15 April, 2024

Hello and welcome to this week’s JMP Report,

On the equity front we saw 4 stocks trade on the local market.

BSP traded 3,812 shares, closing 3t higher at K16.15, KSL traded 120,655 shares, closing 5t lower at K2.90, NGP traded 2,581 shares, closing steady at 69t and CCP traded 2,500 shares, closing 1t higher at K2.12.

WEEKLY MARKET REPORT | 7 April, 2024 – 11 April, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2023 INTERIM | 2023 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 3,812 | 16.15 | 16.15 | – | 0.03 | 0.19 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 120,665 | 2.90 | 2.95 | 2.97 | -0.05 | -1.72 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | PA |

| STO | – | 19.36 | 19.36 | – | – | 0.00 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.15 | 1.11 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | 2,581 | 0.69 | – | – | – | 0.00 | K0.0.3 | – | – | – | – | – | – |

| CCP | 2,500 | 2.12 | 2.12 | – | 0.01 | 0.47 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | – | – | – | – | – | – |

– | – |

– | – | – | – |

| SST | – | 45.00 | 36.46 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | – | – | – | NO |

Dual Listed PNGX/ASX

BFL – 5.79 -9c

KSL – .95c +6c

NEM – 60.27 +3.58

STO – 7.81 +12c

Interest Rates

Last week we saw the 7 day Central Bank Bill market remain steady with the liquidity remaining at 1.9mill issuing at 2%. In the TBill market we saw further weakening in the 364 day TBills, averaging 3.47% +8bpts with 235mill on offer. The Bank received a total of 248mill in bids and issued 226mill. We should see the next GIS announcement possibly see an announcement this week.

Other assets we monitor

Gold – 2,359 – +$118

Silver – 28.06 +$3.09

Platinum 977.50 +$77.50

Palladium – 1,050m +$51

Bitcoin 65,101 -6%

Ethereum 3,157 -7.8%

What we’ve been reading this week

What Is Hydrogen And Why Is It Revolutionising Energy

There’s no need to have a deep education in organic chemistry to understand the importance of hydrogen and the way it’s shaping the future of energy.

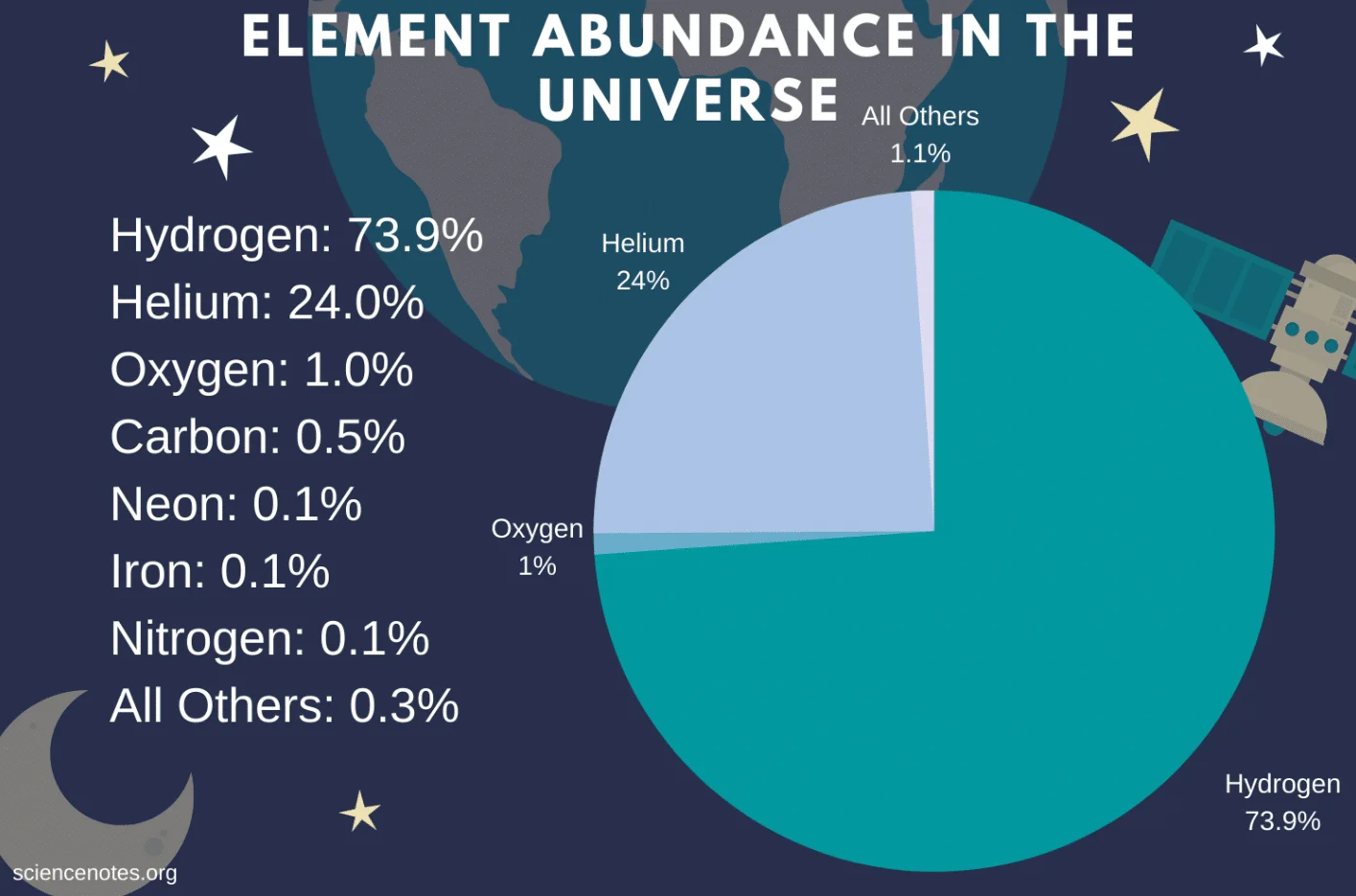

Hydrogen is the lightest and most abundant atomic element in the universe.

The reason for this goes back to the Big Bang – the theory on how the universe was created.

The Big Bang quickly led to the formation of protons, neutrons, and electrons. And since hydrogen is the simplest element, it formed most quickly.

In fact, the sun and other stars are essentially giant balls of hydrogen and helium gases.

Hydrogen is colorless, odorless, non-toxic, and highly flammable.

Most importantly, the earth is riddled with hydrogen.

It can be found in a wide range of compounds – from oxygen in water (H2O) to hydrocarbons like petroleum and natural gas.

Best of all, hydrogen is considered an ‘energy carrier’ rather than an energy source itself because it needs to be produced from other substances.

But once it’s produced and used as a fuel, it does not produce harmful greenhouse gas emissions, such as carbon dioxide (CO2), or other harmful pollutants like methane or sulfur dioxide.

- The only byproduct that enters the atmosphere during hydrogen combustion is water vapor, making it a clean alternative to fossil fuels.

Hydrogen also has a high energy content per unit of mass, which makes it an attractive option for energy storage and transportation.

It can store more energy in a smaller volume compared to conventional batteries, making it suitable for applications where space and weight are critical factors.

This is what makes Hydrogen ideal as a source of energy.

It can be used in various applications – such as powering fuel cell vehicles and combustion engines.

- In fuel cells, hydrogen reacts with oxygen to produce electricity – making it a clean power source for transportation, industrial capacity, and providing electricity in homes.

So while hydrogen itself is a great source of energy, producing it comes with a catch…

Not All Hydrogen Is Created Equally: The “Good Kind” Vs. The “Bad Kind”

Even though hydrogen is a special and abundant element, it doesn’t exist by itself in nature.

As mentioned above, it has to be produced by separating it from other things it’s found in – like water, plants, and fossil fuels.

There are different ways to produce hydrogen, and some are cleaner than others.

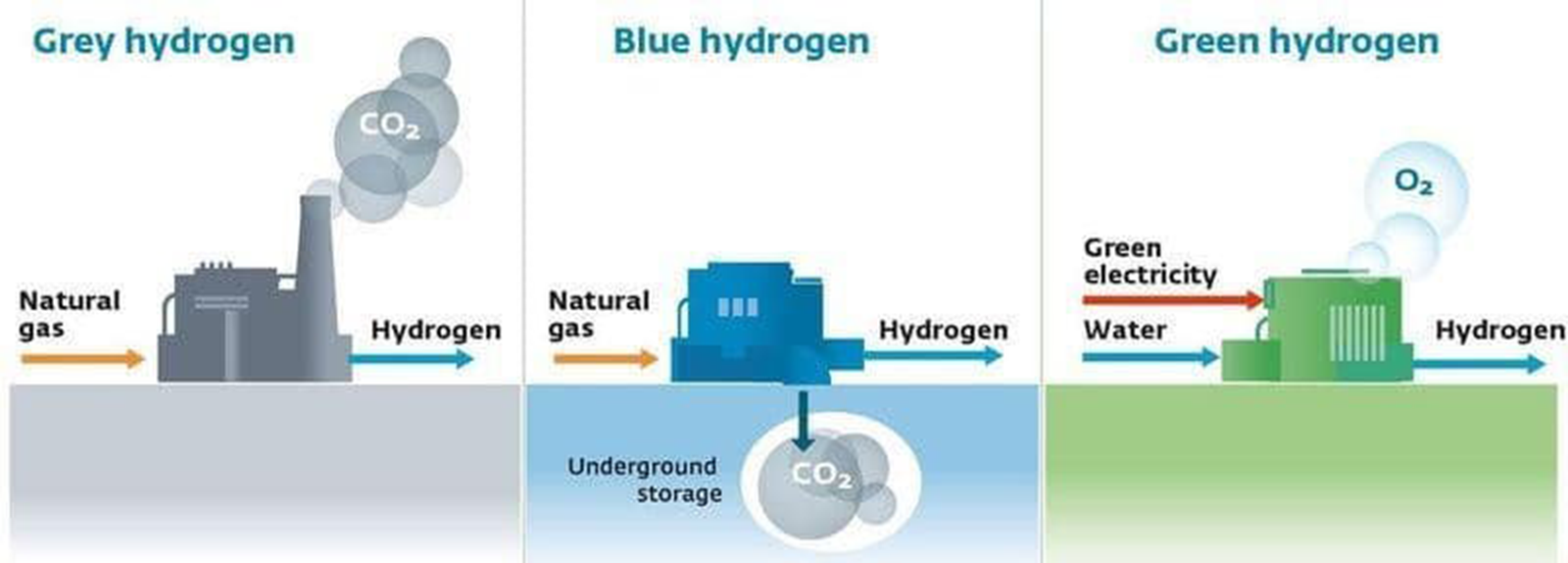

- “Green” hydrogen is the cleanest. It’s made by splitting water into hydrogen and oxygen using renewable energy like solar and wind. No harmful CO2 is released into the ai

- “Blue” hydrogen is made from natural gas or fossil fuels, but the CO2 it produces is captured and stored, so it doesn’t harm the environment as much.

- “Grey” hydrogen is the least clean. It’s made using natural gas or methane, and the CO2 is released into the atmosphere, which is not good for our planet.

Right now, most of the hydrogen we produce is “grey” (roughly 95%), and it creates a lot of harmful emissions that flow into the atmosphere and accelerating climate change.

That’s why “green” hydrogen production and infrastructure is ramping up as a zero-emissions alternative.

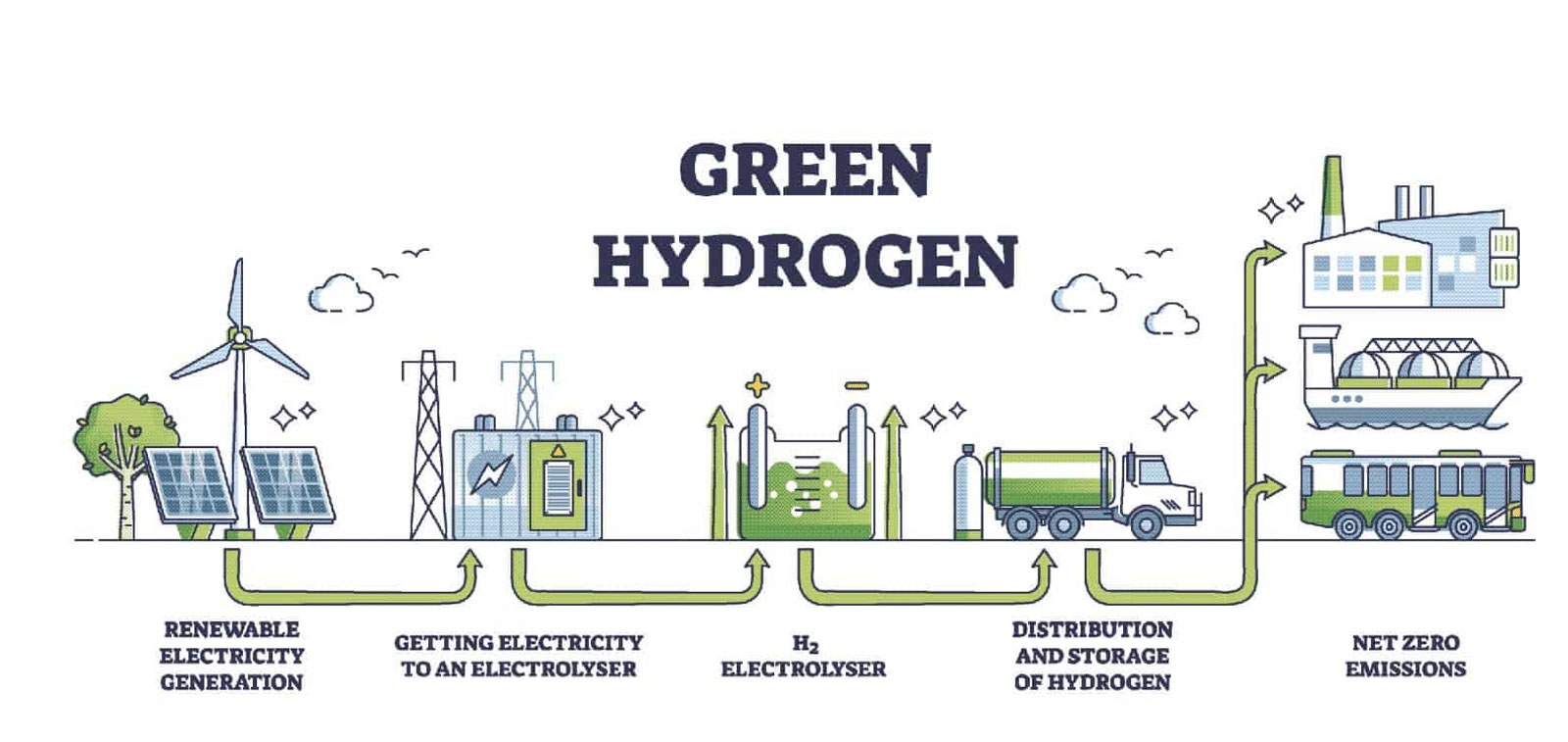

Put simply, green hydrogen is produced cleanly through a process known as electrolysis.

Here’s how it works:

- During the electrolysis process, electricity from renewable sources – like solar or wind turbines – is used to split water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2). This happens when an electric current is passed through the water, causing the hydrogen atoms to separate from the oxygen atoms.

- The separated hydrogen gas is collected and stored for later use.

- The oxygen that is produced during electrolysis is also collected, but it can be released into the atmosphere without causing any environmental harm since it’s just pure oxygen.

Green Hydrogen: Energizing The Race Towards Net-Zero

Governments around the world have pushed for a ‘net-zero’ environment by 2050 – meaning the balance between the amount of greenhouse gas (GHG) that’s produced and the amount that’s removed from the atmosphere.

And because of this zero-emission and powerful renewable energy source that green hydrogen offers, governments and corporations around the world have realized they cannot hit their climate change goals without it. And these goals are ambitious.

- According to the United Nations, more than 70 countries, including the biggest polluters – China, the U.S., and the EU – have set a net-zero target, covering about 76% of global emissions.

- More than 3,000 businesses and financial institutions are working with the Science-Based Targets Initiative to reduce their emissions in line with climate science.

- And more than 1000 cities, over 1000 educational institutions, and over 400 financial institutions have joined the “Race to Zero”, pledging to take rigorous actions to halve global emissions by 2030.

Because of this, governments have aggressively pushed incentives and subsidies to push green hydrogen infrastructure and production.

The Green Hydrogen Market Is Still In The Early Stage – But Growing Quickly

It’s clear that the current path is to move from grey hydrogen green hydrogen.

Major countries around the world have set up green hydrogen policies to make sure it grows fast enough to help achieve the net-zero goals.

For example, over the last couple of years we’ve seen the:

- USA: Inflation Reduction Act

- EU: Green Deal

- UK Hydrogen Strategy

- Canada’s National Hydrogen Strategy

- Japan’s METI: Committed to H2 within transportation, industry, and power production.

- India’s National Hydrogen Mission

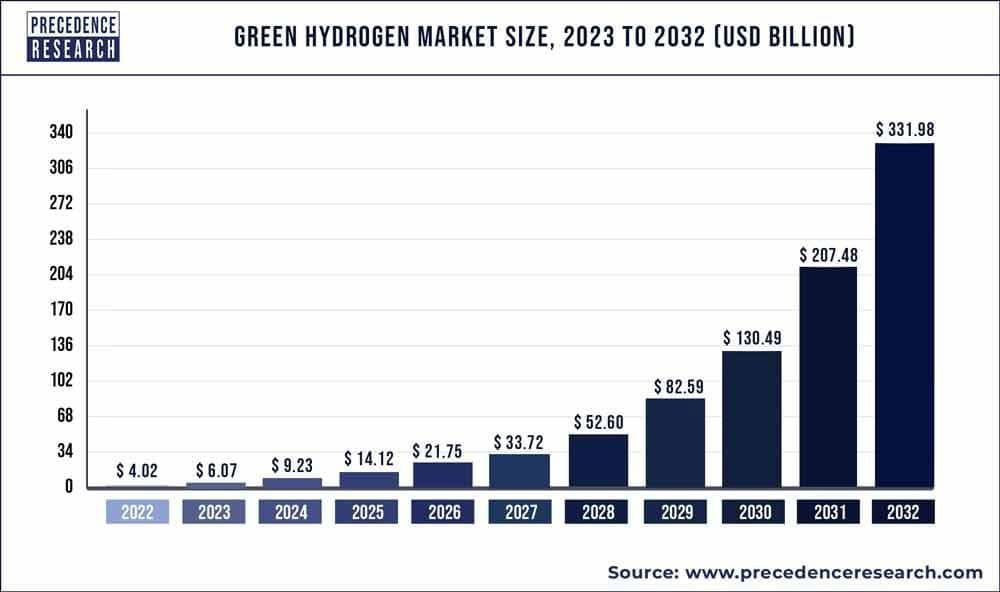

And on the back of all these subsidies, the global green hydrogen market is poised to grow at a compounded annual growth rate of 54.98% between 2023 to 2032 – from $4.02 billion in 2022 to over $331.98 billion by 2032.

But all this growth requires much more green hydrogen infrastructure and investment.

Producing it is one thing, using it is another.

The entire hydrogen supply chain requires trillions in capital to scale it appropriately – from transportation and refueling stations to distribution and storage.

In fact, Goldman Sachs believes the world must invest over $5 trillion in green hydrogen supply-chains to reach net-zero targets to supply the huge demand for hydrogen (which is expected to rise 9x by 2050).

” src=”cid:image006.png@01DA8F0A.99530250″ alt=”image006.png” border=”0″ class=”Apple-web-attachment Apple-edge-to-edge-visual-media Singleton” style=”width: 8.7083in; height: 3.8583in; margin: 0px -140.5px; opacity: 1;”>

Goldman Sachs also noted that green hydrogen is the “next frontier of clean technology.”

This is an incredible amount of investment flowing into the rapidly growing sector.

And it’s only the beginning as macro-and-micro fundamentals switch gears towards hydrogen as a clean energy source.

Disclosure: Owners, members, directors, and employees of carboncredits.com have/may have stock or option position in any of the companies mentioned: FHYD

Carboncredits.com receives compensation for this publication and has a business relationship with any company whose stock(s) is/are mentioned in this article

Additional disclosure: This communication serves the sole purpose of adding value to the research process and is for information only. Please do your own due diligence. Every investment in securities mentioned in publications of carboncredits.com involve risks which could lead to a total loss of the invested capital.

USD vs Gold – Shocking Chart

Posted 12/04/2024- Ainslie News

Gold just reached a new all-time-high and U.S. stocks bounced back as worries about inflation eased slightly following a report showing only a slight increase in producer prices for March. This helped offset concerns caused by higher-than-expected consumer price gains earlier in the week.

Earlier this week, we discussed if a $7,700 USD gold price could be plausible in the next two years. Gold has continued to reach new all-time-highs every day this week in Australia, despite “looking high”.

In the last trading day, both the Nasdaq Composite and the S&P 500 closed higher, held up by the data indicating less pressure on prices from the producer side – so relief looking forward on CPI. Investors also found relief in the outcome of a $22 billion sale of 30-year Treasuries. This is nothing groundbreaking, but it didn’t signal a significant decline in demand for U.S. government bonds. This contrasted with late 2023 when weak auctions contributed to a sharp rise in yields, which scared investors out of the stock market.

Market sentiment now depends on the Federal Reserve’s response to persistent inflation alongside solid economic growth. Prior to Wednesday’s consumer price data, expectations were for three 25 basis point rate cuts this year. However, now traders are factoring in only two cuts, reflecting a more cautious outlook.

The Nasdaq outperformed other major indices, climbing by 1.7%, driven largely by gains in the technology sector, while financials lagged. Attention now turns to the upcoming earnings season, with three major U.S. banks – JPMorgan Chase & Co, Citigroup Inc, and Wells Fargo & Co – set to report their first quarter results on Friday.

Take a look at the shocking chart below of how the U.S. Dollar has been performing against gold.

Which answer do you think is most correct?

- A) Holding interest rates higher for an extra month or two will fix everything.

- B) One less cut this year should fix everything.

- C) The micro-detail of one rate cut happening this month or that month will do almost nothing in stopping the exponential devaluation of the currency.

USD VS Gold – 1960s to now

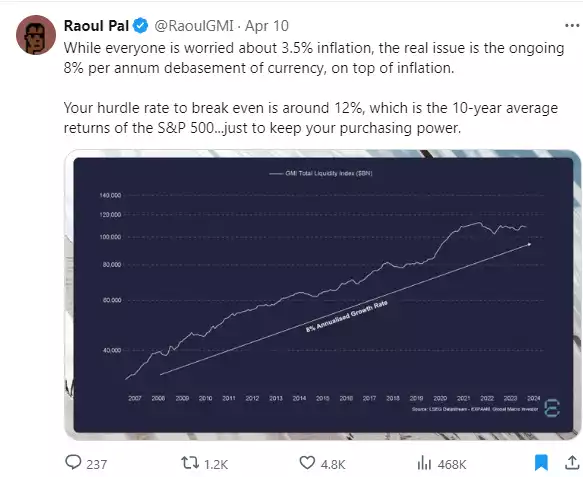

Global Macro Investor and Real Vision chief Raoul Pal puts it another way (tweet below) but either way this screams a huge problem ahead and one gold and silver are the perfect, historically proven assets to hold right now at this point and for some considerable time ahead…

3 Work Trends – Issue 14 – World Economic Forum

April 9, 2024

Employee health drivers, skills-first hiring and AI’s role in creative thinking – these are the stories covered in this issue of the World Economic Forum’s 3 Work Trends newsletter, your guide to the future of work and education in an ever-changing world.

1. The six drivers of employee #health every employer should know

When employees thrive, businesses thrive and so do the societies in which they operate, write the authors of a new article from McKinsey & Company.

When companies invest in employee health and well-being they report increased productivity, reduced absenteeism and better talent attraction and retention.

Research from the McKinsey Health Institute has identified 23 drivers of health, including six key factors that employers should support their workers with.

From encouraging social interaction to fostering better sleeping habits, here’s how employers can improve employee health and, at the same time, create trillions of dollars of economic value around the world.

Learn more here, in this article from McKinsey’s Jacqueline Brassey, Lars Hartenstein, Patrick Simon and Barbara Jeffery.

2. Why #skills need to be the currency for the labour market

LinkedIn’s Sue Duke says that a skills-first approach to hiring is essential if we are to tackle gender inequality in the workplace.

Traditionally, hiring decisions have been made based on previous experience or education.

This skills-first approach should open up more senior roles to women, as their skills, not their experience, will be the defining factor in the hiring decision.

Watch the full video here.

3. Will #AI help or hinder our #creative expression?

Since the release of ChatGPT in November 2022, generative AI has transformed the world of work.

In creative industries opinions on the technology, and the impact it’s set to have, are especially varied.

Radio Davos sat down with Nile Rodgers, the creative force behind disco pioneers Chic, and some of the best-known songs of David Bowie, Madonna and Beyoncé.

Thank you to the World Economic Forum’s 3 Work Trends newsletter, your weekly guide to the future of work and education.

I hope you have enjoyed this week’s read. Thought for the week.. Do you have a Will?

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814