15 October, 2024

Welcome to this week’s JMP Report,

Rather subdued volumes on PNGX last week with total value of trades confined to K452,377:

WEEKLY MARKET REPORT | 7 October, 2024 – 11 October, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 1,250 | 18.20 | 22,750 |

18.16 | – | 0.05 | 0.28% |

| KSL | 117,025 | 3.15 | 368,629 | 3.10 | 3.15 | – | – |

| STO | – | 19.45 | – | – | – | – | – |

| NEM | – | 150.00 | – | – | – | – | – |

| KAM | – | 1.40 | – | – | – | – | – |

| NGP | – | 0.75 | – | – | – | – | – |

| CCP | 22,730 | 2.60 | 59,095 | 2.60 | – | – | – |

| CPL | – | 0.69 | – | – | – | – | – |

| SST | 38 | 50.00 | 1,900 | – | 50.00 | – | – |

| TOTAL | 452,377 |

WEEKLY YIELD CHART | 7 October, 2024 – 11 October, 2024

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 8,503,403,618 | K0.370 | K1.060 | K0.450 | 8.30% |

| KSL | 287,949,279 | 907,040,229 | K0.100 | K0.160 | K0.106 | 8.44% |

| STO | 3,247,772,961 | 63,169,184,091 | K0.310 | K0.660 | k0.506 | 5.99% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 70,971,580 | K0.120 | – | K0.200 | 14.29% |

| NGP | 45,890,700 | 34,418,025 | K0.030 | – | K0.040 | 5.33% |

| CCP | 307,931,332 | 800,621,463 | K0.110 | K0.130 | K0.120 | 9.62% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.00% |

| TOTAL | 75,178,381,615 | 6.24% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

Key takeaways:

- BSP up another K0.05 during the week to K18.20 but with only 1,250 shares changing hands.

- CCP consolidating at K2.60 with modest volumes at 22,730 shares and total value of trades at K59,098.

- KSL held onto K3.15 closing price during the week with 117,025 shares traded for total value of K368,629.

During the week, KSL announced that a total of 516,421 in new shares had been issued to shareholders under the Dividend Reinvestment Plan. This would have resulted in around K1.6 million in additional share capital to the company.

- 364-day Treasury Bills continued their inexorable rise during the week, with weighted average successful bids during the auction ending up at 7.62% – up another 0.13%:

Total issuance across all series for the week was K211.44 million, a shortfall of more than K80 million and almost K70 million less than weekly maturities.

We are back in a period of persistent shortfalls in the amounts bid compared with offers:

- BPNG held a modest GIS auction during the week, looking for a total of K180 million across long-dated series.

- Total successful bids amounted to only around K85 million but (assuming we accept these very small volumes as resulting in price discovery) we can now see the shape of a rather strange looking yield curve:

- Our house view is that the curve is likely to incline much more steeply in coming weeks as there is greater volume brought onto the market and the series buyers enter the fray.

- We also expect the short end of the curve to continue its upward movement which will necessarily drive longer term rates.

- It is likely that increases in the real rates have been driving the recent upward trends, not more temporary shits in inflationary expectations.

- This will necessarily drive prices and yields throughout the entire curve as pricing becomes more efficient.

What we have been reading

S&P Global Launches Climate Center of Excellence Focused on Climate, Environmental, and Nature Research

Mark Segal | October 11, 2024

Market data and solutions provider S&P Global announced the launch of its new S&P Global Climate Center of Excellence, aimed at advancing the company’s research and methodology development in areas including climate, environmental, and nature.

Sitting within S&P’s sustainability-focused unit, S&P Global Sustainable1, the new center will include scientists and strategists, and will collaborate across the company’s divisions “to ensure that S&P Global climate and sustainability solutions are grounded in best-in-class science, data, and methodologies,” S&P Global said, and helping to provide actionable insights to investors, banks, companies, and sustainability solution providers. S&P Global’s divisions include S&P Global Market Intelligence, S&P Global Ratings, S&P Global Commodity Insights, S&P Global Mobility, and S&P Dow Jones Indices.

Thomas Yagel, Chief Operating and Product Officer for S&P Global Sustainable1, said:

“We are exceptionally proud of the world-class scientists advancing S&P Global’s work on long-term climate, environmental, and nature research and methodology development. Developing the most innovative climate risk data solutions requires collaboration across the industry and we are excited to partner with leading experts in the academic and scientific community to help ensure our climate and sustainability solutions are grounded in best-in-class science.”

According to S&P Global, in addition to partnering across the company, the mission of the new center includes tackling complex methodological challenges in climate and environmental science to support long-term innovation, supporting the next generation of science-driven thought leadership to provide intelligence to the market, building external academic partnerships to inform cutting-edge research and innovation, and creating learning opportunities for the company’s employees to elevate science-based thinking on climate and sustainability issues.

Key research focus areas for the new center include physical climate hazards, Earth systems tipping points, nonlinear climate impacts, probabilistic risk modeling, coupled climate and macroeconomic modeling, supply chain exposure, Scope 3 emissions, and financial impact quantification.

Dr. Terence Thompson, Chief Science Officer, S&P Global Climate Center of Excellence, said:

“To push the frontiers in climate research, S&P Global scientists are diving into some of the most complex data and modelling challenges in the physical and economic sciences. We are bridging multi-disciplinary gaps and perspectives to enable advancements in our science-driven methodologies providing actionable information on climate-related risks and opportunities.”

BloombergNEF Reveals Mining Needs $2.1 Trillion by 2050 to Fuel Net-Zero Raw Material Demand. Where Does Silver Stand?

Saptakee S | Carbon Credits 11 October, 2024

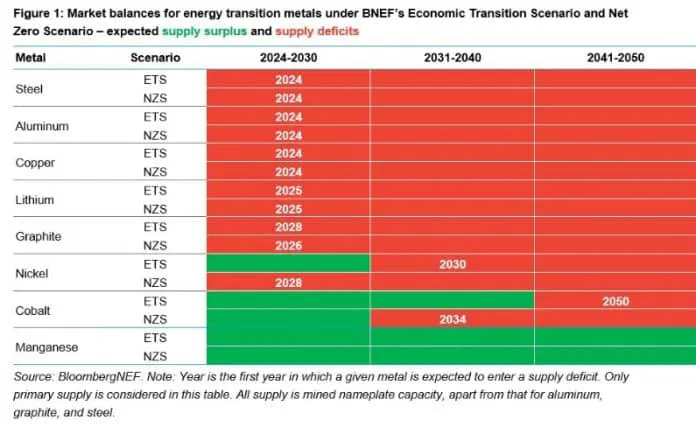

The mining industry faces a critical supply shortage of key metals, despite growth in supply over the past decade. According to BloombergNEF’s Transition Metals Outlook, the world needs $2.1 trillion in new mining investments by 2050 to meet the demand for clean energy technologies. It further illustrates that essential metals like aluminum, copper, and lithium could face deficits as early as this year, which might make EVs, wind turbines, and other low-carbon technologies more expensive.

Kwasi Ampofo, head of metals and mining at BNEF and lead author of the report said,

“The prolonged deficit of these metals will lead to higher prices for raw materials, which increases the cost of clean energy technologies. High costs could slow their adoption, and the energy transition at large”

Interestingly, BloombergNEF’s Economic Transition Scenario (ETS) highlights, that between 2024 and 2050, the world will need about 3 billion metric tons of metals to drive the global energy transition. It further estimates that achieving net zero emissions by 2050 could push that demand to 6 billion metric tons. This means this can spike metal prices and slow the progress of green technologies.

Recycling Metals, A Viable Solution for Supply and Emissions

However, BNEF says recycling metals can ease supply pressures. Sooner, recycled materials will play a crucial role in the supply chain, which will also reduce overall emissions from production.

According to Allan Ray Restauro, a metals and mining associate at BNEF,

“Good government policies are crucial to the industry’s success. For batteries and stationary storage, governments need to establish collection networks, set the requirements for recovery rates, develop the frameworks to trace individual cells and provide the principles on second-life battery management. These actions can build a robust system that oversees the full lifecycle of battery metals.”

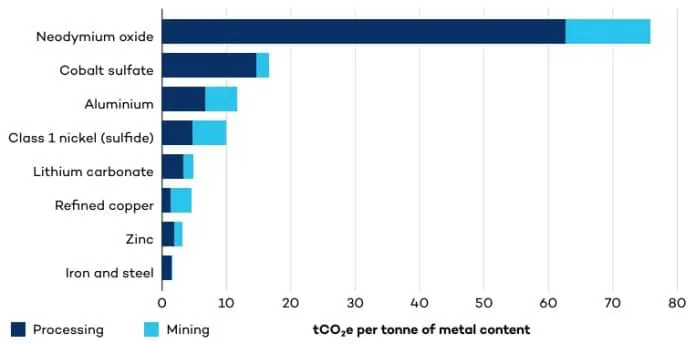

Decarbonizing Mining for a Low-Carbon Future

As the world moves toward a low-emissions economy, resource-rich countries face a tough challenge: reducing emissions while developing their mining sectors. This is because the mining industry is significant for supplying minerals needed for clean energy technologies. Sadly, mining still contributes to global emissions, especially in coal extraction.

Minerals used in selected clean energy technologies

Source: IEA, 2022, p. 6. CC BY 4.0

Countries like Chile are showing progress by using renewable energy in mining operations, but many developing nations struggle to balance growth, sustainability, and emissions goals. In this regard, governments must adopt policies that decarbonize mining while ensuring economic growth and meeting Paris Agreement targets. Countries that implement strong climate policies along with robust financing are the ones to succeed in their global commitments.

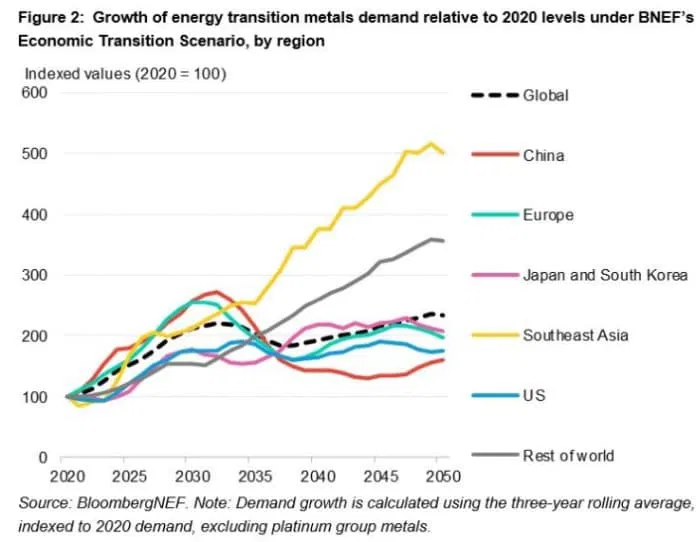

Southeast Asia Set to Lead in Metal Demand Growth

Certainly, the demand for energy transition metals will vary by region. The research indicated that Southeast Asia is poised to become the fastest-growing market for these materials in the 2030s. The region’s vast mining industry could benefit from this demand surge, helping to accelerate industrialization while contributing to global emissions reductions. Conversely, China’s consumption outpaced the global average between 2020 and 2023. The country’s consumption of transition metals is expected to peak by 2030.

In summary, a $2.1 trillion investment in mining is crucial to meet the global push for clean energy. As metal supplies tighten and prices rise, recycling and supportive policies will be essential to keeping the energy transition on track.

Silver Surges as Coeur Mining Acquires SilverCrest

Coeur Mining is making a strategic move to strengthen silver in the industry. In a $1.7 billion all-share deal, Coeur is set to acquire Canadian silver producer SilverCrest, adding the high-grade, low-cost Las Chispas mine in Mexico to its portfolio.

With this acquisition, Coeur has all the potential to become a major global silver producer, aiming to produce 21 million ounces of silver and 432,000 ounces of gold annually. The Las Chispas mine, which began production in late 2022, has over 10.25 million silver equivalent ounces produced in its first full year of operations. Coeur’s CEO Mitchell J. Krebs highlighted the mine’s strong operational performance and low cash costs of $7.73 per ounce.

The press release reported, that in this partnership Coeur will have a 63% share, and SilverCrest will hold 37%. The acquisition price of $11.34 per share offers an 18% premium to SilverCrest’s recent trading levels. Both companies’ boards have endorsed the deal, which is expected to close in Q1 2025 as regulatory and shareholder approval is pending.

Rising Silver Demand and Market Consolidation

According to the United States Geological Survey (USGS), Mexico led global silver production in 2022, producing an estimated 6,300 metric tons of silver. This output far surpassed China, the second-largest producer, with 3,600 metric tons.

While Mexico dominates in production, Peru holds the largest silver reserves globally, with 98,000 metric tons. Australia follows closely, with reserves totaling 92,000 metric tons. Peru’s stable silver output is supported by its vast reserves and advanced mining infrastructure.

In 2023, silver prices jumped nearly 35% due to heightened demand for solar energy and electronics. This surge has triggered significant mergers in the silver mining sector, including Coeur Mining’s $1.7 billion acquisition of SilverCrest and First Majestic’s $970 million purchase of Gatos Silver. Despite these moves, the market grapples with supply shortages, intensifying the race for reserves. On a positive note, Coeur’s acquisition should be a ray of hope for the global silver industry.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630