17 February, 2025

Welcome to this week’s JMP Report,

Last week was pretty quiet on PMGX with total trading value limited to K455,522. Small volumes of trading in BSP, KSL, STO , KAM and CPL were recorded. There were no changes to any closing prices during the week:

WEEKLY MARKET REPORT | 10 February, 2025 – 14 February, 2025

| STOCK | WEEKLY VOLUME |

CLOSING PRICE | VALUE | BID | OFFER | CHANGE | % CHANGE |

| BSP | 1,499 | 20.95 | 31,404 | 20.95 | 21.00 | – | – |

| KSL | 123,143 | 3.30 | 406,372 | 3.30 | – | – | – |

| STO | 499 | 20.40 | 10,180 | 20.40 | – | – | – |

| NEM | – | 150.00 | – | 145.00 | – | – | – |

| KAM | 1,557 | 1.65 | 2,569 | 1.65 | 1.65 | – | – |

| NGP | – | 0.80 | – | – | 0.80 | – | – |

| CCP | – | 3.00 | – | 3.00 | – | – | – |

| CPL | 7,243 | 0.69 | 4,998 | – | 0.69 | – | – |

| SST | – | 50.00 | – | – | 50.00 | – | – |

| TOTAL | 455,522 | – |

Key takeaways:

- KSL continues to dominate trading values with almost 90% of total values for the week. 123,143 shares worth K406,372 were traded.

- There was 1,499 BSP shares changing hands at an unchanged price of K20.95. Current offers of K21.00 are in place in the market.

BSP will announce its full year results for FY2024 on Wednesday 19 February 2025.

Look out for a write-back of a significant earlier provision against a government borrower which has now been successfully resolved.

We also expect a slight overall negative impact on the FY2024 Net Profit After Tax from the reduction in the corporate tax rate for BSP from FY2025 as this resulted in adjustments to the carrying value of future income tax assets on the balance sheet.

Overall, we expect the final dividends to be higher than in the prior year.

WEEKLY YIELD CHART | 10 February, 2025 – 14 February, 2025

| STOCK | NUMBER ISSUED OF SHARES |

MARKET CAP |

2023 INTERIM DIV | 2023 FINAL DIV | 2024 FINAL DIV | YIELD % LTM |

| BSP | 467,219,979 | 9,788,258,560 | K0.370 | K1.060 | K0.450 | 7.21% |

| KSL | 287,949,279 | 950,232,621 | K0.100 | K0.160 | K0.106 | 8.06% |

| STO | 3,247,772,961 | 66,254,56,404 | K0.310 | K0.660 | k0.506 | 5.72% |

| NEM* | – | – | – | – | – | – |

| KAM | 50,693,986 | 88,645,077 | K0.120 | – | K0.200 | 12.12% |

| NGP | 45,890,700 | 36,712,560 | K0.030 | – | K0.040 | 5.00% |

| CCP | 307,931,332 | 923,793,996 | K0.110 | K0.130 | K0.120 | 8.33% |

| CPL | 206,277,911 | 142,331,759 | K0.050 | – | – | – |

| SST | 31,008,237 | 1,550,411,850 | K0.350 | K0.600 | K0.400 | 2.08% |

| TOTAL | 79,729,954,827 | 5.88% |

a LTM = Last Twelve Months. We have calculated yields based on most recently declared

interim and final dividends.

* NEM pays quarterly dividends. We have added last 4 payments at current FX rates.

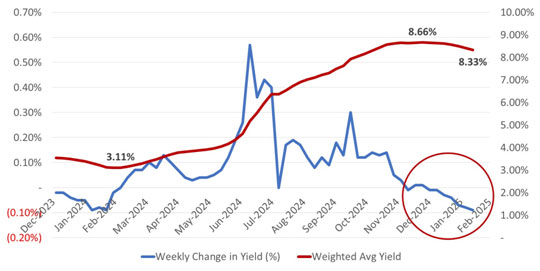

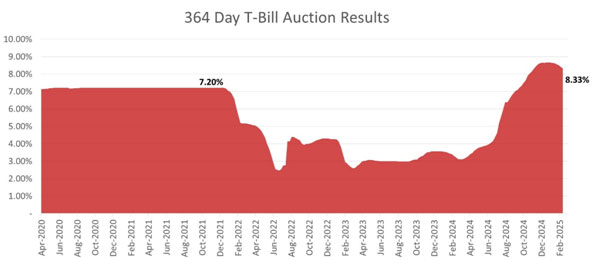

- In fixed interest markets, the 364-day, rates dropped for the 7th week running, finishing at 8.33%.

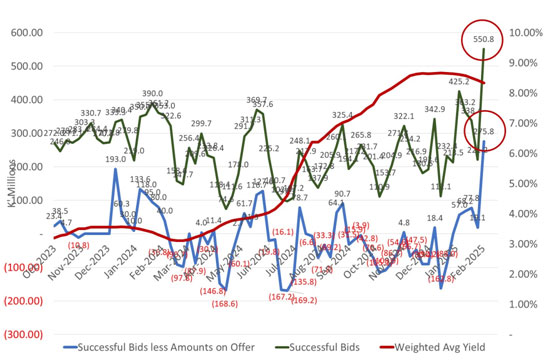

- Total bids of more than K612 million compared with only K275 million of bills on offer, continuing the recent trend of very significant liquidity in the market. This is a change from much of the second half of FY2024 which saw liquidity dry up.

- BPNG took advantage of the improved liquidity and more competitive pricing to accept a total of K550 million in total bids in the 364-day category.

What we have been reading

Core Power to Drive Net-Zero Shipping with Mass-Produced Floating Nuclear Power Plants

Core Power, the UK nuclear technology firm, has recently launched the Liberty Programme to transform the maritime sector with advanced nuclear technology. This “US-anchored” initiative plans to introduce floating nuclear power plants (FNPPs) by the mid-2030s. It was announced at the New Nuclear for Maritime Summit in Houston, Texas, on February 12.

Liberty will create rules and a supply chain for modular nuclear reactors in maritime settings. Core Power plans to leverage shipbuilding skills for mass production of FNPPs. They also intend to add nuclear propulsion for commercial vessels later.

Core Power CEO Mikal Bøe noted,

“Liberty will deliver resilient energy security for heavy industry and ocean transport. It will revolutionize the maritime sector and transform global trade.”

Core Power Plans Mass Production of Floating Nuclear Power Plants

As per the press release, The first phase of the Liberty Programme will focus on building FNPPs in shipyards. It will use modular assembly lines similar to traditional shipbuilding. This method ensures efficiency and cuts costs. It also makes use of a skilled workforce. FNPPs will be designed as power barges, able to moor at ports, coastal areas, or anchors offshore.

Key benefits of FNPPs

FNPPs will use advanced nuclear technologies, like molten salt reactors.

These reactors are safer than traditional ones and run at near-atmospheric pressure.

Their design reduces overheating risks and boosts safety, insurability, and efficiency.

Nuclear Propulsion for the Maritime Industry

The second phase of Liberty will introduce nuclear propulsion to civil ships, offering major advantages. These vessels will run on a single fuel load for their entire lifespan, cutting fuel costs and emissions. With less frequent refueling, operational costs will be lower. They will also produce no greenhouse gases or air pollutants, making them environmentally friendly. Improved speed and efficiency will allow for larger cargo loads and shorter transit times, enhancing global trade.

Core Power is collaborating with top nuclear technology developers to customize reactors for maritime use. The company plans to start taking orders for FNPPs in 2028 and begin full-scale commercialization by the mid-2030s.

The company is focusing on three areas to ensure a smooth transition to nuclear-powered maritime operations:

Supply Chain Development – Training a skilled workforce and securing nuclear fuel supply.

Business Operations – Developing commercial models for FNPP production and deployment.

Regulatory Frameworks – Collaborating with global organizations like the International Maritime Organization (IMO) and the International Atomic Energy Agency (IAEA) to establish safety standards.

The program also aims to create a civil liability convention for nuclear-powered ships, ensuring regulatory alignment with technological advancements. By leveraging the U.S.’s strong nuclear regulatory frameworks, Core Power seeks to facilitate worldwide FNPP deployment.

Unlocking a $2.6 Trillion Floating Power Market

Core Power estimates the Liberty Programme will open a $2.6 trillion market for floating power. With 65% of global economic activity along coastlines, FNPPs could provide reliable, clean energy for industries and communities worldwide.

Bøe said,

“The Liberty program will unlock a floating power market worth $2.6tn, and shipyard construction of nuclear will deliver on time and on budget. Given that 65% of economic activity takes place on the coast, this will allow nuclear to reach new markets.”

Proven Concept, New Approach

Nuclear-powered ships have been around since the 1950s, successfully operating in harsh marine environments. However, their reactors are designed for military use and cannot be commercially insured. Traditional pressurized reactors require large Emergency Planning Zones (EPZs) to manage accident risks, making them unsuitable for commercial deployment near populated areas.

Modern FNPPs eliminate these challenges. Their designs ensure minimal EPZs, often confined within the ship’s hull. This allows them to generate power near populated regions safely, supporting clean energy goals.

By leveraging modular shipyard production, FNPPs can be deployed rapidly, minimizing environmental impact while providing stable energy for ports, remote locations, and offshore industries.

Floating Nuclear Power: A Game Changer for Net-Zero Ports

Achieving net-zero emissions is nearly impossible without nuclear power. Fossil fuels and their alternatives emit greenhouse gases, while renewables like solar and wind depend on weather. When these sources fail, backup combustion engines increase emissions. Nuclear energy offers a steady power supply with zero emissions, making it an ideal solution for ports.

Why FNPPs are the future of clean port energy?

Reliable Power – Generates 400-1,500 MWh daily to support fluctuating energy demands.

Supports Green Infrastructure – Powers docked ships, EV charging stations, hydrogen production, and water desalination.

Cost-Effective – Provides stable energy pricing, reducing reliance on fossil fuels and carbon taxes.

Quick Deployment – FNPPs are plug-and-play solutions requiring minimal setup.

Scaling Nuclear for Affordability

FNPPs must be mass-produced to make nuclear energy cost-effective. Shipyard assembly lines enable serial manufacturing, reducing costs and speeding up deployment. Core Power envisions that instead of building each nuclear plant from scratch, identical FNPPs can be constructed efficiently and transported where needed.

This approach makes nuclear energy accessible and scalable, allowing ports worldwide to adopt clean power without costly infrastructure investments.

Organizations like the IMO and IAEA set global standards for FNPPs. This ensures safe and efficient implementation. As people learn more, support for nuclear energy as a clean and reliable power source will rise.

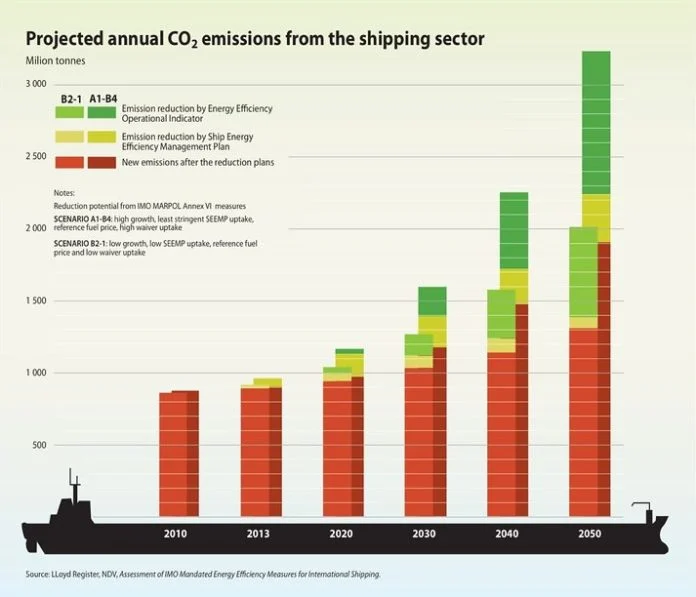

IMO’s Emission Reduction Goals for Maritime Shipping

The 2023 IMO GHG Strategy sets clear goals to cut greenhouse gas emissions from international shipping.

By 2030, shipping emissions should drop by at least 20%, with a target of 30% compared to 2008 levels.

By 2040, the goal is to reduce emissions by 70%, striving for 80%.

To meet these goals, ships must become more energy-efficient, and new ships will face stricter energy requirements. The strategy also encourages using zero or near-zero GHG emission technologies and fuels, aiming for them to supply at least 5% of the energy used by international shipping by 2030, with a target of 10%.

Thus, in the future nuclear-powered vessels will enable zero-emission global trade. With innovation and regulatory support, floating nuclear power will speed up the move to a sustainable, net-zero future And Core Power is setting its goals right!

Following the Yellow Brick Audit

Ainslie Bullion

News feeds are on fire with commentary on whether the 4,580 tons of gold bullion stored at Fort Knox still exists. Over the last two days, secrecy surrounding the U.S. gold reserves has caught the attention of Elon Musk, after his interaction with the account ZeroHedge, and a call out to DOGE and Musk from political commentator Mario Nawfal, blew it up for the world to see on X. America’s newly formed DOGE – who is making auditing of agencies into a game of sorts – has been doing the rounds on all government departments. Scottsdale Mint CEO Josh Phair who broke news weeks ago about gold being repatriated to the US in record form from Europe, was one of the first to raise the recent discussion for a Fort Knox audit.

The last official audit for Fort Knox was in 1974 – infamously known as the ‘show audit’ where politicians and reporters posed with gold bars for photographers and were allowed to peek briefly inside. Before that, the last major audit was in 1953. By this point, there had already been considerable pressure building to open the vault for civilian inspection to prove what the Fort held. And considering the gold belonged to the people – taken forcibly by the US government in 1933 – they had every right to know.

The whistle has been blown on Fort Knox’s gold stores since. Ed Durell spent 14 years of his life writing to over 1000 government and banking officials trying to get answers to how much Fort Knox gold was left and how much was gone; Edith Roosevelt – granddaughter of Teddy Roosevelt – petitioned the government about the gold stores in a 1975 edition of the Hampshire Sunday news; and President Ronald Reagan appointed a Gold Commission in 1982 to investigate the situation and report to Congress their findings. No one in Congress has been able to view the gold in 50 years.

Senator Ron Paul who has been working for years to get an audit of the Federal Reserve and was on Reagan’s Gold Commission, detailed in a speech currently going viral online that 15 of the 17 members of the then commission voted against auditing the gold. He is captured in a brilliant photo in the 70s with a demonstration of simulated ‘gold bricks’ on the back of a truck – a stunt to try to gain access to the vault to audit the reserves. In his words: ‘The gold should be in the hands of the people – you should be buying gold and holding gold.’

Speculation and theories have formed in response to the years of secrecy and lack of transparency about these gold holdings – that it has been sold, has been involved in gold swaps with foreign governments and bullion banks, rehypothecated or even been replaced with gold-plated tungsten – theories that the US Treasury and Mint have dismissed or ignored rather than addressing them and providing substantive information to counter them. Republican Senator Rand Paul who is also calling for government transparency and an immediate auditing of Fort Knox, now seems to have the support of Musk. Add that to a growing online chorus over the last 2 days as the public wakes up to the fact that 50 years have passed without anyone so much as seeing the gold or any having serious questions about it being answered.

Fortunately, or unfortunately, it has taken someone such as Musk, who has a big enough presence and is seemingly invested in exposing financial misconduct, to listen to the calls and draw attention to the absolute lack of transparency from the US government – that we may finally see an audit of the Knox gold. Musk posted only hours ago – ‘It would be cool to do a live video walkthrough of Fort Knox!’ Goldfinger GIFs and memes ensued, as did a sizable buildup about the DOGE team auditing Fort Knox in real time for the public to see.

It’s amusing to consider that the gold reserves in Fort Knox have been without an audit since Ainslie has been in business. Ainslie customers can most assuredly take comfort in the fact that our gold is physically present in our vaults, backed ounce for ounce and that we can deliver on each of those ounces for every customer that we custody for.

If Fort Knox is empty, or the US owns far less gold than they say they do, it would trigger financial shock for the entire economic landscape and spark a catastrophic crisis of confidence in the US government, a tidal wave for the markets that no legacy media would be unable to deflect. Online discussion is on fire as we all wonder whether this could truly be possible if we can finally find out if the gold remains there – and if not – what has happened to it. The DOGE team will undoubtedly do what they seem to be gaining a reputation for – busting down the doors of government departments and getting right to the business following paper trails and firing federal employees.

Regards,

JMP Securities Team

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Email: lars.mortensen@jmpmarkets.com

Ph: +675 7200 2233

Mobile: +675 7056 5124

Email: nathan.chang@jmpmarkets.com

Ph: +675 7167 3223

Mobile: +61 422 113 630