15 July, 2024

Hello and welcome to this week’s JMP Report,

On the equity front, last week we saw 6 stocks trade on the local market. BSP traded 3,303 shares, closing steady at K17.50, KSL traded 522,476 shares, closing 1t higher at K3.06, STO traded 1,053 share, closing 12t higher at K19.51, KAM traded 10,000 shares, closing steady at K1.25, NGP traded 19,000 shares, closing 5t at K0.75 and CCP traded 5,903 shares, closing 1t higher at K2.21.

WEEKLY MARKET REPORT | 8 July, 2024 – 12 July, 2024

| STOCK | QUANTITY | CLOSING PRICE | BID | OFFER | CHANGE | % CHANGE | 2024 INTERIM | 2024 FINAL DIV | YIELD % | EX-DATE | RECORD DATE | PAYMENT DATE | DRP |

| BSP | 3,303 | 17.50 | 17.50 | – | – | 0.00 | K0.370 | K1.060 | 8.87 | TUE 27 FEB 2024 | WED 28 FEB 2024 | FRI 22 MAR 2024 | NO |

| KSL | 522,476 | 3.06 | 3.05 | – | 0.01 | 0.33 | K0.097 | K0.159 | 8.82 | TUE 4 MAR 2024 | WED 6 MAR 2024 | MON 15 APR 2024 | YES |

| STO | 1,053 | 19.51 | 19.51 | – | 0.12 | 0.62 | K0.314 | K0.660 | 5.04 | MON 26 FEB 2024 | TUE 27 FEB 2024 | TUE 26 MAR 2024 | – |

| NEM | – | 145.00 | 145.00 | – | – | 0.00 | – | USD 0.250 | 0.63 | MON 4 MAR 2024 | TUE 5 MAR 2024 | WED 27 MAR 2024 | – |

| KAM | 10,000 | 1.25 | 1.25 | – | – | 0.00 | K0.12 | – | – | – | – | – | YES |

| NGP | 19,000 | 0.75 | 0.69 | 0.75 | 0.05 | 6.67 | K0.03 | – | – | – | – | – | – |

| CCP | 5,903 | 2.21 | 2.22 | – | 0.01 | 0.45 | K0.110 | K0.131 | 6.21 | FRI 22 MAR 2024 | WED 27 MAR 2024 | FRI 19 APR 2024 | NO |

| CPL | – | 0.79 | – | 0.79 | – | 0.00 | – | – | – | – | – | – | – |

| SST | – | 48.00 | 48.00 | 50.00 | – | 0.00 | K0.35 | K0.60* | 1.33 | WED 24 APR 2024 | FRI 26 APR 2024 | FRI 26 JULY 2024 | NO |

Dual listed PNGX/ASX Stocks

BFL– 6.55+10c

KSL – 94.5c +1c

NEM – 69.50 +4.50

STO – 7.99 +.05c

On the Interest Rate front

In the 7day market, the Bank took 1.8bn liquidity out of the Financial System with the rate remaining at 2.5%;

In the 364 TBill market we saw the rates move out by 57bpts. The auction was undersubscribed by 35mill with the Bank offering a total of 243mill in the 364day maturity. We can expect the TBills to weaken further again this week.

We have a GIS auction this week with 400mill 5,6,7,8,9 and 10 yr of new maturity series on offer.

Other Assets we like to monitor

Gold – $2,407

Platinum – $998

Palladium – $968.50

Bitcoin – 60,938 +8%

Ethereum – 3,251 +10.5%

What we have been reading

The History and Evolution of Money

Money is more than the dollars, pounds, pesos, or yen we see today. To understand its essence, we need to look back to its origins and evolution.

Money vs. Currency

Money and currency are not the same. Money must be a medium of exchange, a unit of account, portable, durable, divisible, fungible, and, crucially, a store of value that maintains purchasing power over time. Currency, on the other hand, shares all these properties except being a store of value.

The Beginning: Barter System

Before money, there was barter, where people exchanged goods and services directly. This system, although effective for local trade, lacked a standard measure of value, leading to disputes. The Phoenicians and Babylonians expanded the barter system, trading goods like weapons, tea, spices, and even human skulls. Despite its usefulness, barter was inefficient and cumbersome.

The Egyptians and the Birth of Money

In ancient Egypt, gold and silver began to be used as mediums of exchange. These metals were valuable due to the labour required to extract them. However, their varying sizes and purities necessitated the use of scales. Over time, the weight of gold was standardised, making it a reliable medium of exchange, unit of account, portable, durable, divisible, and fungible. Most importantly, it maintained its purchasing power, serving as a store of value. Thus, money was born.

The Fall of Athens: Currency Debasement

Athens, a powerful civilisation, started to debase its currency to fund wars and public works. They mixed copper into gold coins, leading to inflation. As the value of their money decreased, people hoarded the old gold coins and spent the debased ones, exemplifying Gresham’s law (“bad money drives out good”). The increased money supply led to hyperinflation, contributing to the fall of the Athenian Empire. This pattern of debasement and collapse repeated in various civilisations.

Paper Money: Innovation and Risk

The Song Dynasty in China introduced paper money in the 11th century due to the impracticality of carrying heavy metal coins. However, the ease of printing paper money led to overproduction and inflation, as it lacked a store of value. Paper money without backing by gold or silver eventually failed.

Gold and Silver Backed Notes

Early U.S. money was gold and silver coinage. As carrying large amounts of coins became impractical, banks issued paper notes backed by stored gold. These notes acted as receipts for the actual gold or silver. This system maintained trust and value as the notes were redeemable for precious metals.

The Federal Reserve and Fiat Currency

The creation of the Federal Reserve in 1913 marked a significant shift. Initially, U.S. dollars were backed by gold. However, over the next 60 years, deficit spending and involvement in wars led to the abandonment of the gold standard. In 1971, President Nixon removed the dollar’s gold backing, leading to the current fiat currency system, where money is not backed by any physical commodity. This has led to currency debasement and loss of purchasing power.

The Modern Era: Fiat Currency and Inflation

Fiat currencies like dollars, pounds, pesos, or yen are printed without restriction, leading to inflation. These currencies do not maintain their purchasing power over time and fail to serve as a true store of value. This situation is reminiscent of ancient empires that collapsed due to similar practices.

The Evolution Continues: Bitcoin

Bitcoin represents a significant innovation in the history of money. Created in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin is a decentralised digital currency. It embodies the principles of good money: it is a medium of exchange, unit of account, portable, durable, divisible, fungible, and a store of value.

Understanding Bitcoin

Bitcoin is created through a process called “mining,” where computational power is used to solve complex mathematical problems, validating transactions and securing the network. This process requires economic energy (electricity and labour), storing value in the form of Bitcoin. Unlike fiat currency, Bitcoin’s supply is limited to 21 million, preventing debasement.

Bitcoin operates on a decentralised network, removing the need for a central authority like the Federal Reserve. Transactions are verified through a consensus mechanism called “proof of work,” ensuring security and trust in a trustless system. This is akin to the Byzantine Generals Problem, where consensus is needed among decentralised parties to avoid failure.

Bitcoin as Money

Bitcoin fulfills most characteristics of money. It is a medium of exchange, unit of account, portable, durable, divisible, and fungible. Its potential as a store of value is still debated, given its relatively short history compared to gold. However, its fixed supply and decentralised nature position it as a strong candidate for maintaining purchasing power over time.

Challenges and Prospects

Bitcoin faces challenges such as volatility and regulatory hurdles. However, its decentralised nature, fixed supply, and the trust built through mathematics and cryptography make it a revolutionary development in the evolution of money. It addresses the issues of fiat currency, offering a system resistant to debasement and government manipulation.

Conclusion

The history of money reflects human innovation and the constant search for a reliable store of value. From barter to gold, to paper money, and now digital currencies like Bitcoin, each evolution aims to solve the limitations of its predecessors. Bitcoin, with its unique characteristics and decentralised nature, represents a significant step forward, potentially addressing the issues inherent in fiat currency systems and offering a new paradigm for money.

Central banks again a strong source of demand

Posted 11/07/2024

Central banks were big movers in the gold market in 2022 and 2023, snapping up a record 1,082 tonnes in 2022 and another 1,037 tonnes in 2023, which accounted for 29.2% of all mined gold during those years. The World Gold Council (WGC) reports that central banks added another 289.7 tonnes in the first quarter of this year and, although China’s recent decision to step back from buying might lower the total for 2024, net purchases are expected to be around 985 tonnes.

Global production slightly up and China may run out before long

The WGC also recently reported mine production figures by country for 2023 and global mine output increased by 0.3% YoY last year. Interestingly, while China remains the world’s largest gold miner, the U.S. Geological Survey reports its gold reserves are well below the largest countries. Australia (12,000t), Russia (11,100t), and South Africa (5,000t) top the list, with China and the United States both estimated to have around 3,000t of below-ground reserves.

At their current pace of extraction, Chinese gold reserves will be exhausted in eight years, unless further discoveries are found. Meanwhile, at current rates of extraction, it will take 34 years for Russia and 40 years for Australia to exhaust their in-ground supply. Being the world’s largest producer, China’s projected exhaustion of gold reserves could have a significant impact on supply side dynamics in future.

An ounce for your thoughts? 2024 WGC Central Bank Survey

It’s not often that we get direct data on a large group of central banks that gives us an idea of their attitude towards their gold reserves, so let’s delve into some of the data gathered by the World Gold Council’s 2024 Central Bank Survey.

We’re going to need a bigger boat

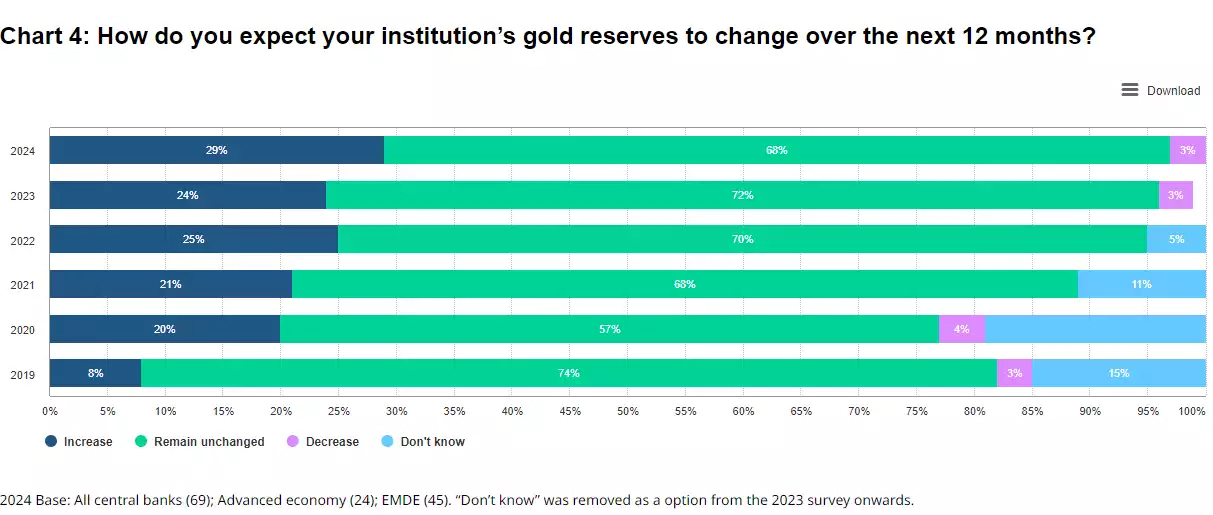

A total of 70 central banks responded to the WGC Survey, which comprised of 24 from advanced economies and 46 from emerging and developing countries. In line with last year, 83% of central banks responding to the survey hold gold in their reserves, with 81% of respondents expecting their gold holdings to increase over the coming year. This represents the highest proportion of respondents since the survey began in 2018, and reflects the higher levels on inflation and geopolitical instability of recent times.

When asked what proportion of total reserves will be denominated in gold in five years, 69% of respondents expected holdings to be higher or significantly higher, while 18% expected holdings to be unchanged, and only 13% of respondents thought that gold holdings would represent a smaller share of reserves.

This information is music to the gold investor’s ears, as it shows that there will likely be increased buying pressure on the gold price from such a significant group of buyers into the medium-term future.

What’s driving reserve management decisions?

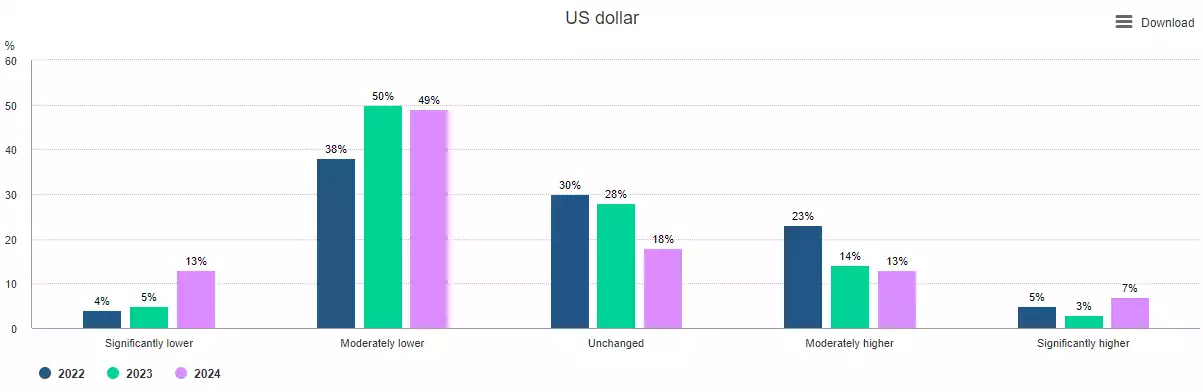

When asked what the most important topics are that determine reserve management decisions, 94% of central banks cited the level of interest rates with inflation concerns (86%), geo-political stability (72%), and ESG issues (45%) cited as other important concerns. While 62% of respondents expected the U.S. dollar to shrink as a share of global reserves, concerns around sanctions and a desire to reduce exposure to the U.S. dollar remain minor drivers, though, this may change given the political uncertainty in the U.S. and in the event of a significant weakening in the relatively strong U.S. dollar.

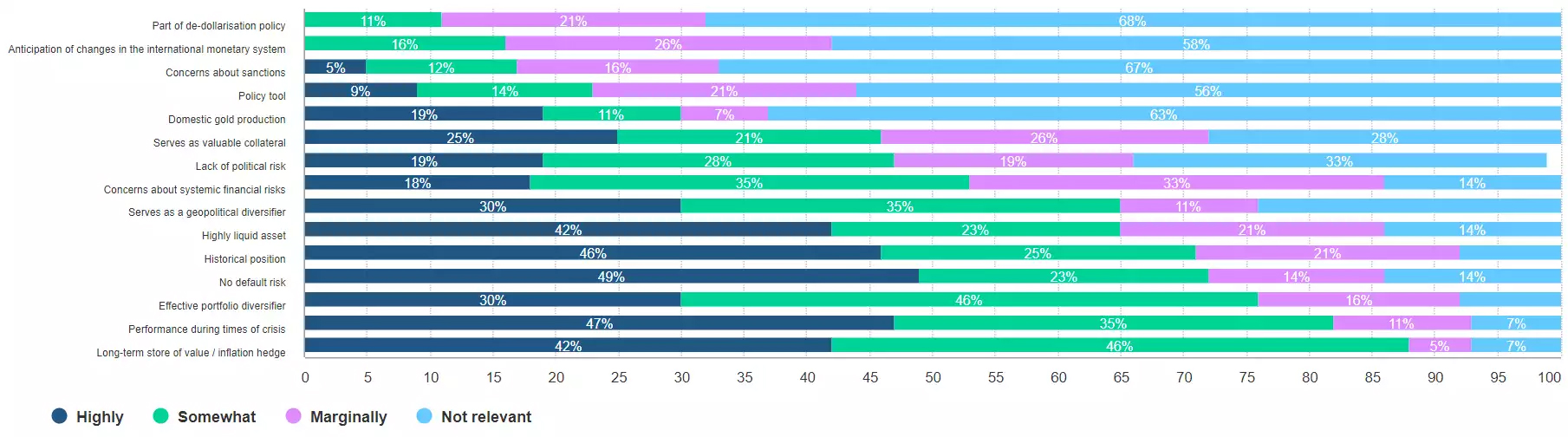

The results of the WGC Survey are clear; central banks view gold as an integral component of their reserve portfolio. The results reinforce the fact that gold is a valuable long-term store of value with the metal offering central banks diversification complementing holdings of debt instruments (such as, T-bills/ bonds) while being largely insulated from political and default risk, with gold a widely accepted form of liquidity and collateral. Many of the features that draw individual investors to gold align to these large institutions. In uncertain times, the value of gold in central bank portfolios look set to rise and this gives us confidence to know that such a larger buyer – 29.2% of all gold mined in 2022 and 2023 – plans to add to their stack.

Thank you to Ainslie Bullion for this article

KPMG Launches New Climate Reporting Resources Hub

Mark Segal July 11, 2024

Global professional services firm KPMG announced today the launch of Clear on Climate Reporting, a new digital hub aimed at helping companies provide reporting to investors and regulators on the financial implications of climate-related risks and opportunities on their businesses.

According to KPMG, the new hub is being launched as companies are seeing greater climate change-drive broader stakeholder scrutiny of financial reporting, particularly with many companies facing growing risks from the physical effects of climate change and the transition to a lower-carbon economy. The firm added that while companies need to consider whether these climate-related matters are material to their financial statements, “there is no single standard that addresses everything and there are a lot of bases to cover to get the accounting right.”

Brian O’Donovan, Global IFRS and Corporate Reporting Leader at KPMG International, said:

“Essentially, companies need to tell investors what the financial implications of their climate-related plans are; and if they believe there’s no financial impact, tell investors why. Investors are looking for a connected picture of performance, showing the financial implications of sustainability plans and actions.”

According to KPMG, at launch, the new hub provides a series of resources covering key climate-related reporting issues for companies, including FAQs to help identify the potential financial statement impacts for businesses, as well as podcasts and videos to explore issues in more depth, including by sector, with more resources, including a new emissions section, to be added in the future.

Among the topics covered on the hub include recognizing liabilities related to net zero commitments, accounting for emissions schemes, ESG measures in executive pay packages, considerations for companies when purchasing carbon credits, and accounting for different forms of government assistance, among others.

Larry Bradley, Global Head of Audit, KPMG International, said:

“What’s described in the front of the annual report won’t always be mirrored in the financial statements in the way users expect. This is often true for climate. It is important that companies both comply with the IFRS Accounting Standards and connect the dots between financial and non-financial information.”

I hope you have enjoyed this week’s read. Please reach out if you would like assistance with your investment journey.

Regards,

Head, Fixed Interest and Superannuation

JMP Securities

a. Level 3, ADF Haus, Musgrave St., Port Moresby NCD Papua New Guinea

p. PO Box 2064, Port Moresby NCD Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814