3 December, 2024

Welcome to this week’s JMP Report,

A quiet week on the PNGX last week, with only K615,745 worth of shares changing hands in the open market:

WEEKLY MARKET REPORT | 25 November, 2024 – 29 November, 2024

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 10,224 | 19.67 | 201,106 |

19.66 | – | 0.02 | 0.77% |

| KSL | 92,509 | 3.20 | 296,029 | 3.14 | – | (0.05) | (1.54%) |

| STO | 629 | 19.65 | 12,360 | 19.60 | – | 0.05 | 0.26% |

| NEM | 27 | 150.00 | 4,050 | 147.00 | – | (19.00) | (11.24%) |

| KAM | – | 1.75 | – | 1.40 | 1.75 | – | – |

| NGP | – | 1.00 | – | – | 1.00 | – | – |

| CCP | 37,000 | 2.70 | 99,900 | – | – | 0.08 | 3.05% |

| CPL | – | 0.69 | – | – | 0.69 | – | – |

| SST | 46 | 50.00 | 2,300 | – | 50.00 | – | – |

| TOTAL | 615,745 |

0.24% |

Key takeaways:

- BSP added a further K0.02 to finish the week at a new record high of K19.67. Volumes were a modest 10,224 shares valued at a total of K201,106.

- KSL traded down K0.05 to close at K3.20 with total volumes at 92,509 shares.

- CCP increased to K2.70 pm 37,00 shares – an increase of K0.08 pr 3.05%.

- A small parcel of NEM changed hands at K150.00 during the week, as did 46 SST shares at K50.00 and 629 STO shares at K19.65.

- The big news for all of the banking stocks was the 2025 National Budget including a somewhat unexpected reduction in the Corporate Income Tax Rate for commercial banks.

- We are returning to a two-tiered banking tax structure for the next 10 years or so:

The Corporate Income Tax (CIT) rate of commercial banks operating in Papua New Guinea will be progressively reduced over the next 10-years to 35% from the current 45%.

Tier 1 = the first K300 million of Taxable Income for a commercial bank

Tier 2 = Taxable income above K300 million.

Tier 1:

For 2025, the first K300 million of taxable income will be taxed at a rate of 40%.

For 2026 and future fiscal years, the first K300 million of taxable income will be taxed at a rate of 35%.

Tier 2:

In 2025, taxable income of a commercial bank in excess of K300 million will be taxed at a rate of 44%.

The tax rates applicable to amounts above that level will then drop by 1% per annum from 43% in 2026, through to 35% in 2034.

- JMP Securities estimates that the impact of these changes are significantly positive for both BSP and KSL.

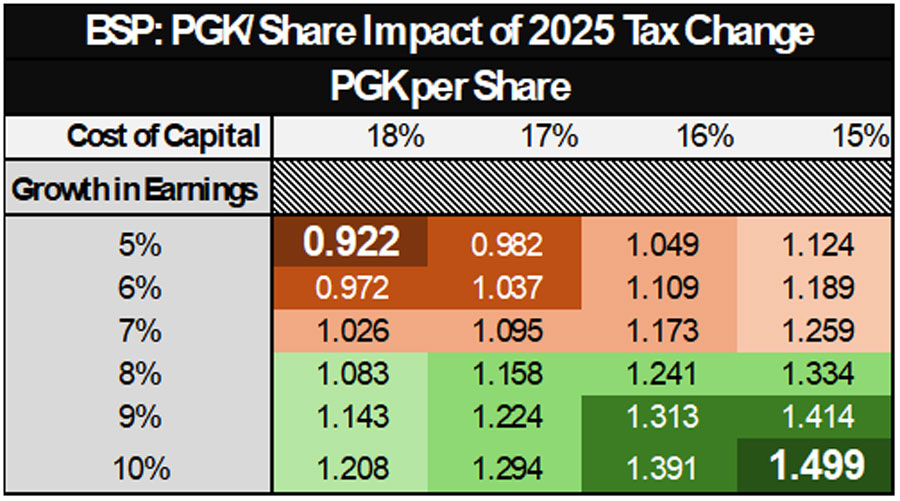

- When viewed in isolation and assuming ceteris paribus, we believe the value of these changes to BSP amount to between K0.922 and K1.499 per share:

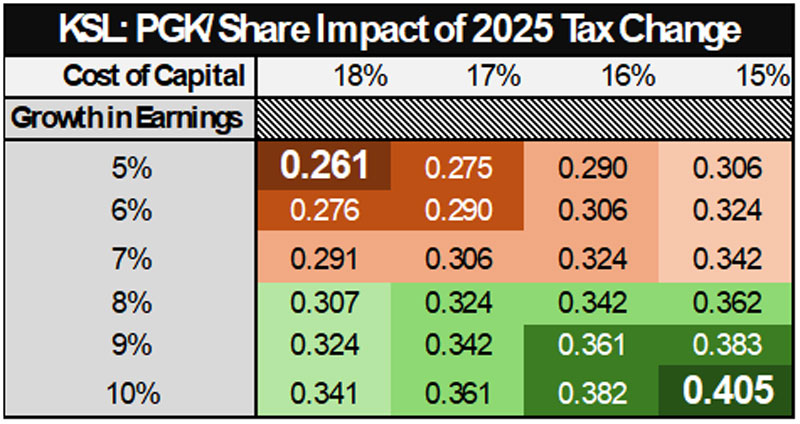

- In the case of KSL, we consider the impact to be between K0.261 and K0.405 per share:

- It is important to note that the above estimates are of the value of the changes to the CIT rate only. The impact on the share prices of BSP and KSL will need to consider the extent to which these changes were already built into the trading prices prior to the announcements.

- We have included below a link to our recent Investor Notes in respect of the impact of these tax changes on BSP.

Download Investor Notes >>

WEEKLY MARKET REPORT | 25 November, 2024 – 29 November, 2024

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 9,190,216,987 | K0.370 | K1.060 | K0.450 | 7.68% |

| KSL | 287,949,279 | 921,437,693 | K0.100 | K0.160 | K0.106 | 8.31% |

| STO | 3,247,772,961 | 63,818,738,684 | K0.310 | K0.660 | k0.506 | 5.93% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 88,714,476 | K0.120 | – | K0.200 | 11.43% |

| NGP | 45,890,700 | 45,890,700 | K0.030 | – | K0.040 | 4.00% |

| CCP | 307,931,332 | 831,414,596 | K0.110 | K0.130 | K0.120 | 9.26% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.00% |

| TOTAL | 76,589,156,744 | 6.12% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

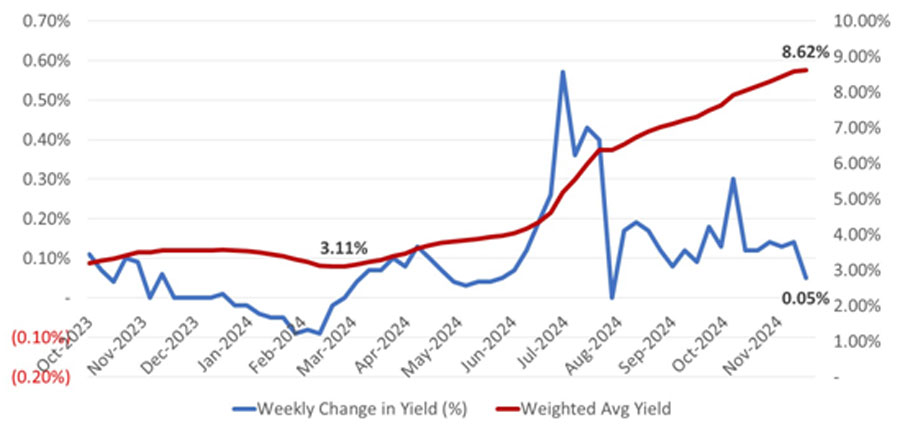

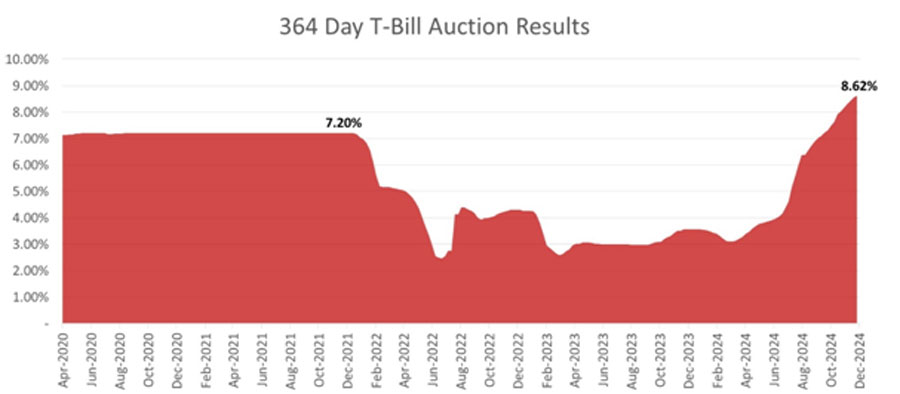

- In fixed interest markets, the 364-day yields rose another 0.05% to 8.62%, taking the increase to an aggregate of 5.51% since March 2024:

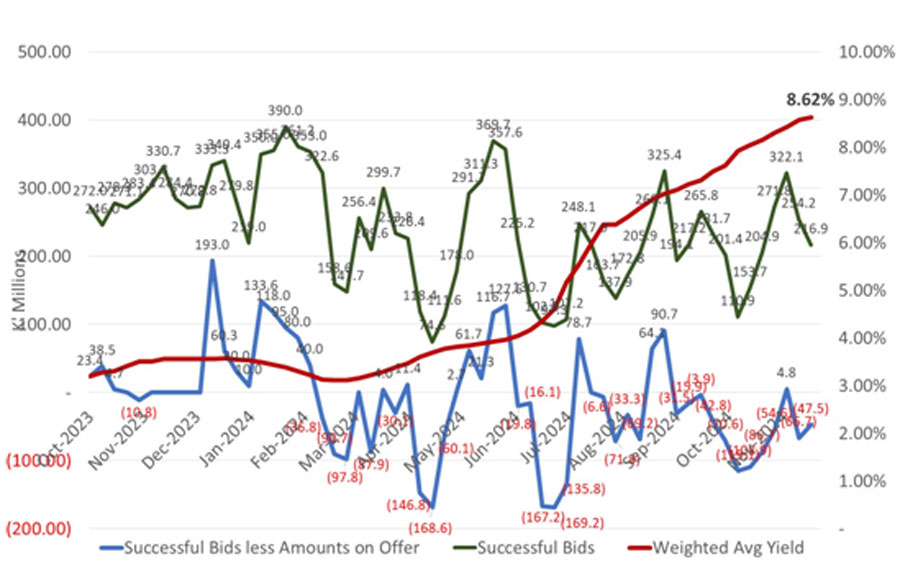

- Treasury Bills were undersubscribed again, with the amounts offered exceeding successful bids by K47 million million. BPNG accepted total volumes of K216.85 million.

- Treasury Bill rates continue their inexorable rise towards 9%:

What we have been reading

XRP Replaces Tether as 3rd-Largest Cryptocurrency While BTC Faces $384M Sell Wall

Coindesk | BY Omkar Godbole | Edited by Sheldon Reback | December 2, 2024

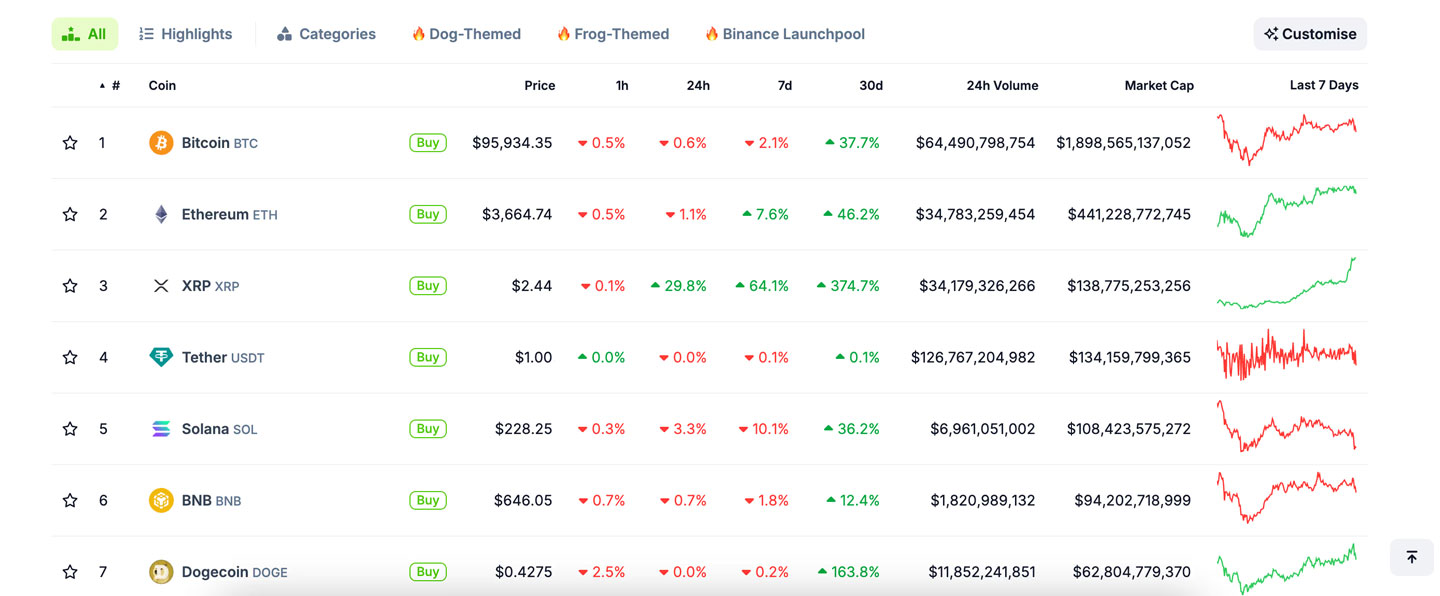

XRP has surged more than 20% in 24 hours, leapfrogging Tether’s USDT.

XRP is now the third-largest coin in the world. (Coingecko)

What to know:

- XRP has surged over 20% in 24 hours, replacing Tether’s USDT as the world’s third-largest cryptocurrency by market value.

The bitcoin order book shows a large stack of sell orders around $100,000, one observer said.

BTC’s dominance rate continues to slide. - XRP (XRP) is on a tear as bitcoin (BTC) struggles to approach $100,000 amid talk of a large “sell wall” near the six-digit price mark.

- XRP, the payments-focused cryptocurrency, has skyrocketed 375% to $2.40 in 30 days. The price has surged more than 20% in the past 24 hours alone, CoinDesk data show.

The meteoric rise has lifted the cryptocurrency’s market capitalization to $139 billion, replacing the leading dollar-pegged stablecoin, Tether’s USDT, as the world’s third-largest digital asset.

“This [XRP] comeback is making waves across the market, potentially signalling the return of retail traders and investors to the crypto market,” Mena Theodorou, co-founder of the crypto exchange Coinstash, said in an email. “Recent XRP trends on TikTok, speculation about the approval of a Ripple-issued stablecoin, and the possibility of an ETF are likely fueling the fire and driving renewed interest in XRP.”

XRP’s trading volumes have surged globally. Upbit, South Korea’s biggest crypto exchange, registered a record $4 billion volume in the XRP-won pair in the past 24 hours. That’s over 27% of the exchange’s total trading volume, according to data source Coingecko.

The record activity in the XRP market comes as South Korea’s Democratic Party, on Sunday, backtracked on a plan to impose crypto capital gains tax in 2025, delaying it by two years.

“Originally planned for 2021, the tax has now been postponed multiple times,” Markus Thielen, founder of 10x Research, said in a note to clients Monday. “This delay is critical, as it effectively removes a major obstacle to speculative trading, giving the green light for another wave of aggressive crypto speculation.”

BTC’s sell wall

Bitcoin, the leading cryptocurrency by market value, started the new week on a weak note, dropping 1% to $96,000. Prices have remained locked between $90,000 and $100,000 for the past two weeks, with upward momentum consistently faltering near the elusive six-digit mark.

Continued appreciation warrants bullish flows strong enough to chew through a stack of sell orders worth $384 million, according to Valentin Fournier, an analyst at BRN.

“Despite strong market catalysts and growing investor confidence, Bitcoin continues to struggle with the $100K psychological barrier. Profit-taking is evident, and a substantial sell wall of over 4,000 BTC must be cleared before higher levels are achievable,” Fournier told CoinDesk in an email.

Moreover, traders are increasingly rotating money out of bitcoin and into other cryptocurrencies. That’s evident from the decline in BTC’s dominance rate, or share of the crypto market, from 61.5% to 56.5% since Nov. 21.

“Bitcoin dominance has dropped by 5% over the past 12 days, breaking below the positive trendline established in June 2023. With significant resistance at $100K, the market is seeing a capital shift towards altcoins, supported by increasing liquidity,” Fournier said.

Texas Launches Multi-State Lawsuit Accusing BlackRock, Vanguard, State Street of Using ESG Investing to Manipulate Energy Markets

Mark Segal | Posted December 2, 2024

Texas Attorney General Ken Paxton announced the launch of a lawsuit against investment giants BlackRock, Vanguard and State Street, joined by 10 other states, accusing the asset managers of using their positions in climate-focused investment initiatives to manipulate coal markets and drive up the cost of energy.

In statements received by ESG Today from BlackRock and State Street, the investment companies described the suit as “baseless,” with a BlackRock spokesperson adding that it “defies common sense.”

The announcement marks the latest in a series of moves in an ongoing anti-ESG movement by Republican politicians in the U.S. Texas has been one of the most active states in anti-ESG initiatives, with actions including having several asset managers placed on a list for potential divestment for allegedly “boycotting” energy companies, as well as joining a multi-state alliance to “protect individuals from the ESG movement,” through actions such as blocking the use of ESG in all investment decisions at the state and local level, and prohibiting state fund managers from considering ESG factors in their investments on behalf of the state.

Several Republican states have launched ESG-focused lawsuits over the past several months, often targeting BlackRock as the largest global investment management company, and a leading voice in the investment community on climate and energy transition-related investment themes, including Mississippi earlier this year, and Tennessee in December 2023.

In the new lawsuit, the Attorneys General claim that the asset managers acquired large shareholdings in major coal producers in the U.S., and used their combined influence to coerce the companies to cut coal production to accommodate clean energy investment goals, resulting in higher energy costs for U.S. consumers.

The suit notes that BlackRock, Vanguard and State Street collectively held substantial shares in major coal companies, including more than 30% stakes in Peabody Energy and Arch Resources, which together account for approximately 30% of the coal produced in the U.S. With the large holdings in place, the suit alleges that the firms violated the Clayton Act, which prohibits the acquisition of shares of companies in which ““the effect of such acquisition may be substantially to lessen competition.”

The suit adds that the firms “effectively formed a syndicate and agreed to use their collective holdings of publicly traded coal companies to induce industry-wide output reductions,” by joining the Net Zero Asset Managers Initiative (NZAM) in 2021, and with BlackRock and State Street also joining Climate Action 100+, noting that each initiative requires commitments from asset managers to engage with portfolio companies to align with climate goals, including the International Energy Agency’s (IEA) outlook that require CO2 emissions from coal to fall by 58% by 2030, and thermal coal output to fall 50% by 2030.

Notably, the asset mangers have since exited or significantly reduced their participation in the climate initiatives, often citing the group’s overly prescriptive requirements. For example, Vanguard exited NZAM in 2022, saying that it aimed “to make clear that Vanguard speaks independently on matters of importance to our investors,” and State Street left CA100+ earlier this year.

Similarly, BlackRock shifted its participation in Climate Action 100+ to its international unit, citing a new strategy by CA100+ that would require signatories to commit to use client assets to pursue emissions reductions in portfolio companies. In a letter to CA100+ published on the asset manager’s website, BlackRock said that “the money BlackRock manages is not our own—it belongs to our clients—and BlackRock is committed to providing clients around the world with choices to support their unique and varied investment objectives.” BlackRock’s website also carries a ‘2030 net zero statement,’ which states that “our role is to help them navigate investment risks and opportunities, not to engineer a specific decarbonization outcome in the real economy.”

Despite the asset managers’ decisions to leave the initiatives, however, the suit says that withdrawal “does not change the reality that Defendants’ holdings threaten to substantially reduce competition,” or “negate the ongoing and future threat of Defendants’ coordinated anticompetitive conduct or absolve Defendants of their legal liability for past violations.”

In a statement announcing the launch of the suit, the Texas AG’s office said:

“Deliberately and artificially constricting supply increased prices and enabled the investment companies to produce extraordinary revenue gains. This conspiracy violated multiple federal laws that prevent a major shareholder, or a group of shareholders, from using their shares to lessen competition or engaging in other anticompetitive schemes. Further, the companies broke Texas antitrust and deceptive trade practices laws.”

In the statement to ESG Today, BlackRock’s spokesperson said:

“BlackRock is deeply invested in Texas’ success. On behalf of our clients, we have billions invested in Texas energy, partnering with the state to attract investments into the Texas power grid and helping millions of Texans retire with dignity.

“BlackRock’s holdings in energy companies are regularly reviewed by federal and state regulators. We make these investments on behalf of our clients, and our focus is on delivering them financial returns.

“The suggestion that BlackRock has invested money in companies with the goal of harming those companies is baseless and defies common sense. This lawsuit undermines Texas’ pro-business reputation and discourages investments in the companies consumers rely on. “

State Street’s spokesperson said:

“State Street acts in the long-term financial interests of investors with a focus on enhancing shareholder value. As long-term capital providers, we have a mutual interest in the long-term success of our portfolio companies. This lawsuit is baseless and we look forward to presenting the facts through the legal process.”

Other states joining the suit include Alabama, Arkansas, Indiana, Iowa, Kansas, Missouri, Montana, Nebraska, West Virginia, and Wyoming.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630