from the sale of carbon credits. Once the fund becomes profitable, it will pay dividends back to the government.

Latuhihin also emphasized that they will adhere to international verification standards and use technology to accurately measure how much CO2 each project removes from the atmosphere.

Challenges in Carbon Credit Pricing and Sales

While the plan is bold, raising such a large sum from carbon credits will not be easy. Christina Ng, Managing Director of the Energy Shift Institute, an independent nonprofit think tank focused on Asia’s energy transition, pointed out that nature-based carbon credits typically trade between $5 and $50 per metric ton of CO2 equivalent. She noted that last year the average price was below $10 per ton.

Considering the maximum price of $50 per ton, Indonesia would need to sell 200 MTS of carbon credits annually to reach the $10 billion mark. This is still short of the $65 billion target over the next four years.

Ng further explained that at the lower price point of $10 per ton, the same amount of carbon credits would only raise $2 billion annually, making the goal even more daunting. The global voluntary market peaked at 239 MTS of carbon credits in 2021, highlighting the magnitude of Indonesia’s challenge.

Another important factor is Indonesia’s past government issues, which haven’t always been conducive to such efforts. However, if the country offers nature-based credits, the entity will need to prove its premium quality.

Leveraging Indonesia’s Nature-Based Solutions for Carbon Credits

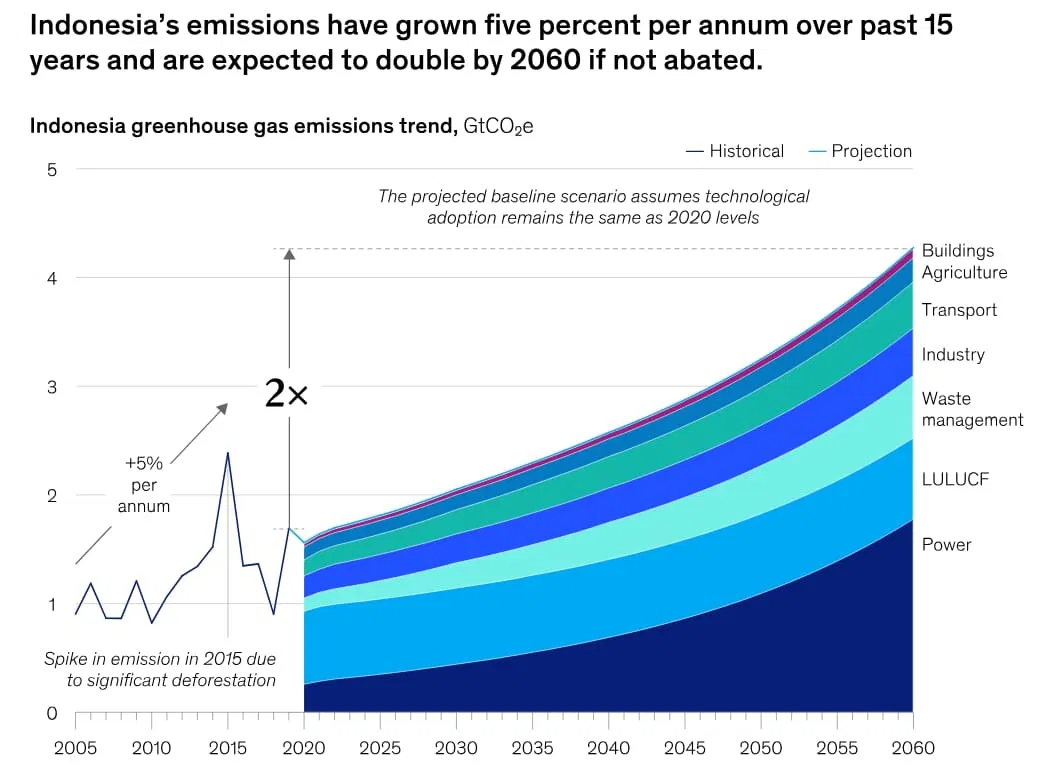

Despite these challenges, the potential is enormous. Indonesia is one of the world’s top 10 carbon emitters and is home to the planet’s third-largest tropical rainforest. The vast tropical rainforests and peatlands offer a unique advantage in the global carbon credit market, providing ample opportunities for large-scale carbon offset projects. Latuhihin emphasized that these offset projects will reduce emissions and create significant job opportunities, supporting Prabowo’s broader economic growth plans.

Notably, Indonesia hosts the world’s largest carbon offset project, the Rimba Raya Conservation. This REDD+ project developer recently won a legal victory in Indonesia, allowing it to resume operations in Borneo.

In July, the U.S., Indonesia, and four NGOs signed the debt-for-nature swap and Coral Reef Conservation Agreement. Under the deal, the U.S. will reduce Indonesia’s debt payments by $35 million over nine years. In return, Indonesia would use these funds to create a conservation fund supporting coral reef protection and restoration. Local NGOs will manage projects that benefit both the reefs and local communities.

The McKinsey Report

McKinsey has significantly reported on how high-quality carbon credits are becoming essential for organizations, especially in high-emitting sectors like aviation, cement, steel, and oil and gas. Nature-based solutions (NBS) such as reforestation, mangrove restoration, and peatland recovery offer effective ways to sequester carbon and generate carbon credits. Emerging markets, like Indonesia, with vast natural resources, provide cost-effective opportunities with environmental and social benefits.

* Having the spotlight on Indonesia, they explained that the country holds one of the world’s largest NBS potentials, translating to over 1.5 GtCO2 in carbon credits.

With corporations increasingly committed to reducing emissions, the demand for Indonesian carbon credits is expected to grow tenfold by 2030. These credits not only support climate action but also boost local economies, improve biodiversity, and enhance soil and water quality.

Source: McKinsey and Company

Global Push to Achieve Carbon Neutrality

Reuters noted that the soon-to-be government plans roadshows and partnerships with major global banks to boost international carbon credit sales. They will target markets where carbon credits command higher prices to enhance their chances of meeting financial goals.

Despite reduced deforestation, Indonesia still faces challenges with forest fires, often caused by farmers clearing land. As the green fund advances, credible and verifiable carbon offset projects will be crucial for attracting international buyers.

By adhering to international standards and using advanced technology to measure carbon dioxide removal, Indonesia seeks to position itself as a global leader in the carbon credit market and achieve net carbon neutrality by 2060.

Disclaimer: Report compiled from Reuters

Robeco Launches High Income Green Bond Strategy

By Mark Segal | ESG September 16, 2024

International asset manager Robeco announced the launch of the High Income Green Bonds strategy, investing in high yielding green bonds by corporate issuers globally.

According to Robeco, the new strategy, categorized as Article 9 under the EU SFDR regulation, was launched in response to growing investor interest in the broad variety of green bonds, fixed income instruments issued by corporates and governments with proceeds earmarked for environmental projects, including supporting transitioning companies in their decarbonization efforts.

Green bond issuance volume exceeded $560 billion in 2023, according to Moody’s, growing over the prior year as issuers from across sectors used the instruments to finance climate transition plans, and invest in capital intensive projects to meet decarbonization commitments, and amidst growing policy support improving the cost competitiveness of climate technologies such as green hydrogen, biofuels, battery storage and carbon capture, utilization and storage (CCUS).

Joop Kohler, Head of Credits for Robeco, said:

“With the growing interest in transition investing, our High Income Green Bonds strategy meets the dual objective of sourcing attractive income for our clients, whilst providing a core tool for investors to achieve their impact goals.”

The new strategy will be managed with a benchmark-agnostic, global approach across all credit sectors within green bond investments, with all corporate bonds required to pass the steps outlined in Robeco’s five-step green bond framework to be eligible for investment.

Criteria assessed under Robeco’s framework include the alignment of issuers’ green bond framework with green bond market standards, the allocation of proceeds to make a positive contribution to the environmental objectives defined by the EU Taxonomy, at least annual impact reporting on the use of proceeds by the issuer, the environmental strategy of the issuer, and adherence to international norms related to social and governance issues.

Kohler added:

“Robeco’s High Income Green Bonds strategy is our first strategy focusing purely on green bonds from corporate issuers. It successfully combines the depth of our sustainability expertise with the long-standing track record and capabilities of our credit team.”

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814