8 July, 2024

Hello and welcome to this week’s JMP Report,

Last week saw 6 stocks trade on the local market. BSP traded 1,176 shares, closing steady at K17.50, KSL traded 148,607 shares, closing steady at K3.05, STO traded 133 shares, closing 1t higher at K19.39, KAM traded 2,000 shares, closing steady at K1.25, NGP traded 2,272 shares. closing 1t higher at K0.70 and CCP traded 1,595 shares, closing 4t higher at K2.20 per share.

WEEKLY MARKET REPORT | 1 July, 2024 – 5 July, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2024 INTERIM | 2024 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 1,176 | 17.50 | 17.50 | – | – | 0.00 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 148,608 | 3.05 | 3.05 | – | – | 0.00 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | YES |

| STO | 133 | 19.39 | 19.50 | – | 0.10 | 0.51 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 2,000 | 1.25 | 1.25 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | 2,272 | 0.70 | 0.69 | 0.75 | 0.01 | 1.43 | K0.03 | – | – | – | – | – | – |

| CCP | 1,595 | 2.20 | 2.16 | – | 0.04 | 1.82 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | 0.79 | – | 0.79 | – | 0.00 | – | – | – | – | – | – | – |

| SST | – | 48.00 | 48.00 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | WED 24 APR 2024 | FRI 26 APR 2024 | FRI 26 JULY 2024 | NO |

Dual Listed PNGX/ASX

BFL – 6.45 steady

KSL – 94.5 +1.5c

NEM -65.00 +1.3

STO 7.99 +33c

On the interest rate front

In the 7 day Central Bank Bill Market, the bank took 2.1bn in maturities and liquidity out of the system at 2.50%, which is in line with current Monetary Policy guidelines. In the 364 day TBill market, the market was very soft with the auction average weakening 26bpts to 4.61%. The Bank offered 266mill with the market taking up 97mill only.

I can see the 364 rates over 5% shortly which will have a significant impact on the remaining GIS auctions for 2024.

Other Assets we like to monitor

Gold -2,387

Platinum – 1,028

Palladium – 1,027

Bitcoin – 56,605 -9.70%

Ethereum – 2,950 -14.25%

What we have been reading

World Bank Fuels India’s Carbon Market and Green Hydrogen with US$1.5B Boost

By Saptakee S

The World Bank approved $1.5B to boost India’s low-carbon energy. This operation aims to spark India’s green hydrogen market, expand renewable energy, and drive funding for low-carbon projects. The funding, announced on June 29 represents the second phase of the Low-Carbon Energy Programmatic Development Policy Operation.

Transforming India’s Renewable Energy Market with a US$1.5B Investment Plan

India, the fastest-growing enormous economy globally, is set to maintain its rapid expansion. To decouple this growth from emissions, scaling up renewable energy, particularly in hard-to-abate industrial sectors, is essential. This strategy aims to ramp up green hydrogen production and consumption, alongside accelerating climate finance to support low-carbon investments. Elaborating further, the second phase of US$1.5B is meant to transform India’s RE market by:

- Producing ~ 450,000 MT of green hydrogen and 1,500 MW of electrolyzers annually from the financial year 2025-2026. It will cover the costs of the latest technology required for green hydrogen production.

- Boosting renewable energy capacity by incentivizing battery energy storage solutions Additionally, it promotes renewable energy integration through incentives for battery energy storage and amendments to the Indian Electricity Grid Code. This is poised to reduce emissions by 50MTS annually.

- Advancing the development of a national carbon credit market.

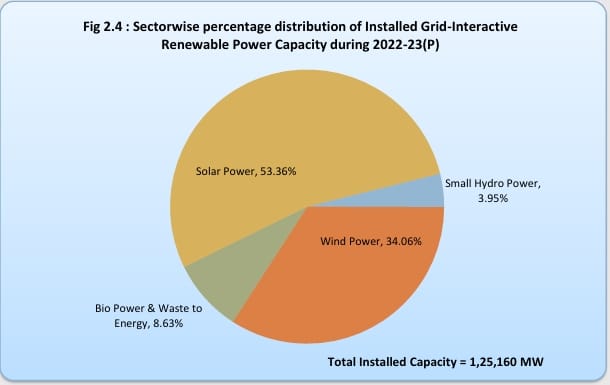

source: Energy Statistics India 2024

Auguste Tano Kouame, World Bank Country Director for India noted,

“The World Bank is pleased to continue supporting India’s low-carbon development strategy which will help achieve the country’s net-zero target while creating clean energy jobs in the private sector. Indeed, both the first and second operations have a strong focus on boosting private investment in green hydrogen and renewable energy.”

First Low-Carbon Energy Program Achievements

Last year (2023) in June, the World Bank approved the $1.5 B First Low-Carbon Energy Programmatic Development Policy Operation. According to the World Bank, this initiative facilitated transmission charge waivers for renewable energy in green hydrogen projects in India. It also outlined a clear strategy to launch 50 GW of renewable energy tenders annually and established a legal framework for a national carbon credit market.

Aurélien Kruse, Xiaodong Wang, and Surbhi Goyal, Team Leaders for the operation, jointly said,

“The operation is helping in scaling up investments in green hydrogen and in renewable energy infrastructure. This will contribute towards India’s journey for achieving its Nationally Determined Contributions targets.”

The executives also praised India’s efforts to establish a robust domestic market for green hydrogen, supported by a fast-growing renewable energy capacity. They noted that the first tenders under the National Green Hydrogen Mission’s incentive scheme have attracted significant private sector interest.

India’s Renewable Energy Landscape through IEA Lens

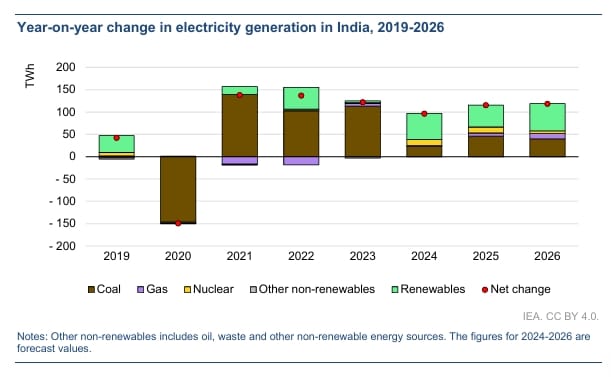

IEA’s 2024 release talks about the connection between India’s economy and renewable energy demand. India’s GDP grew by 7.8% in 2023, making it the world’s fastest-growing major economy and the fifth largest globally. Energy demand in India is expected to outpace all regions by 2050 due to urbanization and increased demand for electricity, cement, and steel. This reliance on imported fossil fuels could increase carbon emissions significantly. Hence, an urgency to curb emissions and become net zero by 2070.

India has scaled up solar and wind investments and promoted domestic clean energy manufacturing through the Production Linked Incentives scheme. The country also boasts of strong energy efficiency programs and a new hydrogen policy.

Latest media reports say that India entered the sovereign green bond market in January 2023, issuing bonds worth $1B. This has spurred clean energy investments, reaching $68B in 2023. Fossil fuel investment also rose to $33 billion. To meet the energy and climate goals, India needs to double clean energy investment by 2030. However, this would suffice with an extra 20% boost. Lowering capital costs is key to making this happen.

As of March 2024, India’s thermal power accounts for 56% of installed capacity, while renewable energy sources contribute 32%, hydroelectric power 11%, and nuclear power 2%. The World Bank has supported this transition with this huge loan.

- India’s goal is to build 47 GW/236 GWh of battery storage and produce 5 MMT of clean hydrogen by 2030.

- India also plans to achieve 40 GW of electrolyzer manufacturing capacity, 30 MMT of carbon capture, and 2 MMT of sustainable aviation fuels by 2030.

Overall, the World Bank funding can accelerate India’s commitment to surpassing 500 GW of renewable energy capacity by 2030. Further aiming to lead in advanced energy solutions. With energy giants like Tata, Adani, and Reliance, the country is close to achieving its energy transition goals.

Deutsche Bank Issues Inaugural €500 Million Social Bond

Mark Segal July 4, 2024

SUSTAINABLE FINANCE

Deutsche Bank announced today that it has raised €500 million through its first-ever social bond offering, with proceeds aimed at supporting the bank’s sustainable asset pool which provides financing for areas including affordable housing, and access to essential services for elderly or vulnerable people.

The issuance follows the publication earlier this year of Deutsche Bank’s Sustainable Instruments Framework, detailing eligible use of proceeds for green and social finance instruments issued by the bank, as well as the process used for asset evaluation and selection, management of proceeds, and reporting commitments.

According to the framework, proceeds from green and social instrument offerings eligible use of proceeds for social bond issuances are designated to assets within Deutsche Bank’s Sustainable Asset Pool, which is composed of loans and investments supporting the transition to a clean, energy-efficient, and environmentally sustainable global economy, and further societal progress. Eligible use of proceeds for social instrument offerings include financing and investments related to the development and provisioning of adequate and affordable housing for disadvantaged populations or communities, or to the promotion and enhancement of access to senior housing with special care.

In a post announcing the new issuance, Deutsche Bank said:

“With this milestone, we expand our ESG issuance programme, which began in 2020 with our first green bond issuance. With the issuance of green and now social financing instruments, we aim to contribute to the further advancement of the sustainable finance market and raise funds that match those we lend to our clients to achieve their goals in transforming their business in a climate-friendly and socially sustainable manner.”

Deutsche Bank announced a series of sustainable finance goals last year, including a target to enable a total of €500 billion in sustainable financing and investments between 2020-2025.

Thank you to ESG Today

Invesco Launches New Global Climate ETF with $1.6 Billion from Pension Insurer Varma

Susan Lahey July 2, 2024

INVESTORS/ NEW FUNDS & PRODUCTS

Global asset manager Invesco announced the launch of the Invesco MSCI Global Climate 500 ETF (KLMT), and new exchange traded fund providing exposure to companies meeting environmental and climate criteria and reducing greenhouse gas emissions.

The new ETF, trading on the NYSE, is being launched with a $1.6 billion investment by Finnish pension insurer, Varma.

Timo Sallinen, Varma’s Head of Listed Securities, said:

“We are very pleased to work alongside Invesco, one the world’s biggest asset managers, and MSCI, a leading global index provider, to create an ETF tailored to Varma’s systematic investment preferences. Our $1.6 billion investment in KLMT will help us meet our principles for responsible investing and gives us more flexibility for investing our €61 billion assets.”

The new ETF seeks to track the MSCI ACWI Select Climate 500 Index. According to MSCI, the index is designed to support investors seeking to reduce their exposure to the greenhouse gas emissions and increase exposure to companies with their emission reduction targets approved by Science Based Targets initiative (SBTi). The index selects constituents from its parent index, the MSCI ACWI ex Select Countries Index, through a process that aims to reduce weighted average greenhouse gas emissions (Scope 1 and 2) intensity relative to enterprise value including cash (EVIC) by 7% and relative to revenue by 10% on an annualized basis, and to increase weight in companies with SBTi-approved emissions reduction targets, in addition to applying other ESG exclusion criteria.

Brian Hartigan, Global Head of ETFs & Indexed Investments at Invesco said:

“The launch of KLMT is clear indication that sophisticated institutions are increasing their usage of ETFs for a variety of functions. We are excited to collaborate with MSCI to address the needs of one such investor and provide Varma with a US ETF that offers the precise strategy needed for their portfolio. Invesco is one of the few global asset managers capable of servicing clients who want customizable, cross-regional ETFs for exacting exposures.”

MSCI and Varma designed the index to ensure it captures constituents with one or more greenhouse gas emissions reduction targets that fit into Varma’s precise investment parameters with respect to energy transition.

Christine Berg, Head of Client Coverage, Americas at MSCI said:

“We are excited that Varma and Invesco have chosen the MSCI ACWI Select Climate 500 Index as the benchmark for the new Invesco MSCI Global Climate 500 ETF. This is a great example of how custom indexes can be used to support the unique views of large institutional investors.

Thank you to ESG Today

Have an awesome week, please feel free to reach out for your investment needs.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814