12 November, 2024

Welcome to this week’s JMP Report,

Total value of trading amounted to K2,194,879 for the week, with trades recorded in BSP, KSL and CCP:

WEEKLY MARKET REPORT | 4 November, 2024 – 8 November, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 25,740 | 19.05 | 490,347 |

19.05 | 20.00 | – | – |

| KSL | 542,545 | 3.14 | 1,703,591 | 3.14 | 3.15 | (0.01) | (0.32)% |

| STO | – | 19.65 | – | 19.60 | – | – | – |

| NEM | – | 150.00 | – | 169.00 | – | – | – |

| KAM | – | 1.75 | – | 1.40 | 1.75 | – | – |

| NGP | – | 1.00 | – | – | 1.00 | – | – |

| CCP | 359 | 2.62 | 941 | 2.62 | – | – | – |

| CPL | – | 0.69 | – | – | 0.69 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| TOTAL | 2,194,879 |

(0.00%) |

Key takeaways:

- BSP has found its groove at K19.05 for now but do not get surprised if it resumes its upward momentum in coming weeks. Volume traded for the week was 25,740 shares valued at K490,347.

Demand is still strong and supply remains constrained. We also suspect there are large pockets of latent demand out in the market waiting for an indication that greater volumes are available. - KSL, likewise, has stabilized around the K3.14-3.15 mark with reasonable weekly volumes hitting the market in the last few weeks. This market remains dominated by the importation of stock from the ASX as there is a profound shortage of PNG-based sellers. However, with the PGK and A$ spread between the KSL price on PNGX compared with ASX narrowing a fair bit (currently down to around 13% – from 20% previously), it is not certain that the imported volumes will continue to flow.

Total number of KSL shares changing hands during the week was 542,545 valued at K1,703,591. - CCP saw a small trade at K2.62 for the week. Demand for CCP is strong but there is a real shortage of sellers at this stage.

WEEKLY MARKET REPORT | 4 November, 2024 – 8 November, 2024

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 8,900,540,600 | K0.370 | K1.060 | K0.450 | 7.93% |

| KSL | 287,949,279 | 904,160,736 | K0.100 | K0.160 | K0.106 | 8.47% |

| STO | 3,247,772,961 | 63,818,738,684 | K0.310 | K0.660 | k0.506 | 5.93% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 88,714,476 | K0.120 | – | K0.200 | 11.43% |

| NGP | 45,890,700 | 45,890,700 | K0.030 | – | K0.040 | 4.00% |

| CCP | 307,931,332 | 806,780,090 | K0.110 | K0.130 | K0.120 | 9.54% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.00% |

| TOTAL | 76,257,568,894 | 6.15% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

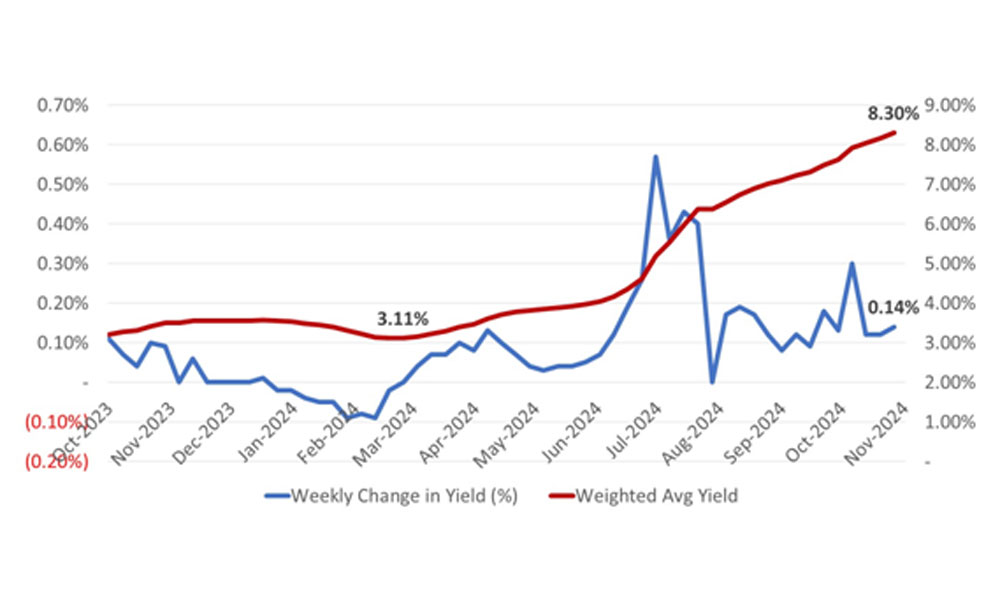

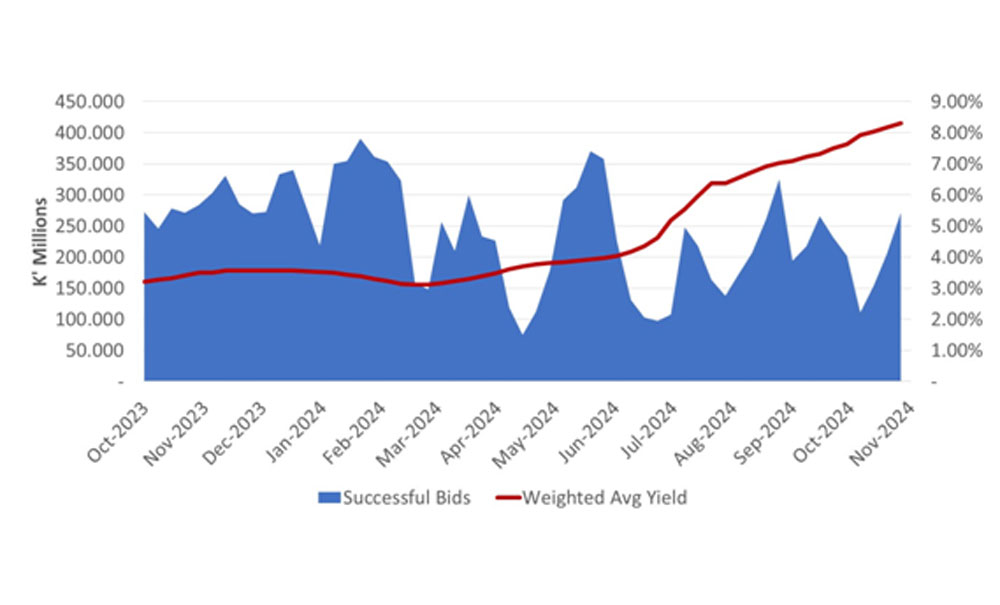

- In fixed interest markets, the 364-day yields rose another 0.14% to 8.30%, taking the increase to an aggregate of 5.19% since March 2024:

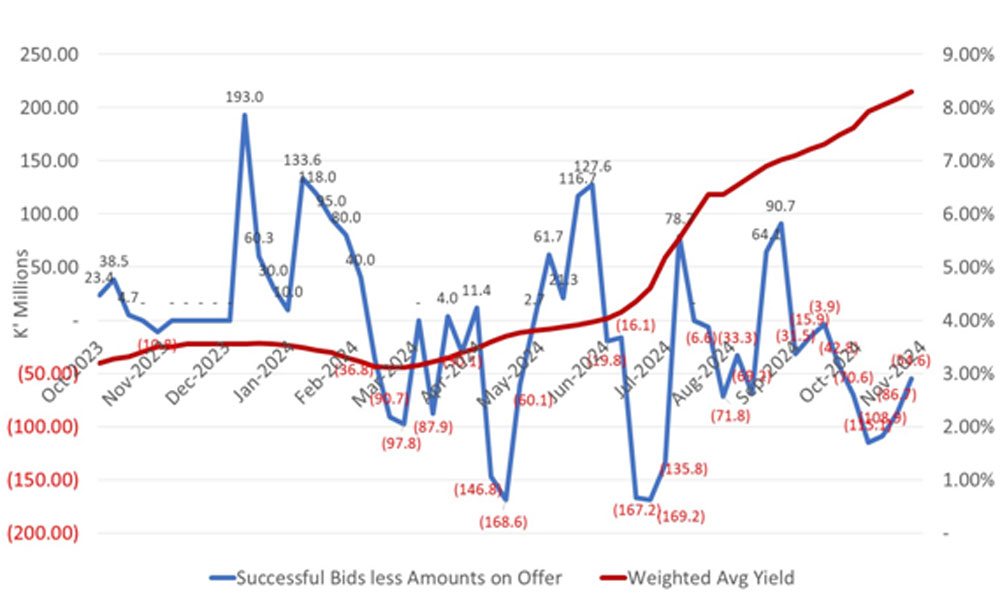

- The auction shortfalls continued, with the 364-day series undersubscribed by K54.6 million and BPNG left K53 million in bids on the table – presumably because they would have pushed the weighted average yield higher than was considered acceptable.

- Every single 364-day auction since 11 September 2024 has been undersubscribed which is an indication that market liquidity constrained and interest rate expectations have been rising higher than BPNG’s willingness to accept.

What we have been reading

Donald Trump elected President of the US (again). Implications for investors and Australia

Dr Shane Oliver – Head of Investment Strategy and Economics and Chief Economist, AMP Investments | November 8, 2024

Key points

– The return of Donald Trump to the US presidency brings the prospect of more US tax cuts and deregulation, but also more tariff hikes and trade wars and policy uncertainty.

– His win was not the surprise it was in 2016, and markets have moved to adjust – but it means higher US bond yields, a higher $US & a knee jerk rise in shares. Shares could be threatened though by the higher bond yields and tariffs.

– Australia is vulnerable to an intensification of trade wars.

– While the US election is important, investors should bear in mind that many other things influence investment markets.

Introduction

Contrary to what would normally be suggested by the solid US economy, low unemployment, falling inflation and strong share market, Donald Trump has been re-elected President of the US. Clearly some combination of the cost-of-living surge, the immigration blow out and too much ‘wokeness’ along with various other things weighed against Kamala Harris. Counting is continuing but Trump looks to have secured at least 270 of the 538 electoral college votes and won the popular vote. The Republicans are also on track to regain control of the Senate &, although its close, look like retaining the House, resulting in a Red Sweep. Trump’s victory portends a ramping up of trade wars and increased economic policy uncertainty with the high risk of weakening of US institutions, democracy & global alliances.

Trump’s key policies

Taxation: Trump would make the 2017 personal tax cuts (which took the top marginal tax rate to 37%) permanent (as they expire next year) and cut the corporate tax rate to 20% with 15% for domestic profits.

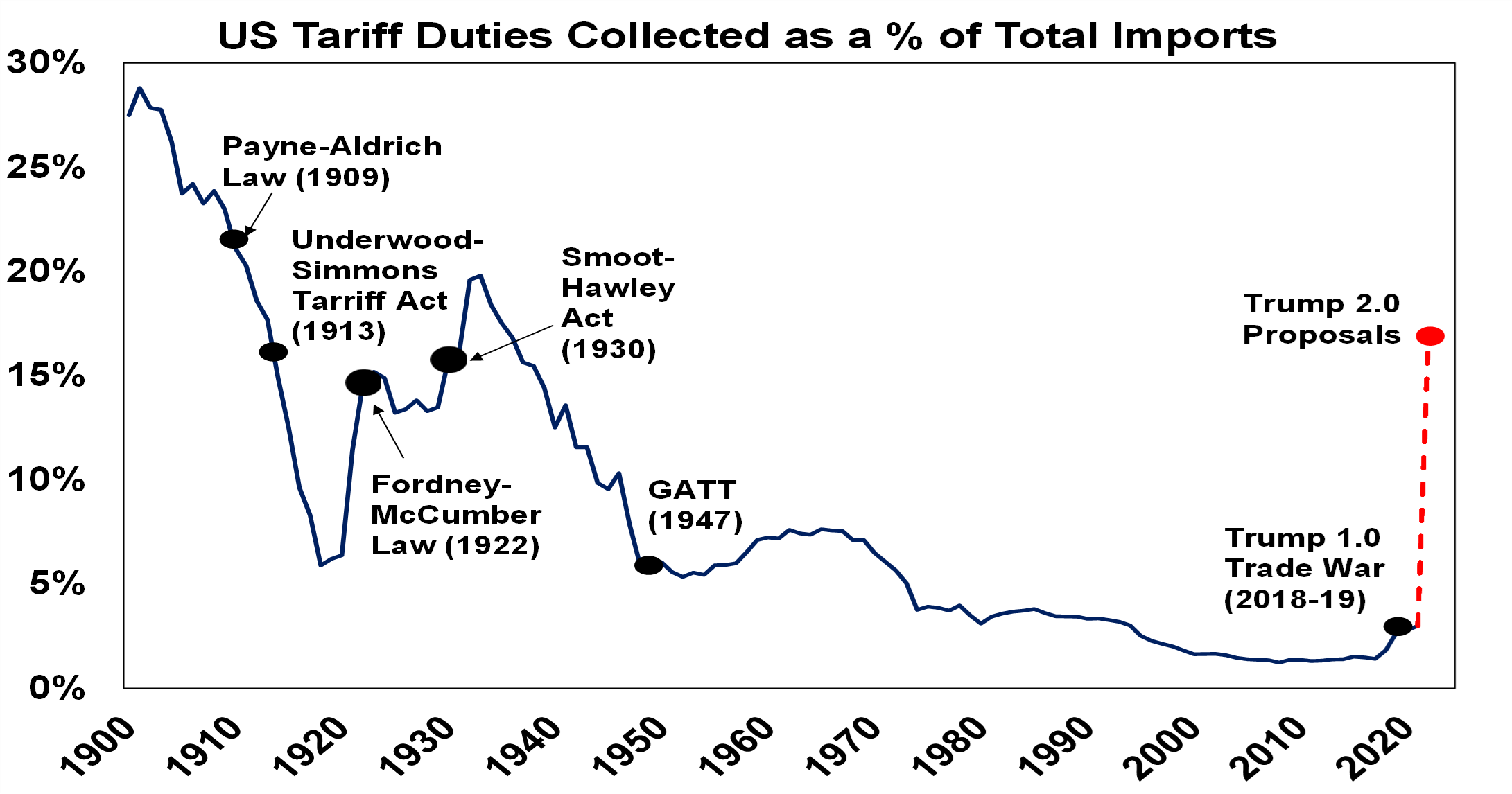

Trade: Trump is threatening a big ramp up in protectionism with a 10-20% tariff on all goods imports and a 50-60% tariff on goods from China. This would take the average US tariff rate on imports from around 2.5% to at least around 17%, a level last seen in the 1930s, and it was a disaster then!

Source: US ITC, Evercore ISI, AMP. Trump 2.0 assumes 10% general tariff and 50% on China.

Source: US ITC, Evercore ISI, AMP. Trump 2.0 assumes 10% general tariff and 50% on China.

Immigration: Trump will aggressively curtail immigration and is threatening mass deportation of between 15-20 million undocumented people.

Fed independence: Trump would seek to replace Jerome Powell, and his supporters are looking at ways to roll back the Fed’s independence.

Climate policy: Trump will likely reverse the US’ net zero commitments and support fossil fuels (“drill baby drill”). Subsidies for green manufacturing are likely to be replaced with wider support for domestic manufacturing (such as a 15% corporate tax rate on domestic profits and tariffs).

Regulation: Trump is likely to slash energy and financial regulation.

Budget deficit: The deficit – already huge at 6.5% of GDP – would likely get bigger under Trump by around 2-3 percentage points of GDP.

Key implications, risks and uncertainties

First, there will be less checks and balances this time around – Trump’s second term as President arguably faces less constraints than seen in his first term as: there are less anti-Trump Republicans in Congress; there is likely to be less “adults in the room” amongst his staff and advisers this time around; and being unable to run for a third term he lacks the political constraints of his first term. Working partly the other way though he is still likely to regard the share market as a barometer of his success and would prefer to see it go up. So this may provide a partial constraint on him.

Second, expect another ramp up in trade wars and further deglobalisation – in practice Trump is likely to target countries with a trade surplus with the US (notably China, Europe and Japan) and rewrite of the trade deal with Canada and Mexico. The tariffs may not get as high as he has been talking about and it may be part of a “maximum pressure” campaign to bring production, including by Chinese manufacturers, back to the US. The latter may be the case, but we could go through a lot of disruption as Trump initially ramps up the pressure resulting in a much bigger impact on share markets than seen in 2018 (where Trump’s trade wars contributed to an almost 20% fall in shares). This time around the proposed tariffs are much bigger (first chart) & he only backed away in 2019 out of a desire to get re-elected which is not an issue this time around. In any case Trump has long been a protectionist suggesting his tariff threats may be an end in themselves. And tariff hikes this time around will likely be made worse as impacted countries hike tariffs on US imports in retaliation (with reports Europe is planning to hit back quickly). The net impact will be a further reversal in global trade and globalisation.

Third, expect increased policy uncertainty – this was a key feature of his first term and flows from Trump’s own erratic approach to policy making. Back to watching the US President’s social media posts!

Fourth, the US is likely to become more polarised, including around how to deal with economic challenges – this was a feature of Trump’s first term and arguably continued under Biden (albeit more mildly). Trump is likely to treat his win as a vindication of his policies and may double down. This could make it harder for the US to reach compromises to solve economic challenges and lead to increased social unrest threatening US democracy.

Fifth, increased geopolitical uncertainty – Trump’s re-election may further weaken global institutions and cooperation, resulting in a further deterioration in multilateral cooperation and increased geopolitical uncertainty. For example, his policy to negotiate an end to the war in Ukraine (which could be a short term positive globally) would almost certainly involve Ukraine ceding territory to Russia which could embolden Russia particularly if Trump weakens or withdraws from NATO.

Finally, the sequencing of policies may have a big impact on investment markets – if he focusses initially on tax cuts and deregulation then US (and hence global) shares could rally further in response as we saw in 2017. But if he goes early and hard on tariffs then any near-term rally in shares could be brief. His inability to have a third term suggests a high risk of the latter.

Specific economic impact of Trump’s victory

While a Harris victory would have meant a continuation of Biden’s policies, Trump is far from the status quo. Put simply Trump’s policies taken together are ambiguous for US growth, negative for global growth and would likely add to inflation.

His policies on tax cuts and deregulation could help boost the supply side of the US economy via increased investment in the US resulting in a boost to productivity. However, on balance Trump’s policies – with higher tariffs resulting in higher import prices and less competition (which is bad for productivity), deportation and lower immigration resulting in lower labour force growth (which will lower potential economic growth) and potential moves to weaken the Fed’s credibility – risk adding to inflation and being negative for US growth. His trade policies with a likely global trade war would be negative for global growth.

There is also a risk that an even higher US budget deficit when US public debt is already very high (at 125% of GDP), will cause a market backlash resulting in much higher bond yields.

As noted in the previous section, much will depend on sequencing. If he runs with tax cuts and deregulation first (as in 2017) it could boost shares and the economy in say 2025, but if he runs first with sharp tariff hikes and immigration cuts it could be taken more negatively early on.

Likely investment market implications

Put simply Trump’s policies point to:

- upwards pressure on US bond yields – via a bigger budget deficit and higher inflation and less rate cuts from the Fed;

- upwards pressure on the value of the $US – via higher tariffs, higher than otherwise Fed interest rates and increased global uncertainty;

- upwards pressure on Bitcoin and other cryptos as Trump is seen as more favourable towards crypto;

- ambiguity for the US share market with tax cuts and deregulation being positive (driving a short term boost), but trade wars and higher bond yields being negative (on a cyclical view);

- US shares outperforming global shares reflecting the tariffs and increased global uncertainty;

- upwards pressure on US financial and energy shares (less regulation) relative to clean energy shares (as climate measures are reversed);

- upwards pressure on US small caps relative to large caps including tech stocks (as small caps will benefit most from the lower corporate tax rate on domestic profits and large caps are vulnerable to a trade war).

Some of these moves had already started prior to the election – with bond yields, the $US and Bitcoin all up over the last month – as a Trump victory started to be anticipated and they have gathered pace in the immediate aftermath (with Bitcoin at a record high). It’s likely that they have further to go in the short term but note that this win for Trump is very different to 2016 where his win surprised markets resulting in big market moves. At the time of Trump’s victory in 2016 shares were relatively undervalued and soared 38% into January 2018 as the focus in his first year was on business-friendly tax cuts and deregulation but they fell in 2018 as the focus shifted to trade wars. This time around shares are already expensive so the upside may be more limited. That said shares may still see further post-election gains on relief that it’s out of the way and hope that he focusses more on tax cuts and deregulation, but this could be reversed if he starts focussing on tariffs and as higher bond yields are bad news for shares.

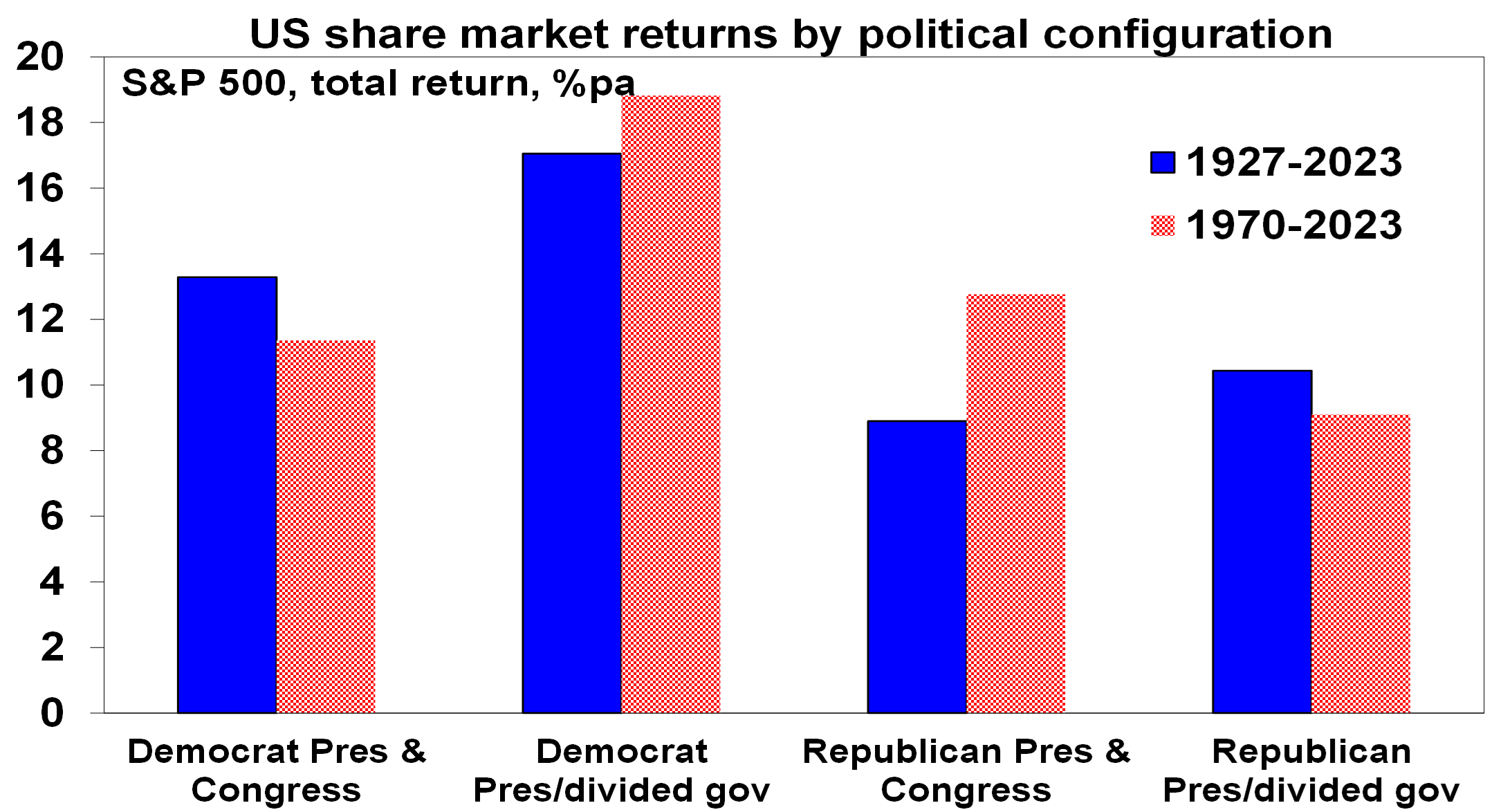

Historically US shares have done best under Democrat presidents with an average return of 14.4% pa since 1927 compared to an average return under Republican presidents of 10% pa. Fortunately, the Republican sweep scenario has been the second-best outcome for shares since 1970. If the Republican’s lose control of the House though, Trump will struggle to cut taxes, and this could see less upwards pressure on bond yields but be bad for shares as Trump could still do the tariff hikes.

Source: Bloomberg, AMP

Source: Bloomberg, AMP

Australia is vulnerable to a new Trump trade war

Polls show that only around 30% of Australians would have voted for Trump so many here will be disappointed. And from an economic point of view, Australians have some reason to be concerned. Exports to the US are only 4% of Australia’s total exports and may be spared from Trump’s tariffs as Australia has a trade deficit with the US. However, as an open economy with high trade exposure to China, Australia is vulnerable to an intensification of global trade wars under Trump, particularly if it weighs on demand for Chinese exports. An OECD study showed that Australia could suffer a 1.2% reduction in GDP as a result of a 10% reduction in global trade between major countries. Resources shares would be most at risk and the $A would likely fall (and we have already seen a bit of that). Of course, similar fears existed during the last Trump trade war, and it didn’t turn out so bad (although the $A fell 10% in 2018 with US tariff hikes and Fed rate hikes). And there would still be demand for iron ore somewhere – it just may switch from China to elsewhere. Much will depend on how other countries respond and how hard Trump goes.

There is also the risk that if Trump’s policies boost US inflation there could be a global flow on, including to Australia, resulting in higher than otherwise RBA interest rates. This is a risk, but I suspect it would be offset by the growth dampening impact of an intensified global trade war.

From a policy point of view, if Trump cuts the US corporate tax rate to 15% on domestic profits it could renew pressure on Australia to cut its corporate tax rate. Trump’s reversal of US climate policies will again add to confusion and may increase pressure for Australia to slow its net zero commitment.

Concluding comment

Finally, it’s worth noting that while the US Presidential election is important, many other things impact investment markets and investors should aim to remain focused on adhering to their financial objectives, ensuring that their portfolios are well diversified across asset classes and geographies and are continuing to take a long-term view. For now, we continue to see central banks cutting interest rates as inflation falls and this will help share markets.

SEC Fines Invesco $17.5 Million for Misleading ESG Investing Claims

ESG Today|Mark Segal Posted 11/11/2024

The U.S. Securities and Exchange Commission (SEC) announced that it has charged global asset manager Invesco for making misleading claims regarding its ESG-related investments, including overstating the proportion of assets under management that integrated ESG considerations.

Invesco has agreed to pay a $17.5 million civil penalty to settle the SEC’s charges, while not admitting or denying the Commission’s allegations.

According to the SEC’s order, while Invesco claimed in its marketing materials from 2020 to 2022 that between 70% – 94% of its parent company’s assets under management were “ESG integrated,” these amounts included a significant proportion of assets held in passive ETFs, that did not consider ESG factors in investment decisions.

The SEC added that despite making its ESG integration claims, “Invesco lacked any written policy defining ESG integration.”

The case marks the latest ESG investment-related action for the SEC, following the Commission’s announcement last month that it had charged ETF provider WisdomTree after finding that funds marketed by the firm as incorporating ESG factors failed to comply with their own criteria, by investing in companies involved in fossil fuel and tobacco activities. WisdomTree paid $4 million to settle the charges.

Sanjay Wadhwa, Acting Director of the SEC’s Division of Enforcement, said:

“As stated in the order, Invesco saw commercial value in claiming that a high percentage of company-wide assets were ESG integrated. But saying it doesn’t make it so. Companies should be straightforward with their clients and investors rather than seeking to capitalize on investing trends and buzzwords.”

In a statement provided to ESG Today, Invesco said:

“We are pleased to resolve this matter related to historical statements made about the percentage of firmwide assets under management that were ESG-integrated. The SEC Order makes no allegations or findings related to disclosures about specific funds or investment strategies. Invesco has not issued public reports of firmwide ESG integration levels since late 2022. Invesco Advisers, Inc. cooperated fully with the investigation and will continue to take a client-led approach of offering investment strategies tailored to the specific investment objectives of its clients.”

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630