July 5, 2021

Welcome to this week’s JMP Report.

Last week on PNGX market, the trading activity was shouldered by BSP, trading 47,221 shares closing unchanged on Friday at K12.30 with KSL trading 65,000 shares also closing unchanged at K3.25. CCP had a smaller parcel of 1,176 shares trading closing unchanged also at K1.70. Refer details below;

|

WEEKLY MARKET REPORT 28.06.21 – 02.07.21 |

||||

|

STOCK |

QUANTITY |

CLOSING |

CHANGE |

% CHANGE |

|

BSP |

47,221 |

12.30 |

. |

|

|

KSL |

65,000 |

3.25 |

– | |

|

OSH |

– |

10.60 |

– | |

|

KAM |

– |

1.00 |

– | |

|

NCM |

– |

81.50 |

– |

|

|

CCP |

1,176 |

1.70 |

– | |

|

CPL |

– |

0.80 |

– |

|

On the interest rate front we saw the 364 day TBill auction rate remain at 7.20%. The yield curve remains a positive curve with short rates remaining relatively steady but we have seen some flattening in the long end as a result of the aggressive bidding in the last 2 GIS auctions.

Our book commences the week with interest in most of the active POMX stocks with BSP heading the orders. In the interest rate market I have buying interest in both the short and long ends.

What we have been reading this week

The never-ending coronavirus pandemic, why lockdowns in Australia make sense until herd immunity is reached

By Dr Shane Oliver, Head of Investment Strategies and Economics and Chief Economist, AMP Capital

Key points

- Snap lockdowns in Sydney, Perth and Queensland are likely to cost the economy $2.5bn, but like previous snap lockdowns are unlikely to derail the recovery.

- Australia has little choice but to continue with snap lockdowns until increased vaccination sets up herd immunity from around early 2022.

- The latest lockdowns and ongoing coronavirus threat will keep the RBA relatively dovish at its July meeting.

Introduction

News that I and many others were effectively in lockdown from Friday was depressing. It got even more depressing when the whole of Sydney and surrounds was put into a two-week lockdown on Saturday. And I am not in Victoria which has had it even worse over the last year, and I can only imagine how bad this must be for those looking forward to school holidays. Or far worse still for those with businesses dependent on people coming together. And now Perth & Darwin are in lockdowns too.

With Sydney and surrounds having around 6.6 million people and about 25% of Australian GDP we estimate a hit to national economic activity from the two-week Sydney lockdown of around $2 billion (or 0.1% of GDP). Perth’s four-day lockdown will cost another $200m and Queensland’s three-day lockdown another $300m. And this follows around a $1.5bn hit from Victoria’s two-week lockdown from late May.

With ongoing lockdowns, it seems like ground hog day. Some even think the lockdowns themselves are the problem – that Australia has become paranoid, going into lockdown & shutting borders at the whiff a new case, locking out the rest of the world and becoming a “lost kingdom of the South Pacific” – imposing a great cost on the economy all to control what some think poses no or little risk for most, or is just a bad dose of the flu.

Australia has made some mistakes. High on the list is: the slow rollout of vaccines; the management of the returned traveller quarantine system; the poor treatment of Australians overseas (particularly those recently in India); and we arguably have been too slow in relation to starting some lockdowns (in Victoria mid-last year and recently in NSW) risking longer lockdowns.

But gloomy as it all seems, Australia’s approach has led to relatively less deaths and a stronger economy. And being early in the vaccination process – both globally and in Australia – it’s still too early to simply relax controls. This note puts it into perspective and what it means for investors.

- Healthy people = healthy economy

The first thing to note is that Australia has performed relatively well through the coronavirus pandemic. Early last year I also thought it may be a bad case of flu, but quickly changed my mind in March last year when it was clear that it was far worse and if not controlled, the hospital system would be overwhelmed leading to more deaths. The occurrence of “long covid”, potential long-term health effects even in the young and now more transmissible variants reinforce this. So, thanks to a sensible health response, rigorous application of restrictions and periodic snap lockdowns after the initial lockdown we have been able to keep cases and deaths per capita relatively low.

Source: ourworldindata, OECD, ABS, AMP Capital

Source: ourworldindata, OECD, ABS, AMP Capital

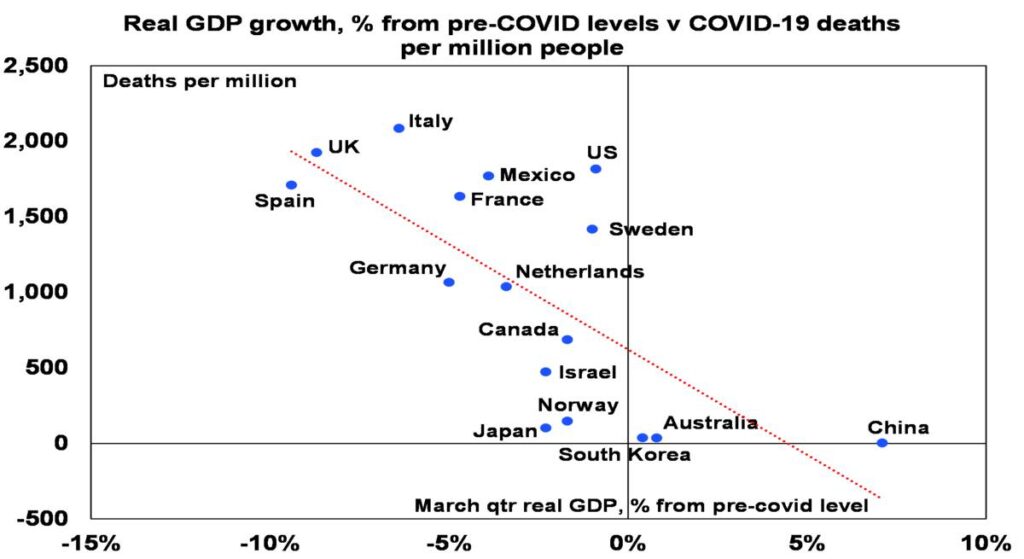

As evident in the next chart, better health outcomes in terms of deaths per capita (vertical axis) have been associated with better economic performance as measured by GDP (horizontal axis). Along with well targeted government support that protected incomes, jobs and businesses Australia is one of the few developed countries with GDP above pre pandemic levels.

Source: ourworldindata, OECD, ABS, AMP Capital

Source: ourworldindata, OECD, ABS, AMP Capital

Better control of the virus has enabled much of Australia to go about life with relatively modest restrictions over much of the last year in contrast to many countries that have seen almost continuous lockdowns, with some only just coming out of them.

Even countries that adopted a laxer approach such as the US or a “let it rip” approach like Sweden saw a bigger hit to their economies than Australia did. If Australia had a laxer approach and as a result had the same per capita deaths as the US, it would have lost an extra 47,000 Australians on top of the 910 deaths so far. More deaths and a worse economy do not strike me as a compelling case to avoid lockdowns.

- Snap lockdowns work

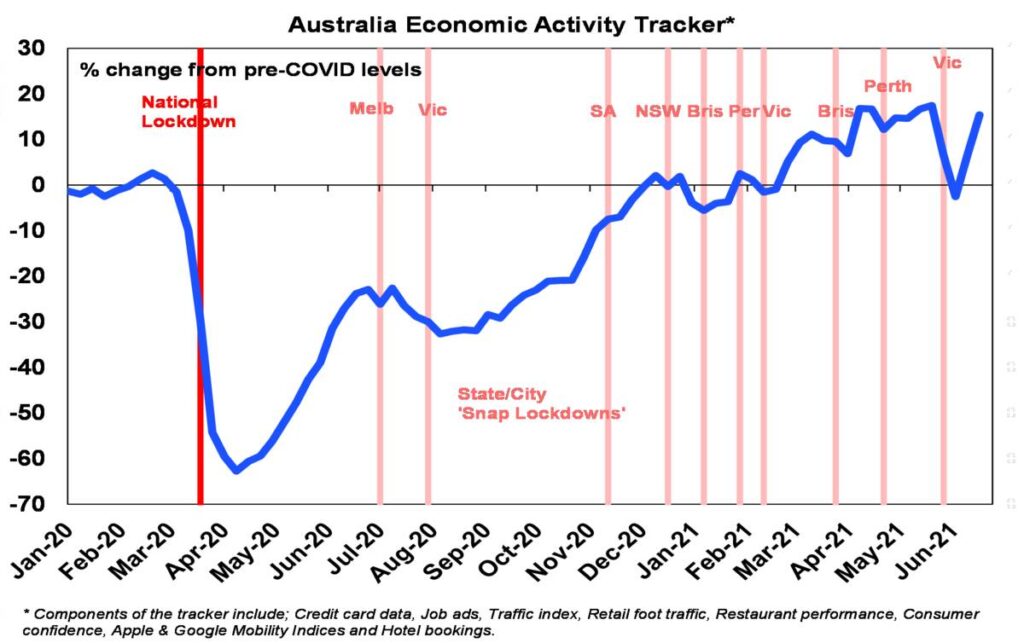

Australia has already had eight snap lockdowns since November last year and the evidence strongly suggests that if applied early when the flow of new cases is relatively low, they head off a bigger problem with coronavirus and hence a longer and more economically damaging lockdown (in the absence of course of most being vaccinated). “A stitch in time saves nine” as the old saying goes! Providing they are short, the economic impact is relatively “minor” (although still horrible) as spending and economic activity is delayed, which then bounces back once the lockdown ends. This is evident in our weekly Australian Economic Activity Tracker (see the next chart), which combines weekly data and shows a rising trend in economic activity through the snap lockdowns since last November, including after Victoria’s recent snap lockdown ended.

Source: AMP Capital

Source: AMP Capital

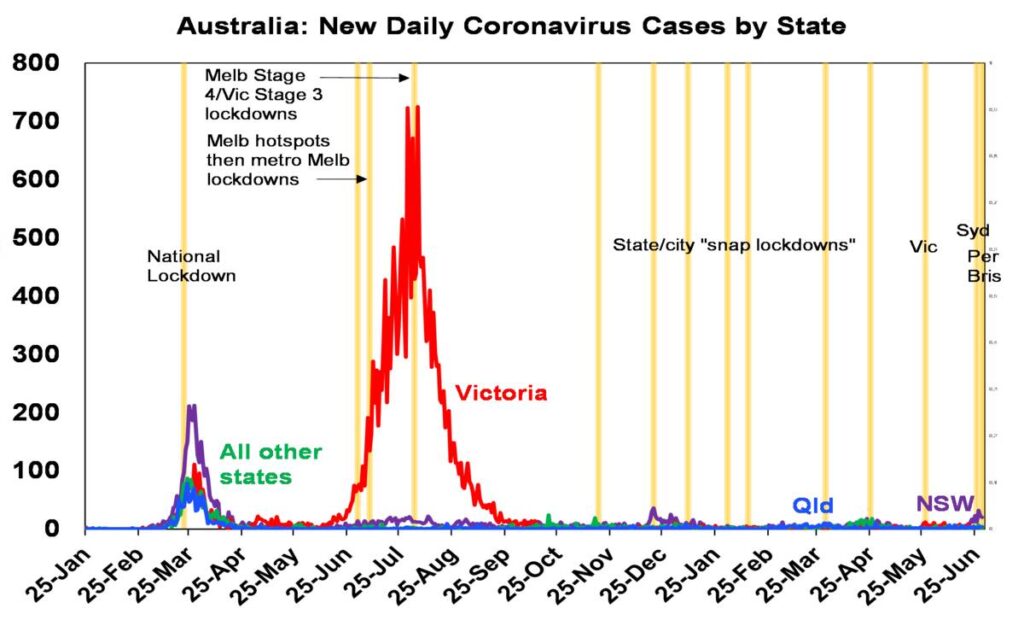

Ideally, the Sydney lockdown should have started a few days earlier when the flow of new cases was lower, but starting at around 20-30 a day was still relatively low compared to last July when the Melbourne hotspot lockdown started when new cases were already spiralling over 60 a day or the over 600 a day when the full Victorian lockdown started in August. This should provide some confidence this lockdown will work in controlling the spread of new cases and can be limited to two weeks or so. See the next chart which puts it into perspective.

Source: covid19data.com.au

Source: covid19data.com.au

If so, while we estimate a hit to economic activity from the Sydney lockdown of about $2 billion if it’s contained to two weeks, much of that will likely be recouped upon reopening. Of course, the risk is greater now that we are dealing with the more virulent Delta variant, but so too was Victoria in late May.

- Border confusion

Everyone wants freedom to travel out of Australia and back in, and an open international border is key to having a dynamic economy long-term, but its short-term importance to the recovery is exaggerated. First, the economy has already rebounded beyond pre-coronavirus levels. Second, Australia normally loses more from Australians travelling overseas than we gain from foreigners coming here, so trapping that spending here benefits the economy. Third, we normally run a trade surplus in education of 2% of GDP but with the pandemic we only lost maybe half that as many foreign students went online. Finally, while the loss of immigration means lower long term potential growth it won’t necessarily impact per capita GDP (& hence living standards) or short-term recovery prospects (except for some sectors). So long-term the international border closure is a big deal, but it’s not so big short-term.

- Covid is not over globally – but vaccines work

Which brings us to the basic problem that coronavirus is still not over globally. The good news is that new daily cases have fallen sharply in the last few months as vaccination ramps up. The bad news is that only 24% of the global population has had one dose. Even in developed countries where 49% have had a first dose, we are yet to hit herd immunity which may be around 80% fully vaccinated, and new more virulent strains (notably Beta, Delta and maybe Delta Plus) are causing problems with rising cases in the UK, Israel and Seychelles (where around 70% are fully vaccinated). In the UK, new cases are running around 18,000 a day which has caused a postponement to the final stage of reopening. But here is the really good news – while the vaccines are not completely effective in stopping people getting the new variants, the evidence suggests they are highly effective in preventing serious illness (which should minimise pressure on hospital systems) and death. So, reopening should be manageable once herd immunity is reached, even with coronavirus circulating in the community. But we are not at that point yet – so coronavirus still poses a risk to reopening in the US and Europe.

Which in turn highlights why Australia – which is further behind on the vaccine front with only 24% of the population having had one dose of vaccine – still has to be cautious in preventing coronavirus taking hold, and so has little choice but to continue down the snap lockdown/global border closure path to keep people healthy and to protect the economy from more debilitating coronavirus-driven lockdowns. Better to wait until herd immunity is reached and we can learn to live with a level of coronavirus circulating in the community rather than dropping our guard too early and having to learn to die from it.

With global vaccine production ramping up and more Pfizer and Moderna vaccines scheduled to arrive in Australia through the second half we should be able to reach herd immunity by early 2022. This is the only way to end the endless snap lockdowns in a way that does not risk Australians’ health and the economy.

Implications for investors

There are several implications for investors:

First, the ongoing threat posed by coronavirus and lockdowns will likely keep the RBA relatively dovish at its July meeting. While we expect it to stick to the April 2024 bond for its yield target and announce some tapering of its bond buying, it’s likely to reiterate that rate hikes remain a long way off.

Second, the threat from coronavirus setbacks is likely to limit the upside in bond yields in the short term.

Third, coronavirus setbacks are another potential trigger for a near term correction in shares and in cyclical stocks specifically. But if snap lockdowns remain relatively short as we expect, they are unlikely to de-rail the Australian economic recovery or the rising trend in Australian shares.

Shane Oliver, Head of Investment Strategy & Chief Economist

NTPC plans IPO for renewables business in huge green push

NTPC has also signed an accord with state-run oil explorer Oil and Natural Gas Corp. to set up offshore wind power plants, he said. (Bloomberg)

NTPC plans to build large renewable energy parks and has secured land for a 5 gigawatt facility in the state of Gujarat

State-run NTPC Ltd., India’s largest power generator, aims to take its renewables unit public to help fund a 2.5 trillion rupees ($34 billion) clean energy expansion, according to a company official with knowledge of the plans.

The New Delhi-based producer wants to list its NTPC Renewable Energy Ltd. unit in the next fiscal year, which begins in April 2022, the official said, requesting anonymity as the discussions are private.

It’s intended to enable a dramatic transformation over the next decade for a company that relies on coal to produce the vast majority of its electricity. NTPC is aiming to double generation capacity to 130 gigawatts by 2032 and slash the share of fossil fuels in that energy mix to about half from 92% currently.

NTPC did not immediately respond to an email seeking comment sent outside usual office hours in India.

India’s biggest fossil-fuel tycoons and companies plan to expand in renewable energy with investor pressure mounting on businesses to reduce carbon emissions and as Prime Minister Narendra Modi’s government debates aggressive climate targets. Mukesh Ambani, Asia’s richest man, last month said Reliance Industries Ltd. will invest about $10 billion over three years on sectors including solar, hydrogen and batteries.

NTPC plans to build large renewable energy parks and has secured land for a 5 gigawatt facility in the western state of Gujarat, the official said. It has also signed an accord with state-run oil explorer Oil and Natural Gas Corp. to set up offshore wind power plants, he said.

In addition to the renewables unit IPO, the company will seek to issue bonds and add loans from domestic and overseas banks to fund its clean energy plans, according to the official. NTPC will also consider selling some assets to raise funds.

The company has been raising the scale of its ambition in renewables, recently flagging it had almost doubled its clean energy target and would help develop 60 gigawatts of capacity by 2032. A target to reduce the share of fossil fuels in its generation fleet to 50% compares to an earlier goal of 70%.

Continuing government policy support and tumbling costs of renewables are also offering additional impetus to India’s utilities and fuel producers. It’s now cheaper to build new utility-scale solar capacity in India than to run most existing coal and gas power stations, according to Bloomberg NEF.

New coal-fired plants are also becoming more expensive amid requirements to add equipment to curb the countries air pollution.

Flying cars will be a reality by 2030, says Hyundai’s Europe chief

Michael Cole says urban air mobility could free up congestion and help with emissions in cities

An artist’s impression of the Hyundai urban air mobility test flights. Cole said the carmaker had made ‘very significant investments’ in the technology. Photograph: Hyundai/PA

Flying cars will be a reality in cities around the globe by the end of this decade, according to a leading car manufacturer, and will help to reduce congestion and cut vehicle emissions.

Michael Cole, the chief executive of the European operations of South Korean car maker Hyundai, said the firm had made some “very significant investments” in urban air mobility, adding: “We believe it really is part of the future”.

Cole conceded: “There’s some time before we can really get this off the ground.

“We think that by the latter part of this decade certainly, urban air mobility will offer great opportunity to free up congestion in cities, to help with emissions, whether that’s intra-city mobility in the air or whether it’s even between cities.”

He told a conference of industry group Society of Motor Manufacturers and Traders: “It’s part of our future solution of offering innovative, smart mobility solutions.”

Guardian business email sign-up

The company showcased its flying car concept, developed in conjunction with the ride-sharing firm Uber, at the Consumer Electronics Show in Las Vegas in January 2020.

Hyundai is also involved in the UK’s first airport without a runway, designed for aircraft that are capable of electric vertical take-off and landing (veto), scheduled to open in Coventry later this year.

The “urban airport” could be used by aircraft including air taxis and autonomous delivery drones.

Container Premiums: Trans-Pacific premium rates leapfrog record high FAK rates for July

Author: Greg Holt Parisha Tyagi George Griffiths

Commodity: Shipping

Most shippers paying premium service fees Asia-US

US retailers hurrying to restock their inventories

Premiums emerge within Asia as capacity limited

Container freight costs from North Asia to North America climbed to a new all-time high at the start of July as General Rates Increases (GRIs) took effect, but most shippers on the spot market were paying well beyond that in premium service fees as carrying capacity from Asia remained in severe shortage.

Platts Container Rate 5 — North Asia to East Coast North America — rose by $1,000/forty-foot equivalent unit (FEU) July 1 to $8,100/FEU on a Freight-All-Kinds (FAK) basis, the highest level since the assessment was launched in July 2017.

But with many US retailers already restocking their inventories as fast as possible ahead of the back-to-school autumn season — or even getting a head start on preparing for end-of-year holidays — premium service fees were required from all but the most favoured shippers to secure equipment and space on ships leaving Asia.

Wide range of rates

For shipments from North Asia to the US East Coast, shipowners were asking for July rates including premium fees in a wide $15,000-25,000/FEU range, depending on urgency and the shipping line’s history with the customer.

“The numbers are really all over the place, but most will be paying $15,000-20,000/FEU from Asia to the US East Coast, or it could be more if it includes inland transport,” a US-based freight forwarder said. “We had a July quote at $11,000/FEU to LA/Long Beach, but that went up to $20,000/FEU to go all the way to Chicago.”

Spot rates including premiums from North Asia to ports on the US West Coast were mostly in the $8,000-12,000/FEU range, but those can increase to $16,000-17,000/FEU for shippers with urgent requirements, another US freight forwarder said.

Platts Container Rate 13 — North Asia to West Coast North America — increased by $800/FEU July 1 to a record high at $6,600/FEU on an FAK basis, including Peak Season and Equipment Imbalance Surcharges but excluding premium service fees.

“Demand from [Beneficial Cargo Owners, or BCOs] is always strong in the pre-Golden Week period, with rushed cargoes for the year-end holidays about to enter the market,” a shipping line representative based in Europe said. “Restocking has been strong for the past few months, but we could see a slow spot in the second half of July due to all the supply-chain bottlenecks and delays.”

Short-haul rates from Asia hit with premiums

With peak season looming over the Asia-to-North America trade lane, premiums have also started to emerge on short-haul ex-Asia routes as container shortages worsen.

“For a shipment from India to Australia, the premium rate is $1,200 per TEU (twenty-foot equivalent unit) over and above the FAK of $2,500/TEU,” a freight-forwarder based in India said. “Even after paying this price, I am not getting a confirmed booking before July 15.”

For the China-to-Middle East trade lane, the premium rate was heard at $1,200 per unit over and above the FAK rate of $7,400/FEU.

Rates for the India-to-US trade lane have also been rising to the current FAK rate of $10,000/FEU plus a premium service fee of $2,000/FEU to guarantee loading.

“It is so difficult to move containers within Asia as carriers have deployed maximum capacity on North Asia to Europe and US routes,” the freight forwarder said. “We are paying premiums even though there is no shortage of twenty-foot containers.”

Premium rates for Southeast Asia-to-North America trade lanes also moved higher as new GRIs took effect from July 1. Industry participants expect demand to peak in July and August.

For shipments from Southeast Asia to the East Coast of North America, the all-inclusive premium rate was heard at $23,000/FEU, while premium rates to the West Coast of North America were at $15,000-$17,000/FEU, up by nearly $3,000/FEU from a week ago for both routes.

“Inventories in the US are running low, and there is going to be a huge buying from retailers to replenish the stocks,” a Hong Kong-based market participant said. “With sharp hikes expected in mid-July, it won’t be too surprising to see the rates touch $30,000 per FEU in the coming months.”

Prompt-loading shippers to Europe pay extra

Premium service fees for shipments from Asia to Europe still appear to be the exception rather than the rule itself, with most carriers opting to do business on a FAK basis rather than imposing premiums along this service route.

“We’re shipping everything FAK. Carriers aren’t giving space on fixed rates anymore,” a European freight forwarder said.

But prices on the prompt-loading FAK spot market began to widen significantly compared with loading dates further out. Shipping lines were asking for $21,000/FEU for a July departure from North Asia to Northern Europe, while rates for cargoes loading in four to six weeks were heard around the $16,000/FEU mark for the same trip.

Despite the mixed sentiment, Platts Container Rate 1 — North Asia-to-North Continent — was assessed unchanged this week at $17,000/FEU, holding at an all-time high level with limited expectations for any downside in the weeks ahead.

We hope you have enjoyed this week’s report and a big thank you to our friends at Ashurst for the attached Edition of Low Carbon Pulse. Please feel free to give me a call for a confidential chat in regard too;

Low Carbon Pulse

- buying or selling shares or interest rate products

- superannuation in PNG, are you compliant?

- financial planning strategies

Regards and have an awesome week,

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814