29 November 2021

Welcome to this week’s JMP Report.

Last week on the share trading front we saw the activity was limited to BSP, KSL, NGP and CCP. BSP traded 776,134 shares to close at K12.35, KSL saw 7,875 shares trade at K3.20, NGP traded 16,500 shares at K0.70 while CCP had 5,335 shares trade at K1.69.

Refer details below;

|

WEEKLY MARKET REPORT 22.11.21 – 26.11.21 |

|||||||||||

| STOCK

|

QTY |

CLOSING |

CHANGE |

% CHANGE | 2020 Final Div | 2021 Interim | Yield % | Ex Date | Record Date | Payment Date | DRP |

|

BSP |

776,134 |

12.35 |

0.005 |

0.05 | K1.0500 | K0.39000 | 11.61% | Fri 24 Sept | Mon 27 Sept | Mon 18 October | No |

|

KSL |

7,875 |

3.20 |

– | 0.00 | K0.1690 | K0.08250 | 7.74% | Wed 01 Sept | Thurs 02 Sept | Fri 01 Oct | No |

|

OSH |

– |

10.60 |

– | 0.00 | K0.0000 | – | 0.00% | Mon 30 Aug | Mon 20 Sept | Thur 20 Oct | |

|

KAM |

– |

1.00 |

– | 0.00 | K0.0400 | K0.06000 | 10.00% | Wed 15 Sept | Mon 20 Sept | Thurs 20 Oct | Yes |

|

NCM |

– |

75.00 |

– |

0.00 | K0.0000 | – | 0.00% | Thu 26 Aug | Fri 24 Sept | Mon 01 Nov | |

| NGP | 16,500 | 0.70 | – | 0.00 | K0.0000 | – | 0.00% | Fri 17 Sept | Fri 24 Sept | Mon 01 Nov | |

|

CCP |

5,335 |

1.69 |

– | 0.00 | K0.1800 | 0.04600 | 6.19% | Fri 1 Oct | Fri 8 Oct | Fri 26 Nov | Yes |

|

CPL |

2,161 |

0.95 |

– |

0.00 | K0.0000 | – | 0.00% | ||||

We expect to see good activity in BSP again this week.

I have attached a copy of the KPMG PNG Budget report which you no doubt have seen plenty of commentary since its release last week but I do wish to draw your attention to the introduction of a market concentration levy on commercial banks (K190m) and telecommunications companies (K95m) with more than a 40% market share. This measure will only apply to one of the four commercial banks, which incidentally is the PNG owned bank, and to one telco. It is the government’s view that a dominant player in the market is able to collect “super-normal profits” and therefore the market concentration levy is a claw back of those “super-normal profits”.

Download KPMG PNG Budge Report

We understand this tax is effective January 1, 2022. There will be plenty more commentary to follow.

On the interest rate front, no surprises coming from the budget which will have any significant impact on rates. With the budgetary pressures, you may see a GIS auction before the end of the year as I have been calling. The last was in July.

In the short end we saw much the same with the market awash with cash which flows through to the weekly auction results with 364 day TBills still averaging 7.20%.

In the long end, the Bank of PNG announced through the week that the Tap Bond facility has bee put on hold for an undisclosed period as a result of COVID impact on Banks staff.

What we have been reading this week

What are we reading

The longer-term legacy of coronavirus – nine implications of importance to investors

Dr. Shane Oliver, AMP Capital

Key Points

- Likely key longer-term implications flowing from the coronavirus pandemic are: bigger government; increased money supply and excess saving; increased geopolitical tensions; reduced globalisation; a faster embrace of technology; a greater focus on lifestyle; and a potential post-pandemic boom.

- The biggest risk is of significantly higher inflation, reversing the long-term downtrend in interest rates.

- Introduction

- The magnitude of the coronavirus shock means it will have implications beyond those associated with its short-term economic disruption. Possibly a bit like a world war – where the post war period is very different to the pre-war period.

- Of course, coronavirus has not yet released its grip as its resurgence in Europe and the US highlights – with a very high risk of the same elsewhere. But there is good reason for optimism – vaccines are 85-95% effective in preventing serious illness and there are now several effective treatments that are useful for those for whom the vaccines are less effective and for the unvaccinated. Vaccines are less effective though in preventing infection (at 60-80%) and their efficacy fades after about five months – so when 70% or less of the population is vaccinated (as in Europe and the US) that still leaves a high proportion of the population who can get sick and overwhelm the hospital system, particularly as colder weather sets in and efficacy wanes resulting in the return of restrictions in some places. And vaccination rates remain low in poor countries running the risk of new waves and mutations. The only way to avoid this is to get vaccination rates to very high levels (with the help of vaccine mandates), quickly roll out booster shots and only remove restrictions gradually. This includes Australia too.

- But the key is that vaccines and new treatments provide a path out of the pandemic and long hard lockdowns and as a result it’s likely that 2022 will be the year we will “learn to live with covid” and it goes from being an epidemic to being endemic. So it makes sense to have a look at what its longer term legacy may be (beyond of course associated medical advances that have been big). Here are 7 key medium to longer term impacts.

#1 Bigger government and bigger public debt

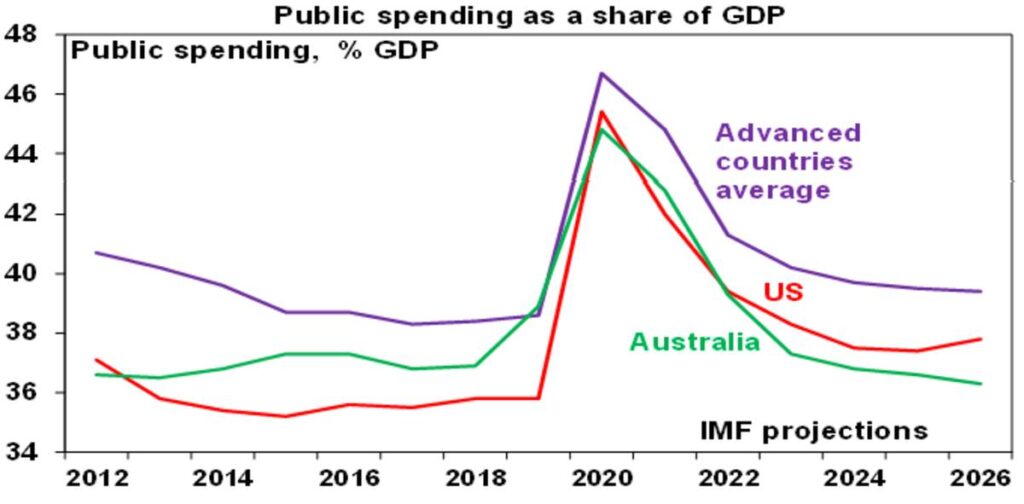

The GFC brought an end to support for economic rationalism and was associated with a leg up in public debt levels. Fading memories of the problems of too much government intervention in the 1970s added to this. The coronavirus crisis has added to support for bigger government intervention in economies and the tolerance of higher levels of public debt. Particularly given that the pandemic has enhanced perceptions of inequality and that governments should do more to boost infrastructure spending & bring production of key goods back onshore. And it’s now combining with a desire for governments to pick and subsidise climate “winners” rather than rely on a carbon price to achieve net zero emissions. IMF projections for government spending in advanced countries show it settling 1% of GDP higher in five years’ time than pre-covid levels.

Source: IMF, AMP Capital

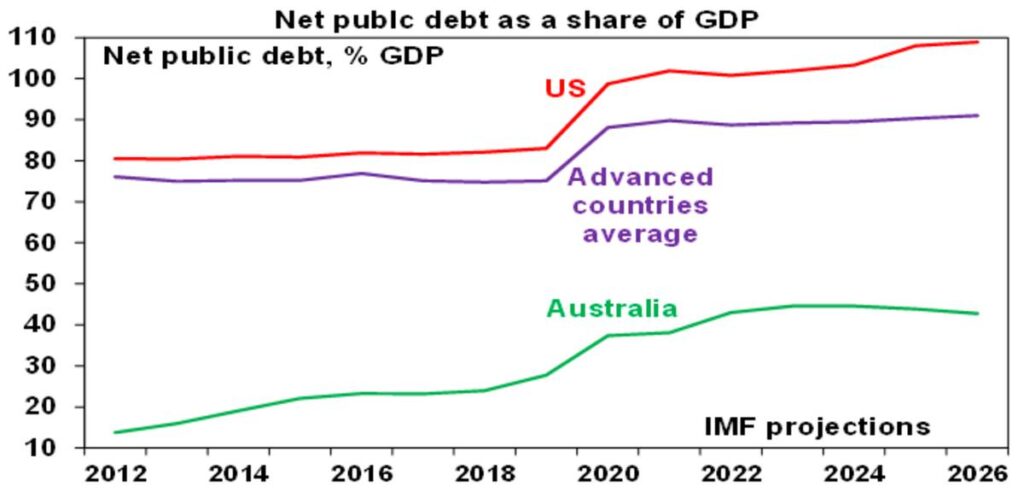

And net public debt is also expected to settle at levels around 15% of GDP higher – more so in the US.

Source: IMF, AMP Capital

Implications – while increased infrastructure spending is positive for productivity, the trend towards bigger government generally is more of a negative for longer term growth.

#2 Increased money supply and excess saving

The combination of quantitative easing (which saw money injected into economies) along with government spending through the pandemic to support household and corporate income boosted broad money supply measures (like M2 and M3 – which include bank deposits) well above their long-term trend. This is evident in excess household savings (savings above their long-term trend built up through the last two years) of $US2.3 trillion in the US (10% of GDP) and $180bn in Australia (8% of Australian GDP). This is radically different to the post GFC period that saw QE boost narrow money (mainly bank reserves) but was offset by fiscal austerity.

Implications – the pool of excess saving provides a boost to spending & a potential disincentive to work (until it runs out) and with increased money supply risks an ongoing boost to inflation, beyond the pandemic driven boost currently being seen.

#3 Increased geopolitical tensions

Geopolitical tensions were on the rise prior to the pandemic with the relative decline of the US & faith in liberal democracies waning from the time of the GFC. This has seen various regional powers flex their muscles – Russia, Iran, Saudi Arabia and notably China, which was facilitated by its own economic rise. The pandemic inflamed US/China tensions, particularly over the origin of coronavirus and as the US’ poor handling of coronavirus reinforced China’s shift away from economic liberalism. Russia and Iran are now seeking to take advantage of the global energy shortage, which itself is partly pandemic-related. The summit between President’s Xi and Biden offers hope for a thaw in tensions but it’s not clear how far that will go.

The pandemic has also arguably inflamed political polarisation – with the hard left tending to support lockdowns & vaccines and the hard right against them. This is perhaps more of an issue in the US and parts of Europe than in Australia.

Implications – increased geopolitical tensions could act as a negative for growth, work against multinationals and be negative for shares. It also poses a threat to Australia – with restrictions on imports of various products into China – so far this has been masked by first higher iron ore prices and then higher energy prices. And more political polarisation risks policy gridlock. Fortunately, it’s not as much of an issue in Australia.

#4 Reduced globalisation

A backlash against globalisation became evident last decade in the rise of Trump, Brexit and populist leaders. The coronavirus disruption has added to this. Worries about the supply of critical items have led to pressure for onshoring of production.

Implications – Reduced globalisation risks leading to reduced growth potential for the emerging world generally. Longer term it could reduce productivity if supply chains are managed on other than economic grounds and will remove a key source of disinflationary pressure from the global economy.

#5 Digital world

Working from home and border closures have dramatically accelerated the move to a digital world. Workers, consumers, businesses, schools, universities, health professionals, young & old have been forced to embrace new online ways of doing things. Many have now embraced on-line retail, working from home & virtual meetings. It may be argued that this fuller embrace of technology beyond Netflix will enable the full productivity enhancing potential of technology to be unleased.

- Implications– there are big ongoing implications from this:

Pressure on traditional retail/retail property has intensified.

The decline of the office – some sort of happy medium (e.g. 2 days in and 3 days at home) will likely be arrived at trading the need for collaboration and team building against the need for quiet time and getting things done. But it has huge implications for office space demand and CBDs.

An ongoing reinvigoration of economic life in suburbs and regions – as work from home continues (albeit not necessarily for five days for all).

Virtual meetings may see less demand for business travel.

#6 Greater lifestyle focus & the “Great Resignation”

It’s conceivable that the lockdowns have driven many to rethink what’s important in life and that pent up saving through the pandemic along with the ability of many to work from home has provided flexibility for some to refocus and a reluctance to the fully return to the old grind. In fact, the term “Great Resignation” has been coined in the US as labour force participation remains below pre pandemic levels and the proportion of workers “quitting” their jobs is at record levels. This in turn (and the absence of skilled immigrants and backpackers in Australia) may be contributing to labour shortages (which given the boost the pandemic provided to goods demand has created supply shortages and a surge in inflation). Of course, some of this may fade as excess savings are run down, people return to work as the pandemic fades and there is less evidence to support a “Great Resignation” in Australia where jobs turnover is normal. And it seems like only yesterday there was talk of automation wiping out lots of jobs – so it could all just be another beat up. Then again, it’s likely some of it will linger as work from home has shown a way to a higher quality lifestyle.

Implications – this will provide an ongoing boost to relative demand for lifestyle property, albeit it risks driving higher wages in the short term. And labour supply in some countries may take a while to get back to what it used to be.

#7 A post pandemic boom?

It’s conceivable that elation once the pandemic is finally over, the spending of pent up demand and excess savings along with the productivity enhancing benefits of new technology unleashed by the lockdowns will drive a re-run of the “Roaring Twenties” much like occurred after Spanish flu. Time will tell.

Implications – growth may turn out stronger than expected.

#8 More Europe

Each new crisis seems to bring Europe closer together. The ECB’s response to the pandemic which has seen it buy more bonds in problem countries and the economic recovery fund where Italy and Spain will receive a disproportionate share highlight that Europe is getting closer and the impending change of government in Germany may add to this. The pressures to keep the Eurozone together (safety in numbers, a high identification as Europeans, support for the Euro, Germany benefitting from the EU & Germany’s exposure to Italian bonds via the ECB) remain stronger than the forces pulling it apart.

Implications – I still wouldn’t bet on the Euro breaking apart.

#9 A smaller Australia?

Given the hit to immigration by 2026 Australia will be 1 million people smaller than expected pre coronavirus. And the Federal Government appears to have rejected the idea of a catch up in immigration levels to make up for lost arrivals.

Implications – the hit to immigration if sustained could mean a more balanced housing market in the years ahead with less upwards pressure on prices and reduced potential growth in the economy as a result of skilled shortages and lower population growth. But of course, this could reverse if the Government rapidly ramps up immigration after next year’s Federal election.

Concluding comments

Some of these implications will constrain growth & hence investor returns – bigger government, reduced globalisation, lower population in Australia and a possible longer-term threat to labour supply. And increased geopolitical tensions could add to volatility. Against this, the faster embrace of technology boosting productivity and a potential post pandemic boom will work the other way and is positive for growth assets.

- The biggest risk is high inflation. Just as World War 2 and expansionary post-war policy ultimately broke the back of 1930s deflation, so to the pandemic and its monetary and fiscal response is likely to have broken the back of the prior disinflationary period. This in turn means the tailwind of falling inflation & interest rates which provided a positive reflation and revaluation boost to growth assets is likely behind us.

Samsung will create 2,000 jobs in Texas with $17 billion chip factory

Yoonjung Seo, CNN Business

Seoul (CNN Business)Samsung is planning to build a $17 billion semiconductor manufacturing facility in Texas as part of efforts to tackle a global shortage of chips.

Announcing its largest ever investment in the United States, the South Korean electronics giant said Tuesday that the factory would create 2,000 high-tech jobs directly, and thousands more in the local economy once it is in full operation. The facility is expected to begin operations in the second half of 2024

“With greater manufacturing capacity, we will be able to better serve the needs of our customers and contribute to the stability of the global semiconductor supply chain,” Kinam Kim, Vice Chairman and CEO of Samsung Electronics, said in a statement.

The company said that it chose the city of Taylor in Texas for its new plant based on multiple factors, including its proximity to Samsung’s current manufacturing site in Austin, the local semiconductor ecosystem, and government support.

The Taylor site will span more than 5 million square meters and is expected to serve as a key location for Samsung’s global semiconductor manufacturing capacity, along with its latest new production line in Pyeongtaek, South Korea.

Samsung’s announcement comes at a time when the Biden administration has been pushing semiconductor production and research in the United States.

Although the currentworldwide shortage of computer chips is primarily driven by the impact of the pandemic, extreme weather events that have hampered production and other factors, the United States has been lagging behind otherproducersfor years.

Its share of worldwide semiconductor manufacturing dropped to just 12% last year, according to the Semiconductor Industry Association. That’s down from 37% in 1990. The trade group blamed “substantial” subsidies offered by foreign governments that place the United States at a “competitive disadvantage.”

Asian countries, including Taiwan and South Korea dominate the industry.Samsung and other South Korean manufacturers are spending huge amounts of money to shore up their production in the decade ahead.

In May, Samsung said thatit would invest 38 trillion Korean won ($34 billion) on production of logic chips, the brains that power computers. That brings its total spend on the business to 171 trillion won ($151 billion) overthe next decade, including commitments announced in 2019.

The chipmaker also announcedin Maythat it has begun construction of the production line in Pyeongtaek — one of the world’s largest hubs for semiconductor production — which it expects to complete in 2022.

Australia – Townsville to Become a Renewable Hydrogen Powerhouse, MoU to Investigate Feasibility of Exporting Hydrogen Through the Port

Australia – Townsville to become a renewable hydrogen powerhouse, MoU to investigate feasibility of exporting hydrogen through the port.

Townsville’s bid to become a renewable hydrogen powerhouse has been strengthened with the signing of another Memorandum of Understanding (MoU) to investigate the process and feasibility of exporting hydrogen through the city’s Port.

The Port of Townsville and Edify Energy Pty Ltd will sign an MoU to work together to advance Edify’s renewable hydrogen export project.

The signing of the MoU follows Edify’s recent development approval to build and operate a renewable hydrogen production plant with up to 1GW electrolyser for 5,000 – 150,000 H2 tonnes per year of renewable hydrogen at the Lansdown Eco-Industrial Precinct, 46km south of Townsville.

Minister for Energy, Renewables and Hydrogen Mick de Brenni said Queensland has a track record of creating energy export industry and the Palaszczuk Government was getting the investment settings right to capitalise on renewable hydrogen.

Mr de Brenni said we are positioning Queensland as a global powerhouse for clean energy exports and the decent, secure jobs that will create for Queenslanders.

“Renewable hydrogen will boost construction, utilities, heavy manufacturing, and a range of local service industries.”

“That equals more jobs in more regional industry in Townsville and across the state.”

Assistant Minister for Hydrogen Development and the 50% Renewable Energy Target by 2030 Lance McCallum said Queensland is fast becoming a renewables superpower.

“Queensland renewables mean more highly skilled jobs, both now and in the industries of the future.”

“Our publicly owned ports are essential to exporting our renewable hydrogen to the world.”

Member for Mundingburra and Hydrogen Champion Les Walker said agreements like this positioned Townsville as a green hydrogen powerhouse.

Mr Walker said. Townsville is well placed to take advantage of this growing industry, particularly as the world looks toward alternative energies.

“We have the facilities at the Port of Townsville to export hydrogen, our workers have the skills and the city is primed to take advantage of the new jobs which will come from this emerging industry.”

“This announcement also shows the importance of the Lansdown Eco-Industrial Precinct which is why the Palaszczuk Government is investing in the site.”

Member for Thuringowa Aaron Harper welcomed the agreement between Edify Energy and the Port of Townsville.

Mr Harper said. This agreement, among a number of others the Port of Townsville has signed, show the confidence major companies have in the potential for hydrogen in the city.

“As a government we’re backing the hydrogen industry because we know there are huge opportunities in this emerging industry and it will create new jobs.”

“That’s why the Palaszczuk Government is investing in the $232 million channel upgrade at the Port of Townsville because we know there are real opportunities to grow the port and bring new industries to the city.”

Edify Chief Executive Officer John Cole said Townsville’s existing infrastructure and industry was well placed to establish a renewable hydrogen production and export industry.

John Cole, Edify Chief Executive Officer:

We are excited to be working with the Port of Townsville and other project proponents in the region. “This MoU is another milestone for our project on its path to exporting renewable hydrogen and for Townsville’s journey to establishing sustainable long-term jobs and industry,” he said.

“Using a renewable energy source to produce large-scale green hydrogen means Townsville will be perfectly poised to be North Queensland’s hydrogen hub and export capital on the east coast. This is where future proofed jobs are created, new skills are learned, existing industries and infrastructure leveraged, manufacturing and communities thrive.”

Port of Townsville Chief Executive Officer Ranee Crosby said North Queensland is uniquely positioned to play a leading role in the world’s growing demand for hydrogen, presenting significant opportunities for the region.

Ms Crosby. Hydrogen made with renewable energy is completely carbon free and is a flexible energy carrier that can power almost anything that requires energy

“This versatility, partnered with Townsville’s global connectivity and highly-skilled workforce, represents boundless opportunities to align the North’s economic prosperity with global ambitions to transition to a clean energy future.”

“The Port recently released our Port Vision 2050 – our roadmap for the next 30 years – which has a strong emphasis on action on climate change and committing to a climate positive future.”

“Facilitating the production, usage and export of green hydrogen is one of the Port’s key strategic goals.”

Edify Energy joins a growing list of proponents seeking to export renewable hydrogen through the Port of Townsville, including Origin Energy and Ark Energy Corporation.

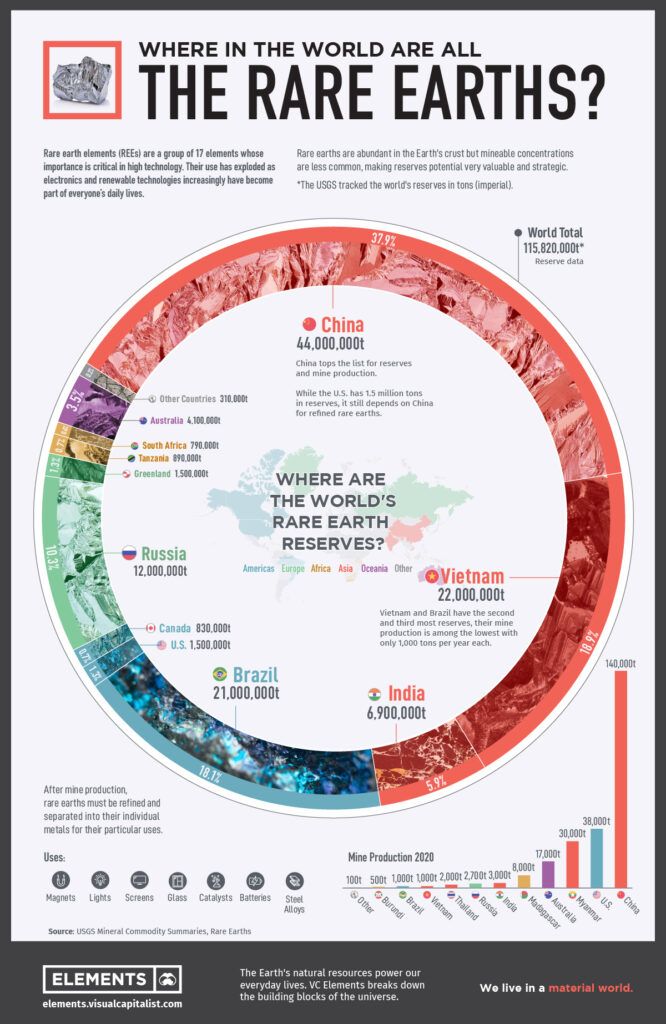

Rare Earth Elements: Where in the World Are They?

Rare Earths Elements: Where in the World Are They?

Rare earth elements are a group of metals that are critical ingredients for a greener economy, and the location of the reserves for mining are increasingly important and valuable.

This infographic features data from the United States Geological Society (USGS) which reveals the countries with the largest known reserves of rare earth elements (REEs).

What are Rare Earth Metals?

REEs, also called rare earth metals or rare earth oxides, or lanthanides, are a set of 17 silvery-white soft heavy metals.

The 17 rare earth elements are: lanthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), lutetium (Lu), scandium (Sc), and yttrium (Y).

Scandium and yttrium are not part of the lanthanide family, but end users include them because they occur in the same mineral deposits as the lanthanides and have similar chemical properties.

The term “rare earth” is a misnomer as rare earth metals are actually abundant in the Earth’s crust. However, they are rarely found in large, concentrated deposits on their own, but rather among other elements instead.

Rare Earth Elements, How Do They Work?

Most rare earth elements find their uses as catalysts and magnets in traditional and low-carbon technologies. Other important uses of rare earth elements are in the production of special metal alloys, glass, and high-performance electronics.

Alloys of neodymium (Nd) and samarium (Sm) can be used to create strong magnets that withstand high temperatures, making them ideal for a wide variety of mission critical electronics and defence applications.

I hope you have enjoyed this week’s read, have a great week

Chris Hagan,

Head, Fixed Interest and Superannuation

JMP Securities

Level 1, Harbourside West, Stanley Esplanade

Port Moresby, Papua New Guinea

Mobile (PNG):+675 72319913

Mobile (Int): +61 414529814