3 June, 2024

Hello and welcome to this week’s JMP Report,

On the equity front, last week we saw 2 stocks trade on the local market. BSP traded 11,844 shares, closing 4t higher at K16.86 and KSL traded 45,619 shares, closing 1t higher at K2.97.

WEEKLY MARKET REPORT | 21 May, 2024 – 25 May, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2024 INTERIM | 2024 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 11,844 | 16.86 | 16.86 | – | 0.04 | 0.24 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 45,619 | 2.97 | 2.97 | 3.00 | 0.34 | 0.34 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | YES |

| STO | – | 19.37 | 19.37 | – | – | 0.00 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | – | 1.25 | 1.16 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | – | 0.70 | – | – | – | 0.00 | K0.03 | – | – | – | – | – | – |

| CCP | – | 2.16 | 2.15 | – | – | 0.00 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | 0.79 | – | 0.79 | – | 0.00 | – | – | – | – | – | – | – |

| SST | – | 45.00 | – | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | WED 24 APR 2024 | FRI 26 APR 2024 | FRI 26 JULY 2024 | NO |

Dual Listed PNGX/ASX Stocks

BFL – 6.49 +24c

KSL – 945c +2c

NEM – 62.45 -6c

STO – 7.63 -4c

Interest Rates

On the interest rate front we saw the Bank take 2.483b out of the system, this is in line with current policy. In the TBill auction, we saw the 364 day rates drift out a further 4bpts to 3.92%. Expect the 364-day rates to continue to drift out further, and we could possibly see over 4% soon. The Bank is showing its control on the rates with 253mill being offered and issued 369mill after receiving 436mill in bids.

In line with Treasury planning, Bank PNG will hold another GIS auction this month and details will be communicated when at hand.

Fincorp and Credit Corp are offering 2.35% for 12mth TD money.

Other Assets we like to monitor

Gold – 2326 -$8

Silver – 30.44 +10c

Palladium – 914 -$52

Platinum – 1,038 +$10

Bitcoin – 67,855 flat

Ethereum – 3,780 -1%

What we have been reading

Water engine on the move for the first time in history: better than hydrogen and breaks power records

by D. García

- Credits: ecoticias.com

This motorcycle engine uses a fuel that was illegal: no electricity, no gasoline, but extremely powerful

This futuristic non-hydrogen engine has the world in suspense: 780 hp with turbocharger

Goodbye to hydrogen with this high-speed engine: a strange fuel not known in America

Leaving out conventional hydrogen in a context of energy transition is difficult, but there is a water engine that has succeeded (at least partially). It breaks power records. The car with two H engines was amazing, but what is coming next is no slouch either. In the context of the decarbonization of the economy that we are going through, H has become a resounding protagonist.

The production of H for energy purposes is a topic of global interest. In fact, in recent years there has been a lot of talk about green H as a strong energy bet. Investment in its production is increasing globally. In the case of Spain, for example, 20% of the world’s new H projects were cornered during the first quarter of 2022.

According to Wood Mackenzie data, by the end of 2022, projects linked to this element raised their production by a total of 11.1 million tons per year. What does this water engine have to knock out such a widespread form of energy?

Water engine: a record that no one expected, but everyone wants

In fact, it does not reject hydrogen altogether, but uses it to its advantage. The Austrian company AVL Racetech has developed a powerful hydrogen combustion engine. An invention that demonstrates that this type of model can boast high performance and be used as an alternative to electric vehicles.

In addition, it has potential for use in racing cars. It has appeared as a result of the union of engineers from AVL Racetech and the HUMDA laboratory in Hungary. Its innovative hydrogen combustion engine has a new feature that makes it special: a water injection system. With this addition, the power problem traditionally associated with this type of engine is solved.

How does the water engine that is revolutionizing the hydrogen market work?

The Port Fuel Injection or PFI inserts traditional water into the engine’s air intake system, which prevents premature ignition that could damage the part and achieves stoichiometric combustion. Translated, this means that the resulting proportions of air and fuel are more or less fixed.

This, the company explains, highlights the potential disadvantages of lean-burn engines. The result of this extensive work has been a two-liter hydrogen engine that produces 410 hp and 500 Newton-meters of torque between 3,000 and 4,000 revolutions per minute, achieving a specific power density of approximately 205 hp per liter (150 kW per liter).

AVL guarantees, based on actual tests, that the engine will be able to compete in top-level motor racing. “The results obtained by our H2 racing engine confirm that we are able to offer an extremely competitive package with this technology,” says AVL Motorsport Director and former professional racing driver Ellen Lohr.

She also warns that the company’s goal is to bring motorsport closer to sustainability.

Is hydrogen suitable for racing cars? This water engine may be the way

Hydrogen combustion engines are good for much more than racing. They can also help smooth the transition to zero-emission vehicles. In this way, the simplest and most abundant chemical element on Earth takes another step into the automotive world.

Those who have always believed in the potential of hydrogen see the water engine as a symbol of victory. It displaces the conception of H in vehicles that we have had up to now. If you’re fascinated by the H-range, you can’t miss what’s happening on the highways – the first H-roads are coming!

An update on global inflation

Econosights

Diana Mousina, Deputy Chief Economist, AMP

27 May 2024

Key points

– Global growth has picked up in early 2024, and is broadening out, after being dominated by the US last year.

– Better global growth is lifting commodity prices, along with other factors like heightened geopolitical concerns and central bank demand for commodities like gold.

– Higher raw materials prices are an upside risk to inflation. If inflation starts rising again, central banks will be forced to delay cutting interest rates or even start hiking again which would be negative for sharemarkets.

– But the current rise in commodity prices has occurred predominantly in metals, which don’t always flow through to inflation. After reaching record highs in recent weeks, gold and copper prices have fallen.

– We expect that most major central banks will be cutting interest rates by the end of the year as inflation slows and economic growth is low.

Introduction

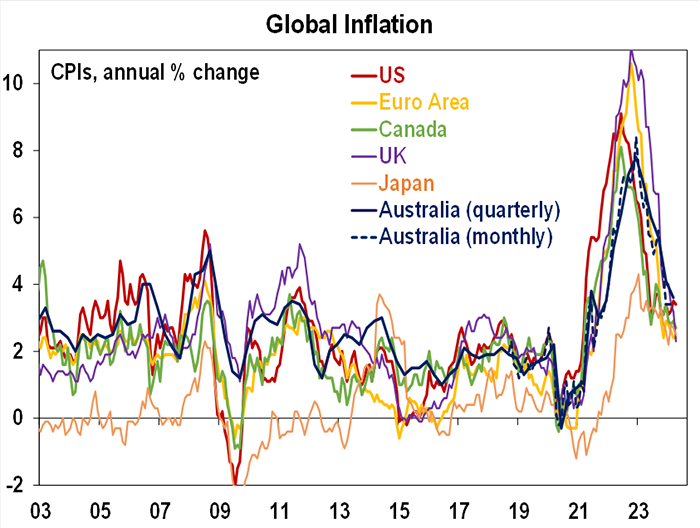

The release of global PMI indicators recently indicated that global growth is ticking up and broadening out around the world, after being dominated by the US in 2023. Stronger global growth (as well as other factors like geopolitical concerns) are lifting commodity prices, which is causing renewed concern about the inflation outlook and leading to financial markets pushing back expectations for rate cuts. Global headline inflation has fallen significantly from its 2022 highs (see the chart below) and is running between 2.5%-3.5% across major economies. But, core inflation is still too high, and has been slower to decline. In this Econosights we look at the impact of stronger global growth on the trajectory for inflation.

Source: Bloomberg, AMP

Global growth and commodity prices

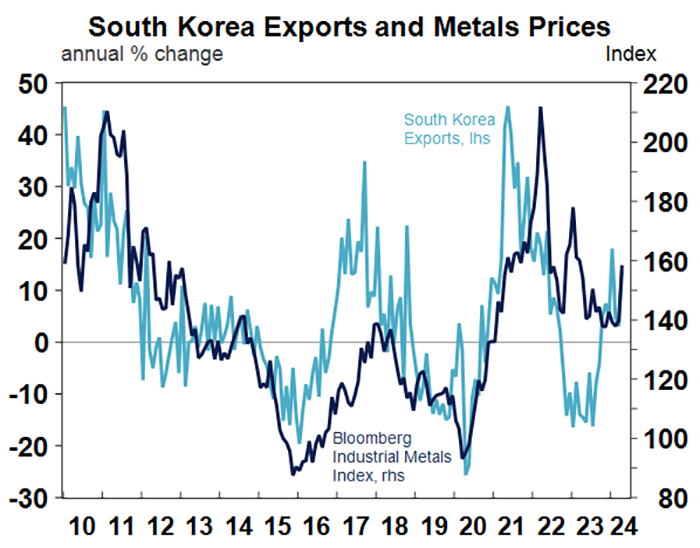

The tick-up in global growth is one explanation for the increase in commodity prices, through the associated lift in demand, particularly for heavy industries. South Korean exports are often considered a bellwether for global growth (because of the high share of semiconductors, chips and motor vehicles and accessories) and have been increasing in early 2024. This has occurred alongside a pickup in industrial metals prices (see next chart).

Source: Macrobond, AMP

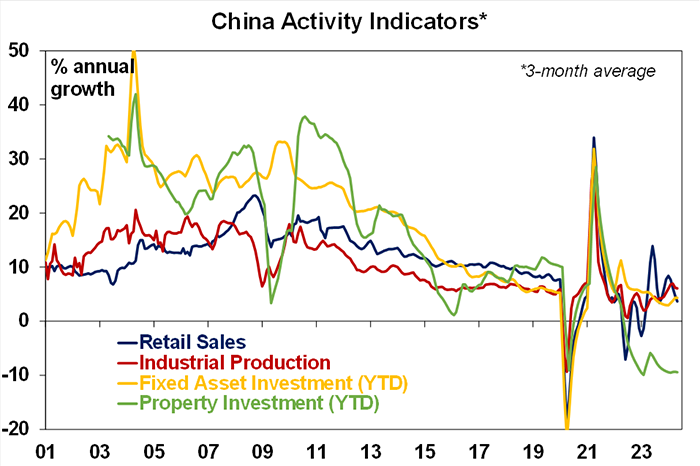

Despite a lot of negative headlines and concerns around Chinese GDP growth (particularly with regards to the property sector), industrial production has held up in China (see the chart below), and industrial metals demand from China accounts for around 40-60% of global industrial metals demand. This reflects the strong growth in areas like solar panels, electric cars, airplanes and infrastructure construction.

Source: Bloomberg, AMP

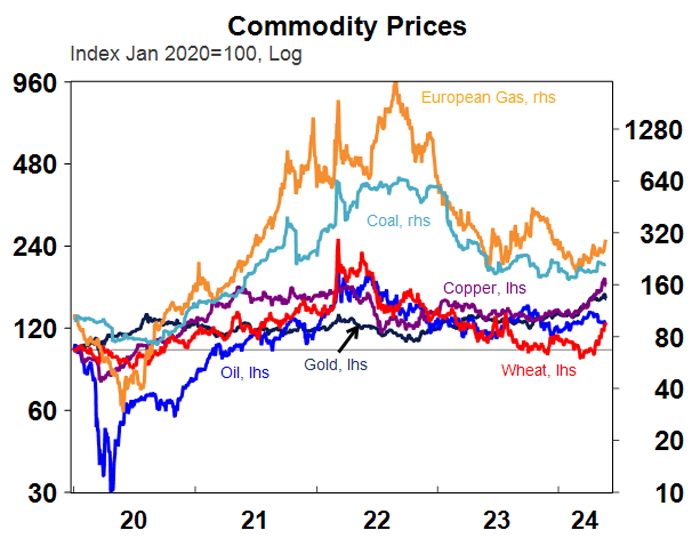

The lift in metals prices has occurred in copper (around a record high), gold (around a record high), aluminium, nickel and silver. But, other commodity markets have also seen a lift, including gas, corn and wheat (due to poorer Russian crop prospects). Oil prices are around $80USD/barrel, down from their highs of ~$90USD/barrel in early April.

Source: Macrobond, AMP

Other explanations for the rise in commodity price include a heightened geopolitical climate (with increasing threats in the Middle East) which usually lifts gold prices (typically seen as a safe haven), central banks buying gold or selling out of US treasuries and purchasing gold and expectations for lower interest rates through this year which decreases the opportunity cost of holding gold and also boosts growth prospects in the future.

Commodity prices and inflation

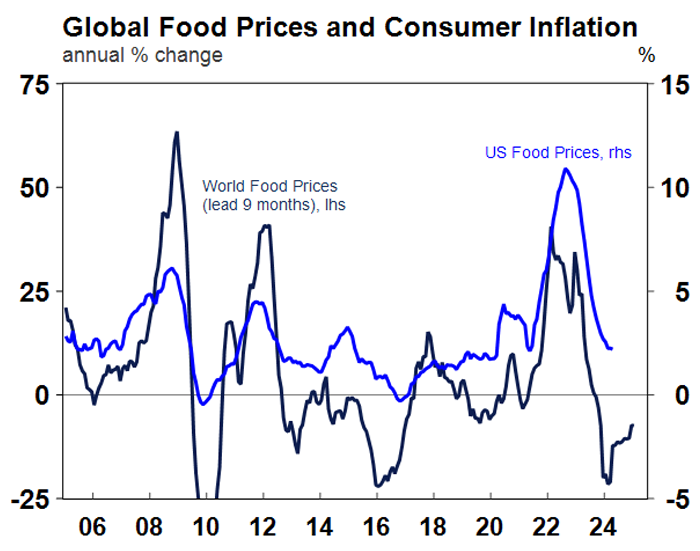

The broad fall across commodity prices in 2023 led to lower goods prices and helped to reduce inflation. So, if the recent tick up in commodity prices is sustained, it is an upside risk for inflation, as raw materials are used in production for many items, especially food. US food inflation has remained elevated (see the chart below) despite a steep fall in world food prices (although the chart below indicates that food prices should fall further).

Source: Macrobond, AMP

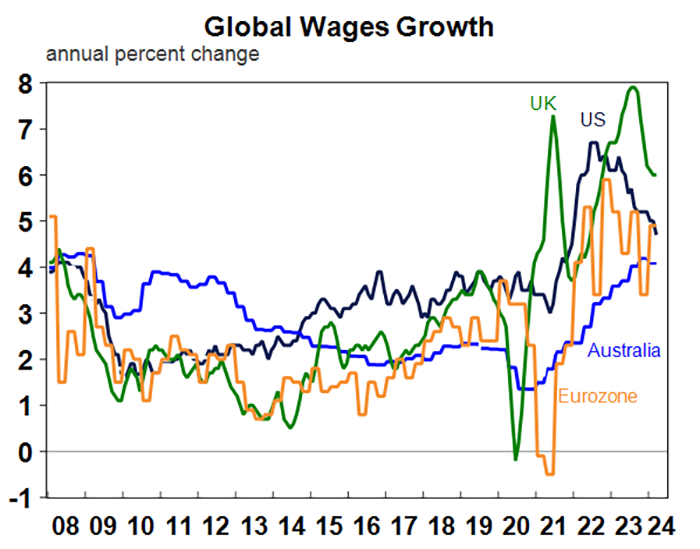

However, the current economic backdrop is quite different to 2022. Across major economies like the US and Australia, multiple rate hikes have weakened the consumer. This is particularly evident in Australia with the faster cash flow transmission from the interest rate set by the central bank to the outstanding mortgage rate paid by households, with consumers drawing down on their accumulated savings. As a result, even if producer prices rise due to higher raw materials, they may not be able to pass on these prices as easily to consumers. As well, wages growth is slowing around the world (see the next chart) and should offset any potential rise in inflation as a result of higher commodity prices. Lower wages growth is needed to reduce services inflation. Although, wages growth still needs to decline further to be back to around 3-3.5%, to be closer in line to central bank inflation targets.

Source: Macrobond, AMP

Implications for investors

We have been expecting inflation to decline further in 2024. The lift in commodity prices is an upside risk to our inflation projections but it’s too soon to be certain that higher raw materials prices will be sustained or passed on to consumers. Global growth improved in early 2024, but the US economy is weakening, China still faces many issues in its property sector and many advanced economies are being negatively impacted by high interest rates. So, the stronger growth backdrop since the start of the year probably doesn’t have much further to rise. We see the current macroeconomic environment as being quite different to 2021/22. In the immediate post-COVID period, producers were able to pass on higher raw materials prices to consumers because consumer demand was strong. But now, growth is softer and consumers are in a weaker position after numerous rate hikes and the draw-down on their accumulated savings. As a result, we expect that there is further downside to inflation and we expect most major central banks to be cutting interest rates by the end of the year. But, the slow progress on reducing services inflation means that any rate cuts will be minimal and central banks will be slow to unwind prior interest rate increases (unless there is a growth downturn or a recession!).

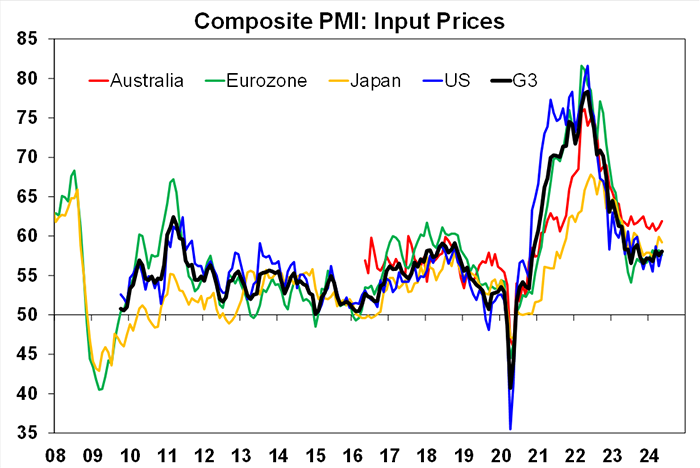

Something for investors to watch are the price indicators in the PMI surveys which are a good leading indicator for inflation. Input prices have mostly been stable in recent months, but it would be good to see some further downside from here.

Source: Bloomberg, AMP

Investors Increasing Focus on Climate Solutions and Transition Strategies: Robeco Survey

INVESTORS/ REPORTS, STUDIES

Mark Segal May 29, 2024

Investors are shifting the focus of their climate investing strategies, with the majority looking to allocate funds to climate solutions and to strategies focused on ‘brown-to-green’ companies transitioning to lower emissions, according to a new survey released by international asset manager Robeco, which also found growing regional disparities in attitudes towards climate change, with North American investor interest lagging increasingly far behind their European and Asia Pacific peers.

For the study, “Global Climate Investing Survey 2024,” Robeco surveyed 300 institutional and wholesale investors across North America, Europe and Asia Pacific, at organizations ranging from insurance companies, pension funds and private banks, to endowments and foundations, sovereign wealth funds, and family offices, collectively representing nearly $29 trillion in assets under management.

Overall, the survey found that while the majority, 62%, of investors reported that climate change is a central or significant part of their investment policies, this figure declined from 71% last year. The decline was driven primarily by a sharp drop among North American investors, declining to only 35%, from 61% in the prior year, while European more than three quarters of European investors describe climate change as significant or central to their investment policies, dipping slightly from last year, while Asia Pacific investors reported an increase to 79%, from 73%, surpassing their European peers for the first time.

The regional differences were similarly reflected in the investors’ policies and actions, with the proportion of investors with public commitments to achieve net zero in their portfolios by 2050 falling to 13% from 19% last year in North America, while remaining stable at 37% in Europe, and growing to 26% from 20% in Asia Pacific. Similarly, 55% of North American investors reported that they are not taking any climate-related engagement action with portfolio companies, compared to only 22% of European and 26% of Asia Pacific investors, as an anti-ESG backlash in the U.S. has led to increasing investor caution on the topic.

Notably, the survey found that investors in every region expect to see a sharp increase in focus on climate change going forward, with 77% overall – including well over half of North American respondents – reporting that they expect climate change to be a significant or central part of their investment policies over the next 2 years.

The survey also provided insight into investors’ evolving approach to climate-related investing, with a growing interest in investments in climate solutions and transition strategies. Nearly half (48%) of respondents reported that they are currently allocating to funds that invest in climate solutions, with another 25% planning to do so over the next two years. Additionally, while only 37% reported that they currently invest in strategies targeting high-emissions companies with credible transition plans to lower carbon emissions, another 26% said that they plan to do so over the next two years.

Lucian Peppelenbos, Climate and Biodiversity Strategist at Robeco, said:

“The transition among corporates and others from brown to green, as they decarbonize, cannot take place without the active involvement of investors, rewarding those making the change and withdrawing support from the unwilling or reluctant.”

Notably, the survey found that insurance companies, which Robeco said tend to be early adopters of climate investing approaches, were the most likely to already be allocating to climate transition strategies, at 47%, with another 27% planning to.

The survey also examined the investors’ approaches to investing in transitioning companies, with 45% reporting investing in active equity strategies specifically targeting transition-oriented companies, and 43% investing in green or sustainability bonds.

In the report, Mark van der Kroft, Chief Investment Officer, said:

“Transition finance is essential, not only for green projects like solar panels and wind farms but also to support businesses and industries that need to transition to cleaner technologies and increased energy efficiency over time. Companies preparing for a low-carbon future will be better positioned for long-term success and profitability.”

Mark Segal – ESG Today

I hope you have enjoyed this week’s report. Please do reach out if you would like to discuss your investment journey and how we at JMP can assist you.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814