11 February, 2025

Welcome to this week’s JMP Report,

The JMP Weekly Report returns after an extended Holiday Season break – ready to keep our readers and clients informed of developments in PNG capital markets in 2025

The week ended Friday 7 February 2025 saw relatively modest trading volumes, dominated by KSL which accounted for 95% of the value of trades:

WEEKLY MARKET REPORT | 3 February, 2025 – 7 February, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 439 | 20.95 | 9,197 |

20.95 | – | – | – |

| KSL | 231,466 | 3.30 | 763,838 | 3.20 | – | – | – |

| STO | 1,463 | 20.40 | 29,845 | – | – | – | – |

| NEM | – | 150.00 | – | 145.00 | – | – | – |

| KAM | 5,816 | 1.65 | 9,596 | 1.55 | 1.65 | – | – |

| NGP | – | 0.80 | – | – | 0.80 | – | – |

| CCP | 1,000 | 3.00 | 3,000 | 3.00 | – | 0.20 | 7.14% |

| CPL | – | 0.69 | – | – | 0.69 | – | – |

| SST | 40 | 50.00 | 2,000 | – | 50.00 | 2.00 | 4.17% |

| TOTAL | 817,476 |

0.16% |

Key takeaways:

A total of K817,476 in value was traded during the week, with CCP and SST recording strong prices, albeit from very low volumes.

Key takeaways:

- CCP traded 1,000 shares at K3.00 which represents an increase in the share price of 7.14% for the week. It will be interesting to see whether the stock can defend this share price into the earnings reporting season with its expected greater volumes of trading.

- SST retraced its way to K50.00, however this was achieved after trading a mere 40 shares during the week.

- As mentioned, KSL dominated trading during the week, with 231,466 shares changing hands at a valuation of K763,838.

- A small parcel of 1,463 STO shares also changed hands at an unchanged closing price of K20,40 per share.

- Finally, KAM registered small trades at an unchanged price of K1.65.

WEEKLY YIELD CHART | 3 February, 2025 – 7 February, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 9,788,258,560 | K0.370 | K1.060 | K0.450 | 7.21% |

| KSL | 287,949,279 | 950,232,621 | K0.100 | K0.160 | K0.106 | 8.06% |

| STO | 3,247,772,961 | 66,254,56,404 | K0.310 | K0.660 | k0.506 | 5.72% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 88,645,077 | K0.120 | – | K0.200 | 12.12% |

| NGP | 45,890,700 | 36,712,560 | K0.030 | – | K0.040 | 5.00% |

| CCP | 307,931,332 | 923,793,996 | K0.110 | K0.130 | K0.120 | 8.33% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.08% |

| TOTAL | 79,729,954,827 | 5.88% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

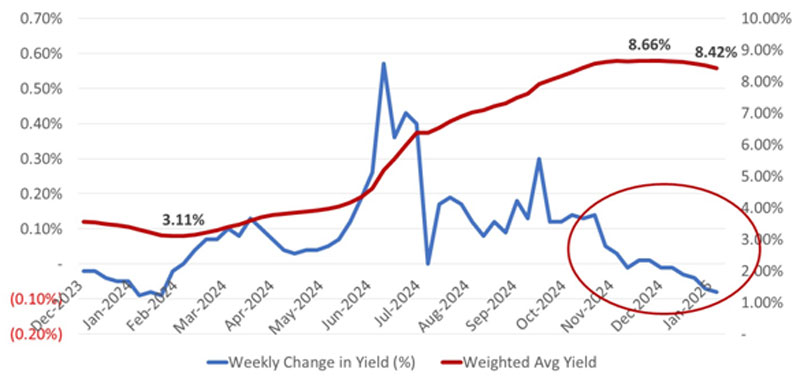

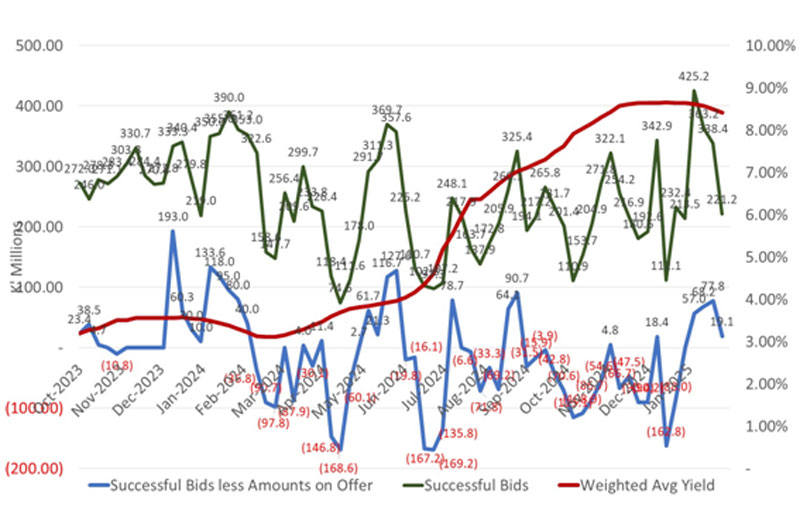

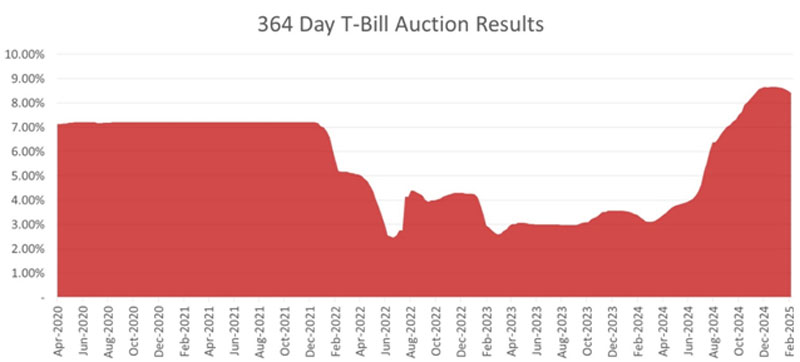

- In fixed interest markets we may be starting to see a new trend in the 364-day market, with yields starting to trop tentatively. Bid volume has increased significantly and there is now the early signs of excess liquidity in the auctions.

- It is too early to say whether this trend is going to hold or whether seasonal factors are in play.

What we have been reading

China’s Renewable Energy Boom: A Record-Breaking Shift or Still Chained to Coal?

China is making record-breaking progress in renewable energy. The country has already achieved its 2030 clean energy goal six years early. With massive investments and policy support, China is set to remain the global leader in renewable energy expansion. But can it sustain this rapid momentum while balancing energy security and economic growth?

Beating the Clock on Clean Energy: Surpassing Renewable Energy Targets

In 2020, China set a goal to install at least 1,200 gigawatts (GW) of solar and wind power by 2030. By the end of 2024, China had already surpassed this target, reaching this milestone 6 years ahead of schedule. This was made possible by aggressive investments, government policies, and a surge in solar and wind installations.

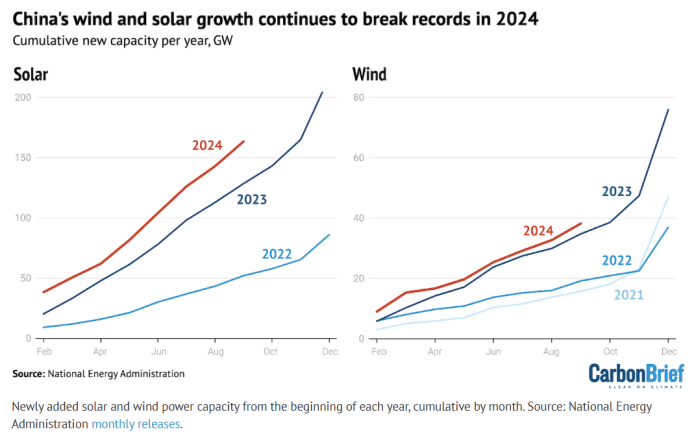

China’s solar capacity grew by an incredible 45.2% in 2024, adding 277 GW. Wind capacity also saw a strong increase of 18%, with an additional 80 GW installed. Overall, total power generation capacity rose by 14.6% in 2024, driven mainly by renewables.

China renewable growth, wind and solar Q3 2024

One major milestone was the completion of the Ruoqiang photovoltaic (PV) project. This massive 4-GW solar farm in the Taklamakan Desert is one of the world’s largest solar power projects. It is part of China’s broader strategy to peak emissions before 2030 and transition toward cleaner energy sources.

This rapid progress is due to strong government support, record investments, and local manufacturers producing affordable solar and wind components.

Leading the World in Renewable Investments

China is the world’s largest market for low-carbon energy investment. In 2024, the country attracted $818 billion in clean energy investments—more than the combined total of the U.S., the European Union, and the UK. This accounted for ⅔ of the global increase in clean energy investments that year.

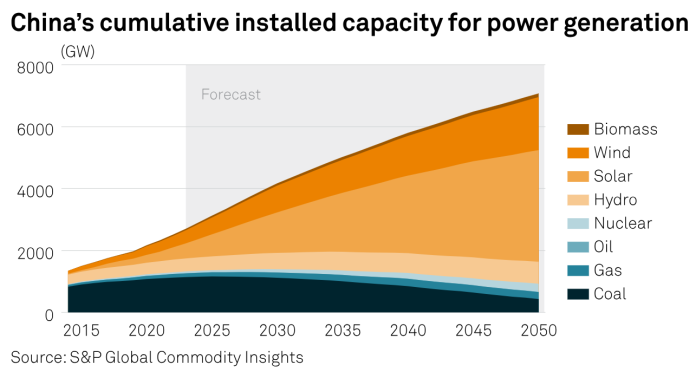

The world’s biggest carbon emitter’s commitment to renewables is reshaping its energy mix. In June 2024, wind and solar power combined surpassed coal in installed capacity for the first time.

China’s 14th Five-Year Plan set a goal for renewables to supply 33% of its electricity by 2025. By 2026, solar capacity alone is projected to overtake coal as China’s leading energy source, with 1.38 terawatts (TW) of solar power expected—150 GW more than coal.

Remi Eriksen, CEO of energy consultancy DNV, once remarked that:

“Intense policy focus and technological innovation are transforming China into a green energy powerhouse.”

And one of these innovations is in the field of nuclear power.

Nuclear Power and SMRs: A Game-Changer for China’s Energy Future?

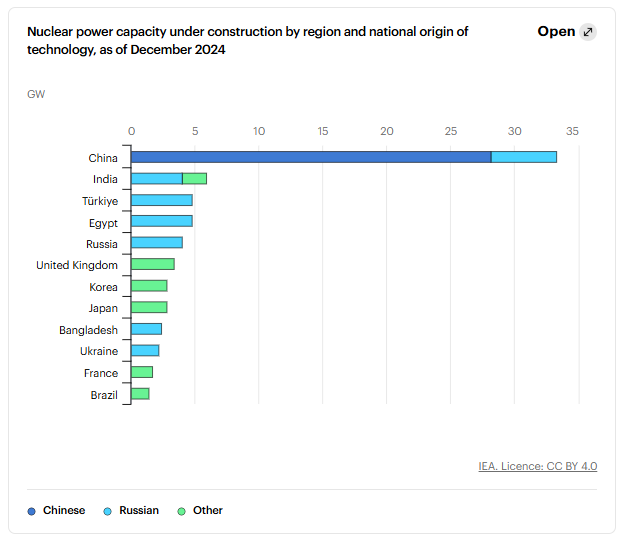

China is also investing heavily in nuclear power, with 29 reactors under construction, totaling 33 GW of capacity. This makes up nearly half of all new nuclear projects worldwide. By 2030, China will surpass the U.S. as the largest nuclear power producer, with a projected capacity reaching up to 320 GW by 2050.

China nuclear power capacity under construction

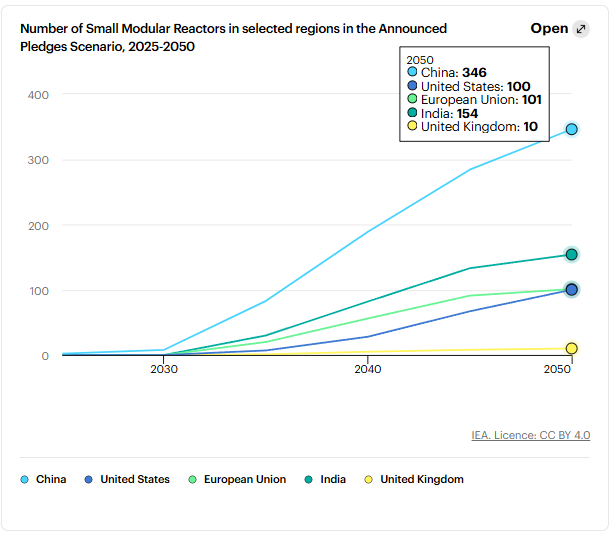

Small Modular Reactors (SMRs) are a key part of China’s nuclear strategy. The country’s first SMR, a high-temperature gas-cooled reactor (HTR-PM), began operations in 2023. Other SMR designs, including the ACP100 and NHR200, are under development.

These compact reactors will support industrial heating, electricity supply, and district heating. By 2050, China’s SMR capacity is expected to reach 35 GW, making it the leading global market for this next-generation nuclear technology.

number of SMRs announced China

China is quickly growing its renewable energy and advancing nuclear power. This makes it a leader in clean energy worldwide. Even though it still uses coal, the focus on renewables and nuclear is cutting carbon emissions a lot.

The Road to Net Zero: Can China Meet its 2060 Goal?

China has set ambitious climate goals. The country aims to peak its carbon emissions by 2030 and reach net zero by 2060. A key driver of this transition is energy independence, as China seeks to reduce reliance on imported fossil fuels.

A recent report from DNV highlights China’s rapid progress. The country had 1.45 TW of renewable energy capacity online by the end of 2024 and is on track to increase its clean energy capacity fivefold by 2050.

- By that time, renewables are expected to supply 60% of China’s energy needs, although fossil fuels will still account for around 40% of the mix.

Challenges and the Role of Coal

Despite this rapid progress, coal remains a significant part of China’s energy system. The country still consumes over 50% of the world’s coal and continues to build new coal-fired power plants. In 2022, China approved 6x more new coal capacity than the rest of the world combined.

The heavy reliance on coal is partly due to energy security concerns. Events like Russia’s invasion of Ukraine and reduced rainfall affecting hydropower have made alternatives like gas and hydroelectric power more expensive.

- Coal remains a backup energy source to support the country’s rising electricity demand, which increased by 6.8% in 2024.

However, China’s long-term goal is to reduce this dependence. The government is implementing policies to phase out fossil fuels gradually while ensuring energy stability. By 2050, China’s emissions are expected to drop by 70% compared to current levels, marking significant progress in its clean energy transition.

Future Outlook: A Renewable Superpower

China’s energy transition is at a critical turning point. The country’s investments and policy shifts indicate a strong commitment to clean energy. By 2030, China’s total energy consumption is expected to peak and then decline by 20% in 2050 due to increased efficiency and electrification.

China aims for net zero by 2060, which is ten years later than the UN’s 2050 target to keep global warming under 1.5°C. So, while progress is strong, more efforts are needed to speed up the shift from fossil fuels.

Overall, China is leading the world in renewable energy expansion, breaking records in solar and wind installations. The country’s rapid growth in clean energy capacity is reshaping its power mix and reducing its reliance on coal.

Global economic outlook: Six themes for 2025

Gregory Daco – EY- Parthenon Chief Economist, Startegy and Tansations, Ernst & Young LLP

In brief

Global GDP growth is expected to remain stable, but with significant divergences across regions.

Global inflation anticipated to steadily decline, but with risks from trade protectionism, geopolitical tensions, and wage and services costs.

Six key themes in the 2025 global economic outlook include the US as growth leader and disruptor, price volatility and cautious monetary policy recalibration.

Global economic activity is expected to maintain modest momentum in 2025. Real GDP growth should remain stable at 3.1% – on par with the expected advance in 2024 – but our global economic outlook foresees strongly desynchronized growth patterns across regions.

Real GDP in advanced economies is projected to grow 1.8% in 2025, up from 1.7% in 2024. In the US, economic activity is expected to remain robust, supported by solid income and productivity, even as real GDP growth slips from 2.8% in 2024 to 2.2% in 2025. In Europe, steady income growth and falling interest rates should drive stronger consumer spending growth and a modest recovery in investment. Real GDP growth in the euro area should pick up to 1.3%–surpassing 1% for the first time in three years. Real GDP growth in Japan is likely to rebound toward 1.1% driven by a gradual acceleration in real wages and consumer spending.

Emerging markets are anticipated to grow at 4.1% in 2025, in line with growth in 2024. We foresee real GDP growth in mainland China slowing to 4.5% in 2025 as structural property sector and demographic challenges will restrain economic activity despite fiscal and monetary policy support. India should remain a bright spot, with real GDP growth expected at 6.4%, driven by public investment and strong domestic demand. Latin America is expected to see a mildly stronger expansion, despite a notable slowdown in growth in Brazil.

Global inflation is expected to decline steadily, easing from 4.5% in 2024 to 3.5% in 2025 – still somewhat higher than the 3.1% pace in 2019. Advanced economies are likely to bring inflation under control faster than emerging economies. However, the near-term trajectory to price stability may still face challenges with persistent services and wage inflation in several parts of the world leading to desynchronized monetary policy responses. Risks to the global inflation outlook will be tilted to the upside given the prospects of increased protectionism, geopolitical tensions, derisking and demographic constraints.

In a world increasingly subject to supply shocks that constrain economic output and drive up inflation, central banks will tread carefully. We anticipate widespread monetary policy desynchronization in 2025 as central bankers respond to divergent domestic and international conditions. In advanced economies, the Fed will likely ease policy more gradually than the European Central Bank (ECB) while the Bank of Japan tightens policy prudently in the face of a virtuous wage-inflation dynamic.

Across emerging markets, some economies, like Brazil, are facing resurgent inflationary pressures that may prompt policy tightening. At the opposite end of the spectrum, mainland China will continue to ease policy to avoid the risk of persistent deflation. Central bankers in Latin America and Asia will be keenly focused on the Fed’s policy moves to preempt and buffer potential foreign exchange shocks.

In 2025, fiscal policy will be shaped by the challenges of managing elevated public debt and high interest rates amid competing economic and political demands. Growing populist calls for increased social spending, tax cuts and subsidies, alongside long-term needs related to energy transition, military spending and aging demographics, further strain fiscal management, especially in politically unstable regions where immediate concessions often overshadow long-term reforms.

Global economic outlook: six themes for 2025

The global economic environment is poised for significant shifts in 2025, driven by evolving market dynamics, geopolitical realignments and structural transformations across industries. Below, we explore six key macroeconomic themes that will shape the year ahead, with a focus on their implications for major economies around the world.

1. US economic exceptionalism: a global growth leader and disruptor

The US economy will remain the global growth leader in 2025 driven by solid income growth, pro-cyclical productivity growth, accommodating fiscal policy and easing monetary policy. While we anticipate real GDP growth in major economies around the world to realign with trend-growth, the US will be one of the few exceptions where this convergence will be from above-potential GDP growth toward 2.2%. The implications are two-fold: the US economy will remain the main driver of global economic resilience, but mildly softer momentum will limit the global pull.

The US will also be a major global growth disruptor with regulatory, immigration, trade and tax policy changes representing opportunities and risks worldwide. The composition, timing and magnitude of policy shifts is still uncertain, but likely to have a consequential influence on economic and inflation dynamics in 2025 and beyond.

Trade policy, in particular, is likely to have an outsized impact on the global economy in late 2025 and 2026 with tariffs and other protectionist measures that could push the global economy into “stagflation” (economic stagnation combined with elevated inflation), if pursued to their fullest extent.

Conversely, tax cuts and stronger private sector confidence on the prospects of pro-business policies and deregulation could support stronger spending and investment in the near-term, even if policy uncertainty should not be underestimated as a headwind.

Finally, US exceptionalism will also bring challenges to global markets, as resulting US dollar strength could exacerbate inflationary pressures worldwide and disrupt capital and investment flows to emerging markets.

2. Trade and geopolitics: derisking in a fragmented universe

Governments will continue to blend national security priorities with strategic competitiveness goals using industrial policy and trade protectionism to support their objectives. The fragmentation of global trade, exacerbated by tensions between the US and mainland China, and the rise of geoeconomic blocs will continue to redefine supply chain dynamics.

In this environment, the role of “connector economies” – emerging markets that have advantageous locations and preferential trade agreements across major blocs – will grow. India, Saudi Arabia, Mexico, Brazil, the United Arab Emirates and Southeast Asian economies will benefit from maintaining or developing strong trade and investment relations across geopolitical blocs. India, in particular, will continue to foster trade and investment ties across geopolitical divides while being a critical driver of South-South trade. Southeast Asia is likely to remain the top destination for foreign investment among emerging markets.

In the US, protectionist measures will be used in a transactional manner to extract trade, immigration, drug traffic control, defense spending and other political concessions from trading partners. We anticipate targeted tariffs on trading partners. However, we note that a scenario factoring 60% tariffs on Chinese imports and a 10% universal tariff on all imports from other US trading partners (assuming proportional retaliation against US exports) would reduce global GDP by 1.4% after two years, with GDP in the US, mainland China, Mexico and Canada reduced by 2.0% to 3.0%.

In Europe, the European Commission will also make increasing use of trade-defensive tools such as tariffs and step up scrutiny of foreign direct investments in strategic sectors. And, in emerging countries, this trend will increasingly manifest in resource nationalism, as governments from Mexico to Indonesia seek greater state involvement in the resources sector or higher value-added process to occur domestically.

Meanwhile, geopolitical hotspots – Ukraine, the Middle East and Taiwan – will remain potential disruptors to global supply chains, given their strategic importance in energy, technology and trade routes. The ongoing conflict in Ukraine fuels uncertainty about future pockets of tension and their effects on commodities prices. Tensions in the Middle East, a region central to oil production and trade routes, elevate the risk of energy supply and transport cost shocks that could further strain inflationary pressures globally. Similarly, escalating frictions in Taiwan – a hub for advanced semiconductor manufacturing – pose significant risks to technology supply chains, with potential repercussions for industries reliant on these critical components. Collectively, these geopolitical challenges underscore the fragility of global supply networks in an increasingly fragmented and volatile world.

3. Price volatility: easing inflation pressures but supply fragilities

Inflation will only gradually converge toward central bank targets across regions, with upside risks stemming from structural supply fragilities, geopolitical tensions and volatile commodity prices.

In advanced economies, where inflation surged to multidecade highs following the pandemic, price pressures are expected to moderate but remain uneven. Wage cost pressures, potential tariffs and limited innovation undermining global competitiveness in some sectors are likely to persist across European economies and the UK. In the US, we expect the moderating trend in inflation will remain in place through early 2025, though it could then change as deregulation, potential immigration restrictions and tariffs lead to a renewed inflation impulse. In contrast to President-elect Trump’s first term, these inflationary pressures would come in a new paradigm defined by fragile supply conditions, elevated geopolitical tensions and structural upside risks to inflation. Geopolitical tensions such as the wars in Ukraine and the Middle East could further exacerbate inflation volatility, particularly in energy and agricultural commodities.

Mainland China will face a different macroeconomic challenge: the risk of deflation due to subdued consumer spending trends, cautious business investment and ongoing deleveraging in the property sector. This has prompted authorities to announce stimulus measures to prevent exacerbating deflationary pressures. Indeed, deflation could slow the economic recovery by delaying consumer purchases, eroding corporate revenues and worsening real debt burdens, particularly if property sector weakness and slowing exports continue to weigh on private sector confidence.

Emerging markets will grapple with the challenge of curbing inflation while contending with fragile supply chains, volatile commodity prices and foreign exchange fluctuations. Several Asian emerging economies, including India and Indonesia, are better positioned to maintain price stability due to proactive fiscal measures and monetary prudence. The combination of a diversified supply base that mitigates reliance on external inputs and importing deflation from China should further support disinflation.

The five D’s of structurally higher inflation – demographics, debt, de-risking, decarbonization and digitalization – will remain in place. Aging populations requiring more private and public spending; elevated levels of public expenditure on domestic and industrial policy; a growing focus on de-risking and building resilience in a geopolitically fragmented world; the greening of the global economy via greater outlays to reduce carbon emissions; and capital investment to develop generative artificial intelligence (GenAI) will likely mean that central banks’ inflation targets represent a floor rather than a ceiling in most economies over the medium term.

Still, inflation risks are not entirely tilted to the upside as an end to conflicts around the world, restrained protectionism, stronger productivity growth or subdued demand growth would translate into a lower inflation environment.

4. Monetary policy: reasons to recalibrate but recalibrate with caution

Generally easing inflation should continue to favor monetary policy recalibration in the near term. But while central banks will find plenty of reasons to pursue their policy easing cycle, they will almost certainly recalibrate with caution given the risks from inflation volatility tied to trade, wages, energy and food cost pressures. As a result, global monetary policy will be desynchronized as central bankers respond to divergent domestic and international conditions and may even be forced to tighten policy amid resurgent inflationary and exchange rate pressures.

The Federal Reserve is likely to proceed carefully in easing policy after having reduced the federal funds rate by 100 basis points (bps) in 2024. Unsure about what the neutral fed funds rate is, data-dependent policymakers will likely favor easing at every other Federal Open Market Committee (FOMC) meeting through Q3 2025 given upside risks to inflation stemming from deregulation, tax cuts, tariffs and immigration restrictions. A prolonged pause in the easing cycle should not be discounted, and a 2025 Fed rate hike is more than just a tail risk.

Central banks in the rest of the world face equally complex recalibration challenges, reflecting diverse economic conditions. The ECB is expected to ease policy more rapidly than the Bank of England (BoE) considering weaker growth prospects and mildly lower inflation projections in the eurozone due to more constrained wage growth.

Central banks in Canada, Sweden, Switzerland and New Zealand will continue to lead global policy recalibration given lower inflation prospects and softer labor market conditions. With some delay relative to its peers, the Reserve Bank of Australia is likely to commence its easing cycle in early 2025 given soft growth dynamics and easing inflation. The Bank of Japan will be the exception among developed markets’ central banks with gradual tightening and normalization of policy in the face of moderate consumer and wage price inflation after two decades of deflation.

Central banks in emerging markets will carefully navigate the complex interplay of global and domestic pressures, with a keen eye on the Federal Reserve’s monetary policy stance to mitigate foreign exchange volatility and capital flow reversals. In Asia, monetary easing is expected to gain traction as inflation moderates and economic conditions stabilize. India is likely to proceed cautiously, with the Reserve Bank of India (RBI) adopting a measured approach to rate reductions. With headline inflation above the 4% target, robust economic growth and geopolitical uncertainties will temper the pace of easing. Across Latin America, monetary policy will broadly shift toward accommodation as inflationary pressures subside, although Brazil may remain an outlier with rate hikes to counter persistently high inflation.

Meanwhile, the People’s Bank of China (PBoC) will face deflationary risks rather than inflation in the coming months. The PBoC is expected to implement policy interest rate and reserve requirement ratio (RRR) cuts and complement these accommodative policies with bond purchases in 2025.

This global divergence in monetary policy trajectories underscores the fragmented nature of the global recovery and the difficulty of achieving synchronized growth. For many central banks, recalibrating with caution will mean balancing inflation control with the imperative to sustain growth and ensure financial stability in an increasingly volatile environment.

5. Labor in flux: talent scarcity, productivity and AI

The future of global labor markets will be shaped by the intricate interplay of economic pressures, demographic shifts and rapid technological advancements. Advanced economies, grappling with cyclical headwinds and slower employment growth have so far benefited from labor supply rebounds fueled by immigration. However, mounting populist opposition to immigration threatens to exacerbate talent shortages in aging societies, further straining already fragile labor markets. In addition, some economies, like Europe, face the dual challenge of subdued productivity growth and declining competitiveness, compounded by rigid labor markets and slower adoption of innovative technologies.

Policymakers and business leaders will need to counter these challenges by fostering stronger workforce participation and accelerating investments in automation and AI to offset demographic pressures. Business leaders, facing rising costs of talent post-pandemic, are likely to focus on preserving their talent but drive productivity enhancements and constrain wage growth to contain labor costs.

We have been firm believers in what has now become the consensus view that the US productivity surge was sustainable. Longer-tenured and better trained employees, strong business formation, efforts to offset high wage bills with efficiency gains and judicious business investment in a high-interest rate environment form the bedrock of this acceleration in productivity. If firms across other advanced economies can generate strong productivity momentum, they will be able to control costs and protect margins without sacrificing talent in an environment of still-elevated wages and fading pricing power.

Emerging markets should be better positioned to leverage demographic dividends and reform momentum. Economies like India, ASEAN nations and Brazil are intensifying efforts to improve labor market efficiency and foster innovation. Policies promoting higher workforce participation, particularly among women, are becoming central to sustaining growth in regions experiencing rapid social and economic change. Meanwhile, digital transformation is driving competitiveness in regions such as mainland China and Sub-Saharan Africa. In the coming years, successfully aligning workforce potential with technological capabilities will be critical for emerging markets to solidify their position as engines of global economic expansion.

At the forefront of these shifts, GenAI is poised to redefine productivity and reshape the global economy. We estimate the GenAI revolution could contribute $1.7 trillion to $3.4 trillion to global GDP by 2035, equivalent to adding an economy the size of India. For the US, this transformation could translate into the equivalent of two to four extra years of economic growth within a decade. To fully capitalize on this potential, business leaders and policymakers must prioritize the integration of advanced technologies, commit to reskilling and workforce adaptability, and implement structural reforms that foster inclusive and sustainable economic growth.

6. Fiscal policy: a delicate balancing act

Fiscal policy in 2025 is set against a backdrop of high public debt, elevated interest rates and competing political and economic priorities. Global public debt is forecast to remain at 91% of GDP, creating an environment where governments face rising borrowing costs and reduced fiscal flexibility. The high-interest rate environment compounds the challenge, as debt servicing increasingly absorbs resources that could otherwise support growth-oriented investments. Rising populist pressures for social spending, tax cuts and subsidies further complicate fiscal management, particularly in politically unstable regions where short-term appeasement often takes precedence over structural reforms.

Advanced economies must grapple with balancing fiscal consolidation against populist pressures for greater spending and tax cuts as well as rising spending needs related to energy transition, defense and aging demographics. In the US, potential extensions of tax relief measures, such as the 2017 Tax Cuts and Jobs Act, could widen the deficit, while rising interest expenses, entitlement costs and defense spending further constrain fiscal options. Similarly, Japan’s fiscal outlook is overshadowed by an aging population that continues to drive up health care and pension costs, demanding ever-higher expenditures even as economic growth remains subdued.

In Europe, fiscal policy will be tightened mildly, though fiscal positions will diverge across countries. France will display the highest deficit within the euro area, with no significant tightening expected amid political gridlock, making the country highly vulnerable to disruptions in sovereign bond markets. In Germany, the deficit will be much lower, as the recent government collapse prevents any increase in government expenditures in the short term, even though looser fiscal policy and public investment in infrastructure and the energy transition are badly needed to lift the economy out of stagnation. Fiscal policy will also remain expansionary in Central and Eastern Europe, particularly Romania and Poland, due to rising military spending and populist pressures.

Emerging markets will face intensified fiscal pressures in 2025 as high global interest rates and a strong US dollar amplify the cost of dollar-denominated debt, limiting their capacity for fiscal expansion. Brazil exemplifies these challenges with a populist agenda promoting much looser government spending and a likely 15 percentage points (ppt) rise in the debt-to-GDP ratio by 2030. Currency depreciation amid fiscal sustainability concerns along with high inflation have, in turn, prompted a significant tightening of monetary policy. In Asia, India is expected to sustain growth through moderate public investment, while mainland China relies on targeted fiscal measures to counter its structural slowdown. In Gulf Cooperation Council (GCC) states, governments are diversifying fiscal revenues away from oil and stimulating non-oil sector activity with public investment. Sub-Saharan Africa must navigate fiscal consolidation alongside political instability and growing demands for infrastructure, energy and climate resilience investments.

In 2025, sustainable pro-growth fiscal policy should focus on unlocking long-term productivity gains while addressing the constraints of elevated debt levels and high interest rates. Strategic investments in digitalisation, education, infrastructure and green energy will be essential for driving economic transformation and resilience. However, the risk of these growth-enabling expenditures being overshadowed by rising debt servicing costs is significant, especially for emerging markets with constrained fiscal space.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630