8 October, 2024

Welcome to this week’s JMP Report,

Solid volumes traded during the week ending 4 October 2024, with aggregate value of trades increasing to K3.48 million:

WEEKLY MARKET REPORT | 30 September August, 2024 – 4 October August, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 153,607 | 18.15 | 2,787,967 |

18.12 | – | 0.07 | 0.39% |

| KSL | 99,929 | 3.15 | 314,776 | 3.10 | 3.20 | 0.05 | 1.61% |

| STO | 10 | 19.45 | 195 | 19.45 | – | – | – |

| NEM | – | 150.00 | – | 147.00 | – | – | – |

| KAM | – | 1.40 | – | 1.30 | 1.90 | – | – |

| NGP | – | 0.75 | – | – | 0.80 | – | – |

| CCP | 146,337 | 2.60 | 380,476 | 2.51 | – | 0.09 | 3.59% |

| CPL | – | 0.69 | – | – | 0.69 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| TOTAL | 3,483,414 |

WEEKLY YIELD CHART | 30 September August, 2024 – 4 October August, 2024

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 8,480,043,619 | K0.370 | K1.060 | K0.450 | 8.32% |

| KSL | 287,432,858 | 905,413,503 | K0.100 | K0.160 | K0.106 | 8.44% |

| STO | 3,247,772,961 | 63,169,184,091 | K0.310 | K0.660 | k0.506 | 5.99% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 70,971,580 | K0.120 | – | K0.200 | 14.29% |

| NGP | 45,890,700 | 34,418,025 | K0.030 | – | K0.040 | 5.33% |

| CCP | 307,931,332 | 800,621,463 | K0.110 | K0.130 | K0.120 | 9.62% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.00% |

| TOTAL | 75,078,604,029 | 6.24% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

NEM has been exluded from Market-wide yield calcs.

Key takeaways:

- Good volumes of BSP traded during the week, with 153,607 shares and aggregate value of K2.79 million for the week. New all-time high closing price at K18.15.

- CCP traded up again, closing at K2.60 with reasonable volumes at 146,337 shares and K380,476 in aggregate value.

- KSL reclaimed K3.15 per share as the market moved 99,929 shares during the week.

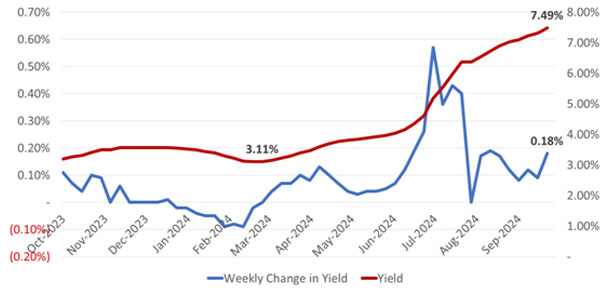

- Treasury Bill interest rates increased another 0.18% for the week, reaching a high of 7.49% in the 364-day series. Rates look set to continue higher as BPNG has still not found solid support and we suspect the demand for credit will remain high for the balance of the year:

Total issuance across all series for the week was K293.8 million, just about what was sought but we suspect at a higher yield than BPNG was hoping for.

- BPNG has announced that they will be holding another GIS auction this week. It will be interesting to see whether the Central Bank is able to fill in the gaps in the current long term yield curve.

We view the curve at present as a combination of some reality, some mystery and some fantasy, following the GIS auction of a couple of weeks ago.

The early years in the curve are probably a reasonable assessment of where the market is at, except we note that Treasury Bill rates keep climbing and, as this continues, it is likely to be reflected across the curve.

The middle of the curve remains a mystery, with no bids having been received. We strongly suspect though, that the yields in this range will exceed the earlier years and that the curve will remain upwards trending throughout its duration.

The final part of the yield curve is probably a complete fantasy, with 8-year paper having been issued (in small values) at basically the same interest rate as the 3-year paper.

We look forward to continuing auction activity gradually informing the market as to the appropriate shape of the GoPNG debt yield curve in the coming weeks and months.

- KAM Investor Note. (Download PDF)

What we have been reading

Perth Mint Gold Sales at 10-Month High

Ainslie Bullion | 04/10/2024

Why are so many people suddenly buying physical gold? Perth Mint’s silver sales also reached a 7-month high. Let’s look at a few key developments and why gold has been moving sideways this week.

Gold temporarily fell in price by 0.9% Monday but has recovered most of its losses after a week of ranging. The short selloff was likely partially caused by investors waiting for key U.S. economic data to be released. The dollar also reached its strongest level in a month, which made gold temporarily less expensive.

One topic currently stealing the spotlight is the possibility of Israel striking Iran’s oil facilities. This could halt an estimated 1.5 million barrels per day of oil being produced and cause the price of oil to spike. Speculators often flock to place risky leveraged trades on the back of oil shortages, and this has the potential to be a major one. What this means for gold is that it may be serving as a distraction this week from gold trading. At the same time, any serious attack could reignite gold buying as a safe haven.

Investors will get a host of key pointers on the economy over the next few weeks that could offer some signs about future economic trends. Incoming ISM services data and initial jobless claims are approaching, and the U.S. non-farm payroll report is due tonight. These may have a bearing on expectations of future rate cuts by the Fed also.

Recent data on Wednesday showed U.S. private payrolls rose more than expected in September. This is another data point going against the Fed’s recent aggressive cut, but it does support the theory that they have successfully pulled off a soft landing. Although crashes often happen after rate-cutting cycles begin, this is not always the case, and definitely not what most people want to see happen. The probability of a 50-basis-point rate cut at the Fed’s November meeting dipped to 36% from 49% last week, according to the CME FedWatch Tool. Unless the upcoming data is exceedingly poor, one might expect Jerome Powell to follow through with a series of smaller, consistent cuts.

The Perth Mint announced this week that its gold product sales in September were the highest in 10 months, while those of silver jumped to a seven-month high. This is potentially from the large escalations in the Middle East mentioned above, which are compounded with a clear path of increasing global liquidity, which we discuss in our latest macro and global liquidity analysis. What is interesting is that buyers have been specifically accumulating physical gold and silver, rather than digital contracts representing the price of the two metals.

HSBC, IFC Launch SDG-Focused Emerging Markets Sustainable Corporate Bond Fund

Mark Segal | ESG Today | 07/10/2024

HSBC Asset Management and World Bank Group member the International Finance Corporation (IFC) announced an agreement to launch a new fund targeting SDG-aligned corporate bond issuers in emerging markets.

According to HSBC and IFC, the new fund aims to enhance sustainability in the emerging markets corporate bond space by investing in key areas such as sustainable technologies, social impact, and a just transition. As part of the agreement, IFC will support HSBC’s Global Emerging Markets Corporate Sustainable Bond strategy with a proposed $100 million investment in the fund.

The agreement marks a continued collaboration between HSBC and IFC, following the previous joint launch of the HSBC Real Economy Green Investment Opportunity GEM Bond Fund (REGIO), which reached investor commitments of nearly $540 million at final close in 2022.

Nicolas Moreau, CEO of HSBC Asset Management, said:

“We are pleased to expand our partnership with IFC, which dates back to 2019 following the launch of HSBC Real Economy Green Investment Opportunity GEM Bond Fund (REGIO)2, as we reinforce our contribution to improved sustainability in emerging markets and help support our clients’ sustainable investment objectives. We hope this collaboration demonstrates the financial market opportunity in funding sustainability to help bridge the financing gap for EM corporate issuers whose activities are aligned with and positively contribute to the UN’s Sustainable Development Goals.”

The announcement comes as significant investment is needed to advance and accelerate emerging markets’ transition to a sustainable future, according to HSBC and IFC, with the new fund supporting the HSBC Global Emerging Markets Corporate Sustainable Bond strategy, which seeks to make ESG change and measurable impact by investing in emerging markets corporate that contribute to the UN SDGs, as well as help bridge the financing gap for emerging markets corporate issuers.

The new fund will be categorized as Article 9 under the Sustainable Finance Disclosure Regulation (SFDR), HSBC and IFC added.

Mohamed Gouled, Vice President of Industries, IFC, said:

“By aligning with SFDR Article 9, which places a strong emphasis on issuer-level sustainability and transparency beyond just an issuance’s use-of-proceeds, the HSBC corporate bond strategy will support the growth of sustainable businesses and accelerate their green transition. IFC’s investment is expected to mobilize additional institutional investors and increase the pool of capital dedicated to sustainability-related transactions in emerging markets.”

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630